7-Year Prison Term For GPB Capital's David Gentile In Ponzi Scheme Case

Table of Contents

The GPB Capital Ponzi Scheme: A Detailed Look

The Scheme's Mechanics

The GPB Capital Ponzi scheme operated by attracting investors with promises of high returns from investments in alternative assets, primarily focusing on automotive dealerships and waste management businesses. These promises were demonstrably false. The scheme's mechanics involved:

- Misrepresentation of Investments: Investors were presented with misleading financial statements and projections that significantly overstated the value and profitability of the underlying assets.

- Using New Investor Funds to Pay Off Older Investors: A classic Ponzi scheme characteristic, GPB Capital used money from new investors to pay returns to earlier investors, creating the illusion of consistent profitability and attracting more victims.

- Specific Investment Vehicles Used: GPB Capital offered various investment vehicles, including private placements and limited partnerships, making it difficult for investors to independently verify the legitimacy of the investments.

This sophisticated fraudulent investment scheme successfully concealed its true nature for years, misleading investors and leading to substantial financial losses. The use of complex financial instruments and opaque business structures further obscured the fraudulent activities. Keywords: Investment fraud, fraudulent investment scheme, securities fraud, misleading investors.

The Scale of the Fraud

The GPB Capital Ponzi scheme involved billions of dollars in investor funds, impacting thousands of individuals across the United States. The scale of the fraud is truly staggering:

- Dollar Amounts Defrauded: Estimates of the total losses inflicted on investors range in the billions of dollars.

- Number of Investors Impacted: Thousands of investors, many of whom were retirees relying on their investments for retirement income, were severely impacted by the scheme.

- States/Countries Affected: The fraud's reach extended across numerous states in the US, highlighting the widespread nature of the scheme.

The sheer magnitude of the financial losses and the number of victims underscore the devastating impact of this type of financial crime. Keywords: Financial losses, investor losses, victim impact statement.

David Gentile's Conviction and Sentencing

The Charges

David Gentile faced multiple serious criminal charges, including:

- Wire Fraud: Using electronic communication to execute the fraudulent scheme.

- Securities Fraud: Making false statements and omissions in connection with the sale of securities.

- Conspiracy: Working with others to commit the fraudulent acts.

The prosecution presented substantial evidence in court, including internal documents, witness testimonies, and financial records, demonstrating Gentile's knowledge and participation in the Ponzi scheme. Keywords: Criminal charges, guilty verdict, federal court, legal proceedings.

The Sentence and its Implications

Gentile's seven-year prison sentence, along with potential fines and restitution payments, sends a strong message about the severity of financial crimes.

- Length of Sentence: The seven-year sentence reflects the gravity of the offense and the substantial harm inflicted on investors.

- Potential for Appeals: While Gentile may appeal his conviction and sentence, the sentence stands as a significant deterrent to others considering similar fraudulent activities.

- Impact on other GPB Capital executives: The sentencing of David Gentile sets a precedent for the prosecution of other individuals involved in the GPB Capital scheme.

This case highlights the potential legal ramifications for those involved in investment fraud. Keywords: Prison sentence, jail time, restitution payments, legal ramifications.

Lessons Learned and Investor Protection

Due Diligence and Investor Education

The GPB Capital case underscores the critical importance of thorough due diligence before making any investment. Investors need to:

- Verify Investment Legitimacy: Independently verify the claims made by investment firms, consulting with financial professionals and regulatory resources.

- Understand Investment Risks: Educate themselves about the risks associated with various investment types.

- Seek Professional Advice: Consult with qualified financial advisors before making significant investments.

The emphasis on investor education and responsible investment practices is crucial in protecting individuals from future investment scams. Keywords: Investor protection, due diligence, financial literacy, investment scams.

The Role of Regulatory Agencies

Regulatory agencies like the SEC play a crucial role in protecting investors:

- SEC Investigations: The SEC actively investigates potential investment fraud and takes enforcement actions against perpetrators.

