$6.1 Billion Celtics Sale: Analyzing The Impact On Fans And The Franchise

Table of Contents

Financial Implications of the $6.1 Billion Sale

The $6.1 billion price tag represents a watershed moment, significantly altering the financial landscape of the NBA. This unprecedented valuation has profound implications for the Celtics and the league as a whole.

Impact on Franchise Valuation

- Comparison to previous record sales: This sale dwarfs previous records, setting a new benchmark for NBA franchise valuations. The previous record was significantly lower, highlighting the explosive growth in the value of professional sports franchises.

- Potential for future sales to exceed this amount: Given the current economic climate and the continued growth of the NBA’s global popularity, it's conceivable that future franchise sales could surpass this record.

- Impact on league revenue sharing: The increased value of franchises will likely influence revenue sharing agreements within the NBA, potentially leading to a redistribution of funds among teams.

The factors contributing to this exorbitant price include the Celtics' rich history, their passionate fan base, consistent on-court success, and the lucrative Boston market. The team’s brand recognition and strong media presence also play a significant role.

Potential for Increased Investment in Team Infrastructure

The new ownership group now has substantial capital to reinvest in the franchise. This could translate into significant improvements across various aspects of the organization.

- Upgrades to facilities: Expect renovations and upgrades to TD Garden, potentially enhancing the fan experience with modernized amenities and improved infrastructure.

- Enhanced scouting and player development programs: Increased investment could lead to more sophisticated scouting networks and advanced player development programs, improving the team's long-term competitiveness.

- Increased marketing and fan engagement initiatives: The new owners might invest heavily in marketing campaigns, social media engagement, and innovative fan interaction programs to strengthen the Celtics' brand and connection with their fans.

This increased investment could lead to a more competitive team on the court and a more robust brand off the court, benefiting both the team and its fans.

Debt Management and Financial Stability

While the sale price is impressive, it’s crucial to analyze the franchise’s post-sale financial health.

- Debt levels: The new owners will likely have incurred significant debt to finance the acquisition. Managing this debt effectively will be crucial for the team’s long-term financial stability.

- Potential for reinvestment: Balancing debt repayment with reinvestment in the team will be a key challenge for the new ownership.

- Impact on long-term financial sustainability: Careful financial management is critical to ensuring the Celtics' continued success and financial stability for years to come. Poor financial decisions could significantly impact the team's ability to compete at the highest level.

Impact on Fans and the Fan Experience

The $6.1 billion Celtics sale will inevitably impact fans, both positively and negatively.

Ticket Prices and Accessibility

- Potential for price increases: The high purchase price could lead to increased ticket prices, potentially pricing out some long-time, loyal fans.

- Impact on season ticket holders: Existing season ticket holders might experience price adjustments, impacting their affordability.

- Measures to maintain affordability for fans: The new ownership will need to strike a balance between profitability and fan accessibility, potentially through innovative ticket pricing models or enhanced fan engagement programs to justify higher costs.

Maintaining affordability and accessibility for fans is vital for the continued success and loyalty of the Celtics fanbase.

Changes in Team Strategy and Roster Composition

New ownership often brings changes in team management and strategic direction.

- Potential changes in coaching staff: The new owners might opt for a coaching change, bringing in a new philosophy or approach to the team.

- Player acquisitions: Expect potential changes in the roster composition, with new players acquired to fit the new ownership's vision and strategic goals.

- Overall team strategy: The emphasis might shift from long-term player development to immediate championship contention, or vice versa, depending on the new ownership's priorities.

These changes will significantly influence the on-court performance and the overall direction of the franchise.

Marketing and Fan Engagement

The increased capital could fuel innovative marketing and fan engagement initiatives.

- Increased social media engagement: Expect a boost in social media presence and more interactive digital experiences for fans.

- New marketing campaigns: The new ownership will likely launch targeted marketing campaigns to reach a wider audience and enhance the Celtics' brand image.

- Improved fan interaction at games: Expect upgrades to the in-game experience, potentially through enhanced entertainment and improved fan amenities at TD Garden.

Investing in fan engagement is key to fostering loyalty and attracting new fans to the Celtics.

The Broader Impact on the NBA

The $6.1 billion Celtics sale has far-reaching consequences for the entire NBA.

