1,050% Price Hike On VMware: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

AT&T's Stance on the VMware Price Increase

AT&T's apprehension regarding the potential 1,050% VMware price increase is rooted in the significant impact it would have on their operational costs and infrastructure. Such a drastic price hike would represent a monumental shift in their IT budgeting and could severely impact their long-term competitiveness.

- Increased licensing fees impacting budget allocation: The sheer magnitude of the proposed price increase would force AT&T to reallocate significant budget resources, potentially diverting funds from other crucial initiatives.

- Potential for reduced competitiveness due to higher operational expenses: Increased operational costs directly translate to reduced profitability and could make AT&T less competitive in the telecommunications market.

- Concerns about the lack of transparency in Broadcom's pricing strategy: AT&T, along with many other industry players, is concerned about the lack of clarity surrounding Broadcom's post-acquisition pricing model. This lack of transparency breeds uncertainty and makes it difficult to plan for future IT expenditures.

- Risk of vendor lock-in and reduced negotiating power: The acquisition raises concerns about vendor lock-in, potentially reducing AT&T's negotiating power and limiting their options for alternative virtualization solutions.

Broadcom's Response and Acquisition Justification

Broadcom has responded to the criticism surrounding the potential VMware price increase, claiming the acquisition will ultimately lead to cost savings and efficiency gains for customers. Their rationale centers on the potential synergies between VMware's virtualization technologies and Broadcom's existing portfolio.

- Broadcom's claims of cost savings and efficiency gains: Broadcom asserts that integrating VMware's technologies into its broader ecosystem will streamline operations and lead to cost reductions for customers in the long run. However, specific details and evidence supporting these claims remain scarce.

- Potential for enhanced product integration and innovation: Broadcom highlights the potential for enhanced product integration and accelerated innovation through the merger. This could lead to improved performance and new features for VMware customers.

- Broadcom's perspective on the long-term value proposition: Broadcom emphasizes the long-term value proposition of the acquisition, suggesting that initial price increases may be offset by future cost savings and technological advancements.

- Counterarguments to concerns about monopolistic practices: Broadcom argues that the acquisition will not stifle competition and maintains that the combined entity will remain a strong competitor in the market.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware acquisition is currently under intense regulatory scrutiny due to significant antitrust concerns. Governmental bodies in various jurisdictions, including the United States and the European Union, are closely examining the potential impact of the merger on competition in the virtualization and semiconductor markets.

- Concerns about reduced competition in the virtualization market: Regulators are concerned that the merger could significantly reduce competition in the virtualization market, potentially leading to higher prices and less innovation.

- Potential impact on innovation and consumer choice: A less competitive market could stifle innovation and limit consumer choice, potentially harming businesses reliant on virtualization technologies.

- Review process timeline and potential outcomes: The regulatory review process is ongoing, and the outcome remains uncertain. The timeline for a final decision varies depending on the jurisdiction.

- Similar past acquisitions and their regulatory outcomes: Regulators will likely consider the outcomes of similar past acquisitions in the technology sector when making their decision.

Impact on VMware Customers and the Broader Market

The potential 1,050% VMware price increase has far-reaching implications for VMware's extensive customer base and the broader virtualization and cloud computing markets. Businesses may need to reassess their IT strategies and explore alternative solutions.

- Potential for customer churn due to increased licensing costs: The substantial price hike could lead to significant customer churn, as businesses seek more affordable virtualization solutions.

- Shift in market dynamics and competitive landscape: The acquisition will undoubtedly reshape the market dynamics and competitive landscape, potentially leading to increased market share for alternative virtualization providers.

- Opportunities for alternative virtualization providers: The proposed price increase creates opportunities for competitors like Citrix, Nutanix, and others to attract VMware customers seeking more competitive pricing and potentially less vendor lock-in.

- Long-term implications for enterprise IT strategies: Businesses will need to carefully consider the long-term implications of this merger when formulating their enterprise IT strategies and budgeting for future virtualization needs.

Conclusion

The 1,050% price hike on VMware following Broadcom's acquisition has ignited significant debate, particularly highlighted by AT&T's concerns. The potential for increased costs, reduced competition, and regulatory scrutiny necessitates a careful evaluation of the long-term implications for businesses and the tech industry. The outcome will significantly shape the future of virtualization and cloud computing.

