$100,000 Bitcoin? Analyzing The Impact Of Trump's 100-Day Speech On BTC

Table of Contents

Trump's 100-Day Speech: Key Policy Statements and Their Potential Impact on BTC

Trump's 100-day speech, delivered in [Insert Date], contained various policy pronouncements with potential repercussions for the cryptocurrency market. Let's examine the key areas and their potential influence on Bitcoin's price.

Focus on Economic Policies:

The speech addressed several aspects of economic policy, including fiscal policy, trade, and regulation. These announcements could significantly impact investor confidence and, subsequently, Bitcoin's price.

- Fiscal Policy: Statements regarding government spending and taxation could influence investor sentiment. Increased government spending might lead to inflation, potentially driving investors towards Bitcoin as a hedge against inflation. Conversely, tax increases could dampen investor enthusiasm, affecting overall market performance, including Bitcoin.

- Trade Policies: Trade disputes and protectionist measures could create economic uncertainty. This uncertainty often leads investors to seek refuge in assets perceived as less susceptible to market fluctuations, potentially boosting Bitcoin's demand as a safe haven asset.

- Regulatory Changes: Any hints about upcoming regulations concerning financial markets, including cryptocurrencies, could significantly impact Bitcoin's price. Positive regulatory developments fostering clarity and legal framework could attract institutional investors, driving price up. Conversely, stricter regulations might limit growth or even lead to price drops.

Market Reaction to the Speech:

