5 Key Strategies To Secure A Private Credit Role

Table of Contents

Mastering the Fundamentals of Private Credit

To succeed in a private credit role, a strong foundation in the fundamentals is crucial. This means understanding the intricacies of various private credit investment structures and the associated risks.

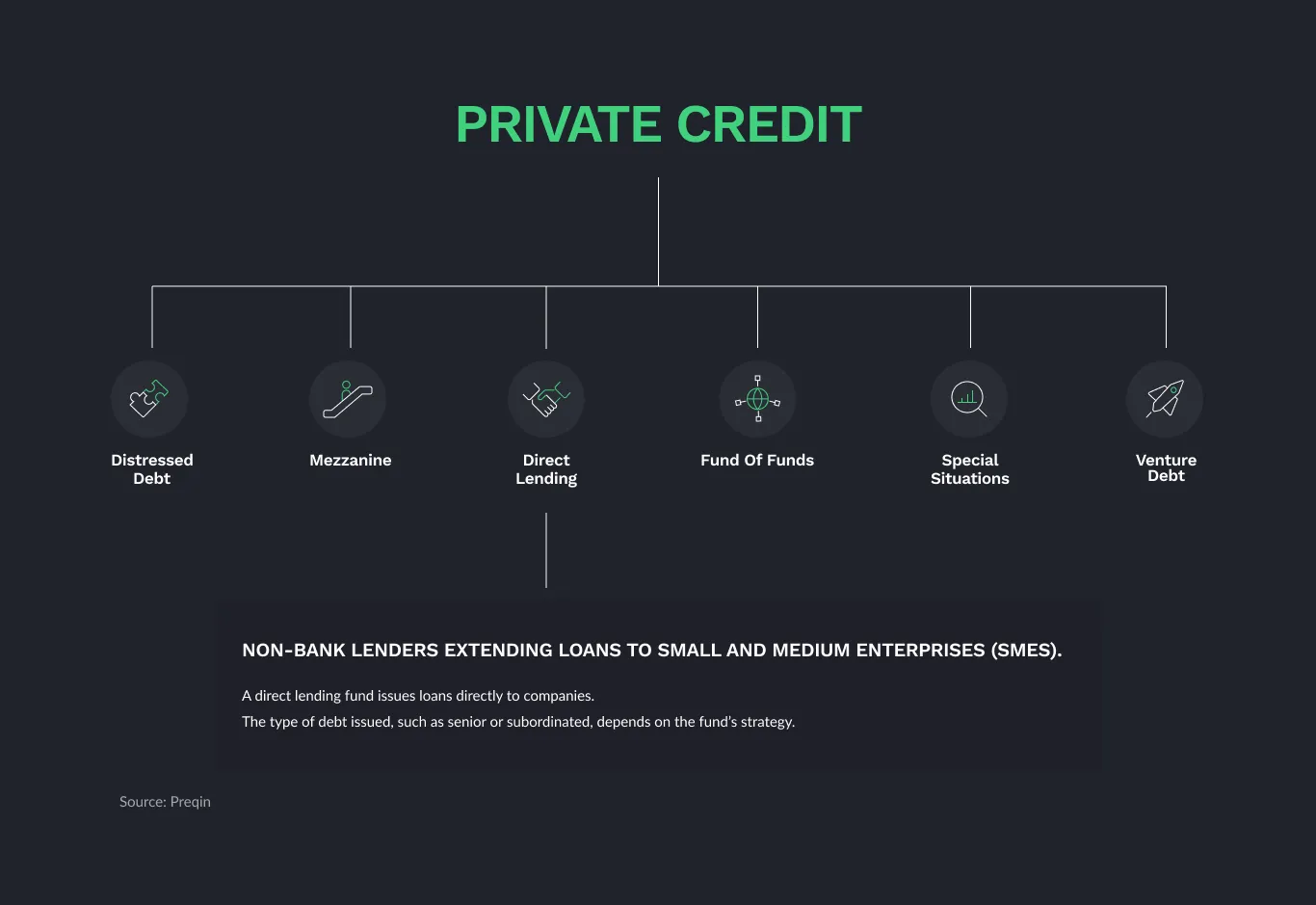

Understanding Private Credit Structures

Private credit encompasses diverse investment strategies. It's essential to differentiate between various types such as:

- Direct Lending: Providing loans directly to companies outside of the public markets.

- Mezzanine Financing: A hybrid of debt and equity financing, offering a higher return but also increased risk.

- Distressed Debt: Investing in debt securities of financially troubled companies, aiming to capitalize on restructuring or turnaround opportunities.

Understanding key terms is also paramount:

- Senior Debt: Debt with priority claim on assets in case of default.

- Subordinated Debt: Debt with lower priority in case of default, offering higher yields to compensate for the increased risk.

- Covenant: A clause in a loan agreement that restricts the borrower's actions.

- Yield: The return an investor receives on their investment.

Understanding the differences between public and private credit markets, including the varying levels of liquidity and risk, is also vital for a successful private credit role. Finally, proficiency in credit risk assessment, encompassing both quantitative and qualitative analysis, is non-negotiable.

Networking and Building Relationships in the Private Credit Industry

Networking is paramount for securing a private credit role. Building genuine relationships within the industry can significantly increase your chances of landing your desired position.

