£3 Billion Cut To SSE Spending Plan: Impact Of Slowing Growth

Table of Contents

The Reasons Behind the £3 Billion Cut

SSE's decision to slash its spending by £3 billion is a direct response to a confluence of challenging macroeconomic factors. The current economic climate, characterized by high inflation and rising interest rates, has significantly increased the cost of borrowing and made large-scale infrastructure projects considerably more expensive. This has a direct impact on the viability of projects previously considered feasible.

Government policies and regulations also play a significant role. Uncertainty surrounding future energy policies and regulatory changes introduces risk into long-term investment planning. This uncertainty makes it difficult for companies like SSE to accurately assess the return on investment for large-scale projects, leading them to be more cautious.

- Increased financing costs: Higher interest rates make securing funding for major projects considerably more expensive.

- Uncertainty in energy markets: Fluctuations in energy prices and demand create unpredictability in revenue projections.

- Pressure from investors for improved profitability: Shareholders are demanding greater returns in the current economic climate, prompting companies to prioritize profitability over ambitious growth strategies.

- Shifting consumer demand: Changing consumer behaviours and energy consumption patterns require a reassessment of investment priorities.

Impact on SSE's Renewable Energy Investments

The £3 billion cut to SSE spending plan has significant implications for the company's ambitious renewable energy targets. SSE, a major player in the UK's renewable energy sector, had planned substantial investments in wind, solar, and other renewable energy sources. However, this spending reduction will inevitably lead to delays or even cancellations of several projects.

This slowdown in investment will directly impact the UK's commitment to achieving net-zero emissions. Reduced investment in renewable energy infrastructure will hamper the transition to cleaner energy sources and could potentially delay the UK's progress towards its climate goals.

- Delayed deployment of wind farms: Several planned onshore and offshore wind farm projects could face significant delays, impacting electricity generation capacity.

- Postponed solar energy projects: Investments in large-scale solar farms may be put on hold, reducing the contribution of solar power to the national grid.

- Reduced investment in energy storage solutions: Essential energy storage projects, crucial for balancing intermittent renewable energy sources, could be scaled back.

- Impact on job creation in the renewable energy sector: Delays and cancellations of projects will inevitably affect employment opportunities in the growing renewable energy sector.

Wider Implications for the Energy Sector

SSE's decision to implement a £3 billion cut to its spending plan could signal a broader trend amongst energy companies facing similar economic pressures. Other large energy firms may be forced to reconsider their own investment strategies, leading to a potential slowdown in the development of new energy infrastructure across the UK.

This reduced investment carries significant implications for UK energy security and independence. A slower transition to renewable energy sources could increase the UK's reliance on fossil fuels, impacting both energy prices and the nation's climate goals.

- Potential for reduced investment across the energy sector: Other energy companies might follow suit, leading to a general slowdown in energy infrastructure development.

- Increased energy prices due to slower renewable energy deployment: Reduced renewable energy capacity could lead to higher energy prices for consumers.

- Risk to UK energy security: Increased reliance on imported fossil fuels poses a significant risk to the UK's energy security.

- Implications for green jobs and economic growth: Reduced investment in renewable energy will negatively impact the growth of green jobs and the wider economy.

SSE's Response and Future Outlook

SSE has responded to the criticism surrounding the £3 billion cut to SSE spending plan by stating that the decision reflects a necessary prioritization of projects and a commitment to efficient capital allocation in a challenging economic environment. Their revised investment strategy focuses on cost optimization and efficiency, aiming to maximize returns on existing investments while carefully selecting new projects.

The future outlook for SSE remains uncertain. While the company aims to maintain its commitment to renewable energy, the impact of the spending cuts will be felt for years to come. Strategic partnerships and acquisitions might become more prominent in their future plans.

- SSE's revised investment priorities: Focus is shifting towards projects with higher returns and lower risk.

- Focus on cost optimization and efficiency: SSE is actively seeking ways to reduce operational costs and improve efficiency across its operations.

- Potential for strategic partnerships or acquisitions: Collaborations and acquisitions may become key strategies for achieving growth objectives.

- Long-term outlook for SSE's profitability and growth: The long-term impact on profitability and growth will depend on the success of their revised strategy and the wider economic conditions.

Conclusion: Understanding the Long-Term Effects of the £3 Billion Cut to SSE Spending

The £3 billion cut to SSE's spending plan represents a significant development with far-reaching consequences for SSE itself, the UK energy sector, and the nation's climate goals. The decision reflects the challenges faced by energy companies in navigating a complex economic environment. The impact of SSE spending cuts, including delays in renewable energy projects and potential risks to energy security, will require close monitoring. The reduced investment in renewable energy raises concerns about the UK's ability to meet its climate targets. Understanding the long-term effects of these SSE investment reductions and SSE's revised energy strategy is crucial. To stay informed on future developments related to the £3 billion cut to SSE spending plan and the evolving energy landscape, continue to follow reputable news sources and industry publications.