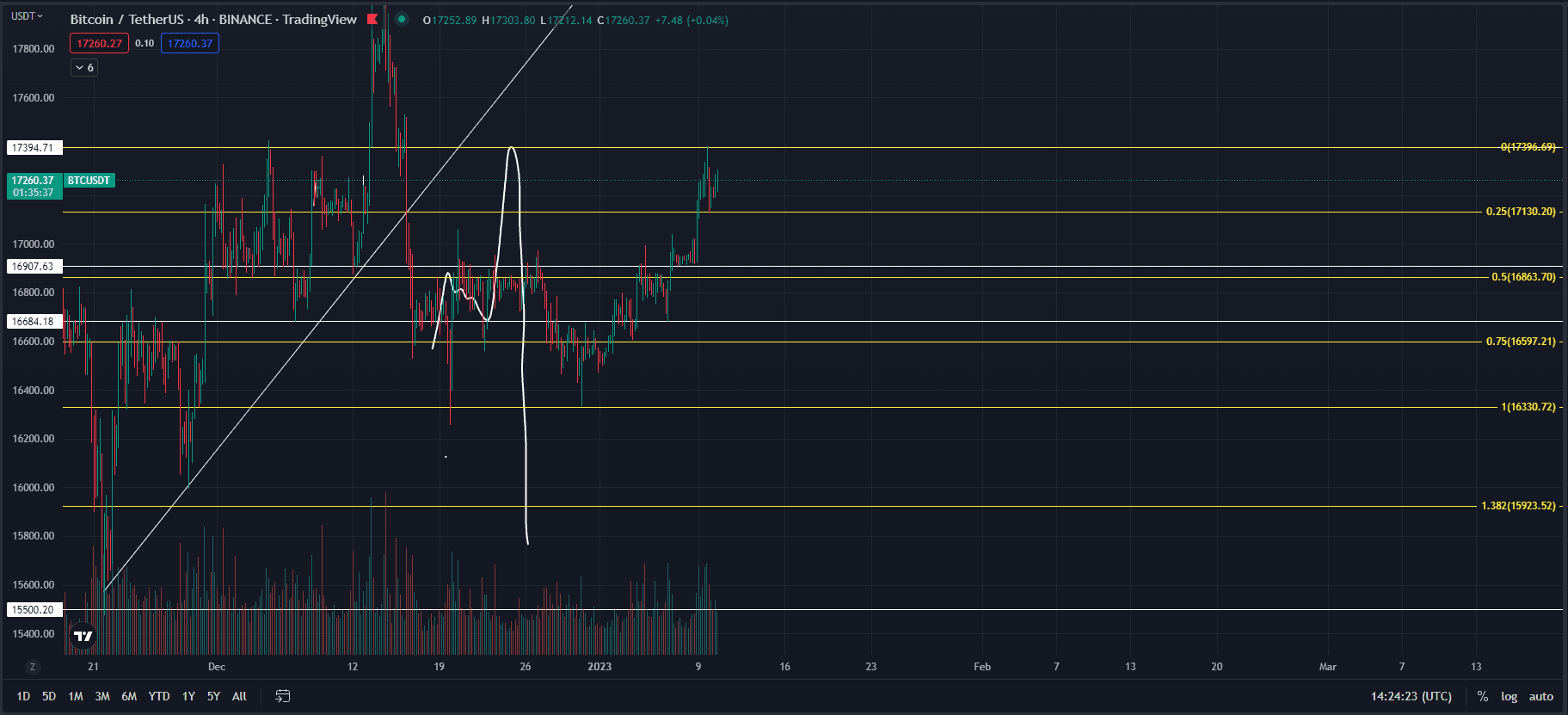

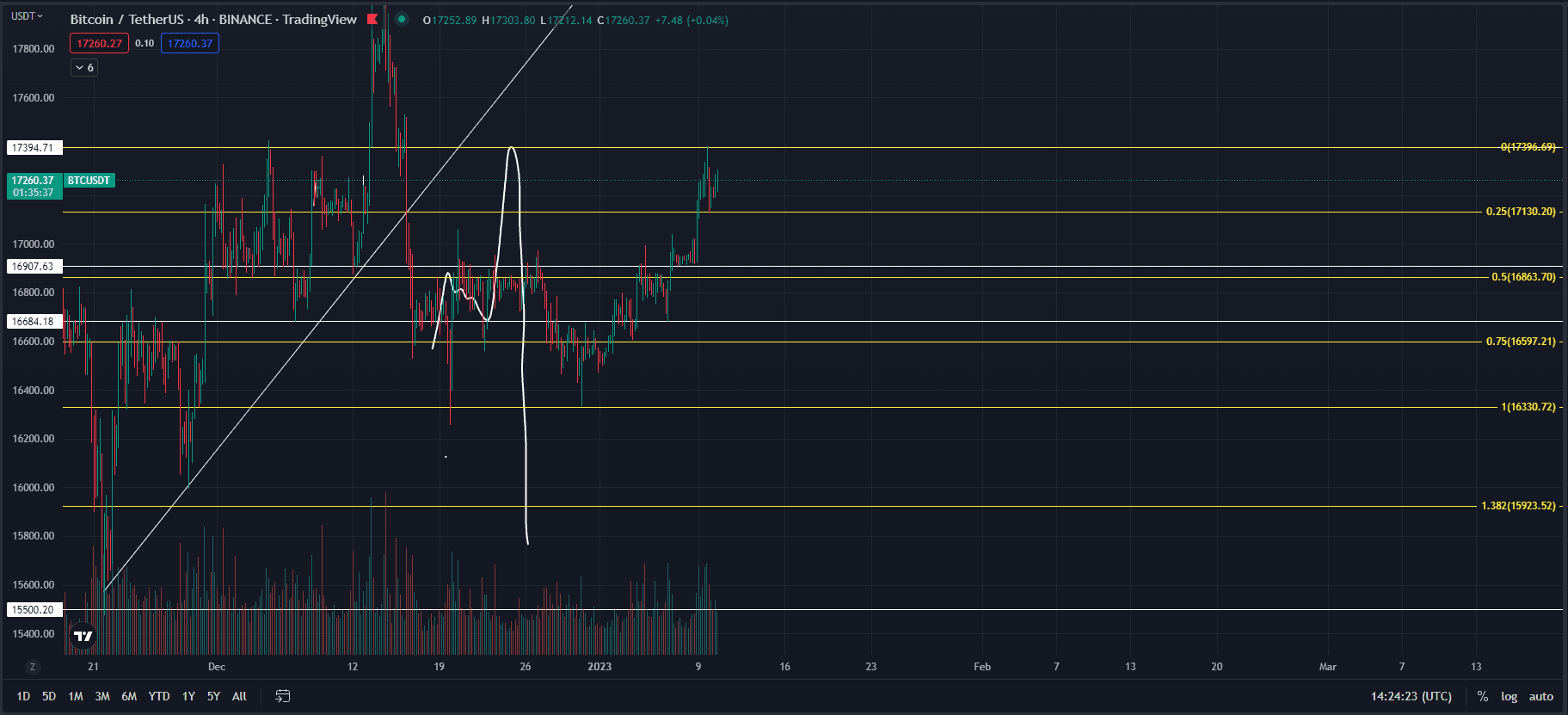

The immediate market response to Trump's 100-day speech was [Describe the immediate market reaction – e.g., a slight dip, a surge, or minimal change]. (Include a chart or graph here illustrating Bitcoin's price fluctuation around the date of the speech). News reports from [cite reputable news sources] documented [summarize news reports on the market reaction]. The short-term effects appeared to be [Describe short-term effects], while the long-term consequences are still unfolding and require further analysis.