Call to Action: Stay informed about the ongoing developments regarding the Broadcom-VMware acquisition and the potential impact of the VMware price increase on your business. Regularly monitor regulatory updates and industry analyses to make informed decisions about your virtualization strategy. Understanding the implications of this merger is crucial for navigating the evolving landscape of VMware pricing and exploring alternative solutions.

Featured Posts

-

Mn Hw Ilyas Rwdryjyz Almshtbh Bh Fy Mqtl Mwzfy Alsfart Alisrayylyt Fy Washntn

May 23, 2025

Mn Hw Ilyas Rwdryjyz Almshtbh Bh Fy Mqtl Mwzfy Alsfart Alisrayylyt Fy Washntn

May 23, 2025 -

Big Rig Rock Report 3 12 A Deep Dive Into The Big 100 Trucking Rankings

May 23, 2025

Big Rig Rock Report 3 12 A Deep Dive Into The Big 100 Trucking Rankings

May 23, 2025 -

Big Rig Rock Report 3 12 On Rock 106 1 What You Missed

May 23, 2025

Big Rig Rock Report 3 12 On Rock 106 1 What You Missed

May 23, 2025 -

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 23, 2025

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 23, 2025 -

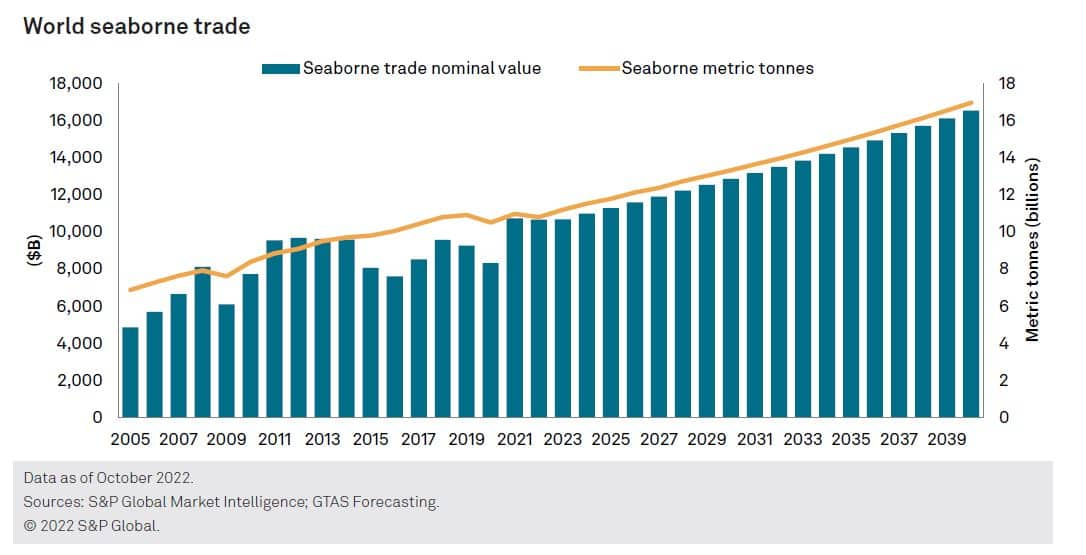

Recent Surge In Us China Trade Understanding The Trends

May 23, 2025

Recent Surge In Us China Trade Understanding The Trends

May 23, 2025

Latest Posts

-

How Joe Jonas Deftly Defused A Couples Argument

May 23, 2025

How Joe Jonas Deftly Defused A Couples Argument

May 23, 2025 -

A Couples Fight Joe Jonass Clever Reply

May 23, 2025

A Couples Fight Joe Jonass Clever Reply

May 23, 2025 -

Joe Jonas The Unexpected Response To A Marital Dispute

May 23, 2025

Joe Jonas The Unexpected Response To A Marital Dispute

May 23, 2025 -

Jonathan Groff And Just In Time A Broadway Tony Awards Prediction

May 23, 2025

Jonathan Groff And Just In Time A Broadway Tony Awards Prediction

May 23, 2025 -

Just In Time Jonathan Groffs Broadway Performance And Tony Prospects

May 23, 2025

Just In Time Jonathan Groffs Broadway Performance And Tony Prospects

May 23, 2025