2025 Market Downturn: D-Wave Quantum (QBTS) Stock's Significant Fall

Table of Contents

Macroeconomic Factors Contributing to QBTS Stock Decline

The Broader 2025 Market Downturn

2025 presented a challenging economic climate. High inflation, fueled by supply chain disruptions and increased energy costs, led to aggressive interest rate hikes by central banks globally. These actions, while intended to curb inflation, inadvertently slowed economic growth, sparking recessionary fears. This overall market volatility significantly impacted tech stocks, which are often considered more sensitive to economic downturns than more established sectors. For a relatively young company like D-Wave Quantum, already facing the inherent risks of investing in a nascent technology, the macroeconomic headwinds proved particularly challenging.

- Inflationary Pressures: Soaring inflation eroded consumer spending and corporate profits, impacting investor confidence and driving down stock valuations.

- Interest Rate Hikes: Higher interest rates increased borrowing costs for companies, hindering expansion plans and reducing profitability.

- Recessionary Fears: The looming threat of a recession prompted investors to move towards safer, more established investments, leading to a sell-off in riskier tech stocks, including QBTS.

- Market Volatility: The uncertain economic outlook created significant market volatility, with sharp daily fluctuations in stock prices.

Sector-Specific Challenges for Quantum Computing

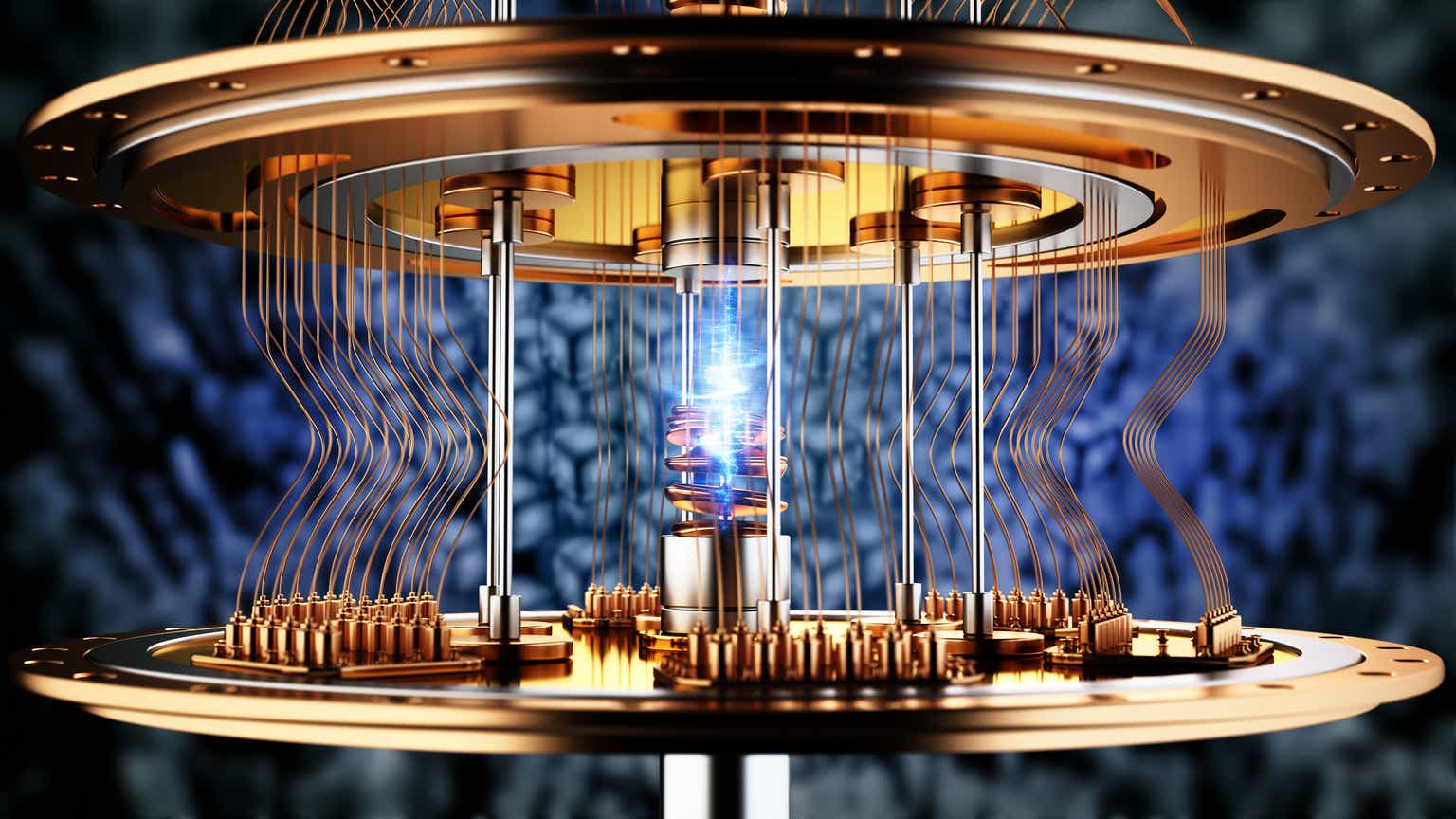

The quantum computing sector, while promising, also faced specific challenges in 2025. The technology is still in its early stages of development, with limited practical applications readily available to generate significant revenue. High development costs and intense competition further contributed to investor apprehension.

- Technological Limitations: The technology is complex and requires significant breakthroughs before it can achieve widespread commercial viability.

- Market Competition: Several major players are vying for dominance in the quantum computing market, creating intense competition and squeezing profit margins.

- High Development Costs: Research and development in quantum computing require substantial investment, making profitability a long-term prospect.

- Limited Practical Applications: The lack of widespread, commercially viable applications limited the immediate revenue generation potential for companies in the sector.

D-Wave Quantum (QBTS) Specific Vulnerabilities

Company-Specific Financial Performance

D-Wave Quantum's (QBTS) financial performance leading up to and during the 2025 downturn played a crucial role in its stock price decline. While specific financial data would need to be analyzed using publicly available QBTS financial statements, areas to scrutinize for a complete picture would include:

- Revenue Growth: The rate of revenue growth, or lack thereof, directly reflects the company's ability to commercialize its technology and penetrate the market.

- Profitability Margins: Low or negative profit margins highlight the challenges of operating in a capital-intensive industry with limited immediate revenue streams.

- Debt-to-Equity Ratio: A high debt-to-equity ratio suggests a reliance on debt financing, increasing financial vulnerability during economic downturns.

Competitive Landscape and Technological Advancements

