3 Financial Mistakes Women Often Make: Expert Advice

Table of Contents

Underestimating the Importance of Retirement Planning

Retirement planning is crucial for a secure financial future, yet many women underestimate its importance. Failing to adequately plan for retirement can lead to significant financial hardship later in life. This section explores two key areas where women often fall short.

Delaying Retirement Savings

Many women delay starting retirement savings due to various life priorities, such as raising children or focusing on a career. This delay can severely impact their long-term financial well-being due to the reduced time for their investments to grow.

- Start early, even with small contributions: The power of compounding interest means that even small contributions made early will significantly impact your retirement nest egg. Every dollar invested early has more time to grow exponentially.

- Utilize employer-sponsored retirement plans like 401(k)s: Many employers offer matching contributions to 401(k) plans, essentially giving you free money. Take full advantage of this! Also, explore the tax advantages offered by these plans.

- Consider Roth IRAs for tax-advantaged growth: Roth IRAs offer tax-free withdrawals in retirement, making them an attractive option for long-term savings.

Not Adjusting for Life Changes

Life is full of unexpected changes. Marriage, children, divorce, career changes, or even unexpected health issues, significantly impact financial needs and retirement planning. Failing to adapt your retirement strategy to these life events can leave you with insufficient savings.

- Regularly review and adjust your retirement plan: Life circumstances change, and your retirement plan should reflect those changes. Schedule annual reviews to ensure your plan remains aligned with your goals.

- Seek professional financial advice: A financial advisor can help you navigate complex life transitions and develop a personalized retirement plan that accounts for your unique circumstances.

- Consider life insurance and disability insurance: These insurance policies provide financial protection in case of unexpected events, protecting your financial future and your retirement savings.

Neglecting Investing and Portfolio Diversification

Investing can be intimidating, but it's a crucial element of building long-term wealth. Many women avoid investing altogether, limiting their potential for financial growth. Understanding and implementing effective investing strategies is essential for achieving financial independence.

Fear of Investing

The fear of losing money is a common barrier to investing. However, avoiding investing altogether is often a far greater risk to long-term financial well-being.

- Start with small, manageable investments: Don't feel pressured to invest a large sum of money immediately. Begin with small, regular investments to build confidence and experience.

- Consider index funds or ETFs for diversified exposure: These are relatively low-cost ways to gain exposure to a broad range of stocks or bonds, reducing your risk.

- Educate yourself on investing basics: Numerous resources are available to help you understand the basics of investing. Books, online courses, and financial advisors can provide valuable guidance.

Lack of Portfolio Diversification

Putting all your eggs in one basket is a risky strategy. Concentrating investments in a single asset class or company exposes you to significant risk. Diversification spreads risk across various investments.

- Diversify your portfolio across different asset classes: A well-diversified portfolio includes a mix of stocks, bonds, real estate, and potentially other asset classes, depending on your risk tolerance and financial goals.

- Consult a financial advisor for personalized portfolio diversification strategies: A financial advisor can help you create a portfolio that aligns with your risk tolerance and financial goals.

- Regularly rebalance your portfolio: Over time, the proportion of assets in your portfolio may drift from your desired allocation. Regular rebalancing helps ensure you maintain your target asset allocation.

Ignoring Debt Management Strategies

High levels of debt, particularly high-interest debt, can severely impact your financial health and ability to achieve your long-term goals. Effective debt management is essential for building a strong financial foundation.

High-Interest Debt Burden

Credit card debt and other high-interest loans can quickly spiral out of control. Addressing high-interest debt aggressively is critical for long-term financial well-being.

- Create a budget: Tracking your income and expenses is the first step toward managing your debt effectively.

- Prioritize paying off high-interest debt: Focus your efforts on paying off the debts with the highest interest rates first, using methods like the debt snowball or avalanche methods.

- Consider debt consolidation options: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and potentially save you money.

Lack of Financial Literacy

A lack of financial knowledge can hinder your ability to manage your debt effectively. Building financial literacy is crucial for making informed financial decisions.

- Seek educational resources: Many free and low-cost resources are available to improve your financial literacy.

- Take advantage of free online resources and workshops: Utilize online courses, webinars, and local workshops to expand your financial knowledge.

- Consult a financial advisor: A financial advisor can provide personalized guidance and support to help you navigate complex financial matters.

