5 Key Factors Driving Today's Surge In The Indian Stock Market (Sensex & Nifty)

Table of Contents

Strong Economic Fundamentals Fueling Growth

India's robust economic performance is a cornerstone of the current market surge. This strong foundation attracts both domestic and foreign investment, creating a positive feedback loop of growth.

Robust GDP Growth

India's consistently high GDP growth rate is a major driver of the Indian Stock Market surge. This attracts both domestic and foreign investment, fueling further expansion.

- Government initiatives boosting infrastructure: Projects like the Bharatmala Pariyojana (highway development) and the ambitious renewable energy targets are stimulating economic activity.

- Growing consumer spending: A rising middle class with increased disposable income is driving demand and boosting consumption-based sectors.

- Positive manufacturing indices: Improved manufacturing performance signals a healthy industrial sector and contributes to overall economic strength.

The government's "Make in India" initiative, for example, is encouraging domestic manufacturing and reducing reliance on imports, leading to a stronger and more self-reliant economy. The IMF's projections for India's GDP growth consistently place it among the fastest-growing major economies globally, further boosting investor confidence.

Improving Macroeconomic Indicators

Stable inflation and a strengthening rupee contribute significantly to investor confidence, thereby supporting the Indian Stock Market surge.

- Decreasing fiscal deficit: Government efforts to control spending and improve fiscal management enhance investor trust.

- Rising foreign exchange reserves: A healthy reserve of foreign currency provides a buffer against external shocks and strengthens the rupee.

- Controlled inflation rates: Stable inflation rates ensure predictable business conditions and encourage investment.

The Reserve Bank of India's (RBI) proactive monetary policies, aimed at managing inflation and maintaining currency stability, have played a critical role in fostering this positive macroeconomic environment. The controlled inflation, coupled with the strengthening rupee, makes Indian assets more attractive to foreign investors.

Increased Foreign Institutional Investor (FII) Investments

A significant influx of capital from Foreign Institutional Investors (FIIs) is another major factor contributing to the Indian Stock Market surge.

Positive Global Sentiment

A positive global economic outlook and lower interest rates in developed markets are diverting capital towards emerging economies like India, offering comparatively higher returns.

- Global fund managers' positive outlook on India's growth potential: Many leading global investment firms view India as a high-growth market with long-term potential.

- Comparatively higher returns compared to developed markets: The relatively higher returns offered by Indian equities compared to developed markets are attracting significant FII investment.

Global events and the overall investor sentiment towards emerging markets significantly impact FII flows. The current positive global sentiment towards India's economic prospects is directly fueling the recent market gains.

Government Initiatives Attracting Foreign Investment

Pro-business reforms and ease of doing business initiatives implemented by the Indian government are actively encouraging FIIs.

- Tax reforms: Simplified tax structures and reduced corporate tax rates are making India a more attractive investment destination.

- Simplification of regulations: Streamlined regulations and reduced bureaucratic hurdles ease the process of setting up and operating businesses.

- Infrastructure development: Significant investments in infrastructure projects reduce operational costs for businesses and boost investor confidence.

Initiatives like the Goods and Services Tax (GST) have simplified the tax system, making it easier for businesses to operate and attracting more foreign investment.

Government's Pro-Growth Policies and Reforms

The government's proactive approach to economic development is a key driver of the Indian Stock Market surge.

Focus on Infrastructure Development

Massive investments in infrastructure projects are boosting economic activity, creating jobs, and driving growth across various sectors.

- Highway construction: The expansion of India's national highway network improves connectivity and facilitates trade and commerce.

- Renewable energy projects: Investments in renewable energy sources are creating new industries and promoting sustainable development.

- Digital infrastructure development: Expanding digital connectivity is improving access to information and services, fostering economic growth.

Large-scale projects like the dedicated freight corridors are significantly improving logistics efficiency, benefiting various industries and contributing to the overall economic growth.

Initiatives to Boost Domestic Consumption

Government measures designed to increase disposable income and encourage consumer spending are playing a crucial role in driving economic activity.

- Government schemes targeting rural income: Initiatives aimed at improving rural incomes increase purchasing power and boost consumption.

- Tax benefits for the middle class: Tax breaks and other incentives for the middle class enhance their disposable income, leading to increased spending.

These initiatives stimulate domestic demand, creating a virtuous cycle of growth and contributing significantly to the Indian Stock Market surge.

Technological Advancements and Digital Transformation

India's rapid technological advancement and digital transformation are powering economic growth and fueling the Indian Stock Market surge.

Growth of the Tech Sector

The burgeoning tech sector is a significant contributor to the Indian economy's growth and stock market performance.

- Rise of start-ups: The thriving start-up ecosystem is creating innovation and generating employment opportunities.

- Growth in IT services exports: India's strong IT services sector is a major source of foreign exchange earnings.

- Increasing digital adoption: The expanding digital economy is transforming various sectors and boosting productivity.

