5 Key Actions To Secure A Private Credit Role

Table of Contents

1. Master the Fundamentals of Private Credit

Before you even begin applying for private credit analyst positions or similar roles, you need a rock-solid understanding of private credit fundamentals. This involves more than just knowing the basics of credit analysis; it requires a deep comprehension of the entire private debt landscape.

- Different Types of Private Debt: Familiarize yourself with direct lending, mezzanine financing, distressed debt, and other forms of private debt. Understand their characteristics, risk profiles, and typical investor profiles.

- Credit Analysis Techniques: Master the art of credit analysis, including financial statement analysis, ratio analysis, cash flow forecasting, and the evaluation of credit risk. You should be comfortable analyzing a company's creditworthiness and assessing its ability to repay debt.

- Financial Modeling for Private Credit: Proficiency in financial modeling is crucial. You need to be able to build sophisticated models to project cash flows, assess deal profitability, and conduct sensitivity analysis for private credit transactions. Mastering Excel and potentially specialized financial modeling software is essential.

- Legal and Regulatory Aspects: Gain a working knowledge of the legal and regulatory frameworks governing private debt transactions. This includes understanding loan agreements, covenants, and relevant regulations.

2. Build Relevant Skills and Experience

Landing a private credit role requires more than just theoretical knowledge; employers prioritize practical skills and experience. The most sought-after skills include:

- Credit Underwriting: Demonstrate a proven ability to analyze credit risk and make informed lending decisions. Any experience in credit underwriting, even in a different sector, is valuable.

- Financial Modeling Expertise: Your financial modeling skills should be top-notch. Practice building complex models and be prepared to discuss your methodology and assumptions during interviews.

- Private Equity or Investment Banking Experience: While not always mandatory, experience in private equity, investment banking, or other related fields provides a significant advantage. These roles often expose you to similar deal structures and analytical frameworks.

- Industry Knowledge: Staying up-to-date on industry trends, market conditions, and regulatory changes is crucial. Read industry publications, attend webinars, and network with professionals to enhance your knowledge. Consider pursuing certifications like the CFA or CAIA to further demonstrate your commitment.

3. Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Building strong relationships with professionals in the field can open doors to opportunities you might not find through traditional job applications.

- Industry Events and Conferences: Attend industry conferences and networking events to meet professionals and learn about new developments.

- Leverage LinkedIn: Use LinkedIn effectively to connect with professionals, join relevant groups, and participate in industry discussions.

- Informational Interviews: Reach out to professionals for informational interviews to learn about their careers, gain insights, and potentially build valuable connections.

- Professional Organizations: Join relevant professional organizations to expand your network and stay updated on industry trends.

4. Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression on potential employers. They need to highlight your relevant skills and experience convincingly to secure an interview.

- Keyword Optimization: Integrate keywords from job descriptions to ensure your application is easily found by Applicant Tracking Systems (ATS).

- Quantifiable Achievements: Quantify your accomplishments whenever possible to demonstrate the impact of your contributions. Use metrics and numbers to showcase your success.

- Tailored Approach: Don't use a generic resume and cover letter. Tailor each application to the specific job description and the company's culture.

- Seek Feedback: Get feedback from mentors, career counselors, or trusted professionals to refine your application materials.

5. Ace the Interview Process

The interview process is your chance to showcase your skills, experience, and personality. Thorough preparation is essential.

- Practice Interview Questions: Practice answering common behavioral and technical questions related to private credit, financial modeling, and credit analysis. Prepare examples from your past experiences to illustrate your skills.

- Case Study Preparation: Be prepared for case studies or modeling exercises that assess your analytical abilities and problem-solving skills.

- Company Research: Thoroughly research the firm and the interviewer before the interview. Demonstrate your understanding of their investment strategy and their place within the private credit market.

- Enthusiasm and Passion: Express your genuine interest in private credit and the firm. Your passion will be evident and make a positive impact.

Conclusion

Securing a private credit role requires a strategic approach. By mastering the fundamentals of private credit, building relevant skills and experience, networking strategically, crafting a compelling resume and cover letter, and acing the interview process, you significantly increase your chances of success. The private credit industry offers a dynamic and rewarding career path with excellent growth potential. Start implementing these 5 key actions today to secure your desired private credit role and embark on a rewarding career in private debt!

Featured Posts

-

Chennai 2025 Wtt Star Contender Sharath Kamals Final Match And Emotional Farewell

May 22, 2025

Chennai 2025 Wtt Star Contender Sharath Kamals Final Match And Emotional Farewell

