400% Up And Still Climbing? Exploring XRP's Potential For Further Growth

Table of Contents

Analyzing XRP's Recent Price Surge: Factors Contributing to Growth

Several key factors have contributed to XRP's impressive price surge. Let's examine the most significant ones:

Increased Adoption of RippleNet by Financial Institutions

RippleNet, Ripple's real-time gross settlement system, has seen significant adoption by major financial institutions globally. This increased usage directly impacts XRP demand.

- Examples: Several large banks, including Santander, SBI Holdings, and MoneyGram, utilize RippleNet for faster and cheaper cross-border payments.

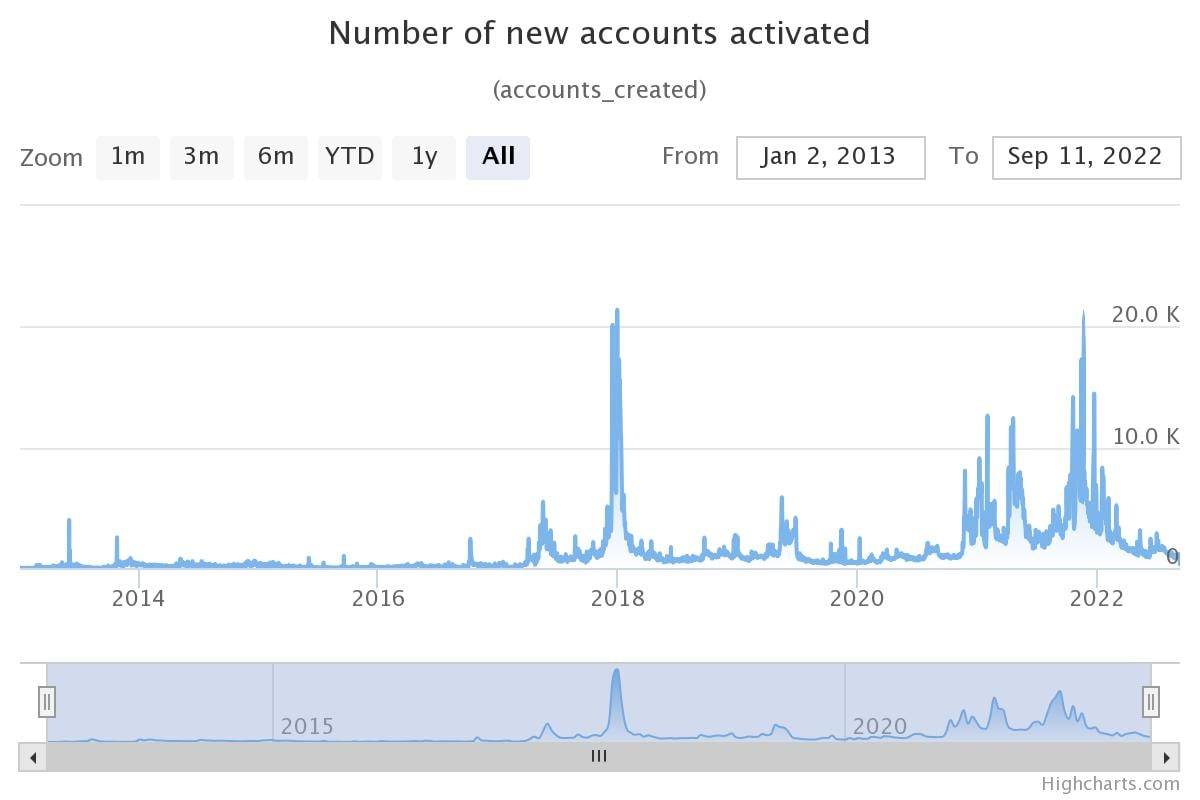

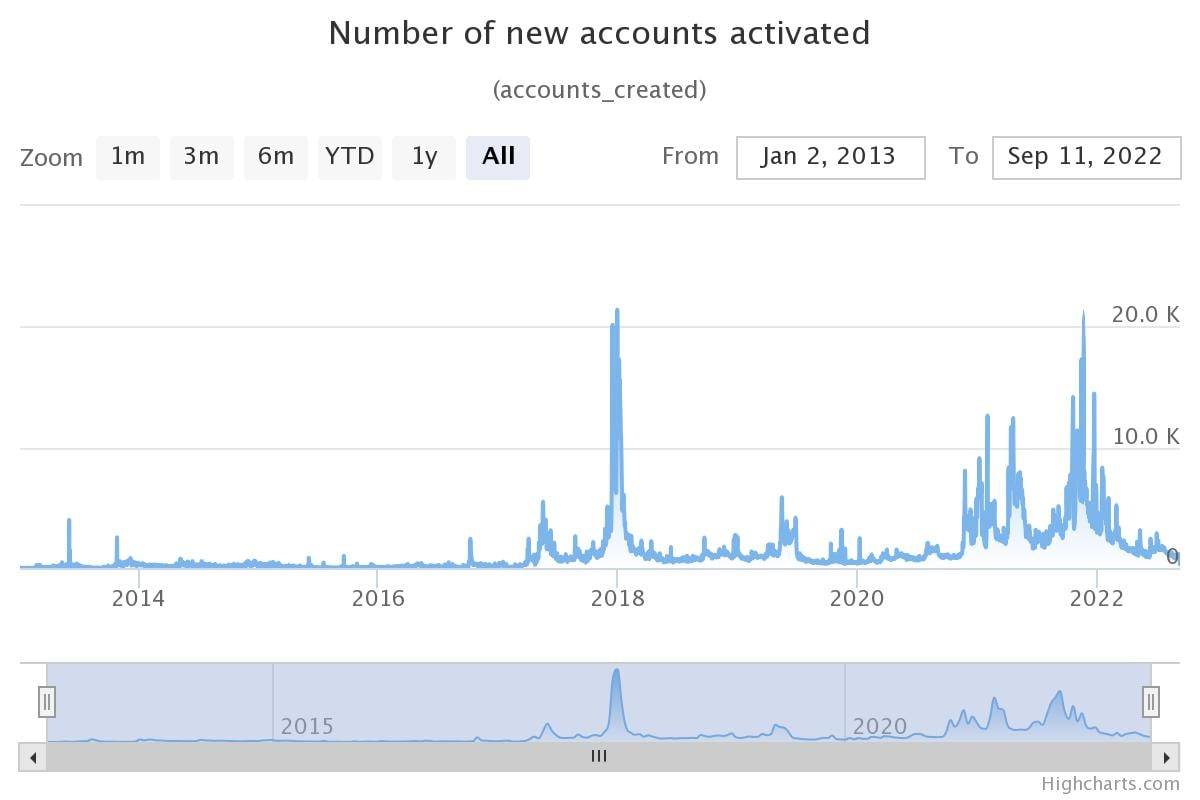

- Transaction Volume: The volume of transactions processed through RippleNet has steadily increased, reflecting growing confidence and usage within the financial industry. This increased XRP transaction volume is a primary driver of price appreciation.

- Positive Impact: This institutional adoption signifies a growing acceptance of XRP as a viable solution for international payments, boosting investor confidence and driving up the XRP price.

Technological Advancements and Upgrades within the XRP Ledger

The XRP Ledger itself has undergone significant upgrades, enhancing its speed, scalability, and overall efficiency.

- Improvements: Enhancements in transaction processing speed and network capacity have made the XRP Ledger more robust and capable of handling a higher volume of transactions.

- New Features: The introduction of new features and functionalities continuously improves the XRP Ledger's capabilities, attracting more developers and users.

- Network Performance: These technological advancements have improved the overall performance and reliability of the XRP Ledger, increasing its attractiveness to both individuals and institutions. XRP scalability is no longer a concern for many, thanks to these improvements.

Positive Regulatory Developments and Legal Battles

The ongoing legal battle between Ripple and the SEC has significantly impacted XRP's price. While uncertainty remains, some positive developments have boosted investor sentiment.

- SEC Lawsuit Updates: Positive developments and favorable court rulings in the Ripple SEC lawsuit could significantly impact investor confidence and drive up the XRP price.

- Regulatory Uncertainty: Despite the ongoing legal uncertainty surrounding XRP regulation, some positive signals have emerged, mitigating some of the regulatory risk.

