110% Return Predicted: Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

The ETF in Question: Unpacking BlackRock's iShares Global Clean Energy ETF (ICLN)

The ETF attracting significant attention is the iShares Global Clean Energy ETF (ICLN). This BlackRock fund provides exposure to a broad range of global companies involved in the clean energy sector. ICLN's investment strategy focuses on companies that are involved in producing renewable energy, energy efficiency technologies, and other environmentally friendly energy solutions.

- Investment Focus: Renewable energy sources such as solar, wind, hydro, geothermal, and biofuels; energy efficiency technologies; and smart grid infrastructure.

- Underlying Assets and Performance History: ICLN tracks the S&P Global Clean Energy Index, which includes a diverse portfolio of leading global companies in the clean energy sector. While past performance is not indicative of future results, ICLN has shown significant growth potential historically. [Insert historical performance data, if available, with proper sourcing].

- Expense Ratio: The expense ratio of ICLN is [Insert Expense Ratio] which is [Compare to competitors - e.g., competitive or higher/lower than average] compared to similar ETFs in the sector.

- BlackRock Factsheet: [Insert link to the official BlackRock factsheet for ICLN]

The 110% Prediction: Analyzing the Forecasts

The 110% return prediction for ICLN stems from a confluence of factors, analyzed by [Cite reputable source, e.g., a specific analyst or financial institution]. Their methodology likely incorporates projections for increased global demand for renewable energy due to climate change initiatives, technological advancements leading to lower production costs, and supportive government policies worldwide.

- Key Factors Driving Predicted Growth:

- Booming Renewable Energy Market: The global shift towards cleaner energy sources is driving significant growth in the sector.

- Technological Advancements: Continued innovation is reducing the cost of renewable energy technologies, making them more competitive.

- Government Support and Regulations: Many governments are implementing policies to incentivize renewable energy adoption.

- Potential Risks:

- Market Volatility: The clean energy sector, like any other market segment, is subject to market fluctuations and volatility.

- Geopolitical Events: Global political instability and trade wars can significantly impact the sector.

- Technological Disruption: Unexpected technological breakthroughs could render existing technologies obsolete.

- Comparison to Similar ETFs: [Compare ICLN to other clean energy ETFs, highlighting its advantages and disadvantages].

Why Billionaires Are Investing: A Look at the Elite's Portfolio Diversification

High-net-worth individuals are drawn to ICLN for several strategic reasons. The potential for high returns is certainly a significant factor, but it's only one piece of the puzzle. Billionaires are known for their sophisticated diversification strategies, and ICLN fits well within this framework.

- Tax Advantages: [Mention any potential tax advantages associated with investing in ICLN or ETFs in general].

- ESG Investing Alignment: ICLN aligns perfectly with Environmental, Social, and Governance (ESG) investment strategies, a growing trend among high-net-worth investors.

- Long-Term Growth Potential: The long-term outlook for the clean energy sector is exceptionally positive, making ICLN an attractive investment for long-term growth.

- Capital Appreciation and Dividend Income: Investors can benefit from both capital appreciation and potential dividend income from ICLN.

Investing in the BlackRock ETF: A Practical Guide

Investing in ICLN is relatively straightforward. You can purchase it through most reputable online brokerage accounts.

- Minimum Investment Requirements: [State the minimum investment requirements, if any].

- Brokerage Fees and Commissions: [Discuss brokerage fees and commissions – vary depending on the broker].

- Steps to Purchase: [Outline the steps to purchase the ETF through an online brokerage. This can be generic, focusing on the general process].

- Disclaimer: Investing involves risk. The value of investments can go down as well as up, and you may not get back the amount you invested. This information is for educational purposes only and should not be considered financial advice.

Conclusion

The predicted 110% return on the iShares Global Clean Energy ETF (ICLN) has attracted significant attention, particularly from billionaire investors seeking high-growth potential within the rapidly expanding clean energy sector. While no investment guarantees returns, the underlying factors driving this prediction are compelling. However, it's crucial to conduct thorough research and understand the associated risks before investing.

