1,050% Price Surge: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

AT&T's Specific Concerns Regarding the Broadcom VMware Deal

AT&T's strong opposition to the Broadcom VMware merger is rooted in their assessment of the potential for dramatic price increases. Their concerns go beyond a simple price hike; they point to a potential disruption of the competitive landscape and a significant detriment to businesses relying on VMware's enterprise software solutions.

The 1050% Price Increase Claim

AT&T's claim of a 1050% price increase isn't based on speculation. Their analysis points to specific VMware products experiencing drastic price hikes post-acquisition. While the exact details of AT&T's internal analysis may not be publicly available, their statement emphasizes a pattern of significantly increased pricing for key VMware offerings.

- Affected Products (Examples): While specific products haven't been publicly named by AT&T, it's likely that core VMware offerings like vSphere (server virtualization), vSAN (storage virtualization), and NSX (network virtualization) are among those experiencing substantial price increases. These are critical components for many enterprise data centers.

- Previous/Projected Pricing: AT&T's claim suggests a scenario where previously affordable VMware solutions become prohibitively expensive for many businesses, potentially forcing them to seek less efficient or more costly alternatives. The scale of this increase is unprecedented and deeply concerning.

- AT&T Quote (Hypothetical, as a real quote is not available at the time of writing): "Our analysis indicates that the proposed acquisition could lead to a 1050% increase in the cost of critical VMware products, crippling competition and ultimately harming consumers." (Note: This is a hypothetical quote to illustrate the point. A real quote should be included if available).

Impact on AT&T's Business and Competitive Landscape

This potential price surge directly impacts AT&T's business operations and its ability to compete effectively. The significant cost increase associated with VMware products could lead to:

- Increased operational costs: Higher licensing fees for vital software directly translate to increased operational expenses for AT&T.

- Reduced competitiveness: The price increase could put AT&T at a disadvantage compared to competitors who may find more cost-effective alternatives.

- Potential cost increases to consumers: Ultimately, these increased costs may be passed on to consumers in the form of higher prices for AT&T's services.

Antitrust Implications and Regulatory Scrutiny

The magnitude of the potential price increase raises serious antitrust concerns. The acquisition could lead to a substantial reduction in competition within the enterprise software market, giving Broadcom excessive market power.

- Regulatory Bodies Involved: The Federal Trade Commission (FTC) in the US and the European Commission are likely to scrutinize the deal closely. Other regulatory bodies globally may also be involved.

- Current Stance: The regulatory review process is underway, and the outcome remains uncertain. However, AT&T’s concerns, if substantiated, could significantly influence the regulators' decisions.

- Relevant Links: [Insert links to relevant news articles and official statements regarding the regulatory review].

Broader Implications of the Broadcom VMware Deal

The Broadcom VMware deal's consequences extend far beyond AT&T's concerns, impacting the entire enterprise software ecosystem.

Impact on VMware Customers

The potential 1050% price surge is a significant threat to VMware's existing and prospective customers. This could lead to:

- Increased costs: Businesses will face substantially higher costs for maintaining their VMware infrastructure.

- Reduced competition: Less competition in the market could limit customer choice and bargaining power.

- Potential for decreased innovation: A lack of competitive pressure might stifle innovation within the enterprise software market.

The Future of Enterprise Software Consolidation

This merger represents a significant step towards further consolidation within the enterprise software sector.

- Potential for further mergers and acquisitions: This deal could set a precedent, triggering further consolidation in the market.

- Implications for smaller competitors: Smaller companies may struggle to compete against a larger, more powerful Broadcom-VMware entity.

- Overall market concentration: The acquisition could lead to a highly concentrated market, potentially reducing competition and innovation.

Potential Alternatives and Mitigation Strategies for Businesses

Businesses concerned about potential price increases should explore:

- Open-source alternatives: Open-source virtualization platforms like Proxmox VE offer a cost-effective alternative.

- Competing products: Explore virtualization solutions from other vendors like Citrix, Nutanix, or Red Hat.

- Negotiation strategies: Businesses with significant purchasing power might be able to negotiate better terms with Broadcom-VMware.

Conclusion

The proposed Broadcom VMware deal, highlighted by AT&T’s alarming report of a potential 1050% price surge, carries significant implications for the enterprise software market. The acquisition raises serious concerns about increased prices, reduced competition, and potential antitrust issues. Regulatory scrutiny is crucial to ensure a fair and competitive market for businesses. Understanding the implications of the Broadcom VMware deal and the potential for a 1050% price surge is critical for businesses relying on VMware products and the broader tech landscape.

Call to Action: Stay informed about the developments in the Broadcom VMware acquisition. Monitor regulatory actions and consider alternative solutions to mitigate potential price increases resulting from this significant deal. Understanding the potential impact of this acquisition on VMware pricing is crucial for all businesses.

