2 Stocks Predicted To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: [Company Name A] – The AI-Powered Cybersecurity Disruptor

Growth Potential and Market Opportunity:

[Company Name A] is a rapidly growing cybersecurity firm leveraging cutting-edge artificial intelligence to provide proactive threat detection and response solutions. Its business model focuses on offering a comprehensive, AI-driven platform that anticipates and neutralizes cyber threats before they can cause significant damage. The global cybersecurity market is booming, projected to reach [Insert Market Size Projection and Source] by [Year]. This presents a massive opportunity for [Company Name A] to capture significant market share.

- High growth rate in the AI-driven threat intelligence sector.

- First-mover advantage in utilizing [Specific AI Technology, e.g., advanced machine learning algorithms] for proactive threat detection.

- Strong partnerships with leading system integrators and managed security service providers (MSSPs).

- Positive analyst ratings and price targets indicating substantial future growth.

Competitive Advantages and Risks:

[Company Name A]'s competitive advantage lies in its proprietary AI algorithms, which offer superior accuracy and speed compared to traditional cybersecurity solutions. This, coupled with its scalable platform, allows it to effectively serve both small and large enterprises. However, the company faces potential risks including:

- Strong intellectual property protecting its core AI technology.

- Highly scalable technology capable of handling massive data volumes.

- Potential regulatory hurdles related to data privacy and security compliance.

- Competition from established players in the cybersecurity market.

Stock #2: [Company Name B] – The Cloud-Based Data Analytics Innovator

Technological Innovation and Market Penetration:

[Company Name B] is revolutionizing data analytics with its innovative cloud-based platform, designed for speed, scalability, and accessibility. Its proprietary technology enables businesses to extract valuable insights from complex datasets faster and more efficiently than traditional methods. The company's rapid expansion into new markets, coupled with a robust customer acquisition strategy, is driving impressive growth.

- Proprietary technology providing real-time data processing and analysis.

- Rapid expansion into underserved markets such as [Specific Market Segment, e.g., the healthcare industry].

- Strong customer acquisition strategy focused on ease of use and demonstrable ROI.

- Positive media coverage and industry recognition for its innovative approach.

Financial Performance and Future Projections:

[Company Name B] has demonstrated strong financial performance with consistent revenue growth and improving profit margins. Based on reputable analyst forecasts (cite sources), the company is projected to [Insert specific financial projections, e.g., double its revenue within the next two years]. A comparison of its key financial metrics to Palantir’s shows a potentially faster growth trajectory.

- Strong revenue growth exceeding industry averages.

- Improving profit margins demonstrating operational efficiency.

- Positive cash flow indicating financial stability.

- Analyst predictions for significant future growth, surpassing Palantir's projected growth rate.

Comparison to Palantir: Key Differentiators and Potential for Surpassing Market Cap

Both [Company Name A] and [Company Name B] offer distinct advantages compared to Palantir. While Palantir focuses on large government contracts and complex data analysis, these two companies target broader markets with more readily scalable and user-friendly solutions. Their focus on AI and cloud-based technologies positions them for faster growth in rapidly expanding sectors.

| Metric | [Company Name A] | [Company Name B] | Palantir |

|---|---|---|---|

| Market Focus | Cybersecurity | Cloud Data Analytics | Big Data Analytics (Gov & Commercial) |

| Key Technology | AI-powered threat detection | Cloud-based data platform | Proprietary data integration platform |

| Growth Rate (Projected) | [Insert Projected Growth] | [Insert Projected Growth] | [Insert Palantir's Projected Growth] |

| Market Cap (Current) | [Insert Current Market Cap] | [Insert Current Market Cap] | [Insert Palantir's Current Market Cap] |

Several market scenarios could support the prediction of these companies surpassing Palantir’s market cap, including continued strong growth in cybersecurity and cloud-based data analytics, coupled with Palantir facing challenges in maintaining its growth trajectory. However, it's crucial to acknowledge potential limitations, such as increased competition, economic downturns, and unforeseen technological disruptions.