Call to Action: Ready to explore the potential of this high-growth BlackRock ETF? Conduct your due diligence, consult a financial advisor, and consider adding this investment to your diversified portfolio today. Remember, investing in BlackRock ETFs, like any investment, carries risk. Do your research and invest wisely.

Featured Posts

-

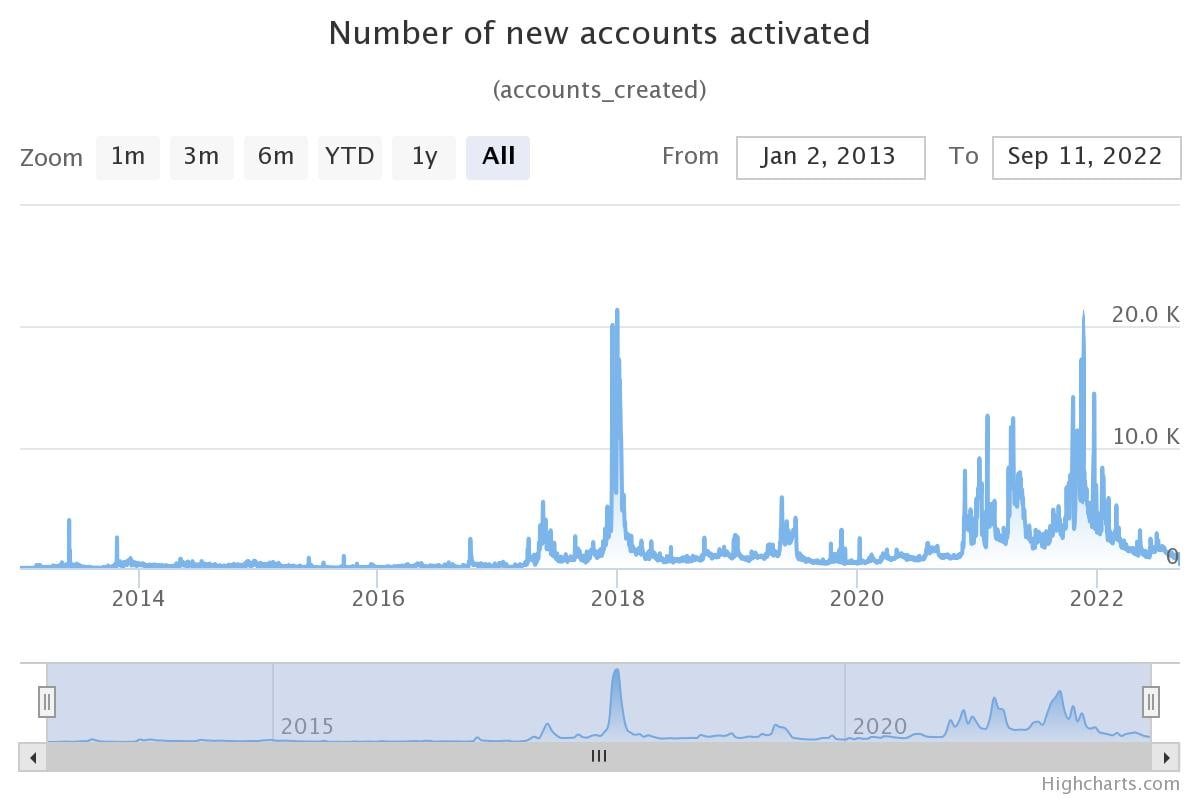

