$67M In Ethereum Liquidations: What This Means For The Market

Table of Contents

Understanding Ethereum Liquidations

What are Liquidations?

In the volatile world of cryptocurrency trading, liquidations represent a critical risk for leveraged traders. A liquidation occurs when a trader's position is automatically closed by an exchange or lending platform due to insufficient collateral to cover potential losses. This typically happens when the price of an asset moves significantly against the trader's position.

-

Leveraged Trading: Leveraged trading allows traders to borrow funds to amplify their potential profits. While this can lead to significant gains, it also magnifies losses. If the market moves against the trader, their losses can quickly exceed their initial investment, triggering a liquidation.

-

Types of Liquidations: Liquidations can occur through various mechanisms:

- Margin Calls: Exchanges issue margin calls when a trader's collateral falls below a certain threshold, demanding additional funds to maintain the position. Failure to meet the margin call results in liquidation.

- Stop-Loss Orders: Traders can set stop-loss orders to automatically close their positions when the price reaches a predetermined level, limiting potential losses. While not strictly a liquidation, it serves a similar purpose.

-

Platforms Affected: Ethereum liquidations occur across various platforms, including both centralized exchanges (like Binance, Coinbase) and decentralized exchanges (DEXs) within the DeFi ecosystem. The scale of the recent $67 million event highlights the vulnerability across the entire crypto landscape.

The $67 Million Figure: Context and Significance

The $67 million figure represents a significant event in the Ethereum market, especially when compared to previous liquidation events. While the exact timeframe needs further specification, depending on the source, the sheer magnitude points to a potentially destabilizing factor within the market.

-

Comparison to Previous Events: Analyzing the $67 million figure against previous liquidation events provides crucial context. Is this an outlier, or is it indicative of a growing trend of increased market volatility and risk-taking?

-

Correlation with Broader Market Trends: The liquidations likely correlate with broader market trends, such as Bitcoin price movements and overall investor sentiment. A sudden drop in Bitcoin's price can often trigger a cascade of liquidations across the entire cryptocurrency market, including Ethereum.

-

Affected Assets: While the focus is on Ethereum liquidations, it's important to analyze which other assets were affected. Were other cryptocurrencies also subject to significant liquidations, indicating a systemic issue rather than an isolated incident?

Causes of the Ethereum Liquidations

Market Volatility and Price Swings

The cryptocurrency market is inherently volatile. Sudden price drops, even relatively small ones, can have a catastrophic effect on leveraged positions, leading to widespread liquidations.

-

Impact of Sudden Price Drops: A sharp, unexpected drop in the Ethereum price can trigger margin calls and liquidations en masse, as traders' collateral is quickly eroded.

-

Market Manipulation and Large Sell-offs: Large-scale sell-offs, possibly orchestrated or amplified by market manipulation, can exacerbate price drops and accelerate liquidations.

-

Price Triggers: Identifying the specific price triggers that initiated the $67 million liquidation event is crucial for understanding the dynamics at play. Was it a single event, or a series of factors contributing to the overall decline?

Leverage Risks and Over-Exposure

The allure of high leverage in cryptocurrency trading is undeniable, but it carries substantial risks, especially in volatile markets. Over-leveraging exposes traders to significant losses, and even small price movements can lead to devastating consequences.

-

Danger of High Leverage Ratios: Traders using high leverage ratios are particularly vulnerable. A small price movement against their position can quickly wipe out their capital and trigger liquidation.

-

Risk Management Strategies: Implementing robust risk management strategies, including diversification, position sizing, and stop-loss orders, is crucial for mitigating the risks associated with leveraged trading.

-

Algorithmic Trading: Algorithmic trading, while efficient, can also amplify liquidations. Automated trading bots reacting to price changes can create a feedback loop, accelerating downward price spirals.

Implications and Future Outlook for the Ethereum Market

Short-Term Impact on Ethereum Price

The $67 million in Ethereum liquidations had an immediate impact on the ETH price, likely contributing to a temporary price drop.

-

Immediate Consequences: The short-term impact on the ETH price can range from a minor correction to a more significant decline depending on the market's response.

-

Potential for Further Price Drops or Rebounds: The immediate aftermath of the liquidations could lead to either a further price drop due to continued selling pressure or a rebound as buyers step in to take advantage of lower prices.

-

Market Sentiment: Analyzing market sentiment in the wake of the liquidation event is crucial. Is the overall sentiment bearish, suggesting further downward pressure, or is there a sign of recovery?

Long-Term Implications for the DeFi Ecosystem

The event raises concerns about the long-term health and stability of the decentralized finance (DeFi) ecosystem.

-

Effect on DeFi Stability: The significant liquidations could potentially shake investor confidence in DeFi protocols.

-

Impact on Investor Confidence: A significant drop in investor confidence could lead to decreased participation and liquidity within the DeFi ecosystem.

-

Potential Regulatory Scrutiny: Large-scale liquidations may attract greater regulatory scrutiny, potentially impacting the future development and growth of the DeFi sector.

Lessons Learned and Future Predictions

The $67 million Ethereum liquidation event provides valuable lessons for traders and investors.

-

Key Takeaways for Traders: The importance of responsible risk management, diversification, and avoiding over-leveraging cannot be overstated.

-

Future Liquidation Predictions: While predicting future liquidation events is impossible, understanding the factors that contribute to them can help investors prepare for potential volatility.