May 22, 2025 -

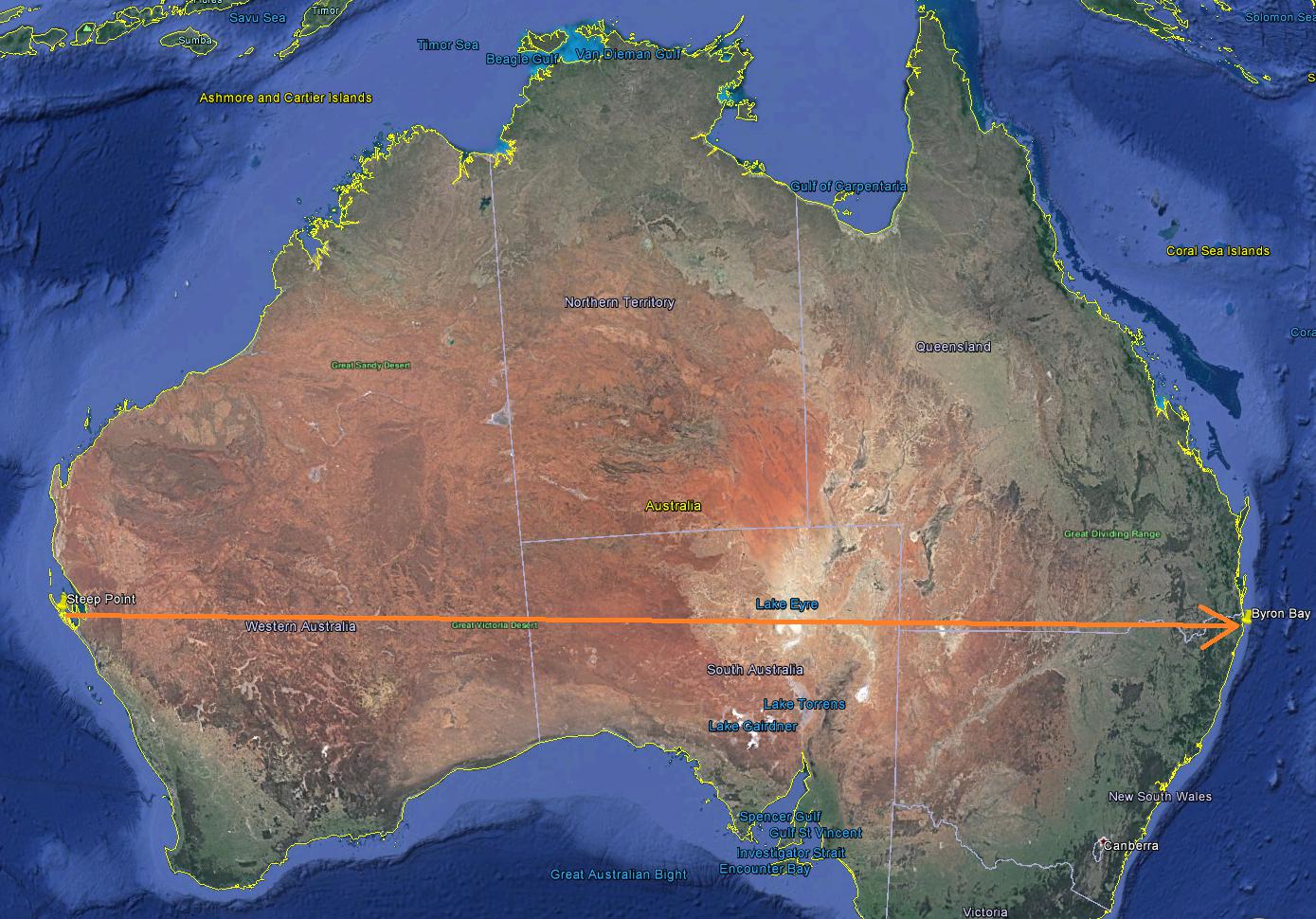

Trans Australia Run Is The World Record About To Fall

May 22, 2025

Trans Australia Run Is The World Record About To Fall

May 22, 2025 -

Abn Amro Ziet Flinke Groei In Occasionverkoop Impact Van Toenemend Autobezit

May 22, 2025

Abn Amro Ziet Flinke Groei In Occasionverkoop Impact Van Toenemend Autobezit

May 22, 2025 -

Celebrating Peppa Pigs Baby Sister A Girl

May 22, 2025

Celebrating Peppa Pigs Baby Sister A Girl

May 22, 2025 -

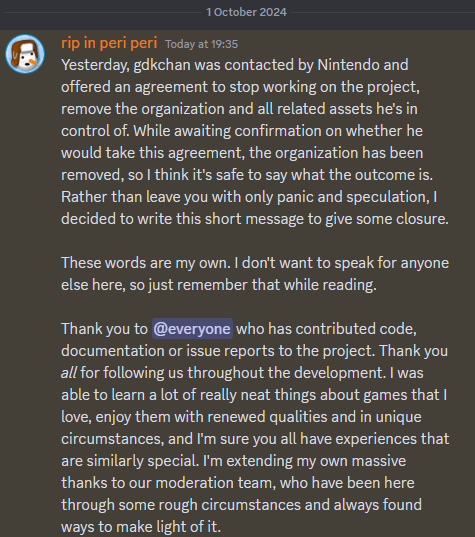

Ryujinx Emulator Shut Down Following Nintendo Communication

May 22, 2025

Ryujinx Emulator Shut Down Following Nintendo Communication

May 22, 2025

Latest Posts

-

Vidmova Ukrayini U Vstupi Do Nato Naslidki Dlya Bezpeki Ukrayini Ta Yevropi

May 22, 2025

Vidmova Ukrayini U Vstupi Do Nato Naslidki Dlya Bezpeki Ukrayini Ta Yevropi

May 22, 2025 -

Nato Nun Tuerkiye Ve Italya Icin Ortak Plani Aciklandi

May 22, 2025

Nato Nun Tuerkiye Ve Italya Icin Ortak Plani Aciklandi

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025 -

Taylor Swift And Blake Lively Amid The It Ends With Us Legal Drama

May 22, 2025

Taylor Swift And Blake Lively Amid The It Ends With Us Legal Drama

May 22, 2025 -

Nato Ta Ukrayina Aktualni Peregovori Ta Perspektivi Chlenstva

May 22, 2025

Nato Ta Ukrayina Aktualni Peregovori Ta Perspektivi Chlenstva

May 22, 2025