40% Palantir Stock Growth By 2025? A Realistic Investment Opportunity?

Table of Contents

Palantir Technologies (PLTR) has captured the attention of investors worldwide with its groundbreaking data analytics platform. Recent market fluctuations and impressive technological advancements have ignited speculation about its future growth potential. This article examines the compelling question: Is a 40% surge in Palantir stock price by 2025 a realistic prospect? We will analyze market trends, company performance, and inherent risks to provide a comprehensive perspective on this potentially lucrative investment opportunity.

Palantir's Current Market Position and Growth Drivers

Government Contracts and Revenue Streams

Palantir's revenue streams are significantly influenced by its substantial government contracts, particularly within the US intelligence and defense sectors. However, the company is actively diversifying its commercial client base, expanding into sectors like finance, healthcare, and energy. This diversification reduces reliance on a single revenue source, bolstering the long-term sustainability of the Palantir investment. Further growth could be driven by increased government spending on advanced data analytics and cybersecurity solutions, a trend expected to continue in the coming years.

- Key Government Contracts: CIA, Department of Defense, various other national security agencies.

- Key Commercial Contracts: Large financial institutions, healthcare providers, energy companies (specific names would be added here in a final version for SEO purposes).

- Growth Potential: Increased adoption of Palantir's Foundry platform by both government and commercial clients.

Technological Innovation and Competitive Advantage

Palantir's proprietary Foundry platform stands as a significant differentiator. Its capabilities in data integration, analysis, and visualization surpass those of many competitors in the data analytics space. This advantage stems from continuous investment in research and development, ensuring the platform remains at the forefront of technological innovation. Palantir's commitment to innovation consistently enhances its competitive position and expands its addressable market.

- Key Technological Differentiators: Foundry's intuitive interface, advanced AI/ML capabilities, strong data security features.

- Recent Innovations: Improvements in automation, enhanced collaboration tools, expansion of platform capabilities into new domains.

- Competitive Landscape: While competitors exist (e.g., AWS, Microsoft Azure), Palantir's unique platform and focus on complex data problems provide a strong competitive edge.

Factors Affecting Palantir Stock Price

Market Volatility and Economic Conditions

Palantir's stock price, like many technology stocks, is susceptible to broader market volatility. Macroeconomic factors, such as inflation, interest rate changes, and global economic uncertainty, significantly influence investor sentiment and investment decisions. Geopolitical events can also create instability, impacting the overall market and specifically impacting Palantir stock. Understanding these external factors is crucial for assessing the risk associated with a Palantir investment.

- Market Risks: General market downturns, technological sector corrections, shifts in investor sentiment.

- Economic Factors: Inflation rates, interest rate hikes, economic recessions, global supply chain disruptions.

- Geopolitical Risks: International conflicts, trade wars, regulatory changes in key markets.

Financial Performance and Profitability

Analyzing Palantir's financial performance—revenue growth, profitability, cash flow, and debt levels—is essential for assessing its long-term sustainability. While Palantir has demonstrated significant revenue growth, achieving consistent profitability remains a key focus. Investors should carefully examine the company's financial reports to assess its path to profitability and its overall financial health. High debt levels or inconsistent financial performance could negatively impact the stock price.

- Key Financial Metrics: Revenue growth rate, operating margin, net income, free cash flow, debt-to-equity ratio.

- Profitability Path: Focus on increasing operating margins through operational efficiency and expansion of high-margin commercial contracts.

- Financial Health: Assessment of cash reserves, debt levels, and overall financial stability.

Assessing the 40% Growth Prediction

Analyst Forecasts and Market Sentiment

Predicting a 40% increase in Palantir's stock price by 2025 requires careful consideration of various analyst forecasts and current market sentiment. Analyst predictions vary considerably, reflecting the inherent uncertainty in the technology sector. Examining the rationale behind these predictions helps understand the potential range of outcomes. Analyzing investor sentiment through media coverage and social media discussions also provides valuable insight.

- Analyst Predictions: A summary table comparing different analyst predictions, their target prices, and supporting rationale (would be inserted here in a final version).

- Market Sentiment: Analysis of investor sentiment based on media coverage, social media trends, and overall market perception of Palantir.

- Potential Outcomes: A discussion on the range of possible outcomes – from significant growth exceeding 40% to stagnation or decline.

Risks and Potential Downsides

Investing in Palantir stock involves inherent risks. Intense competition in the data analytics sector poses a challenge. Regulatory hurdles and potential changes in government spending could also impact the company's performance. Further, all technology stocks carry a degree of risk, and diversification within an investment portfolio is recommended.

- Competitive Risks: Competition from established tech giants and emerging data analytics companies.

- Regulatory Risks: Changes in government regulations and policies impacting data privacy and security.

- Technological Risks: Rapid technological advancements that could render current technology obsolete.

- Mitigating Strategies: Diversification of investments, thorough due diligence before investing, and continuous monitoring of market conditions.

Conclusion

This analysis explored the possibility of a 40% Palantir stock growth by 2025, considering its market position, growth drivers, and potential risks. While Palantir boasts strong technological capabilities and a growing customer base, significant market volatility and economic uncertainties persist. Achieving a 40% increase is ambitious and contingent on several key factors.