-

Minimizing Future Risks: Staying informed about market trends, continuously improving risk management strategies, and understanding the intricacies of leveraged trading are key to minimizing future risks.

Conclusion

This article analyzed the recent $67 million in Ethereum liquidations, exploring their causes, implications, and potential long-term effects on the cryptocurrency market. We examined the risks associated with leveraged trading, the impact of market volatility, and the importance of robust risk management strategies. Understanding Ethereum liquidations and their impact is crucial for navigating the complexities of the cryptocurrency market. Stay informed about market trends, practice responsible risk management, and continue learning about the intricacies of Ethereum and its associated risks to make informed investment decisions. Keep up-to-date on the latest news about Ethereum liquidations and market analysis to protect your investments.

Featured Posts

-

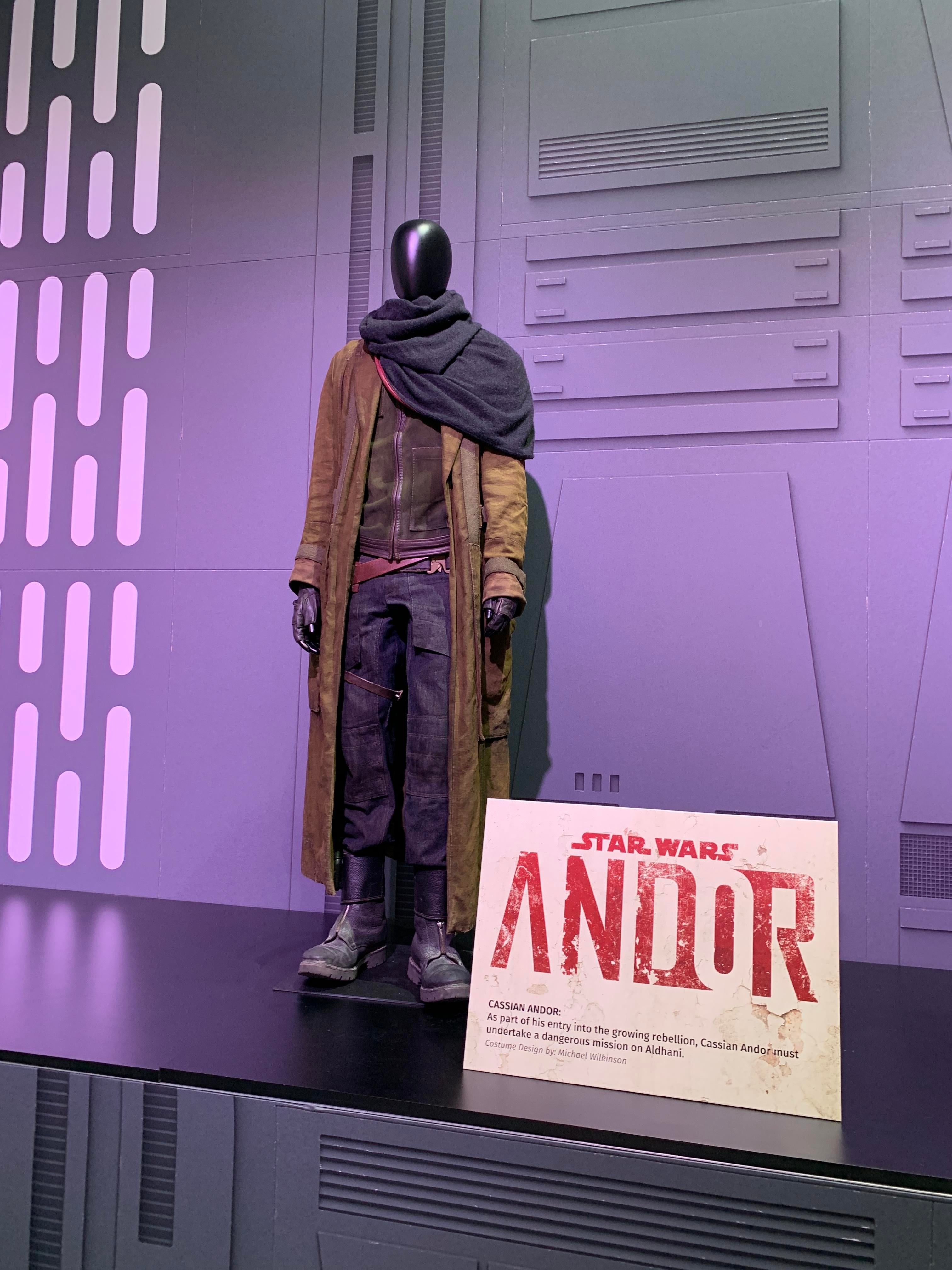

Andor First Look A 31 Year Old Star Wars Mystery Solved

May 08, 2025

Andor First Look A 31 Year Old Star Wars Mystery Solved

May 08, 2025 -

Is Ubers Future In Self Driving Cars Stock Market Implications

May 08, 2025

Is Ubers Future In Self Driving Cars Stock Market Implications

May 08, 2025 -

Lahwr Ky Ahtsab Edaltwn Myn 50 Kmy Kya Yh Tshwysh Ka Baeth He

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Myn 50 Kmy Kya Yh Tshwysh Ka Baeth He

May 08, 2025 -

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025 -

Angels Hitting Woes Continue 13 More Strikeouts In Twins Sweep

May 08, 2025

Angels Hitting Woes Continue 13 More Strikeouts In Twins Sweep

May 08, 2025