$100,000 Bitcoin? Analyzing Trump's Potential Influence On BTC Price

Table of Contents

Trump's Economic Policies and Their Impact on Bitcoin

Trump's economic policies, if implemented, could significantly influence Bitcoin's trajectory. Two key areas warrant close examination: deregulation and its effect on crypto adoption, and the impact of his fiscal policies on inflation.

Deregulation and Crypto Adoption

A Trump administration is likely to favor deregulation across various sectors, and this could have a profound impact on cryptocurrency adoption.

- Increased Institutional Investment: Relaxed regulations could encourage institutional investors, such as hedge funds and pension funds, to allocate a larger portion of their portfolios to Bitcoin, driving up demand.

- Favorable Regulatory Frameworks: A less restrictive regulatory environment could create a clearer legal pathway for crypto businesses to operate in the US, fostering innovation and attracting further investment.

- Easier Access for Retail Investors: Simplified regulatory processes could make it easier for individual investors to buy, sell, and hold Bitcoin, increasing participation in the market.

The increased mainstream acceptance resulting from deregulation could significantly boost Bitcoin's price. Historically, periods of reduced regulatory scrutiny have often coincided with bull runs in cryptocurrency markets. For example, the period following the 2017 ICO boom, while not solely attributable to deregulation, illustrates how a less restrictive environment can fuel rapid growth.

Fiscal Policy and Inflation

Trump's pro-growth fiscal policies, characterized by increased government spending, could potentially lead to higher inflation rates. Bitcoin, often viewed as a hedge against inflation, could see increased demand as investors seek to protect their purchasing power.

- Increased Government Spending: Large-scale infrastructure projects and tax cuts could inject significant capital into the economy, potentially fueling inflation.

- Higher Inflation Rates: Sustained inflation erodes the value of fiat currencies, making alternative assets like Bitcoin more attractive.

- Bitcoin's Role as a Store of Value: Many investors see Bitcoin as a store of value, similar to gold, offering protection against inflationary pressures.