400 Up And Still Climbing Exploring Xrps Potential For Further Growth

May 08, 2025

400 Up And Still Climbing Exploring Xrps Potential For Further Growth

May 08, 2025 -

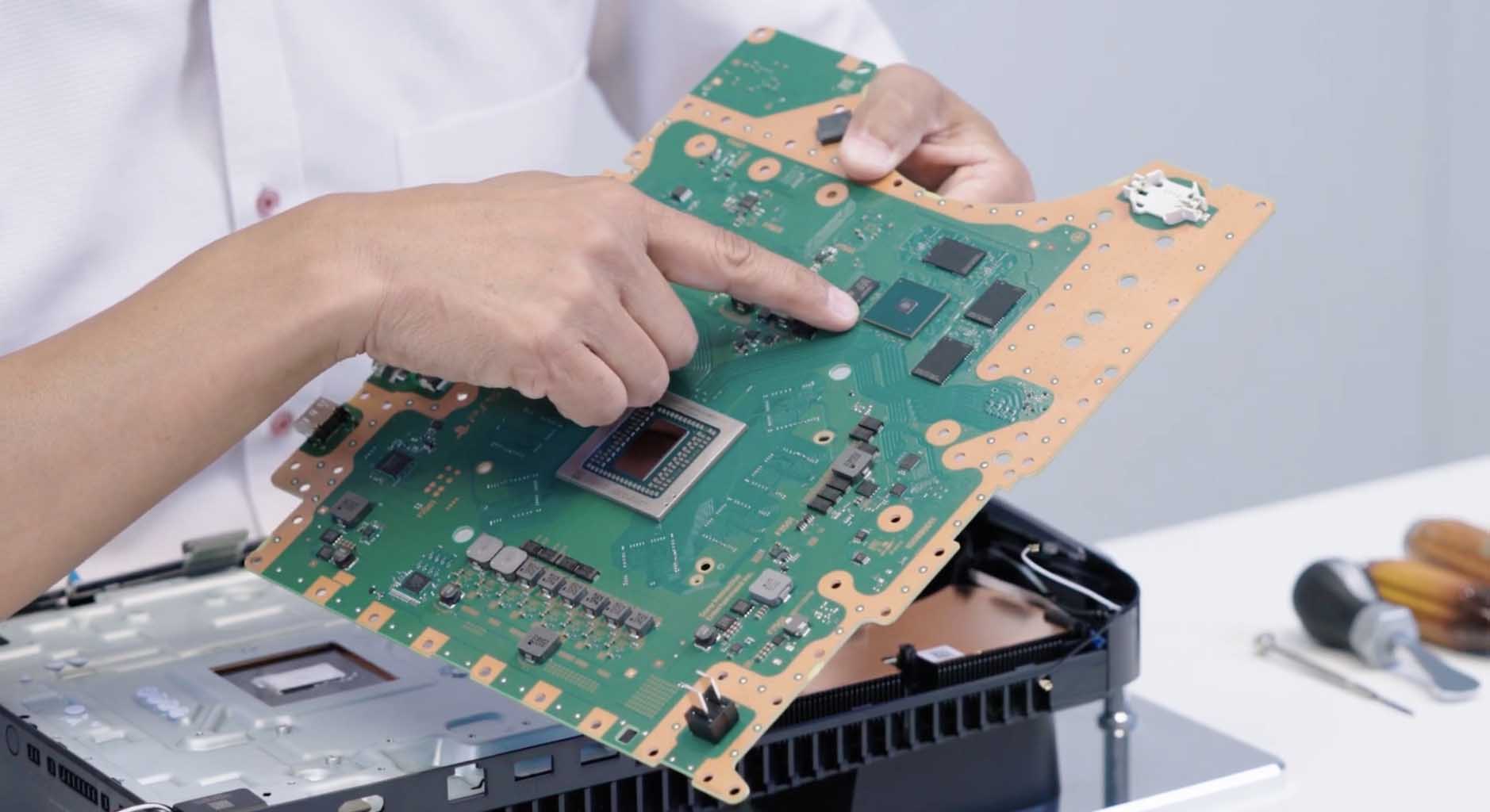

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025 -

April 2nd 2025 Lotto And Lotto Plus Winning Numbers

May 08, 2025

April 2nd 2025 Lotto And Lotto Plus Winning Numbers

