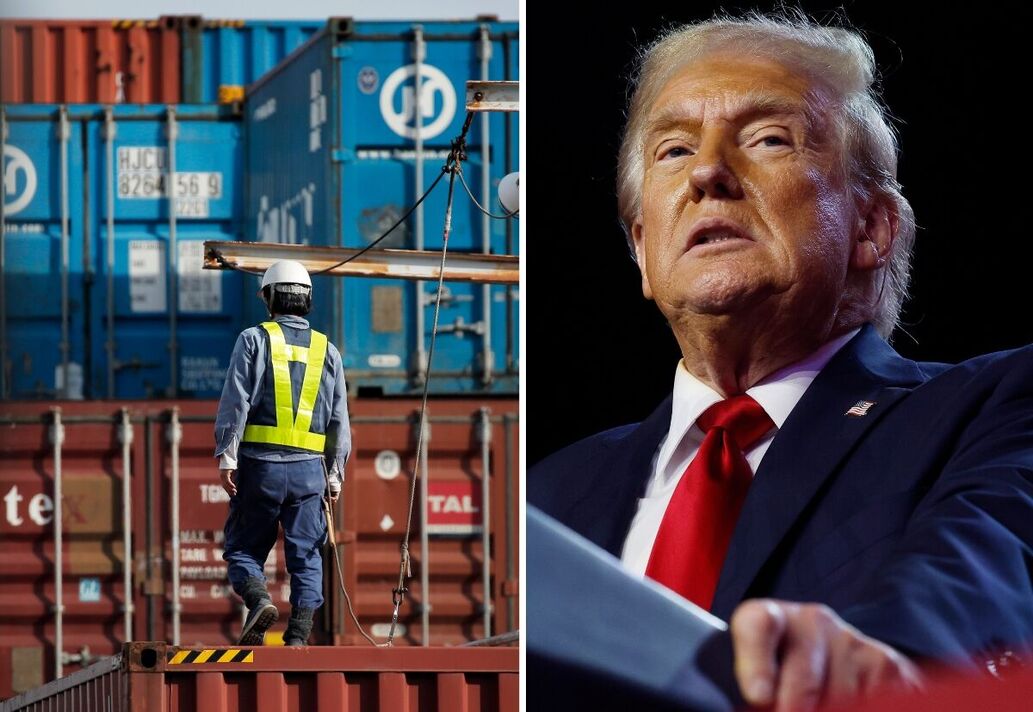

$174 Billion Wipeout: How Trump Tariffs Impacted Top Billionaires

Table of Contents

The Target Industries: Where the Billionaire Losses Hit Hardest

Trump's tariffs targeted numerous sectors, disproportionately impacting the fortunes of billionaires invested in those industries. The most significant losses were felt in retail, technology, and manufacturing – sectors heavily reliant on global supply chains and international trade. The impact wasn't uniform; some billionaires were hit harder than others depending on their specific portfolio and level of exposure to import/export activities.

- Retail: Companies like Walmart, heavily reliant on imported goods, faced increased costs due to tariffs. These higher costs were often passed on to consumers, impacting sales and ultimately eroding profit margins, directly affecting the net worth of its shareholders and major investors.

- Technology: The tech sector, while less directly affected than retail, experienced disruptions in supply chains and increased costs for components sourced from China and other tariffed countries. This affected companies like Apple, impacting the wealth of its investors and executives.

- Manufacturing: American manufacturers, while initially hoping for protection, also faced challenges. Increased costs for imported raw materials and components led to higher production costs, reduced competitiveness, and decreased profitability – again, translating into losses for the billionaires invested in these businesses.

Keywords: Tariff impact on specific industries, affected companies, billionaire losses by sector

The Mechanisms of Loss: How Tariffs Eroded Billionaire Fortunes

The erosion of billionaire fortunes wasn't a direct result of tariffs alone; it was a complex interplay of several economic mechanisms.

- Reduced Consumer Spending: Higher prices on imported goods due to tariffs led to reduced consumer spending. This decrease in demand negatively impacted businesses across various sectors, translating into lower profits and decreased valuations, impacting the wealth of shareholders and investors.