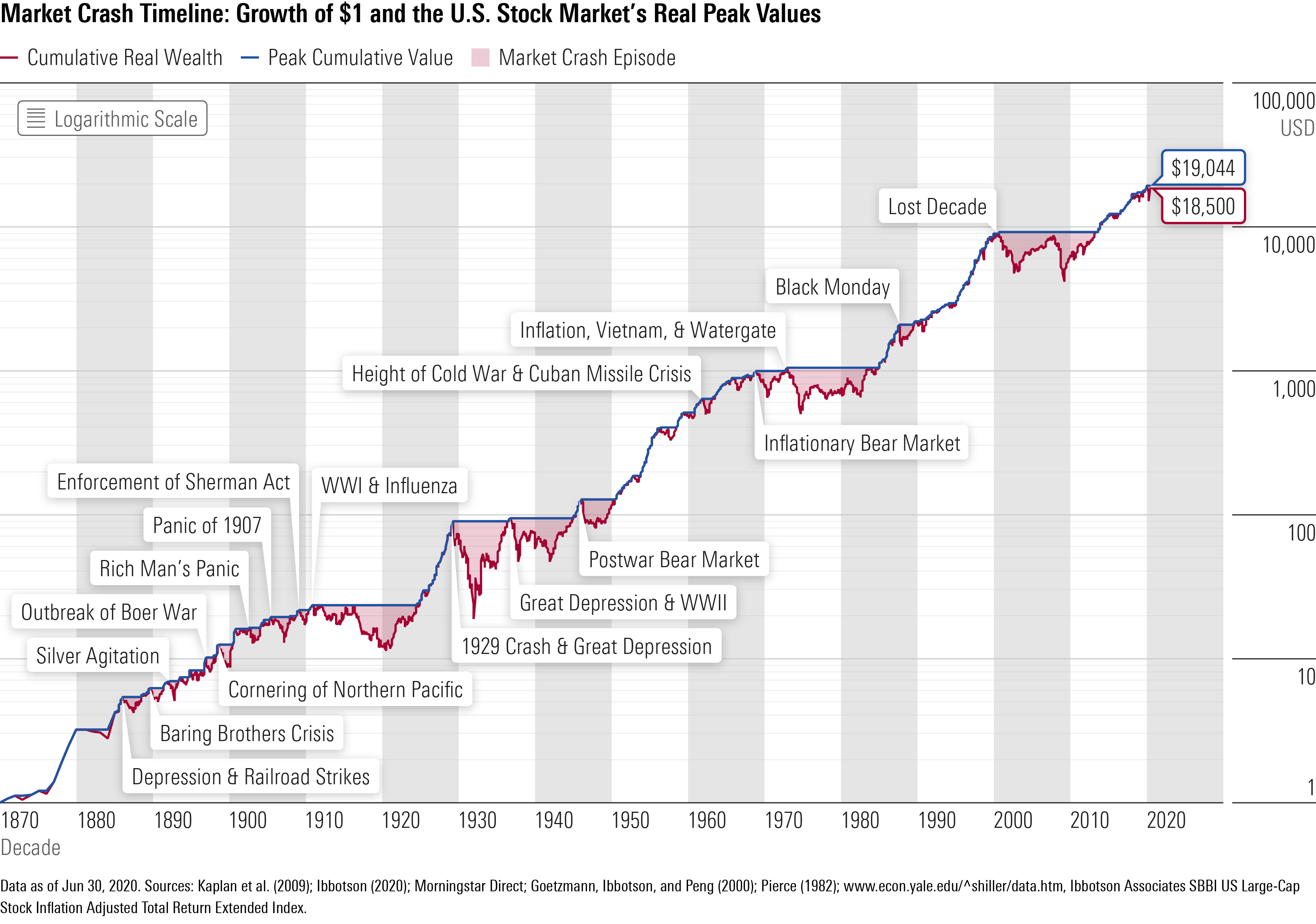

Historically, there's a correlation between periods of high inflation and increased Bitcoin price. Analyzing historical inflation data alongside Bitcoin's price charts reveals a tendency for Bitcoin's value to rise during periods of economic uncertainty and inflation.

Trump's Stance on Cryptocurrencies and Technology

Trump's past statements and actions, combined with potential geopolitical impacts under his leadership, offer further clues to Bitcoin's future.

Past Statements and Actions

While Trump hasn't explicitly endorsed Bitcoin, his past comments and actions regarding technology and finance provide some insight into his potential approach to cryptocurrencies.

- Public Comments on Bitcoin: Analyzing Trump's past public comments on cryptocurrencies and fintech, even if indirect, can reveal potential policy preferences.

- Potential Advisors' Views on Crypto: The views and expertise of potential advisors within a Trump administration on issues related to crypto regulation and technological innovation could greatly influence future policy.

- His Administration's Past Actions Related to Fintech: Reviewing the actions and policies of his previous administration towards fintech innovation can provide insights into his future approach to cryptocurrency regulation.

His previous administration's focus on deregulation suggests a potential openness to a more lenient approach towards the crypto industry.

Geopolitical Impacts

A Trump presidency could significantly impact global geopolitical stability, indirectly influencing Bitcoin's safe-haven status.

- International Relations: Trump's approach to international relations could lead to increased global uncertainty, potentially boosting Bitcoin's appeal as a decentralized and less susceptible asset.

- Trade Wars: The potential for renewed trade conflicts could create economic instability, increasing demand for Bitcoin as a safe haven.

- Increased Market Uncertainty: Periods of heightened geopolitical uncertainty often see investors flocking to safe-haven assets like gold and Bitcoin.

Increased market volatility due to geopolitical factors could drive investors towards the perceived stability and decentralization of Bitcoin.

Market Sentiment and Speculation Around $100,000 Bitcoin

Market sentiment and speculation play a crucial role in determining Bitcoin's price, and Trump's influence extends to these areas as well.

Social Media Influence

Social media and news cycles significantly influence market sentiment. Trump's presence on social media and his ability to shape narratives could impact Bitcoin's price.

- Impact of News Headlines: Positive or negative news headlines related to Trump and Bitcoin could trigger immediate price fluctuations.

- Social Media Trends: Social media trends and discussions surrounding Trump and Bitcoin can significantly impact investor sentiment.

- Potential for Pump-and-Dump Schemes: Trump's unpredictable nature and the potential for misinformation could create opportunities for manipulative market behavior.

The interplay between Trump's pronouncements, news coverage, and social media chatter could create a volatile environment pushing Bitcoin's price either up or down, potentially influencing the $100,000 target.

Investor Behavior and Psychological Factors

Investor psychology significantly impacts Bitcoin's price volatility, and Trump's unpredictable nature amplifies this effect.

- Fear, Uncertainty, and Doubt (FUD): Trump's actions and statements could create FUD, potentially leading to sell-offs.

- Investor Confidence: Conversely, positive news or perceived support from Trump could boost investor confidence and fuel a price surge.

- Herd Mentality: Investors often follow trends, and Trump's influence could exacerbate herd mentality, leading to sharp price movements.

Trump’s potential actions could trigger a range of investor responses, from panic selling to enthusiastic buying, dramatically influencing Bitcoin's price trajectory towards—or away from—the $100,000 mark.

Conclusion

The potential impact of a Trump presidency on Bitcoin's price and the likelihood of it reaching $100,000 is complex and multifaceted. We've explored the potential effects of his economic policies (deregulation and inflation), his stance on cryptocurrencies and technology, and the influence of market sentiment and investor psychology. While the path to $100,000 Bitcoin remains uncertain, Trump's influence on various economic and geopolitical factors could significantly impact the journey. Keep your eye on the potential for $100,000 Bitcoin under a Trump presidency; understanding this dynamic relationship is crucial for savvy investors. For further reading on this complex interplay between politics and cryptocurrency, explore resources from reputable financial news outlets and research institutions.

