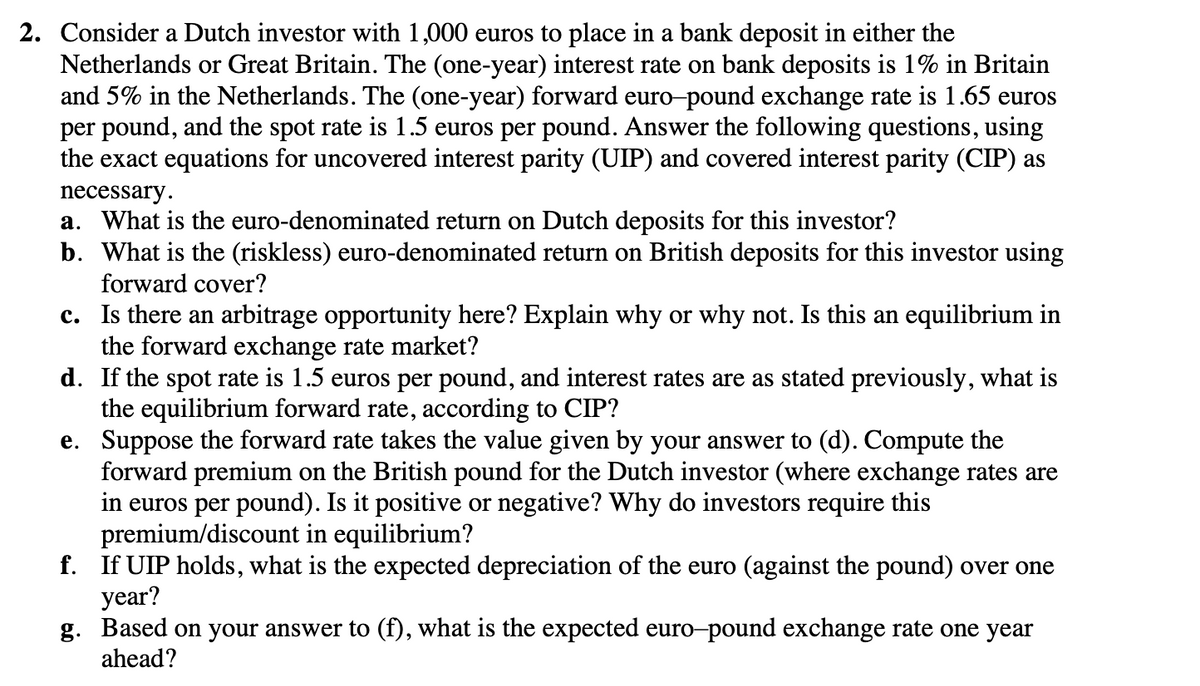

$65 Billion Dutch Investor Issues Strong Warning To US Money Managers

Table of Contents

The Nature of the Warning: What are the specific concerns?

The Dutch investor's warning isn't a vague expression of unease; it pinpoints several critical vulnerabilities within the current landscape of US investment strategies. The concerns aren't limited to a single factor but rather represent a confluence of risks that, when combined, paint a concerning picture for the future. These concerns extend across various aspects of portfolio construction and risk management.

-

Overexposure to Specific Sectors: The warning highlights the overreliance on specific sectors, particularly the technology sector, which has seen explosive growth but also carries significant volatility. This lack of diversification significantly increases exposure to market corrections within those sectors.

-

Underestimation of Inflation Risks: The investor expresses deep concern over the underestimation of inflation's persistent impact on investment returns. The current inflationary environment poses a substantial threat to the purchasing power of assets and requires a more robust approach to inflation hedging.

-

Lack of Diversification in Portfolios: A critical flaw identified is the insufficient diversification within many US investment portfolios. This concentration of risk leaves portfolios vulnerable to significant losses should any single asset class or sector underperform.

-

Vulnerability to Specific Geopolitical Events: The ongoing geopolitical instability across the globe is cited as a significant concern. The investor warns that many portfolios lack adequate protection against the cascading effects of geopolitical events on financial markets.

-

Concerns Regarding Sustainability Practices (ESG): The warning also touches upon the increasing importance of Environmental, Social, and Governance (ESG) factors. The investor suggests that insufficient consideration of ESG risks could expose portfolios to significant reputational and financial damage.

These concerns, backed by the substantial €65 billion investment at stake, underscore the gravity of the situation and the urgent need for a reassessment of current investment strategies.

Impact on US Money Managers and the Market

The implications of ignoring this €65 billion investment warning are substantial and far-reaching, potentially impacting both individual money managers and the broader US financial markets. The consequences for those who fail to heed this advice could be severe.

-

Loss of Investor Confidence: Failure to adapt to the changing market landscape and address the identified risks could erode investor confidence, leading to capital outflows and damaging reputations.

-

Reduced Investment Returns: The identified risks—inflation, geopolitical instability, and sector overexposure—directly threaten investment returns, potentially leading to significant underperformance compared to more diversified and risk-managed portfolios.

-

Increased Regulatory Scrutiny: Regulatory bodies are increasingly focused on risk management and investor protection. Ignoring this warning could invite increased scrutiny and potentially lead to penalties for non-compliance.

-

Market Corrections and Volatility: A widespread failure to address these risks could trigger market corrections and increased volatility, further amplifying the negative impact on investment portfolios.

The Dutch Investor's Perspective: Why is this investor so concerned?

The €65 billion investment warning stems from a sophisticated understanding of global financial markets and a long-term investment philosophy. The investor’s perspective is shaped by a cautious approach to risk management, emphasizing diversification and a deep understanding of macroeconomic trends. The sheer scale of their portfolio (€65 billion) lends significant weight to their concerns, highlighting the potential systemic impact of the identified vulnerabilities. Their deep understanding of portfolio management and investment strategy, combined with a robust risk assessment framework, has likely informed this forceful warning.

