7% Drop In Amsterdam Stock Market: Trade War Fears Fuel Market Volatility

Table of Contents

Understanding the Recent Volatility in the Amsterdam Stock Market

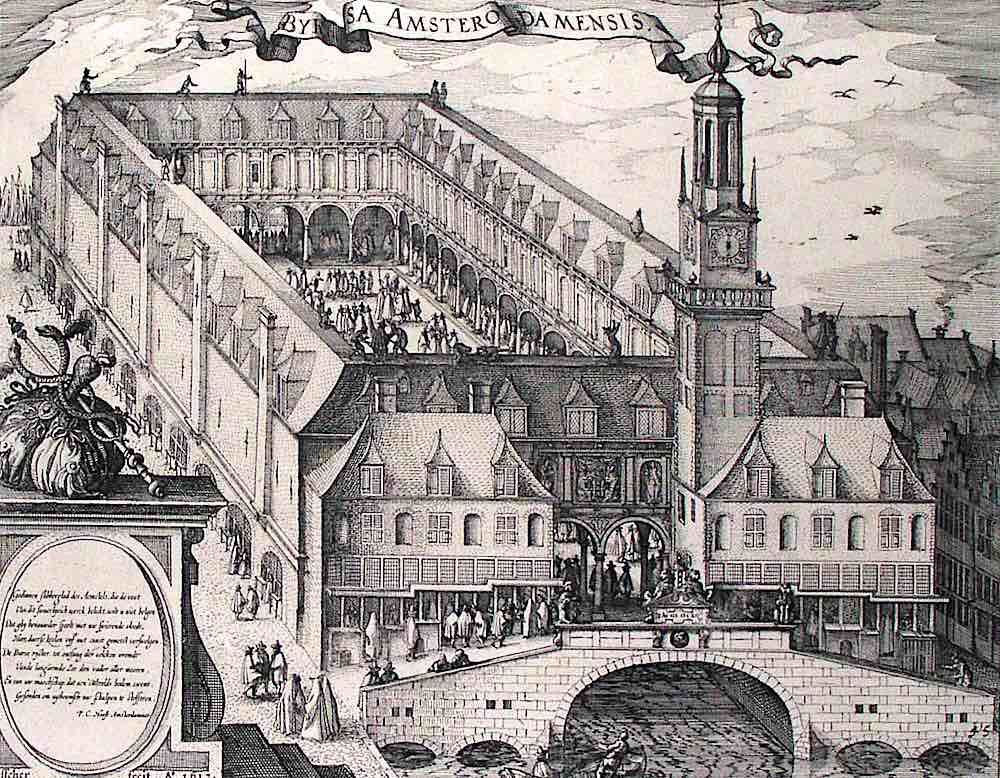

The Amsterdam Stock Exchange, while relatively small compared to giants like New York or London, plays a vital role in the Dutch economy. Its sensitivity to global events, particularly shifts in international trade, makes it particularly vulnerable to external shocks. The recent volatility is clearly reflected in key indices:

- AEX Index: The benchmark AEX index experienced the brunt of the 7% decline, signaling widespread market distress.

- Sectoral Impacts: Export-oriented sectors, such as technology and agriculture, suffered the most significant drops, highlighting the direct impact of trade disruptions. Financials also experienced considerable losses due to increased uncertainty.

- Visual Representation: [Insert Graph/Chart showing the 7% drop in the AEX index]. This visual clearly demonstrates the severity of the recent market downturn.

The Role of Trade War Fears in the Market Decline

The primary catalyst behind this sharp decline in the Amsterdam Stock Market is the escalating global trade war. Increased tensions between major economic powers create a climate of uncertainty that directly undermines investor confidence.

- Triggering Events: Recent announcements of new tariffs, stalled trade negotiations, and retaliatory measures between key trading partners significantly contributed to the market downturn. The uncertainty surrounding future trade policies creates a chilling effect on investment.