Leveraging Professional Networks

Actively engage with the private credit community:

- Attend industry events: Conferences, seminars, and workshops provide excellent opportunities to meet professionals and learn about current trends.

- Join professional organizations: The CFA Institute and various industry-specific associations offer valuable networking opportunities and access to industry insights.

- Utilize LinkedIn effectively: Optimize your profile, connect with relevant individuals, and participate in industry discussions.

Don't underestimate the power of:

- Informational interviews: These informal conversations can provide valuable insights into the industry and potential job opportunities.

- Building genuine relationships: Focus on building authentic connections rather than simply collecting contacts.

- Networking online and offline: Combine online engagement with in-person networking for a comprehensive approach.

Tailoring Your Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression. Tailoring these documents to each specific private credit role you apply for is critical.

Highlighting Relevant Skills and Experience

Showcase your quantitative skills, financial modeling abilities, and credit analysis experience:

- Keywords: Incorporate relevant keywords such as financial modeling, credit underwriting, due diligence, portfolio management, quantitative skills throughout your resume and cover letter.

- Quantify achievements: Use numbers and data to demonstrate the impact of your work. For example, instead of saying "improved efficiency," say "improved efficiency by 15%."

- Tailoring to each job: Carefully review each job description and customize your resume and cover letter to highlight the skills and experiences most relevant to that specific private credit position.

Acing the Private Credit Job Interview

The interview is your chance to shine. Thorough preparation is key to securing a private credit role.

Preparing for Behavioral and Technical Questions

Expect a mix of behavioral and technical questions:

- STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions, providing concrete examples of your skills and experience.

- Technical Questions: Be prepared for technical questions related to financial modeling, valuation, credit analysis, and specific aspects of private credit investments. Practice your responses beforehand.

- Enthusiasm and Interest: Demonstrate genuine enthusiasm for the role and the private credit industry. Research the firm thoroughly and prepare insightful questions to ask the interviewer.

Securing a Private Credit Internship or Entry-Level Role

Internships and entry-level roles provide invaluable experience and networking opportunities.

Building a Foundation for a Successful Career

- Internships: Gain hands-on experience, build your network, and learn from experienced professionals.

- Entry-Level Roles: Develop foundational skills and knowledge, paving the way for advancement within the private credit industry.

- Resources: Utilize online job boards, networking events, and professional contacts to find private credit internships and entry-level positions.

Conclusion

Securing a private credit role requires a multifaceted approach. By mastering the fundamentals of private credit, building a strong network, crafting compelling application materials, acing the interview, and potentially starting with an internship or entry-level position, you significantly increase your chances of success. Start implementing these strategies today to land your dream private credit role and embark on a rewarding career in this dynamic field. The opportunities in the private credit market are vast; seize them! Start your successful journey in private credit now!

Featured Posts

-

Russias Victory Day Parade Symbolism Strength And Putins Agenda

May 10, 2025

Russias Victory Day Parade Symbolism Strength And Putins Agenda

May 10, 2025 -

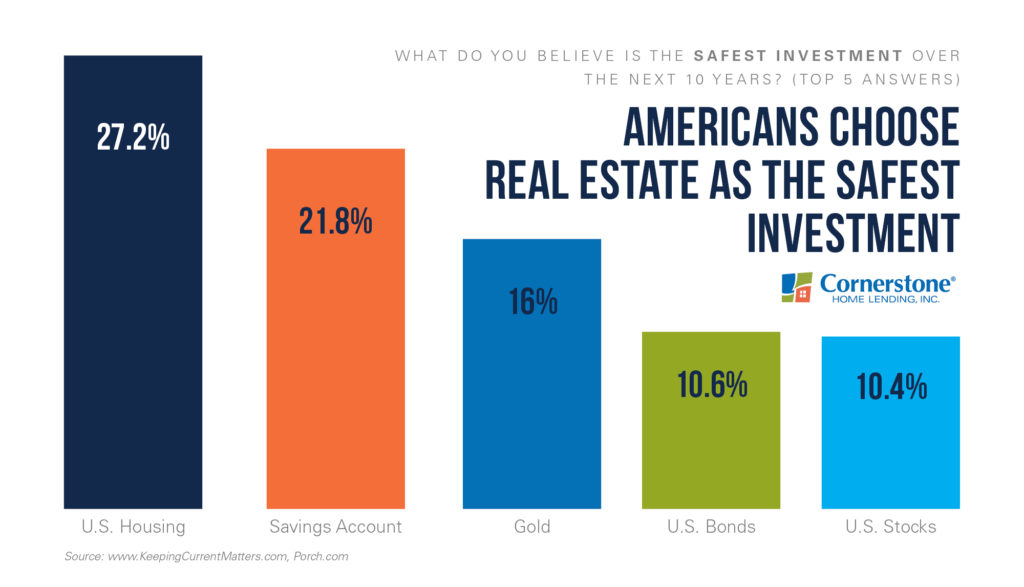

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025 -

Jeanine Pirro Advises Ignoring The Stock Market In The Coming Weeks

May 10, 2025

Jeanine Pirro Advises Ignoring The Stock Market In The Coming Weeks

May 10, 2025 -

Become A Stronger Ally Your Guide For International Transgender Day Of Visibility

May 10, 2025

Become A Stronger Ally Your Guide For International Transgender Day Of Visibility

May 10, 2025 -

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025