- Investor Sentiment: A positive outcome in the lawsuit could significantly improve investor sentiment, leading to increased investment and a higher XRP price.

Potential Catalysts for Further XRP Growth

Several factors could further propel XRP's growth in the future.

Expansion into New Markets and Partnerships

Ripple's continued expansion into new markets and strategic partnerships will be crucial for future growth.

- New Partnerships: Collaborations with new financial institutions and technology companies will broaden RippleNet's reach and increase XRP adoption.

- Emerging Markets: Expansion into emerging markets with a high demand for efficient cross-border payment solutions could significantly boost XRP's global adoption.

- Market Expansion: Strategic partnerships and market expansion directly translate into increased XRP demand and, consequently, a higher price. XRP partnerships are key to unlocking this potential.

Growing Demand for Cross-Border Payment Solutions

The global demand for faster, cheaper, and more efficient cross-border payment solutions is rapidly increasing.

- Efficiency Needs: Businesses and individuals increasingly require reliable and cost-effective solutions for international transactions, creating a significant opportunity for XRP.

- XRP Use Cases: XRP's unique features make it well-suited for addressing the inefficiencies of traditional cross-border payment systems.

- Future Price Impact: This growing demand for efficient payment solutions directly impacts the future price of XRP, driving further growth.

Increased Institutional Investment and Market Capitalization

Increased institutional investment will likely play a significant role in driving up XRP's market capitalization.

- Institutional Adoption: As more institutional investors recognize XRP's potential, increased investment will likely follow, boosting market capitalization and price.

- Market Cap Growth: Higher investment directly translates into a larger XRP market cap, making it a more attractive asset for long-term investors.

- Long-Term Growth: Sustained institutional investment is a key factor in XRP's long-term growth potential. XRP investment by large players will be instrumental in driving the price upwards.

Risks and Challenges Facing XRP's Future Growth

Despite its significant potential, XRP faces several risks and challenges.

Regulatory Uncertainty and Legal Proceedings

The outcome of the Ripple lawsuit remains uncertain, posing a significant risk to XRP's future.

- Negative Outcomes: An unfavorable ruling could negatively impact investor confidence and suppress the XRP price.

- Investor Confidence: Regulatory clarity is crucial for attracting mainstream investors, and any negative legal developments could severely damage confidence.

- Legal Uncertainty: The ongoing legal uncertainty surrounding XRP regulation presents a major risk to its future growth trajectory.

Competition from Other Cryptocurrencies and Payment Solutions

XRP faces intense competition from other cryptocurrencies and established payment networks.

- XRP Competitors: The cryptocurrency market is highly competitive, and XRP faces competition from other digital assets offering similar functionalities.

- Market Share: Maintaining market share against established players and emerging competitors presents a significant challenge.

- Payment Network Competition: The competition from established payment networks and newer technologies poses a threat to XRP's market dominance.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, making XRP susceptible to significant price swings.

- XRP Volatility: The price of XRP, like other cryptocurrencies, is subject to considerable volatility, posing risks to investors.

- Cryptocurrency Market Risk: Investing in XRP involves considerable risk due to the inherent volatility of the cryptocurrency market.

- Price Fluctuation: Investors must be prepared for significant price fluctuations and potential losses when investing in XRP.

The Future of XRP: A Promising Outlook?

XRP's recent price surge is largely due to increased RippleNet adoption, technological advancements, and positive developments in the ongoing legal battle. However, several factors could further drive its growth, including expansion into new markets, growing demand for cross-border payments, and increased institutional investment. Despite this promising outlook, the risks associated with regulatory uncertainty, competition, and market volatility cannot be ignored. Learn more about XRP's potential by conducting thorough research and understanding the risks involved before making any investment decisions. Invest in XRP responsibly, track XRP price trends, and stay informed about the latest news and developments. The future of XRP remains uncertain, but its potential for significant growth is undeniable.

Featured Posts

-

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025 -

Thunder Players Clash With National Media Outlets

May 08, 2025

Thunder Players Clash With National Media Outlets

May 08, 2025 -

Uss Truman Second Jet Lost At Sea Prompts Safety Review

May 08, 2025

Uss Truman Second Jet Lost At Sea Prompts Safety Review

May 08, 2025 -

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025