- Mechanism of Impact: Trade wars lead to uncertainty about future business conditions. This uncertainty reduces business investment, impacting job growth and economic activity. Reduced consumer confidence due to potential price increases on imported goods further exacerbates the situation.

- Ripple Effects: The consequences extend far beyond national borders. Disruptions to international trade and supply chains negatively affect Dutch businesses that rely on global exports and imports, creating a domino effect impacting numerous sectors.

Analyzing the Impact on Key Dutch Sectors

The Amsterdam Stock Market volatility has had a disproportionate impact on several key Dutch sectors:

- Agriculture: The Netherlands is a major agricultural exporter. New tariffs and trade barriers severely affect this sector, impacting farmers and related businesses.

- Technology: Dutch technology companies reliant on global supply chains and export markets faced significant challenges, with share prices reflecting the heightened uncertainty.

- Finance: The financial sector felt the pressure due to decreased investor confidence and increased risk aversion. Concerns around potential loan defaults and reduced investment opportunities led to market volatility.

- Government Response: The Dutch government is actively monitoring the situation and considering measures to mitigate the negative impacts on specific sectors. Further policy announcements are anticipated.

Investor Sentiment and Market Predictions

The market reaction to the recent volatility indicates a shift toward increased risk aversion.

- Expert Opinions: Analysts predict short-term fluctuations will continue, with the market's trajectory heavily dependent on the resolution (or escalation) of trade disputes. Long-term predictions vary, contingent on economic recovery and government responses.

- Investor Behavior: We're seeing capital flight from riskier assets, as investors seek safer havens. This reflects the cautionary sentiment prevalent in the market.

- Future Fluctuations: The potential for further Amsterdam Stock Market volatility remains high, heavily reliant on ongoing global developments and the evolving trade war landscape.

Strategies for Navigating Amsterdam Stock Market Volatility

Managing investments during periods of heightened market uncertainty requires careful planning and strategic adjustments:

- Diversification: Diversifying investment portfolios across different asset classes and geographical regions is crucial for mitigating risk.

- Long-Term Strategy: Maintaining a long-term investment strategy is paramount. Short-term market fluctuations should not dictate long-term financial goals.

- Professional Advice: Consulting a qualified financial advisor is strongly recommended. They can provide personalized guidance tailored to individual circumstances and risk tolerance.

Conclusion

The 7% drop in the Amsterdam Stock Market underscores the significant impact of global trade war fears on even seemingly insulated markets. The resulting Amsterdam Stock Market volatility has affected various sectors, impacting investor sentiment and the broader economic outlook. Understanding the underlying causes and potential consequences is vital for navigating this challenging period. To effectively manage your investments during this period of Amsterdam Stock Market volatility, stay informed about global trade developments, regularly monitor relevant market indices, and consider seeking expert financial advice. Remember to diversify your portfolio and maintain a long-term perspective. For more market updates and investment strategies, visit [link to relevant resource].

Featured Posts

-

Escape To The Country Top Destinations For A Tranquil Life

May 25, 2025

Escape To The Country Top Destinations For A Tranquil Life

May 25, 2025 -

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025 -

Dreyfus Affair French Parliament Considers Posthumous Honor

May 25, 2025

Dreyfus Affair French Parliament Considers Posthumous Honor

May 25, 2025 -

Escape To The Country Choosing The Right Location For You

May 25, 2025

Escape To The Country Choosing The Right Location For You

May 25, 2025 -

Dissidents Chinois En France Face A La Mainmise De Pekin

May 25, 2025

Dissidents Chinois En France Face A La Mainmise De Pekin

May 25, 2025

Latest Posts

-

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 25, 2025 -

From Poop Papers To Podcast Gold Ai Driven Content Transformation

May 25, 2025

From Poop Papers To Podcast Gold Ai Driven Content Transformation

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Influence

May 25, 2025 -

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025 -

Will Elon Musk Continue To Support Dogecoin

May 25, 2025

Will Elon Musk Continue To Support Dogecoin

May 25, 2025