D-Wave Quantum faced stiff competition from established tech giants and emerging quantum computing companies. Analyzing the advancements made by competitors and their impact on D-Wave's market share is crucial for understanding the QBTS stock price drop. Key factors include:

- Quantum Computing Competitors: Identifying and analyzing the strengths and weaknesses of key competitors is essential for assessing D-Wave's competitive position.

- Market Share: Monitoring D-Wave's market share and its trajectory is crucial for gauging its success in a competitive landscape.

- Technological Innovation: Evaluating D-Wave's pace of innovation and its ability to stay ahead of competitors is critical for assessing its long-term prospects.

Analyzing the QBTS Stock Price Drop and Investor Sentiment

Charting the QBTS Stock Price Decline

A chart visualizing the QBTS stock price decline during 2025 would be invaluable. This visual representation, showing key dates and price points, would offer a clear picture of the stock's volatility and the magnitude of its fall. The chart would highlight the correlation between macroeconomic events, company-specific news, and the resulting fluctuations in QBTS market capitalization. Keywords like "QBTS stock chart," "stock price volatility," and "market capitalization" would be essential for SEO purposes.

Investor Sentiment and Market Reaction

Investor sentiment towards QBTS during the downturn significantly influenced its stock price. Analyzing news articles, analyst reports, and social media discussions reveals investor concerns and market reactions.

- Investor Confidence: A decline in investor confidence, reflected in negative news coverage and analyst downgrades, contributed to the sell-off.

- Market Sentiment: The overall negative market sentiment surrounding tech stocks exacerbated the decline in QBTS stock price.

- Analyst Ratings: Tracking changes in analyst ratings and their justifications provides insights into shifting market perceptions.

- Social Media Analysis: Analyzing social media conversations about QBTS can reveal sentiment and gauge public perception.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Fall and Future Outlook

The significant fall of D-Wave Quantum (QBTS) stock in 2025 resulted from a confluence of factors. Macroeconomic headwinds, including high inflation, interest rate hikes, and recessionary fears, created a challenging environment for tech stocks generally. Simultaneously, sector-specific challenges within the quantum computing industry, including technological limitations, high development costs, and intense competition, further impacted QBTS. Finally, company-specific financial performance and competitive pressures added to the downward pressure on QBTS's stock price. The future of QBTS stock and the broader quantum computing sector remains uncertain. While the long-term potential of quantum computing is undeniable, navigating the inherent risks associated with this technology and understanding the impact of macroeconomic conditions remains crucial. Conduct further research on D-Wave Quantum (QBTS) stock, analyzing QBTS financial statements and keeping abreast of market developments, to make informed investment decisions regarding D-Wave Quantum (QBTS) and other quantum computing investments. Effectively managing QBTS stock risk requires a thorough understanding of the factors detailed in this analysis.