Setting a New Benchmark for Franchise Value

- Impact on future franchise sales: This sale sets a new precedent, potentially inflating valuations for other NBA franchises in future sales.

- Potential for increased league revenue: The increased value of franchises could lead to increased league revenue, potentially boosting player salaries and overall league finances.

- The effect on player salaries: The increased revenue could contribute to higher player salaries, further impacting the financial landscape of the league.

This sale has created a ripple effect that will redefine the financial dynamics and future transactions within the NBA.

Conclusion

The $6.1 billion sale of the Boston Celtics represents a monumental shift in the NBA landscape. While the high price tag raises legitimate concerns about accessibility for some fans, the potential for increased investment offers exciting prospects for the franchise’s future, both on and off the court. The true impact on the team's performance, fan experience, and the broader NBA ecosystem will unfold over time. However, one thing remains certain: this sale ushers in a new era for the Celtics and significantly reshapes the financial dynamics of the NBA. To stay updated on the latest developments and analyses regarding this significant transaction and its effects, continue following our coverage of the $6.1 billion Celtics sale and its ripple effects.

Featured Posts

-

Mls Game Day Injury Report Martinez And White Unavailable

May 16, 2025

Mls Game Day Injury Report Martinez And White Unavailable

May 16, 2025 -

Predicting The Padres Vs Yankees Series Analyzing San Diegos Chances Of 7 Straight Wins

May 16, 2025

Predicting The Padres Vs Yankees Series Analyzing San Diegos Chances Of 7 Straight Wins

May 16, 2025 -

Rekord Bobrovskogo 5 Matchey Na Nol V Pley Off N Kh L

May 16, 2025

Rekord Bobrovskogo 5 Matchey Na Nol V Pley Off N Kh L

May 16, 2025 -

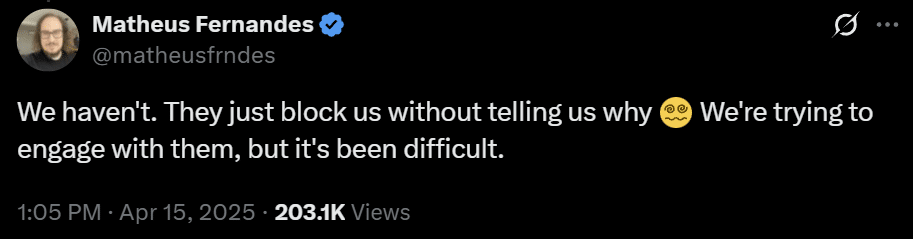

La Ligas Piracy Blockade Vercel Highlights Concerns Over Internet Censorship

May 16, 2025

La Ligas Piracy Blockade Vercel Highlights Concerns Over Internet Censorship

May 16, 2025 -

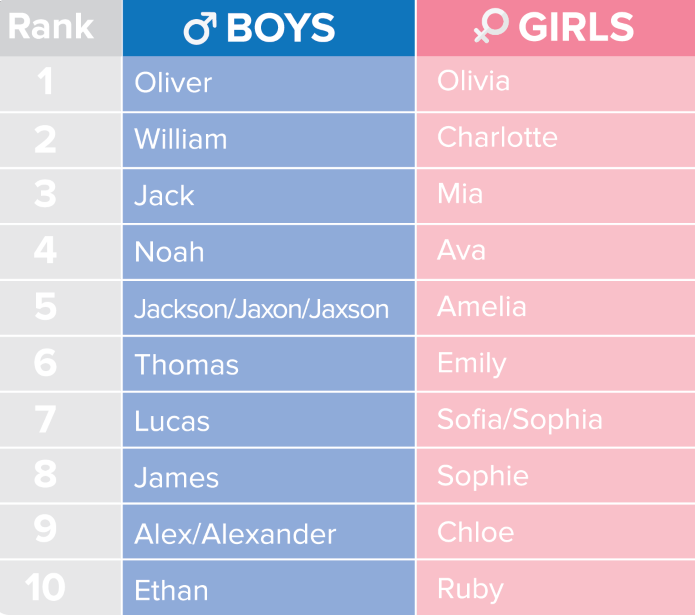

Baby Naming Trends 2024 A Look At The Top Choices

May 16, 2025

Baby Naming Trends 2024 A Look At The Top Choices

May 16, 2025