Conclusion: Investing in High-Growth Stocks: The Case for [Company Name A] and [Company Name B]

This analysis suggests that [Company Name A] and [Company Name B] possess the potential to significantly outperform Palantir within three years, driven by their innovative technologies, strong market positions, and impressive growth projections. While these stocks hold significant promise, remember that all investments carry risk. Conduct thorough due diligence before making any investment decisions. Consider researching these 2 Stocks Predicted to Surpass Palantir's Value in 3 Years further and assessing their suitability within your overall investment strategy. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

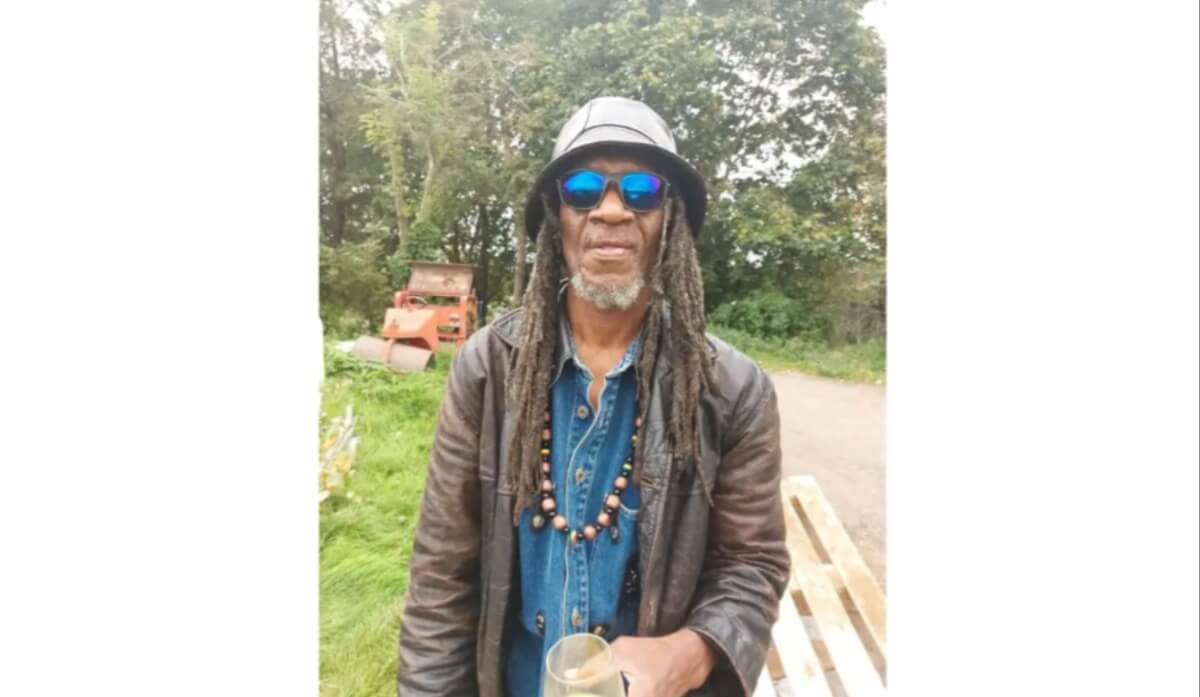

Details Emerge In Racist Stabbing Death Of Man By Woman

May 09, 2025

Details Emerge In Racist Stabbing Death Of Man By Woman

May 09, 2025 -

Formacioni Yll I Gjysmefinaleve Te Liges Se Kampioneve Dominanca E Talenteve Te Psg Se

May 09, 2025

Formacioni Yll I Gjysmefinaleve Te Liges Se Kampioneve Dominanca E Talenteve Te Psg Se

May 09, 2025 -

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025 -

Dakota Johnson At The Materialist Premiere Family Support And Photos

May 09, 2025

Dakota Johnson At The Materialist Premiere Family Support And Photos

May 09, 2025