Featured Posts

-

Learn About Jeanine Pirro Her Education Career And Financial Details

May 09, 2025

Learn About Jeanine Pirro Her Education Career And Financial Details

May 09, 2025 -

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 09, 2025

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 09, 2025 -

700 Point Sensex Rally Detailed Stock Market Analysis And News

May 09, 2025

700 Point Sensex Rally Detailed Stock Market Analysis And News

May 09, 2025 -

Njwm Krt Alqdm Waltbgh Drast Fy Eadat Syyt

May 09, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Eadat Syyt

May 09, 2025 -

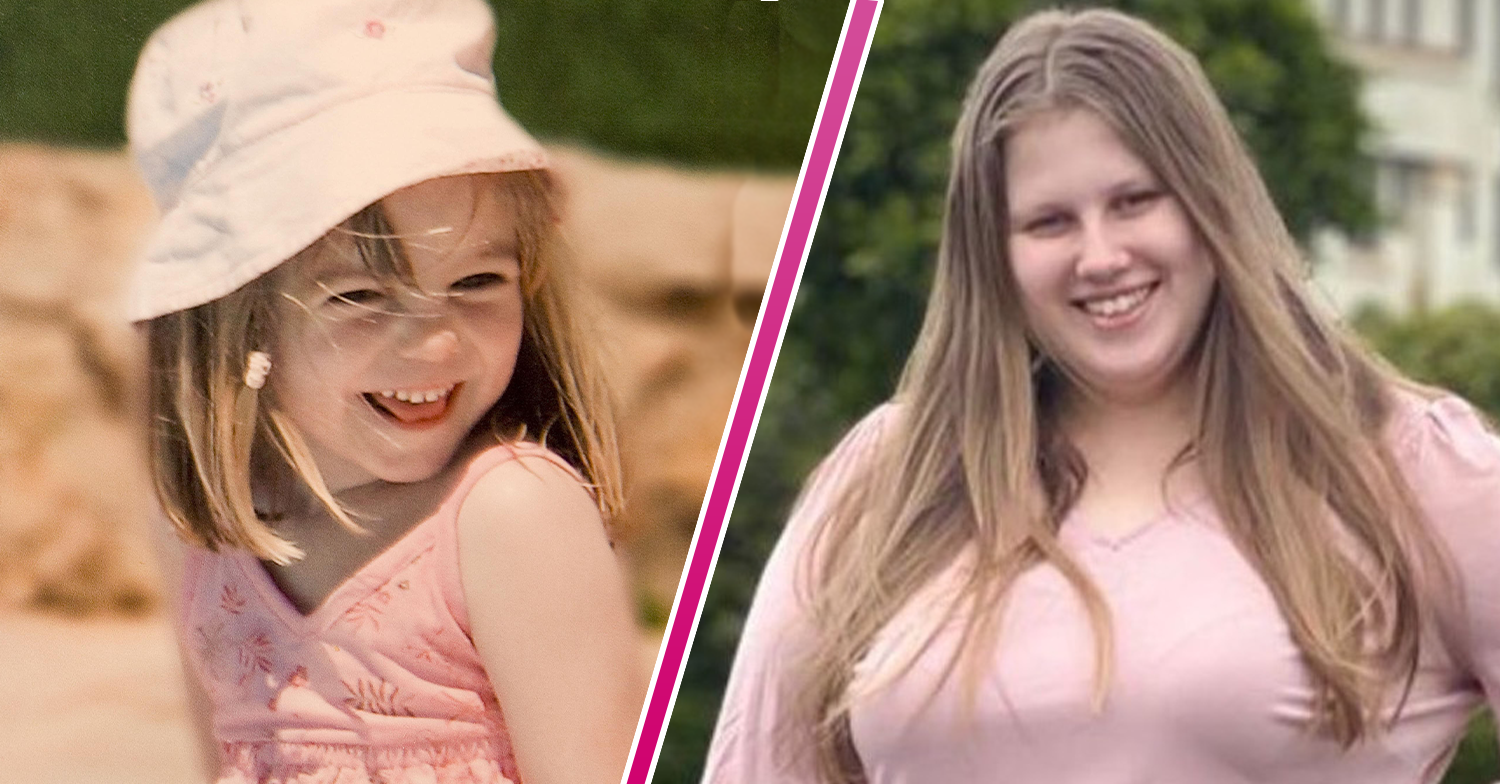

23 Year Old Womans Dna Test Results Fuel Madeleine Mc Cann Speculation

May 09, 2025

23 Year Old Womans Dna Test Results Fuel Madeleine Mc Cann Speculation

May 09, 2025