47% Spike In India's Real Estate Investments: Q1 2024 Report

Table of Contents

Driving Forces Behind the 47% Increase in Indian Real Estate Investments

Several factors contributed to this impressive growth in India real estate investment during Q1 2024. Let's examine the key drivers:

Economic Recovery and Increased Disposable Incomes

India's economic recovery has played a pivotal role. Strong GDP growth, coupled with a rise in disposable incomes, has boosted consumer spending and fueled demand for residential and commercial properties.

- GDP Growth: The robust growth of the Indian economy has led to increased consumer confidence, making real estate a preferred investment avenue. (Insert relevant data on GDP growth here, citing sources).

- Disposable Income Increase: Higher disposable incomes empower more individuals to invest in property, driving up demand across various price segments. (Insert relevant data on disposable income increase here, citing sources).

- Increased Consumer Confidence: A positive outlook on the economy translates directly into increased willingness to invest in long-term assets like real estate.

Government Policies and Initiatives

Supportive government policies have significantly contributed to the growth of the Indian real estate market. Several initiatives aim to boost affordable housing and improve infrastructure.

- Tax Benefits: Tax incentives for homebuyers and developers have made property investment more attractive. (Specify tax benefits here).

- Infrastructure Development: Investments in infrastructure projects, such as improved transportation and utilities, enhance the desirability of specific areas. (Provide examples of infrastructure projects impacting real estate).

- Affordable Housing Schemes: Initiatives like PMAY (Pradhan Mantri Awas Yojana) have played a crucial role in increasing access to affordable housing, fueling demand in this segment.

Low-Interest Rates and Easy Financing Options

Low-interest rates on home loans have made mortgages more affordable, encouraging more people to invest in property.

- Competitive Lending Rates: Banks and Non-Banking Financial Companies (NBFCs) offer competitive lending rates, making financing options readily available.

- Easy Access to Finance: The availability of various loan products and flexible repayment options has simplified the process of securing home loans.

Investment Trends in Different Real Estate Sectors

The 47% surge in India real estate investment is reflected across various sectors:

Residential Real Estate

The residential sector witnessed robust growth, driven by demand across different segments.

- Luxury Apartments: High-net-worth individuals continue to invest in luxury apartments in prime locations.

- Affordable Housing: The growth in affordable housing has been remarkable, driven by government initiatives and increasing urbanization.

- Villas: Demand for independent villas remains strong, particularly in suburban areas.

- Geographical Distribution: Major cities like Mumbai, Delhi-NCR, Bengaluru, and Chennai continue to be hotspots for residential investment.

Commercial Real Estate

The commercial real estate sector also saw significant investment activity, although trends are evolving.

- Office Spaces: While the work-from-home trend impacted demand initially, there's a renewed focus on flexible and technologically advanced office spaces.

- Retail Spaces: Growth in e-commerce is transforming the retail landscape. Investments are shifting towards experiential retail and omnichannel strategies.

- Warehousing and Logistics: The booming e-commerce sector is driving significant investment in warehousing and logistics facilities.

Future Outlook for Real Estate Investment in India

The future of real estate investment in India remains positive, though challenges persist.

Factors Influencing Future Growth

- Economic Growth: Continued economic growth will be a crucial driver of future investment.

- Government Regulations: Supportive policies and streamlined regulations are essential for sustained growth.

- Infrastructure Development: Further investments in infrastructure will enhance the appeal of various locations.

- Global Economic Conditions: Global economic factors can impact investor sentiment.

Expert Predictions and Market Forecasts

(Include insights from industry experts and market forecasts here, citing credible sources).

Advice for Investors

Navigating the Indian real estate market requires careful consideration of various factors, including location, property type, and market trends. Due diligence and professional advice are crucial before making any investment decisions.

Conclusion: Capitalizing on the Booming Indian Real Estate Market

The 47% spike in India real estate investment in Q1 2024 reflects a robust and dynamic market. Driven by economic recovery, government policies, and readily available financing options, the sector presents attractive opportunities for investors. The positive outlook, coupled with diverse investment options across residential and commercial segments, makes this a compelling time to explore India real estate investment. Don't miss out on this booming sector! Invest in India's real estate market now and learn more about lucrative real estate investment opportunities in India.

Featured Posts

-

Real Money Online Casino Games 7 Bits Extensive Selection

May 17, 2025

Real Money Online Casino Games 7 Bits Extensive Selection

May 17, 2025 -

The Jalen Brunson Injury And The Knicks Depth Problem

May 17, 2025

The Jalen Brunson Injury And The Knicks Depth Problem

May 17, 2025 -

Angel Reeses Beautiful Family Photos Featuring Mom Angel Webb Reese

May 17, 2025

Angel Reeses Beautiful Family Photos Featuring Mom Angel Webb Reese

May 17, 2025 -

Celtics Vs Cavaliers Home Court Advantage And Game Outlook

May 17, 2025

Celtics Vs Cavaliers Home Court Advantage And Game Outlook

May 17, 2025 -

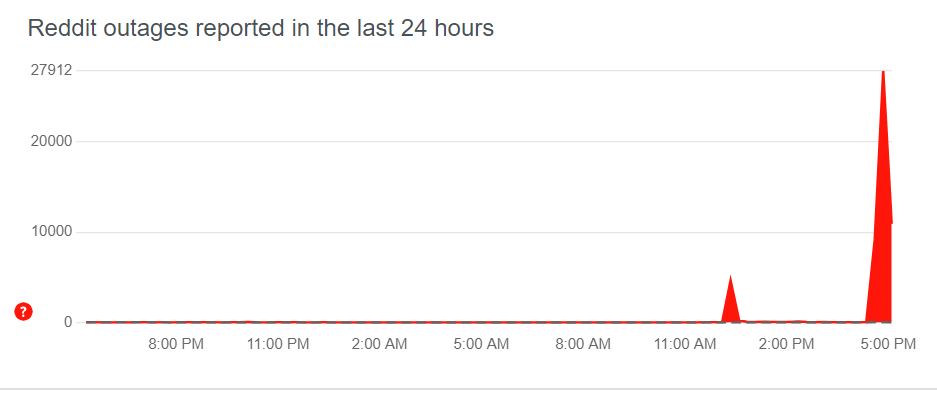

Large Scale Reddit Outage Reported By Users Across The Globe

May 17, 2025

Large Scale Reddit Outage Reported By Users Across The Globe

May 17, 2025