Analyzing the Correlation (or Lack Thereof) Between Trump's Policies and Bitcoin's Price

While Trump's policies could influence Bitcoin's price, it's crucial to acknowledge other factors that contribute to its volatility.

Other Factors Influencing Bitcoin's Price:

Several factors beyond Trump's speech can significantly impact Bitcoin's price:

- Market Sentiment: General investor confidence and market trends significantly impact Bitcoin's price. Positive market sentiment tends to drive prices up, while negative sentiment can lead to corrections.

- Technological Advancements: Developments in Bitcoin's underlying technology, such as scaling solutions and improved security measures, influence investor confidence and adoption rates.

- Adoption Rates: Widespread adoption by businesses and individuals fuels demand, driving price increases. Conversely, reduced adoption can negatively impact price.

- Regulatory Developments (Globally): Regulatory changes in other countries besides the US significantly influence Bitcoin's price. Favorable regulations in major economies can increase institutional investment and drive prices up.

Long-Term Implications:

Trump's economic policies could have long-term implications for the cryptocurrency market. Potential scenarios include: sustained growth fueled by increased adoption and favorable regulation; stagnation due to regulatory uncertainty or economic downturns; or a significant correction triggered by unforeseen events or market manipulation. [Offer reasoned speculation, supported by historical data and current market trends].

Could Bitcoin Really Reach $100,000? A Realistic Assessment

The question of whether Bitcoin can reach $100,000 is complex and depends on several intertwined factors.

Factors Favoring a $100,000 Bitcoin:

Several scenarios could propel Bitcoin's price towards $100,000:

- Mass Adoption by Institutional Investors: Large-scale investment by institutional players like hedge funds and pension funds could significantly increase demand.

- Continued Technological Development: Further advancements in scalability and security could make Bitcoin more efficient and attractive to a wider user base.

- Increased Regulatory Clarity: Clear and favorable regulations globally could increase trust and attract mainstream investors.

Factors Against a $100,000 Bitcoin:

Obstacles could hinder Bitcoin's ascent to $100,000:

- Market Volatility and Potential Price Corrections: Bitcoin's inherent volatility exposes it to significant price swings and potential corrections.

- Increased Regulatory Scrutiny: Unfavorable regulations or increased scrutiny from governments could stifle growth.

- Competition from Other Cryptocurrencies: Competition from other cryptocurrencies with potentially superior technology or features could limit Bitcoin's market dominance.

Conclusion: Trump, Bitcoin, and the Path to $100,000

Trump's 100-day speech likely had some impact on Bitcoin's price, but its influence is just one piece of a complex puzzle. Many factors—market sentiment, technological progress, regulatory environments, and competition—contribute to Bitcoin's price fluctuations. Whether Bitcoin reaches $100,000 is contingent upon a confluence of favorable factors and the continued evolution of the cryptocurrency market. While the possibility remains, it’s crucial to maintain a realistic perspective, understanding the inherent risks and uncertainties involved. To stay informed about Bitcoin price prediction, Trump's impact on Bitcoin, and the possibility of a $100,000 Bitcoin, continue researching and monitoring the market closely.

Featured Posts

-

Ubers Pet Transportation Service Launches In Delhi And Mumbai

May 08, 2025

Ubers Pet Transportation Service Launches In Delhi And Mumbai

May 08, 2025 -

Nba Playoffs Triple Doubles The Ultimate Quiz Challenge

May 08, 2025

Nba Playoffs Triple Doubles The Ultimate Quiz Challenge

May 08, 2025 -

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025 -

Urgent Action Needed The Overvalued Canadian Dollar And Its Impact

May 08, 2025

Urgent Action Needed The Overvalued Canadian Dollar And Its Impact

May 08, 2025 -

Psg Fiton Minimalisht Pas Pjeses Se Pare Analiza E Ndeshjes

May 08, 2025

Psg Fiton Minimalisht Pas Pjeses Se Pare Analiza E Ndeshjes

May 08, 2025