5 Essential Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do: Network Strategically

Building a strong network is crucial for securing a private credit job. Opportunities in investment jobs, particularly within the alternative investment space, are often unadvertised.

Leverage LinkedIn:

LinkedIn is your primary tool for private credit job searching.

- Optimize your LinkedIn profile: Use keywords like "private credit," "credit analyst," "structured finance," "leveraged finance," "debt financing," "portfolio management," and any other relevant terms describing your skills and experience. A compelling headline and summary are essential.

- Reach out to individuals in your network: Request informational interviews to learn more about specific roles and firms. This demonstrates initiative and allows you to gather valuable insights.

- Join relevant groups and participate in discussions: Engage actively in conversations, share insightful comments, and establish yourself as a knowledgeable professional within the private credit community. Attend virtual events hosted by these groups.

- Connect with recruiters: Many specialized recruiters focus on placing candidates in private credit and alternative investment roles.

Attend Industry Events:

Networking at conferences and workshops is invaluable.

- Research relevant events: Look for conferences and workshops focused on private credit, alternative investments, leveraged buyouts, or related areas of finance.

- Prepare insightful questions: Asking thoughtful questions demonstrates your interest and engagement. Research the companies attending beforehand.

- Follow up after the event: Send personalized emails to the individuals you met, reiterating your interest and reinforcing your key qualifications. This demonstrates professionalism and helps maintain the connections you've made.

Do: Showcase Specialized Skills

Private credit roles require a specific skillset. Demonstrating your expertise is paramount.

Highlight Relevant Experience:

Your resume and cover letter must clearly highlight your qualifications.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your impact using metrics (e.g., "Improved portfolio performance by 10%," "Reduced loan defaults by 15%").

- Tailor your application materials: Customize your resume and cover letter for each job application, highlighting the skills and experiences most relevant to the specific role and company.

- Use keywords: Incorporate relevant keywords from the job description into your application materials to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

Develop Strong Financial Modeling Skills:

Proficiency in financial modeling is essential for most private credit jobs.

- Master Excel and financial modeling software: Become adept at using Excel and specialized software like Bloomberg Terminal for building and analyzing complex financial models.

- Practice building models: Develop your skills by building various financial models, including discounted cash flow (DCF) models, leveraged buyout (LBO) models, and others relevant to the private credit industry. Include examples in your portfolio.

- Consider relevant certifications: Obtain certifications like the Financial Modeling & Valuation Analyst (FMVA) designation to demonstrate your expertise.

Do: Prepare for Behavioral Interviews

Behavioral interviews assess your soft skills and past experiences.

Practice the STAR Method:

The STAR method (Situation, Task, Action, Result) is an effective framework for answering behavioral interview questions.

- Prepare examples: Develop compelling examples showcasing your problem-solving skills, teamwork abilities, adaptability, communication skills, and your ability to manage pressure.

- Practice answering common questions: Practice answering common behavioral interview questions such as, "Tell me about a time you failed," "Describe a challenging project and how you overcame it," or "Tell me about a time you worked effectively as part of a team."

- Research the company and interviewer: Understanding the company culture and the interviewer's background allows you to tailor your responses and ask relevant questions.

Don't: Neglect Your Online Presence

Your online presence reflects your professionalism and brand.

Maintain a Professional Online Profile:

Your social media profiles should present a consistent and positive image.

- Review your profiles: Scrutinize your LinkedIn, Twitter, and Facebook profiles for any inappropriate or unprofessional content. Remove anything that might negatively impact your candidacy.

- Create a professional website or portfolio: Showcase your skills and accomplishments through a professionally designed website or online portfolio. This allows you to control your narrative and demonstrate your abilities more effectively than a resume alone.

- Use consistent branding: Maintain a consistent online brand across all your platforms.

Don't: Rush the Application Process

Thorough preparation is crucial for success.

Thorough Research is Key:

Take the time to research each firm and role thoroughly before applying.

- Understand the firm's investment strategy: Research the firm's investment thesis, target industries, and past transactions. Demonstrate that you understand their approach.

- Research the interviewers: Learn about the interviewers' backgrounds and experience to tailor your answers and demonstrate your knowledge of their work.

- Tailor your application: Customize your resume, cover letter, and even your interview responses to align with the specific requirements and culture of each firm.