Call to Action: Investing in Palantir stock demands careful consideration of your risk tolerance and financial goals. Conduct thorough research, review Palantir's stock forecast and PLTR stock predictions, and consult with a financial advisor before making investment decisions concerning Palantir stock or any other data analytics stock. Remember that Palantir investment carries inherent risks.

Featured Posts

-

Jesse Watters Faces Backlash Hypocrisy Claims After Wife Cheating Joke

May 10, 2025

Jesse Watters Faces Backlash Hypocrisy Claims After Wife Cheating Joke

May 10, 2025 -

4 5

May 10, 2025

4 5

May 10, 2025 -

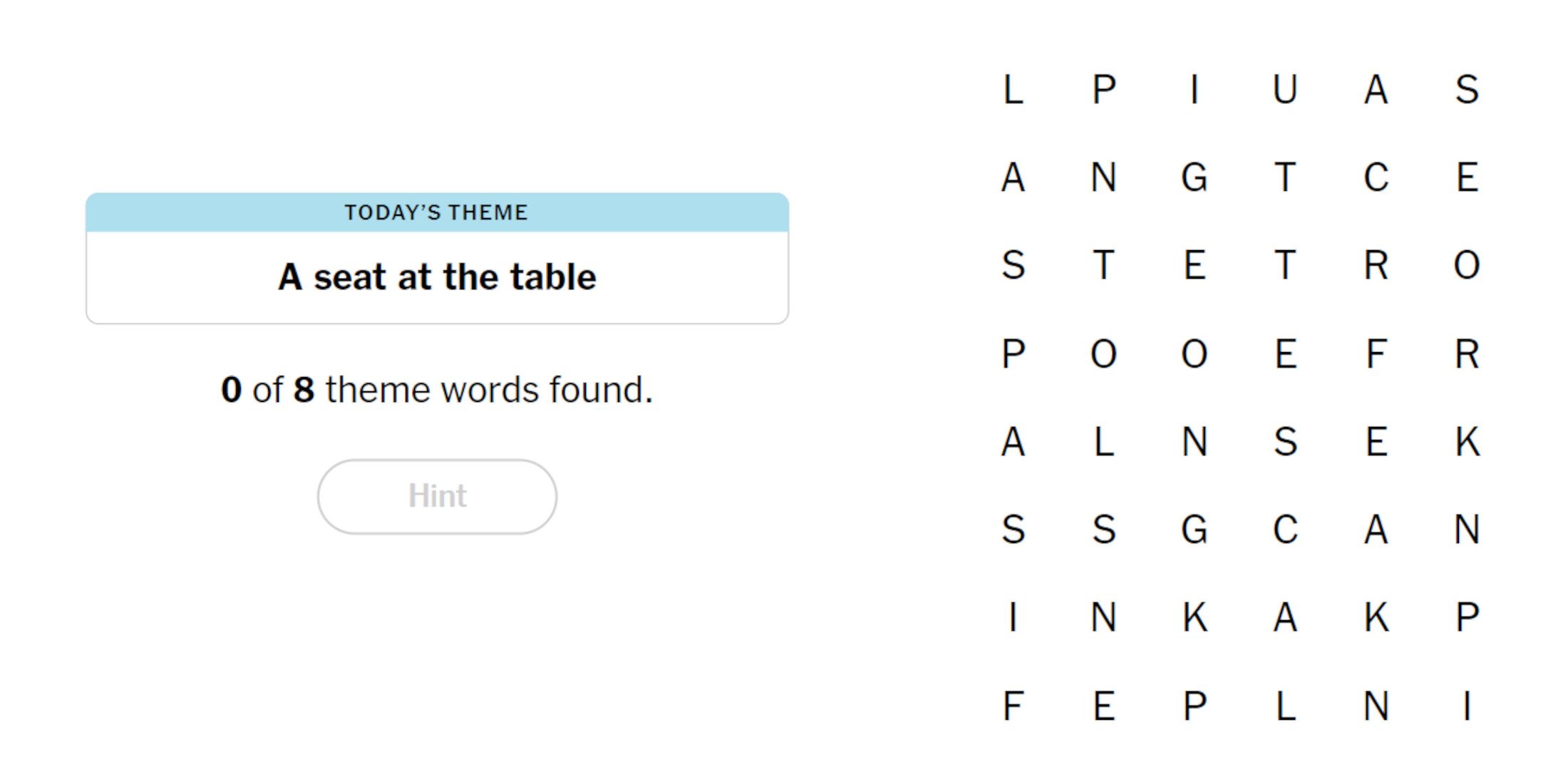

Nyt Strands April 10th 2024 Solutions Game 403

May 10, 2025

Nyt Strands April 10th 2024 Solutions Game 403

May 10, 2025 -

Analyzing Palantirs Potential Is A 40 Stock Increase In 2025 Achievable

May 10, 2025

Analyzing Palantirs Potential Is A 40 Stock Increase In 2025 Achievable

May 10, 2025 -

Potential Tariffs On Commercial Aircraft Examining Trumps Trade Policy

May 10, 2025

Potential Tariffs On Commercial Aircraft Examining Trumps Trade Policy

May 10, 2025