Featured Posts

-

Historic Corruption Conviction Of Former Navy Second In Command

May 20, 2025

Historic Corruption Conviction Of Former Navy Second In Command

May 20, 2025 -

Nigerias Moral Landscape Parallels With Khaled Hosseinis Kite Runner

May 20, 2025

Nigerias Moral Landscape Parallels With Khaled Hosseinis Kite Runner

May 20, 2025 -

Robert Burke Guilty Verdict Four Star Admirals Bribery Case

May 20, 2025

Robert Burke Guilty Verdict Four Star Admirals Bribery Case

May 20, 2025 -

Madrid Open Sabalenka Cruises Past Mertens Into Next Round

May 20, 2025

Madrid Open Sabalenka Cruises Past Mertens Into Next Round

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 20, 2025

Latest Posts

-

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta En Lang Kamp

May 20, 2025

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta En Lang Kamp

May 20, 2025 -

Zoey Stark Sidelined Wwe Raw Injury Report

May 20, 2025

Zoey Stark Sidelined Wwe Raw Injury Report

May 20, 2025 -

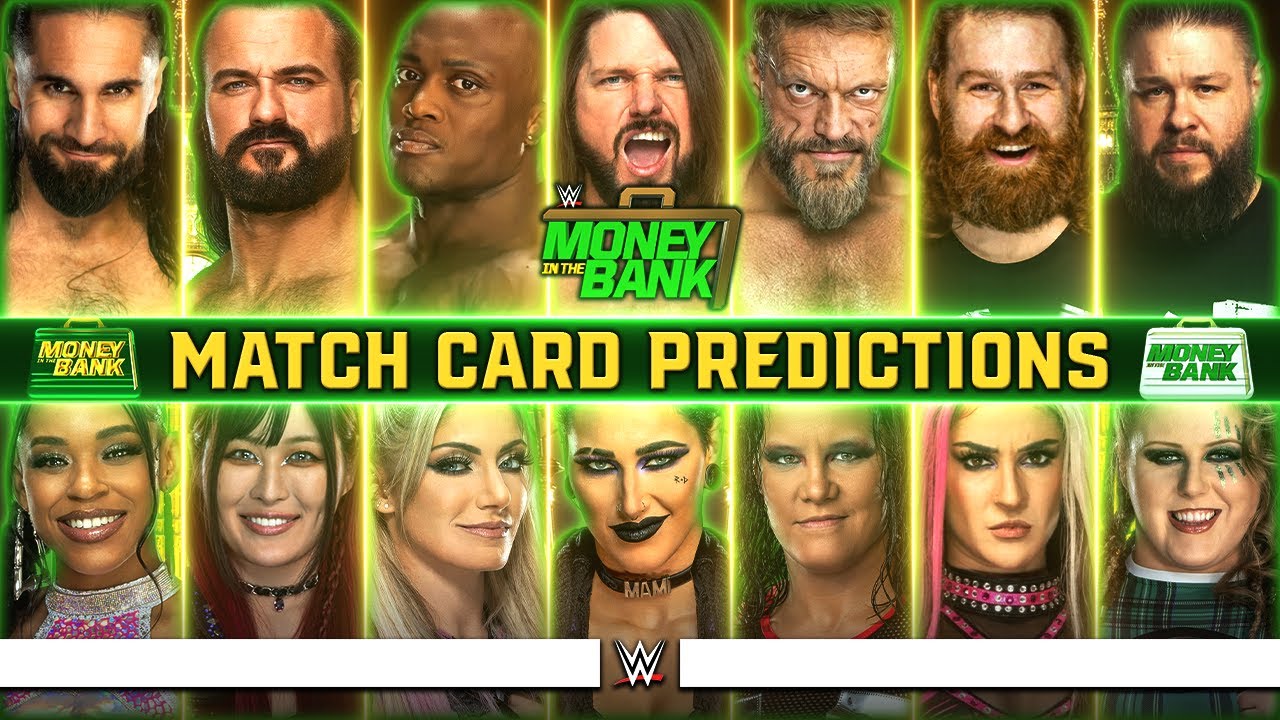

Money In The Bank 2025 Qualification Confirmed For Perez And Ripley

May 20, 2025

Money In The Bank 2025 Qualification Confirmed For Perez And Ripley

May 20, 2025 -

Zoey Starks Injury On Wwe Raw Details And Updates

May 20, 2025

Zoey Starks Injury On Wwe Raw Details And Updates

May 20, 2025 -

Rhea Ripley And Roxanne Perez Road To Money In The Bank Ladder Match

May 20, 2025

Rhea Ripley And Roxanne Perez Road To Money In The Bank Ladder Match

May 20, 2025