Conclusion

Securing a position in the competitive private credit job market requires a proactive and strategic approach. By following these do's and don'ts – networking effectively, showcasing your specialized skills, preparing for behavioral interviews, and maintaining a professional online presence – you significantly increase your chances of success. Remember, thorough research and a well-crafted application are paramount. Don't delay; start refining your job search strategy today to excel in the private credit job market and land your dream private credit job!

Featured Posts

-

Ali Larters Landman Back In Action New Season 2 Images

May 13, 2025

Ali Larters Landman Back In Action New Season 2 Images

May 13, 2025 -

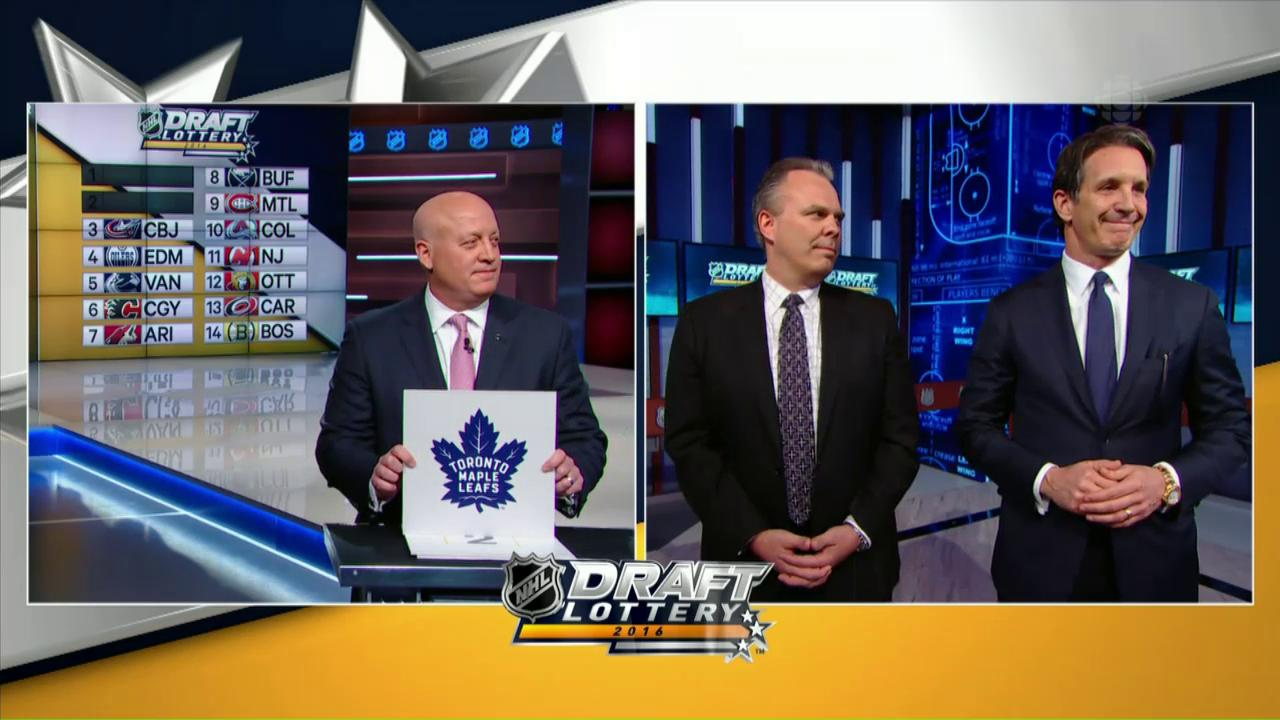

Nhl Draft Lottery Results Islanders Claim Top Pick

May 13, 2025

Nhl Draft Lottery Results Islanders Claim Top Pick

May 13, 2025 -

Untreated Autism And Adhd Identifying Potential Cases Among 3 Million Brits

May 13, 2025

Untreated Autism And Adhd Identifying Potential Cases Among 3 Million Brits

May 13, 2025 -