May 08, 2025 -

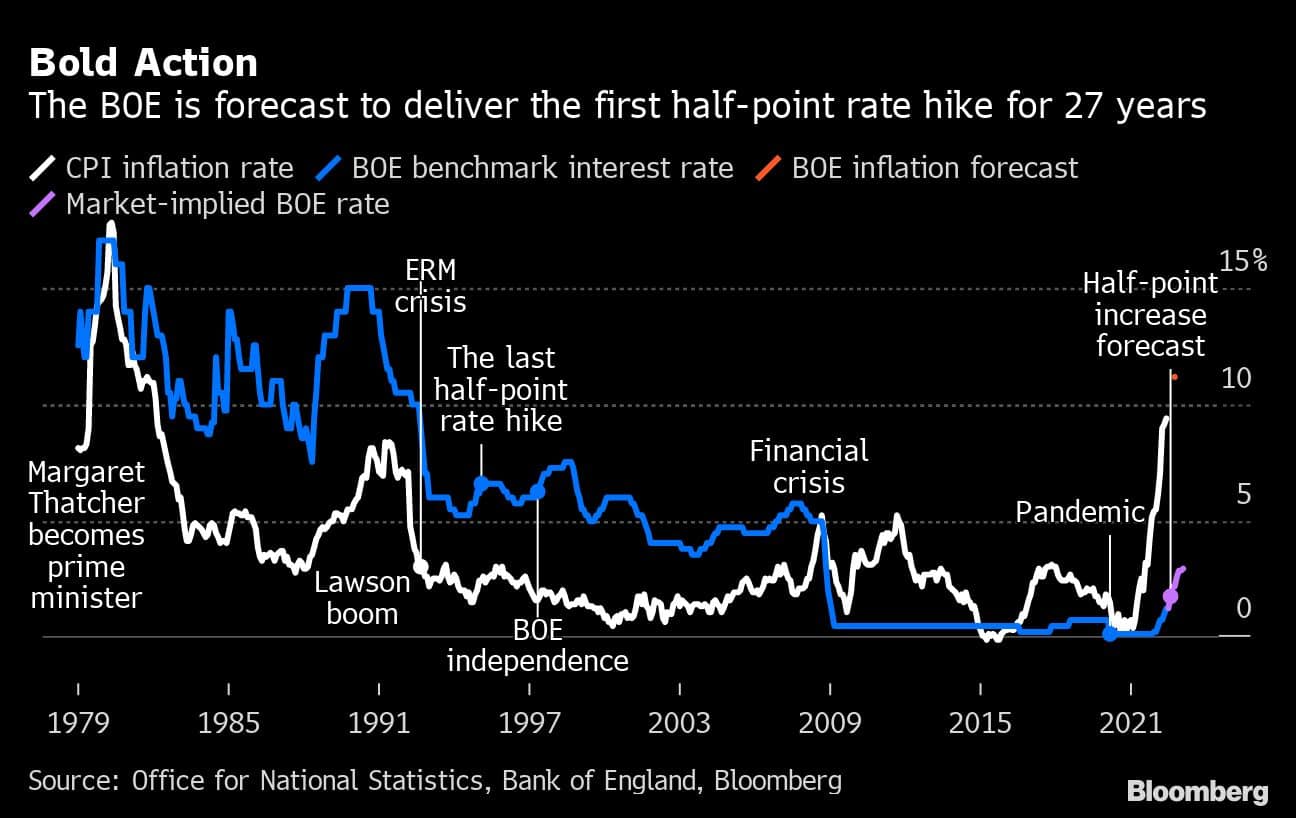

A Half Point Rate Cut The Bank Of Englands Path Forward

May 08, 2025

A Half Point Rate Cut The Bank Of Englands Path Forward

May 08, 2025 -

Xrp Ripple Investment A Comprehensive Guide To Potential Returns

May 08, 2025

Xrp Ripple Investment A Comprehensive Guide To Potential Returns

May 08, 2025