The success of Indian tech companies on the global stage is contributing significantly to investor confidence and driving the Indian Stock Market surge.

Fintech Revolution

The rise of fintech solutions is improving financial inclusion, expanding market access, and driving economic growth.

- Digital payments: The widespread adoption of digital payment systems is boosting financial transactions and enhancing efficiency.

- Online investing platforms: Easy-to-use online platforms are making investing more accessible to a wider population.

- Mobile banking: Mobile banking is increasing financial inclusion, particularly in rural areas.

These advancements are driving financial inclusion, expanding market participation, and contributing to the overall economic dynamism that supports the Indian Stock Market surge.

Positive Investor Sentiment and Market Confidence

Positive investor sentiment and growing market confidence are crucial components of the current market uptrend.

Increased Participation from Retail Investors

A surge in participation from retail investors is boosting market liquidity and driving price increases.

- Rise in Demat accounts: The number of Demat accounts (accounts used for holding securities in electronic form) has increased dramatically, reflecting rising retail investor participation.

- Increased awareness about investing: Greater financial literacy and awareness are encouraging more people to invest in the stock market.

- Ease of access to trading platforms: User-friendly online trading platforms are making it easier for individuals to participate in the market.

The increased participation of retail investors is adding to the market's depth and liquidity, contributing to the current bullish trend.

Positive Media Coverage and Market Optimism

Positive news and increased investor confidence further fuel market growth.

- Positive analyst reports: Favorable analyst reports on Indian companies and the economy boost investor sentiment.

- Optimistic economic forecasts: Positive economic forecasts reinforce the belief in continued market growth.

- Growing media attention: Positive media coverage of the Indian economy and stock market fuels investor enthusiasm.

Positive media narratives and optimistic economic forecasts contribute significantly to the overall positive investor sentiment, driving the Indian Stock Market surge.

Conclusion

The recent surge in the Indian stock market (Sensex & Nifty) is a result of a powerful combination of factors, including strong economic fundamentals, increased FII investments, pro-growth government policies, technological advancements, and positive investor sentiment. Understanding these key drivers is crucial for navigating this dynamic market. To stay informed about the ongoing trends impacting the Indian Stock Market Surge and make informed investment decisions, continue researching and monitoring economic indicators and market analysis. Learn more about the key factors influencing the Indian Stock Market Surge and harness its potential. Don't miss out on this exciting opportunity – stay informed and capitalize on the continued growth of the Indian Stock Market.

Featured Posts

-

Brekelmans Inzet Voor Een Sterke Band Met India

May 09, 2025

Brekelmans Inzet Voor Een Sterke Band Met India

May 09, 2025 -

Air India Responds To Lisa Rays Complaint Actors Claims Unfounded

May 09, 2025

Air India Responds To Lisa Rays Complaint Actors Claims Unfounded

May 09, 2025 -

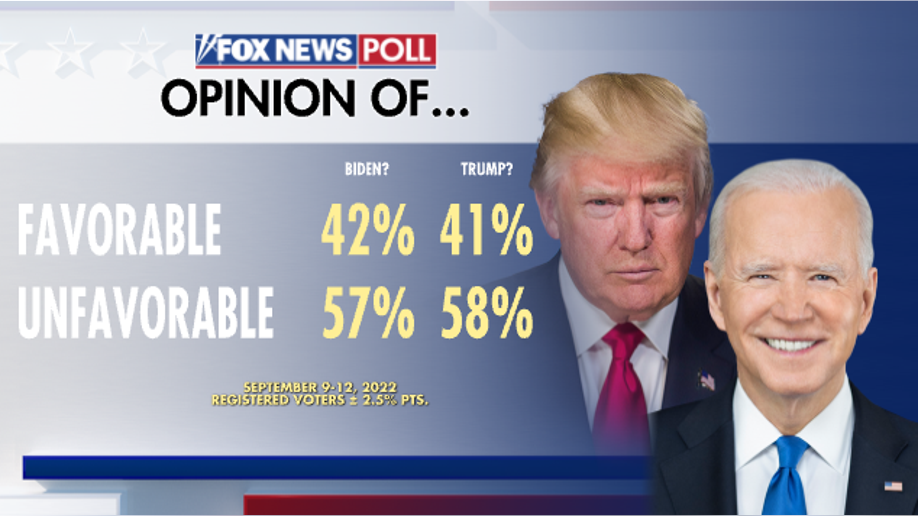

Us Attorney Generals Daily Fox News Appearances A Deeper Dive

May 09, 2025

Us Attorney Generals Daily Fox News Appearances A Deeper Dive

May 09, 2025 -

Melanie Griffith And Dakota Johnsons Siblings At Materialist Red Carpet Event

May 09, 2025

Melanie Griffith And Dakota Johnsons Siblings At Materialist Red Carpet Event

May 09, 2025 -

Woman Arrested For Unprovoked Racist Stabbing Murder

May 09, 2025

Woman Arrested For Unprovoked Racist Stabbing Murder

May 09, 2025