Conclusion

This article highlighted three significant financial mistakes women often make: neglecting retirement planning, avoiding investing and diversification, and mismanaging debt. By understanding these common pitfalls and implementing the expert advice provided, you can take proactive steps toward building a strong financial future. Remember, taking control of your finances is crucial for achieving your financial goals. Don’t let common financial mistakes women make derail your success. Start planning today and secure your financial well-being! (Call to action using variations of the main keyword: Financial Mistakes Women, Women's Financial Planning, Financial Security for Women).

Featured Posts

-

Love And Power The Downfall Of Two Ceos

May 22, 2025

Love And Power The Downfall Of Two Ceos

May 22, 2025 -

Tuerkiye Nin Nato Daki Yeni Konumu Ve Ittifakin Gelecegi Uezerindeki Etkisi

May 22, 2025

Tuerkiye Nin Nato Daki Yeni Konumu Ve Ittifakin Gelecegi Uezerindeki Etkisi

May 22, 2025 -

Bidens 2014 Prostate Cancer Screening What We Know

May 22, 2025

Bidens 2014 Prostate Cancer Screening What We Know

May 22, 2025 -

Podcast Creation Revolution Ais Role In Processing Repetitive Scatological Data

May 22, 2025

Podcast Creation Revolution Ais Role In Processing Repetitive Scatological Data

May 22, 2025 -

Australian Trans Influencers Record Breaking Success Why The Skepticism

May 22, 2025

Australian Trans Influencers Record Breaking Success Why The Skepticism

May 22, 2025

Latest Posts

-

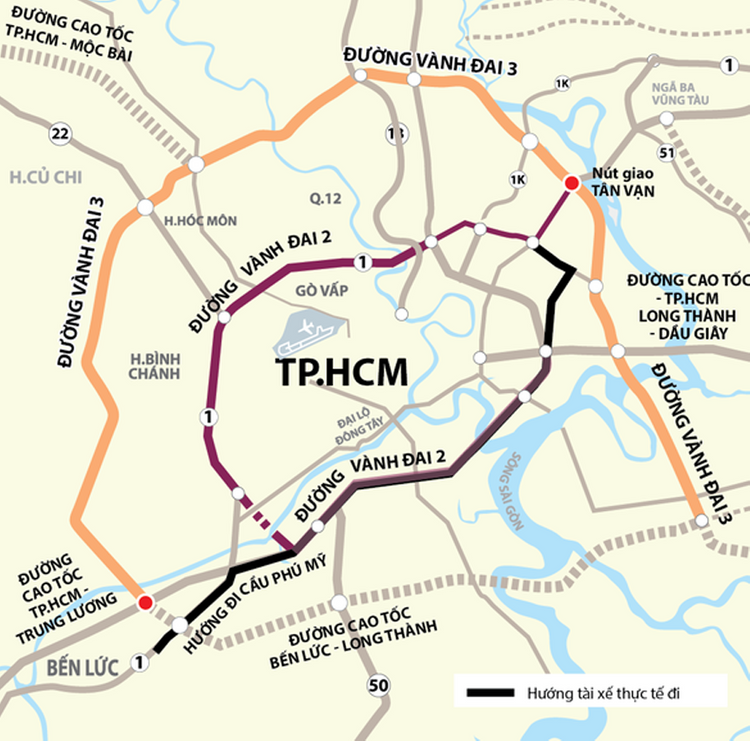

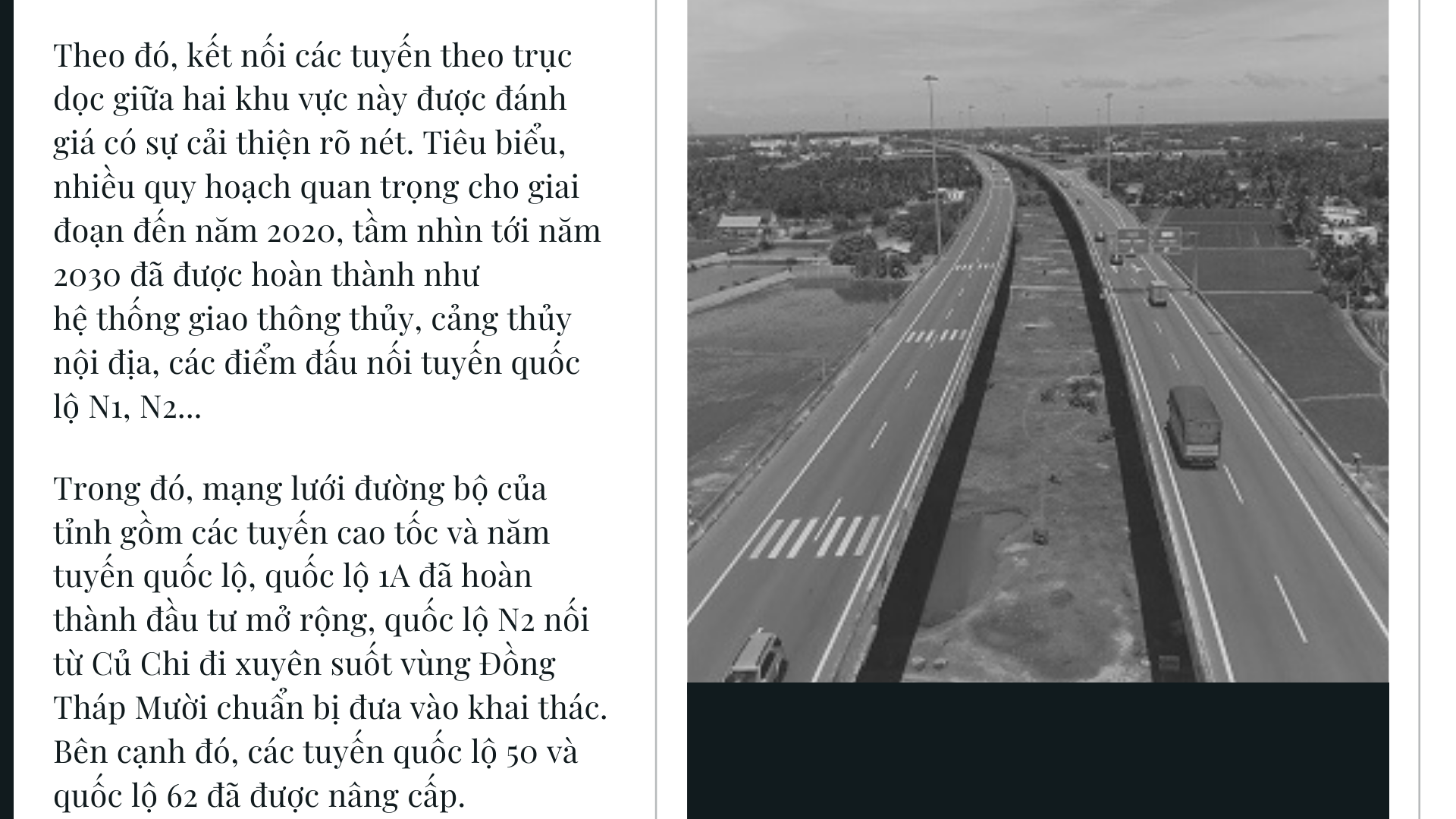

7 Tuyen Duong Ket Noi Tp Hcm Long An Dinh Huong Dau Tu Thong Minh

May 22, 2025

7 Tuyen Duong Ket Noi Tp Hcm Long An Dinh Huong Dau Tu Thong Minh

May 22, 2025 -

Phan Tich 7 Diem Nut Giao Thong Quan Trong Tp Hcm Long An

May 22, 2025

Phan Tich 7 Diem Nut Giao Thong Quan Trong Tp Hcm Long An

May 22, 2025 -

Phuong Tien Di Chuyen Giua Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025

Phuong Tien Di Chuyen Giua Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025 -

Thuc Day Phat Trien 7 Vi Tri Ket Noi Tp Hcm Long An Can Dau Tu

May 22, 2025

Thuc Day Phat Trien 7 Vi Tri Ket Noi Tp Hcm Long An Can Dau Tu

May 22, 2025 -

Cac Tuyen Duong Ket Noi Tp Hcm Den Ba Ria Vung Tau

May 22, 2025

Cac Tuyen Duong Ket Noi Tp Hcm Den Ba Ria Vung Tau

May 22, 2025