$16.3 Billion: Record-Breaking U.S. Customs Duty Collection In April

Table of Contents

Factors Contributing to the Record-High Customs Duty Collection

Several key factors contributed to this record-breaking April U.S. Customs Duty collection. Analyzing these factors provides valuable insight into the current state of U.S. trade and the potential for future changes.

Increased Import Volume

A significant driver of the increased Customs Duty Collection is the substantial rise in import volume from various countries. While precise data for all product categories is still being compiled, preliminary reports indicate a marked increase across several sectors.

- Increased Electronics Imports: Imports of electronics from China and other Asian countries saw a noticeable jump, contributing significantly to increased import duties.

- Booming Demand for Consumer Goods: Strong consumer demand fueled higher imports of various consumer goods, including apparel, furniture, and toys, leading to a rise in tariff revenue.

- Growth in Industrial Machinery Imports: The ongoing expansion of several industrial sectors boosted imports of machinery and equipment, further contributing to the higher duty collections. The increased volume translated directly into a substantial increase in collected import duties.

Higher Tariffs on Certain Goods

Existing tariffs and recent tariff adjustments on specific goods also played a crucial role in boosting Customs Duty Collection. The implementation and adjustment of tariffs on certain imported goods directly impact the amount of duty collected.

- Increased Tariffs on Steel and Aluminum: Existing tariffs on steel and aluminum imports from certain countries continued to contribute to higher duty revenue.

- Tariff Adjustments on Specific Goods: Recent adjustments to tariffs on certain agricultural products and manufactured goods also added to the overall increase in Customs Duty Collection.

- Section 301 Tariffs: Tariffs imposed under Section 301 of the Trade Act of 1974 on goods from specific countries remained in effect, impacting import duty revenue.

Improved Enforcement and Collection Practices

Enhanced enforcement and improved collection practices within U.S. Customs and Border Protection also contributed to the higher revenue figures. Modernization and technological advancements have streamlined the process.

- Improved Technology and Data Analytics: Advanced data analytics and improved tracking systems allowed for more efficient identification and assessment of import duties.

- Strengthened Enforcement Measures: Increased scrutiny and strengthened enforcement measures helped minimize duty evasion and ensure accurate duty collection.

- Streamlined Customs Procedures: Improved customs procedures, including online processing and automated systems, facilitated smoother and more efficient duty collection.

Impact on Businesses and the US Economy

The record-breaking U.S. Customs Duty collection has far-reaching implications for businesses and the overall U.S. economy. Understanding these impacts is crucial for businesses to adapt and strategize accordingly.

Increased Costs for Importers

Higher import duties directly increase the cost of goods for importers, impacting profitability and potentially necessitating adjustments to pricing strategies.

- Reduced Profit Margins: Increased Customs Duty can significantly reduce profit margins, particularly for businesses with low-profit margins.

- Price Increases for Consumers: Importers often pass on increased costs to consumers, potentially leading to higher prices for imported goods.

- Mitigation Strategies: Importers can mitigate the impact by exploring alternative sourcing options, negotiating with suppliers, or seeking customs brokerage services to optimize duty payments.

Potential for Inflationary Pressures

The increased cost of imported goods, driven by higher import duties, can contribute to inflationary pressures within the U.S. economy.

- Increased Production Costs: Higher import duties increase production costs for businesses reliant on imported components or raw materials.

- Higher Consumer Prices: These increased costs are often passed on to consumers, leading to higher prices for various goods and services.

- Impact on Specific Sectors: Sectors heavily reliant on imported goods, such as manufacturing and retail, are particularly vulnerable to inflationary pressures stemming from higher import duties.

Revenue Implications for the US Government

The substantial increase in Customs Duty revenue provides the U.S. government with additional funds that can be allocated to various priorities.

- Reduced Budget Deficit: Increased revenue can contribute to reducing the national budget deficit.

- Infrastructure Investment: A portion of the revenue could be earmarked for investments in infrastructure projects.

- Social Programs: Increased revenue may also lead to greater funding for social programs and initiatives.

Future Outlook for U.S. Customs Duty Collection

Predicting the future of U.S. Customs Duty collection requires considering several dynamic factors that can significantly influence trade flows and tariff policies.

Predicting Future Trends

Several factors could impact future U.S. Customs Duty collections:

- Global Trade Relations: Changes in global trade relations and agreements can significantly influence import volumes and, consequently, duty revenue.

- Economic Growth: Domestic and global economic growth rates directly impact import demand and therefore Customs Duty revenue.

- Policy Shifts: Changes in government policies, such as new trade agreements or tariff adjustments, will play a key role. Potential scenarios include sustained high levels of Customs Duty collection, a potential decline due to decreased imports, or further increases driven by new tariffs or higher import volumes.

Implications for Businesses

Businesses need to adopt proactive strategies to navigate potential future changes in customs duties and import regulations.

- Diversify Supply Chains: Reducing reliance on a single supplier and diversifying supply chains can help mitigate the impact of tariff changes or disruptions.

- Engage Customs Brokers: Partnering with experienced customs brokers can provide valuable expertise and help optimize duty payments.

- Stay Informed on Regulations: Staying abreast of changes in U.S. Customs Duty regulations and policies is vital for compliance and minimizing risk.