Featured Posts

-

Idf Soldiers In Gaza Accounts Of Capture And Perseverance

May 26, 2025

Idf Soldiers In Gaza Accounts Of Capture And Perseverance

May 26, 2025 -

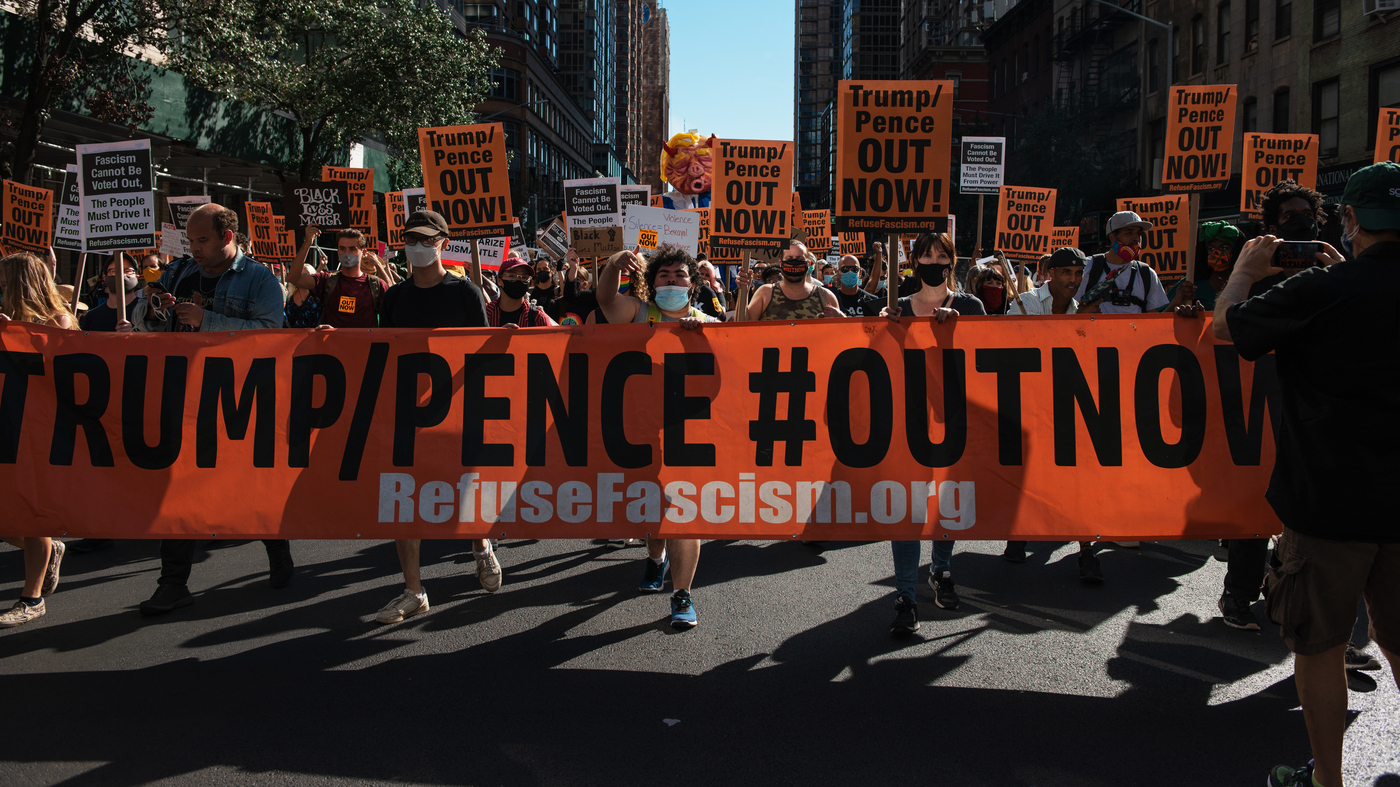

Is Fascism Rising Delaware Governors Warning On The Post Biden World And Trumps Legacy

May 26, 2025

Is Fascism Rising Delaware Governors Warning On The Post Biden World And Trumps Legacy

May 26, 2025 -

Impact Of G 7 De Minimis Tariff Discussions On Chinese Exports

May 26, 2025

Impact Of G 7 De Minimis Tariff Discussions On Chinese Exports

May 26, 2025 -

Moto Gp Inggris Catat Tanggal And Waktu Tayangan Balapan

May 26, 2025

Moto Gp Inggris Catat Tanggal And Waktu Tayangan Balapan

May 26, 2025 -

Atletico Madrid Barcelona Maci Canli Skor Ve Detayli Analiz Fanatik

May 26, 2025

Atletico Madrid Barcelona Maci Canli Skor Ve Detayli Analiz Fanatik

May 26, 2025

Latest Posts

-

Nachalo Syemok Novogo Filma Uesa Andersona

May 28, 2025

Nachalo Syemok Novogo Filma Uesa Andersona

May 28, 2025 -

Pepper Premiere Programacion Y Noticias De Pepper 96 6 Fm

May 28, 2025

Pepper Premiere Programacion Y Noticias De Pepper 96 6 Fm

May 28, 2025 -

Viktor Gyoekeres Kariyer Istatistikleri Ve Son Performansi

May 28, 2025

Viktor Gyoekeres Kariyer Istatistikleri Ve Son Performansi

May 28, 2025 -

Escucha Pepper Premiere En Pepper 96 6 Fm

May 28, 2025

Escucha Pepper Premiere En Pepper 96 6 Fm

May 28, 2025 -

Chto Izvestno O Novom Filme Uesa Andersona

May 28, 2025

Chto Izvestno O Novom Filme Uesa Andersona

May 28, 2025