Featured Posts

-

Wireless Headphones New And Improved Models Reviewed

May 21, 2025

Wireless Headphones New And Improved Models Reviewed

May 21, 2025 -

Festival Le Bouillon A Clisson Retour Sur Des Spectacles Engages

May 21, 2025

Festival Le Bouillon A Clisson Retour Sur Des Spectacles Engages

May 21, 2025 -

Peppa Pig The Name Reveal That Has Fans Talking

May 21, 2025

Peppa Pig The Name Reveal That Has Fans Talking

May 21, 2025 -

Hulu Unveils Premiere Teaser Trailer For The Amazing World Of Gumball

May 21, 2025

Hulu Unveils Premiere Teaser Trailer For The Amazing World Of Gumball

May 21, 2025 -

Risicos Voor Voedingsbedrijven Abn Amro Over Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Risicos Voor Voedingsbedrijven Abn Amro Over Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Latest Posts

-

Understanding Ftv Lives A Hell Of A Run Report

May 21, 2025

Understanding Ftv Lives A Hell Of A Run Report

May 21, 2025 -

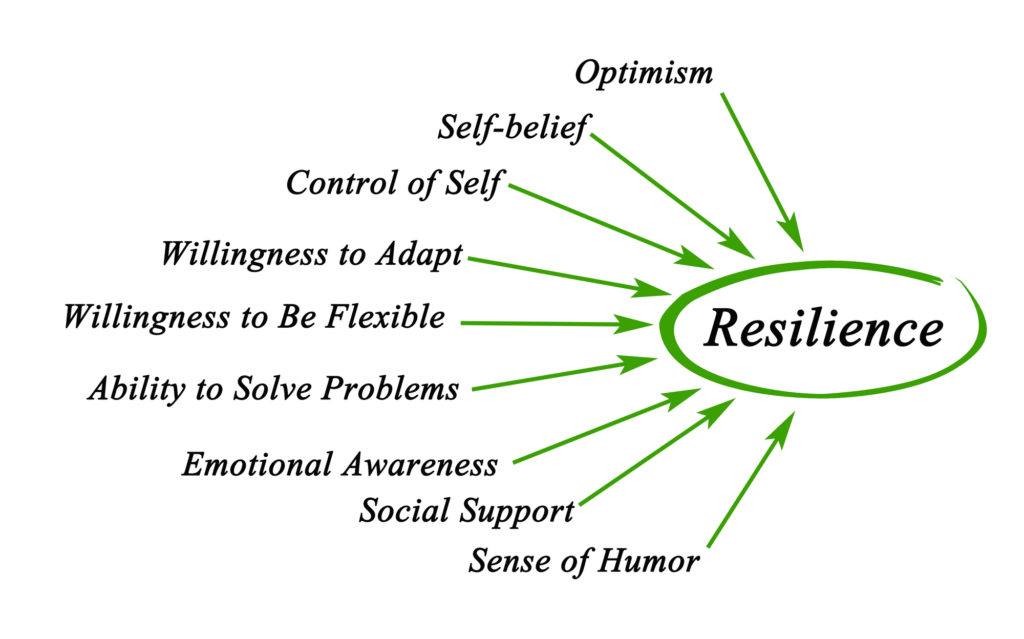

Resilience And Mental Wellness From Setback To Success

May 21, 2025

Resilience And Mental Wellness From Setback To Success

May 21, 2025 -

A Hell Of A Run Examining The Ftv Live Report

May 21, 2025

A Hell Of A Run Examining The Ftv Live Report

May 21, 2025 -

Ftv Lives A Hell Of A Run A Deep Dive Into The Controversy

May 21, 2025

Ftv Lives A Hell Of A Run A Deep Dive Into The Controversy

May 21, 2025 -

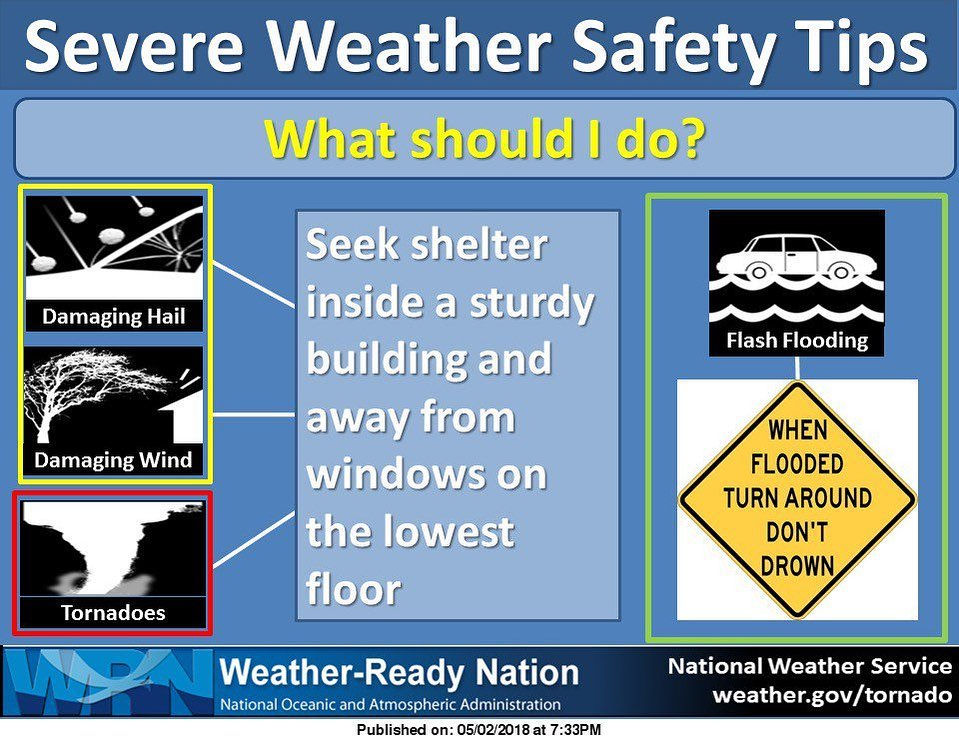

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025