20M XRP Purchased: Whale Activity Signals Potential Price Surge

Table of Contents

The Significance of Whale Activity in the XRP Market

What are Cryptocurrency Whales?

Cryptocurrency whales are entities (individuals or organizations) holding significant amounts of a particular cryptocurrency, often enough to influence market dynamics. These large holders can manipulate prices through buying or selling large volumes, creating significant price swings. Their actions often dictate short-term market trends and can signal potential shifts in the long-term outlook. For example, a whale's massive sell-off can trigger a sharp price drop due to increased supply. Conversely, a significant buy order can create a buying frenzy and push prices higher.

Why this 20M XRP Purchase is Noteworthy

The recent purchase of 20 million XRP is noteworthy for several reasons. The sheer volume of XRP acquired represents a substantial portion of the daily trading volume, indicating a significant commitment from the whale. This large-scale buying can create a substantial increase in demand, potentially outstripping supply and thereby driving up the price. This transaction's size dwarfs many previous whale transactions, suggesting a high degree of confidence in XRP's future prospects.

- Analysis of the transaction's timing: The timing of the purchase relative to recent market trends and news is crucial. If the purchase occurred during a period of low price, it could indicate accumulation in anticipation of a price increase.

- Potential motivations: The whale's motivation could be accumulation (buying low to sell high), speculation (betting on future price appreciation), or even market manipulation (though this is generally difficult to prove and carries significant risks).

- Comparison to similar past events: Comparing this transaction to previous large XRP purchases and their subsequent market impact helps assess the potential for a similar price movement. Analyzing past price reactions to similar whale activity provides valuable insight into potential future outcomes.

Potential Implications for the XRP Price

Short-Term Price Predictions

Based on technical analysis and current market sentiment, the 20 million XRP purchase could trigger a short-term price increase. Many analysts look at support and resistance levels on price charts to gauge potential price movement. A breakout above a key resistance level, often fueled by increased trading volume, could signal a significant price surge. However, short-term price fluctuations are inherently volatile and influenced by many factors, making precise predictions difficult.

Long-Term Price Outlook

The long-term XRP price outlook is dependent on several factors. Positive regulatory developments, increased adoption by businesses and institutions, and significant technological advancements could all contribute to long-term price appreciation. Conversely, negative regulatory decisions, lack of widespread adoption, and competition from other cryptocurrencies could lead to price depreciation.

- Price charts and support/resistance levels: Technical analysts closely monitor these indicators to identify potential price reversal points and predict future movements.

- Catalysts for further price increases: Positive news, such as new partnerships, successful legal outcomes for Ripple, or increased institutional adoption, could act as strong catalysts.

- Potential risks and negative impacts: Regulatory uncertainty, negative media coverage, or security breaches remain significant risks that could negatively impact XRP's price.

Ripple's Role and Regulatory Developments

Ripple's Ongoing Legal Battle

Ripple's ongoing legal battle with the SEC significantly impacts XRP's price and investor sentiment. Uncertainty surrounding the outcome creates volatility. A positive resolution could lead to a significant price surge, while an unfavorable outcome might depress prices.

Regulatory Landscape and its Influence

The broader regulatory landscape for cryptocurrencies heavily influences XRP's price. Clearer regulatory frameworks provide more stability and confidence to investors. Conversely, uncertainty and inconsistent regulations can create volatility and discourage investment.

- Potential outcomes of the SEC lawsuit: Analyzing different possible outcomes and their potential impact on the price helps investors understand the range of scenarios.

- Regulatory clarity and its positive effects: Clear regulatory frameworks reduce uncertainty and increase investor confidence, potentially leading to price appreciation.

- Other regulatory developments affecting XRP: Regulations in other jurisdictions, such as the EU's MiCA regulation, will also impact the XRP market.

Conclusion

The purchase of 20 million XRP by a whale is a significant event that warrants close monitoring. Its potential to influence the XRP price, both short-term and long-term, is substantial. Several factors, including Ripple's legal battle and the broader regulatory environment, will play a crucial role in shaping XRP's future. Remember that the cryptocurrency market is inherently volatile.

Call to Action: The purchase of 20 million XRP by a whale is a significant event that warrants close monitoring. Stay informed about the latest developments in the XRP market and conduct your own thorough research before making any investment decisions regarding XRP price movements and potential surges. Learn more about the potential of XRP and its future price. Is this the start of a major bull run for XRP? Only time will tell, but understanding the dynamics of this whale activity is crucial for navigating the cryptocurrency market.

Featured Posts

-

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Dn Dlha Ky Mwt

May 08, 2025

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Dn Dlha Ky Mwt

May 08, 2025 -

Everything You Need To Know Before Watching Andor Season 2 A Star Wars Recap

May 08, 2025

Everything You Need To Know Before Watching Andor Season 2 A Star Wars Recap

May 08, 2025 -

Uber Auto Service A New Cash Only System

May 08, 2025

Uber Auto Service A New Cash Only System

May 08, 2025 -

Xrps 400 Growth A Deep Dive Into Price Predictions

May 08, 2025

Xrps 400 Growth A Deep Dive Into Price Predictions

May 08, 2025 -

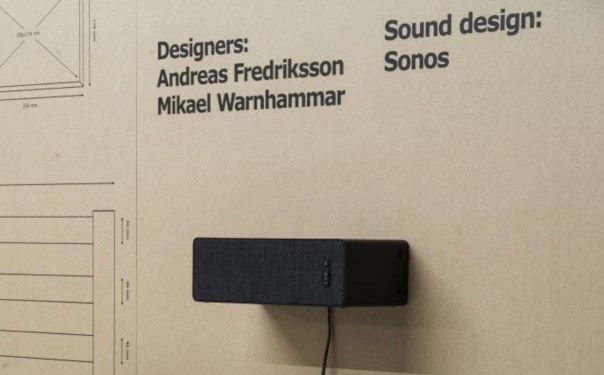

Ikea And Sonos Collaboration Officially Over What It Means For Consumers

May 08, 2025

Ikea And Sonos Collaboration Officially Over What It Means For Consumers

May 08, 2025