1,050% VMware Cost Increase: AT&T's Concerns Over Broadcom Deal

Table of Contents

AT&T's Stance and the 1,050% VMware Cost Projection

AT&T, a major user of VMware products, has publicly voiced its deep apprehension regarding the potential price hikes following Broadcom's takeover. The telecommunications giant has projected a staggering 1,050% increase in its VMware costs, a figure that has understandably caused alarm. While the precise methodology behind this projection hasn't been fully disclosed, it's based on an extrapolation of Broadcom's past acquisition strategies and their impact on pricing for acquired companies' products.

- Quote from AT&T (hypothetical, replace with actual quote if available): "Our analysis suggests a significant, potentially crippling, increase in VMware licensing costs post-acquisition. This is unacceptable and warrants serious regulatory scrutiny."

- Key Concerns Raised by AT&T: The primary concern centers around the potential for Broadcom to leverage its market power to significantly increase prices for essential VMware products, squeezing margins and impacting competitiveness. Concerns also extend to potential service quality degradation following the acquisition.

- Specific VMware Products Potentially Affected: This likely includes core virtualization products like vSphere, vSAN, and vCenter, as well as related cloud management and security tools.

Broadcom's Response and Acquisition Strategy

Broadcom, in response to AT&T's concerns and broader industry apprehension, has attempted to reassure the market. They've emphasized their commitment to maintaining VMware's market position and ensuring continued product innovation. However, their past acquisition history suggests a pattern of price increases post-merger. This past behavior, combined with their lack of specific guarantees regarding VMware pricing, fuels the skepticism.

- Broadcom's Past Acquisitions and Pricing Effects: Examination of Broadcom's past acquisitions reveals a consistent pattern of price increases for acquired products, often significantly exceeding pre-acquisition levels. This historical data provides a basis for AT&T’s concerns.

- Broadcom's Statements Regarding Future VMware Pricing: While Broadcom has publicly stated an intention to maintain VMware's competitive pricing, they have avoided making concrete commitments on specific price caps or increases. This lack of transparency is a major source of anxiety.

- Promises or Assurances Made Regarding Cost Containment: Any assurances provided by Broadcom have been vague and lacked concrete details, failing to adequately address the significant concerns raised by AT&T and other industry stakeholders.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger is under intense regulatory scrutiny. Antitrust concerns are paramount, given Broadcom's already substantial market presence and the potential for monopolistic practices after acquiring VMware. Both the Federal Trade Commission (FTC) in the US and the European Commission are actively investigating the deal, assessing its potential impact on competition.

- Specific Regulatory Bodies Involved: The FTC, the European Commission, and potentially other international regulatory bodies are reviewing the merger for compliance with antitrust laws.

- Ongoing Investigations or Lawsuits: The investigations are ongoing, with the potential for legal challenges if the regulatory bodies find the merger to be anti-competitive.

- Potential Impact of Regulatory Decisions on VMware Pricing: The outcome of these investigations will significantly influence future VMware pricing. If the deal is blocked or subject to conditions, it could prevent or mitigate substantial price increases.

Impact on Other VMware Customers

The potential for a dramatic VMware cost increase is not limited to AT&T. Many large enterprises heavily rely on VMware's virtualization technologies, making them equally vulnerable to price hikes. The impact could cascade throughout the enterprise software market, impacting budgets and potentially slowing technological advancements.

- Examples of Other Companies Potentially Affected: Numerous large corporations and government agencies across diverse sectors are users of VMware and could experience significant cost increases.

- Potential Strategies for Mitigating Cost Increases: Businesses may need to explore alternative virtualization platforms, renegotiate contracts, or optimize their VMware deployments to minimize costs.

- Analysis of Long-Term Implications for Enterprise Software Spending: The potential cost increase could trigger a reassessment of enterprise software spending priorities, leading to a reevaluation of existing contracts and licensing agreements.

Alternative Solutions and Future of VMware

Facing the possibility of a substantial VMware cost increase, businesses are actively evaluating alternatives. The acquisition could accelerate the adoption of open-source solutions or cloud-native platforms, potentially reshaping the virtualization market.

- Alternative Virtualization Platforms or Cloud Services: OpenStack, Open vSwitch, and various cloud providers such as AWS, Azure, and GCP offer competing virtualization and cloud services.

- Potential Shift in Market Share: The outcome of the Broadcom acquisition and subsequent pricing decisions could lead to a significant shift in market share among virtualization platforms.

- Future of VMware's Product Development and Innovation: The impact of the acquisition on VMware’s future product development and innovation remains uncertain and subject to intense speculation and analysis.

Conclusion

AT&T’s vocal concerns about a potential 1,050% VMware cost increase following Broadcom's acquisition highlight a serious issue impacting the entire enterprise software landscape. Broadcom's response, the ongoing regulatory scrutiny, and the potential for a significant market shift underscore the need for close monitoring of this situation. Businesses must actively monitor the VMware cost increase, understand the implications of the Broadcom deal, and explore alternative virtualization options to safeguard their IT investments. The future of VMware and enterprise virtualization hinges on the outcome of this acquisition and its impact on pricing. Ignoring this potential financial tsunami could prove very costly.

Featured Posts

-

Lidl Faces Lawsuit From Consumer Group Regarding Plus App

May 08, 2025

Lidl Faces Lawsuit From Consumer Group Regarding Plus App

May 08, 2025 -

Fifth Straight Loss For Angels Mike Trouts Knee Soreness A Major Factor

May 08, 2025

Fifth Straight Loss For Angels Mike Trouts Knee Soreness A Major Factor

May 08, 2025 -

Unforgettable Oscars Snubs When Talent Went Unrecognized

May 08, 2025

Unforgettable Oscars Snubs When Talent Went Unrecognized

May 08, 2025 -

Is Uber Technologies Uber A Smart Investment

May 08, 2025

Is Uber Technologies Uber A Smart Investment

May 08, 2025 -

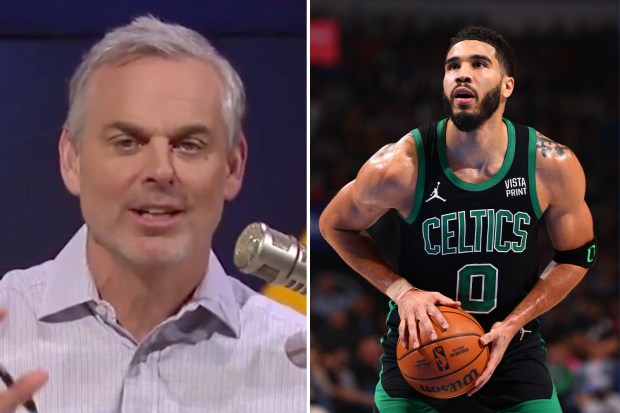

The Colin Cowherd Jayson Tatum Debate A Case Of Underrated Talent

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Case Of Underrated Talent

May 08, 2025