- Increased Production Costs: Tariffs increased the cost of imported raw materials and components, leading to higher production costs for numerous companies. This reduced profit margins and negatively impacted the overall valuations of businesses, consequently impacting billionaire wealth.

- Supply Chain Disruptions: The tariffs caused significant disruptions to global supply chains. Delays, increased transportation costs, and uncertainty regarding trade policies all contributed to increased costs and reduced efficiency, resulting in substantial financial losses for numerous companies and, consequently, for the billionaires associated with them.

Keywords: Tariff mechanisms, supply chain disruptions, reduced consumer spending, increased production costs, impact on investor wealth

Case Studies: Examining Individual Billionaire Impacts

Let's examine a few prominent examples:

-

[Billionaire A]: [Billionaire A's net worth] decreased by [percentage or dollar amount] due to the impact of tariffs on [his/her company]. The increased costs of imported components severely impacted [company's product line], leading to reduced sales and a decline in overall valuation. (Include a chart or graph illustrating the net worth change.)

-

[Billionaire B]: [Billionaire B's company] faced significant supply chain issues due to the tariffs, resulting in production delays and increased costs. This led to a [percentage or dollar amount] decrease in their net worth. (Include a chart or graph illustrating the net worth change.)

-

[Billionaire C]: [Billionaire C's investment portfolio] included a significant stake in several retail companies heavily impacted by the tariffs. Consequently, his net worth experienced a decrease of [percentage or dollar amount]. (Include a chart or graph illustrating the net worth change.)

Keywords: Specific billionaire names, company analysis, net worth changes, impact of tariffs on individual fortunes.

The Ripple Effect: Beyond the Billionaires – Wider Economic Consequences

The impact of Trump's tariffs extended far beyond the billionaires. The ripple effect included:

- Job Losses: Increased costs and reduced competitiveness led to job losses across several industries. This broader economic downturn indirectly impacted billionaire wealth as well.

- Inflation: Higher prices on imported goods fueled inflation, further reducing consumer spending and impacting overall economic growth. This economic uncertainty inevitably impacted the wealth of even the wealthiest investors.

- Reduced Global Trade: The trade war fostered uncertainty and reduced global trade, impacting economic growth worldwide. This global economic slowdown inevitably affected billionaire portfolios.

Keywords: Economic consequences of tariffs, job losses, inflation, ripple effect on the economy, indirect impact on billionaires

Conclusion: Understanding the Lasting Legacy of Trump's Tariffs on Billionaire Wealth

Trump's tariffs resulted in a significant $174 billion loss for top billionaires, impacting various sectors through reduced consumer spending, increased production costs, and supply chain disruptions. The consequences extended far beyond the wealthiest individuals, impacting jobs, fueling inflation, and reducing global trade. Understanding the long-term implications of these trade policies is crucial for navigating future economic uncertainties. Learn more about the impact of Trump's trade policies on billionaire wealth and dive deeper into the analysis of Trump tariffs and their economic effects to gain a comprehensive understanding of this significant economic event.

Featured Posts

-

Europa League Preview Brobbeys Strength A Key Factor

May 10, 2025

Europa League Preview Brobbeys Strength A Key Factor

May 10, 2025 -

Full List Famous Residents Affected By The Palisades Fires

May 10, 2025

Full List Famous Residents Affected By The Palisades Fires

May 10, 2025 -

Analysis Of Petrol Prices In Nigeria The Dangote And Nnpc Factor

May 10, 2025

Analysis Of Petrol Prices In Nigeria The Dangote And Nnpc Factor

May 10, 2025 -

Medieval Book Cover Unveiling Merlin And Arthurs Tale

May 10, 2025

Medieval Book Cover Unveiling Merlin And Arthurs Tale

May 10, 2025 -

Details Of Trumps Planned Trade Agreement With The Uk

May 10, 2025

Details Of Trumps Planned Trade Agreement With The Uk

May 10, 2025