Conclusion

The record-breaking $16.3 billion U.S. Customs Duty collection in April 2024 highlights significant shifts in U.S. trade. Increased import volumes, higher tariffs, and improved enforcement practices all contributed to this unprecedented figure. This surge has significant implications for businesses, potentially increasing costs, impacting pricing strategies, and contributing to inflationary pressures. For the U.S. government, the increased revenue presents opportunities for addressing various economic priorities. To prepare for the future, businesses must stay updated on U.S. Customs Duty changes, understand the impact of U.S. Customs Duty on your business, and develop proactive strategies to navigate this evolving landscape. Learn more about navigating the complexities of U.S. Customs Duty by consulting with a trade expert or exploring resources from the U.S. Customs and Border Protection website.

Featured Posts

-

Hope For Edan Alexander Fathers Plea For Us Involvement In Gaza Hostage Crisis

May 13, 2025

Hope For Edan Alexander Fathers Plea For Us Involvement In Gaza Hostage Crisis

May 13, 2025 -

Gibraltar Brexit Negotiations In Limbo

May 13, 2025

Gibraltar Brexit Negotiations In Limbo

May 13, 2025 -

Career Path Fine Arts Professorship With Spatial Design Emphasis

May 13, 2025

Career Path Fine Arts Professorship With Spatial Design Emphasis

May 13, 2025 -

Finding Off Market Luxury Homes The Luxury Presence Advantage

May 13, 2025

Finding Off Market Luxury Homes The Luxury Presence Advantage

May 13, 2025 -

Novye Standarty Po Fizike I Khimii Dlya Detskikh Sadov

May 13, 2025

Novye Standarty Po Fizike I Khimii Dlya Detskikh Sadov

May 13, 2025

Latest Posts

-

Zdrajcy 2 Odcinek 1 Materialy Dodatkowe I Konflikty Graczy

May 14, 2025

Zdrajcy 2 Odcinek 1 Materialy Dodatkowe I Konflikty Graczy

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025

Zdrajcy 2 Odcinek 1 Analiza Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025 -

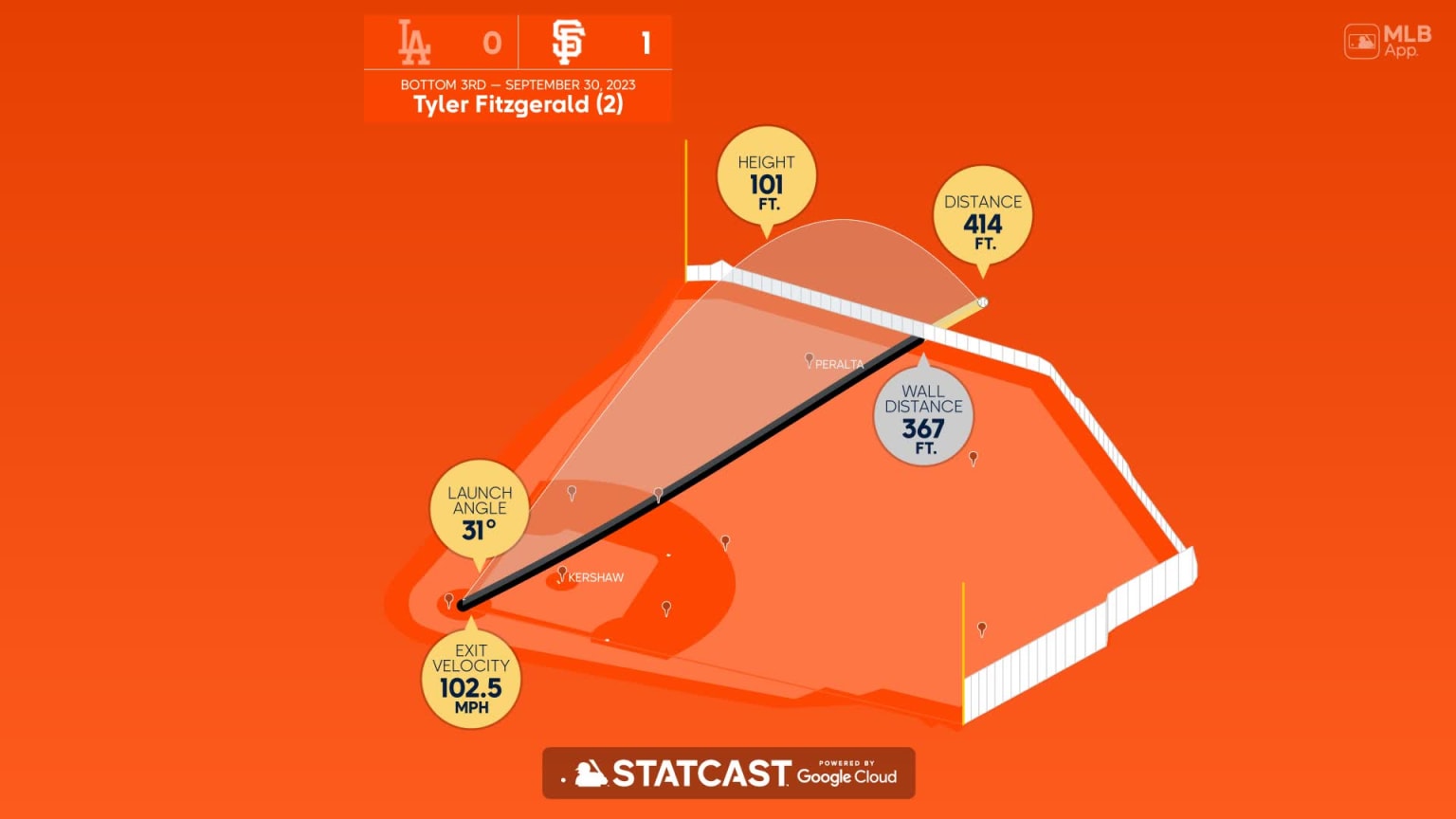

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025