- Enforcement Actions: The agency pursues legal action to recover investor losses and impose penalties on those involved in fraudulent schemes.

- Investor Education Initiatives: The SEC provides resources and educational materials to help investors understand investment risks and protect themselves from fraud.

Strengthening regulatory oversight and increasing investor awareness are essential elements in combating investment fraud. Keywords: SEC investigation, regulatory oversight, financial regulation, investor protection.

Conclusion

The seven-year prison sentence handed down to David Gentile for his role in the GPB Capital Ponzi scheme serves as a powerful reminder of the severe consequences of investment fraud. The scale of this scheme, impacting thousands of investors and resulting in billions of dollars in losses, highlights the need for increased vigilance and responsible investment practices. Investors must prioritize due diligence, understand the warning signs of Ponzi schemes, and utilize the resources available to protect themselves from similar fraudulent activities. Learn how to identify investment fraud and protect yourself from GPB Capital-style Ponzi schemes. Invest wisely to avoid the devastating consequences of financial crime. For further information on investor protection and identifying fraudulent investments, refer to resources from the SEC and other reputable financial organizations.

Featured Posts

-

Elaqt Twm Krwz Wana Dy Armas Hqyqt Frq Alsn Albalgh 26 Eama

May 11, 2025

Elaqt Twm Krwz Wana Dy Armas Hqyqt Frq Alsn Albalgh 26 Eama

May 11, 2025 -

Hertha Bscs Crisis Boateng And Kruses Differing Perspectives

May 11, 2025

Hertha Bscs Crisis Boateng And Kruses Differing Perspectives

May 11, 2025 -

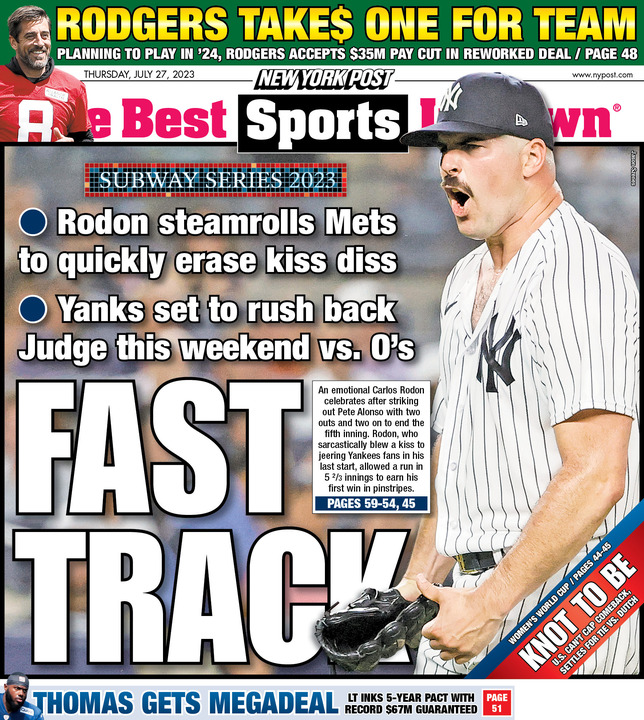

Will Aaron Judge Break Records Again A Yankees Magazine Analysis

May 11, 2025

Will Aaron Judge Break Records Again A Yankees Magazine Analysis

May 11, 2025 -

62 Salh Tam Krwz Awr 36 Salh Adakarh Emr Ka Frq Mhbt Myn Rkawt Nhyn

May 11, 2025

62 Salh Tam Krwz Awr 36 Salh Adakarh Emr Ka Frq Mhbt Myn Rkawt Nhyn

May 11, 2025 -

Selena Gomez Denies Wedding First Dance With Benny Blanco

May 11, 2025

Selena Gomez Denies Wedding First Dance With Benny Blanco

May 11, 2025