Analyzing The Impact And Legacy Of The Da Vinci Code

May 13, 2025

Analyzing The Impact And Legacy Of The Da Vinci Code

May 13, 2025 -

Dy Kabryw Ythda Qanwn Lyw Qst Hbh Aljdyd

May 13, 2025

Dy Kabryw Ythda Qanwn Lyw Qst Hbh Aljdyd

May 13, 2025

Latest Posts

-

George Straits Dairy Queen Visit Photo With Employee Goes Viral

May 14, 2025

George Straits Dairy Queen Visit Photo With Employee Goes Viral

May 14, 2025 -

Parker Mc Collums Bold Claim Targeting George Straits Throne

May 14, 2025

Parker Mc Collums Bold Claim Targeting George Straits Throne

May 14, 2025 -

The Future Of Country Music Mc Collums Ambitious Bid For The Top Spot

May 14, 2025

The Future Of Country Music Mc Collums Ambitious Bid For The Top Spot

May 14, 2025 -

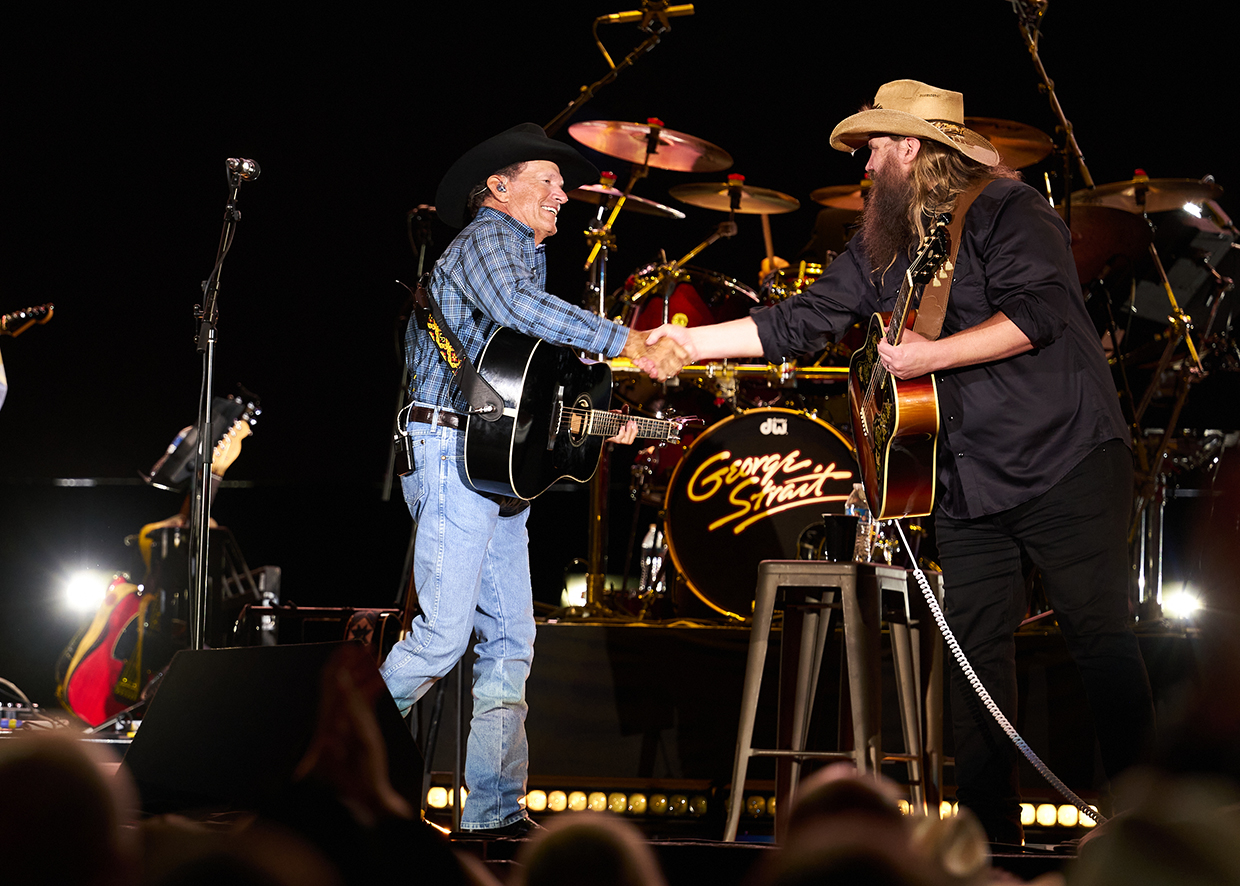

2025 Stadium Tour George Strait And Chris Stapletons Announced Dates

May 14, 2025

2025 Stadium Tour George Strait And Chris Stapletons Announced Dates

May 14, 2025 -

George Strait And Chris Stapleton Announce Joint 2025 Stadium Tour

May 14, 2025

George Strait And Chris Stapleton Announce Joint 2025 Stadium Tour

May 14, 2025