Recommendations for US Money Managers and Investors

Based on the Dutch investor's warning, US money managers and investors must take proactive steps to mitigate the identified risks. A comprehensive risk management strategy is crucial in navigating the current complex financial environment.

-

Diversify investments across asset classes: Reduce reliance on any single sector or asset class by diversifying across stocks, bonds, real estate, and alternative investments.

-

Review and adjust risk profiles: Regularly review and adjust investment portfolios to ensure they align with individual risk tolerance and the evolving market conditions.

-

Strengthen ESG integration within portfolios: Actively incorporate ESG factors into investment decisions to mitigate reputational and financial risks associated with unsustainable practices.

-

Enhance due diligence and risk assessment processes: Implement robust due diligence and risk assessment processes to identify and manage potential vulnerabilities.

-

Closely monitor geopolitical factors: Stay informed about geopolitical developments and their potential impact on investment portfolios, incorporating geopolitical risk into investment strategies.

Conclusion: Heeding the $65 Billion Warning

The €65 billion investment warning from the Dutch investor serves as a stark reminder of the vulnerabilities within current US investment strategies. Ignoring this warning could lead to significant losses, damaged reputations, and increased regulatory scrutiny. Protecting your investments requires proactive risk management, diversification, and a comprehensive understanding of the evolving market landscape. Heed the $65 billion investment warning, take immediate action to protect your portfolio, and consider diversifying your investments to mitigate the identified risks. For further guidance on investment strategies and risk management, consult with a qualified financial advisor. Don't underestimate the significance of this Dutch Investor Alert; safeguarding your investments in the current climate is paramount.

Featured Posts

-

Man Utd Player Receives Backlash After Costly Mistake

May 28, 2025

Man Utd Player Receives Backlash After Costly Mistake

May 28, 2025 -

Pacers Vs Knicks Nba Responds To Tyrese Haliburtons Outstanding Play

May 28, 2025

Pacers Vs Knicks Nba Responds To Tyrese Haliburtons Outstanding Play

May 28, 2025 -

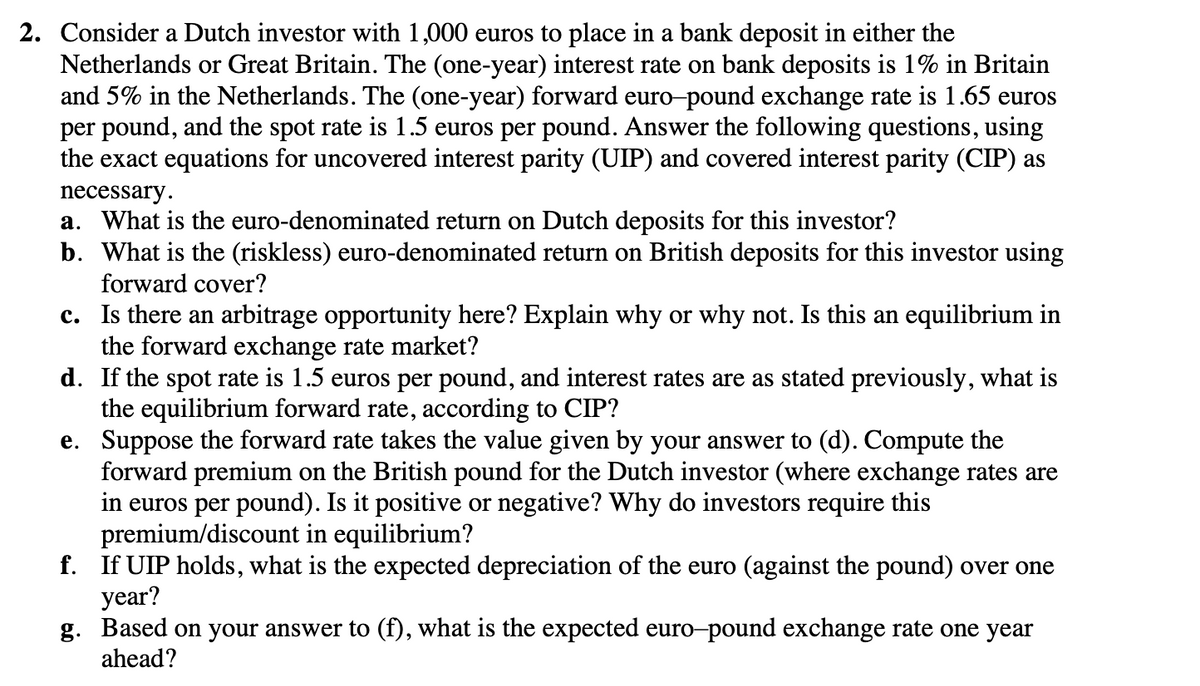

Tuesdays Weather Wind Advisory Plus Snow Accumulation

May 28, 2025

Tuesdays Weather Wind Advisory Plus Snow Accumulation

May 28, 2025 -

Overtime Thriller Mathurin Leads Pacers To Victory Over Nets

May 28, 2025

Overtime Thriller Mathurin Leads Pacers To Victory Over Nets

May 28, 2025 -

Amorims Influence On Garnachos Manchester United Future

May 28, 2025

Amorims Influence On Garnachos Manchester United Future

May 28, 2025

Latest Posts

-

Banksy In Dubai A World News Update On The Exhibition

May 31, 2025

Banksy In Dubai A World News Update On The Exhibition

May 31, 2025 -

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025 -

World News Banksy Artwork Unveiled In Dubai Exhibition

May 31, 2025

World News Banksy Artwork Unveiled In Dubai Exhibition

May 31, 2025 -

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025 -

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025