$900 Million Tariff: Apple Stock Takes A Hit

Table of Contents

The $900 Million Tariff: A Breakdown of the Impact on Apple

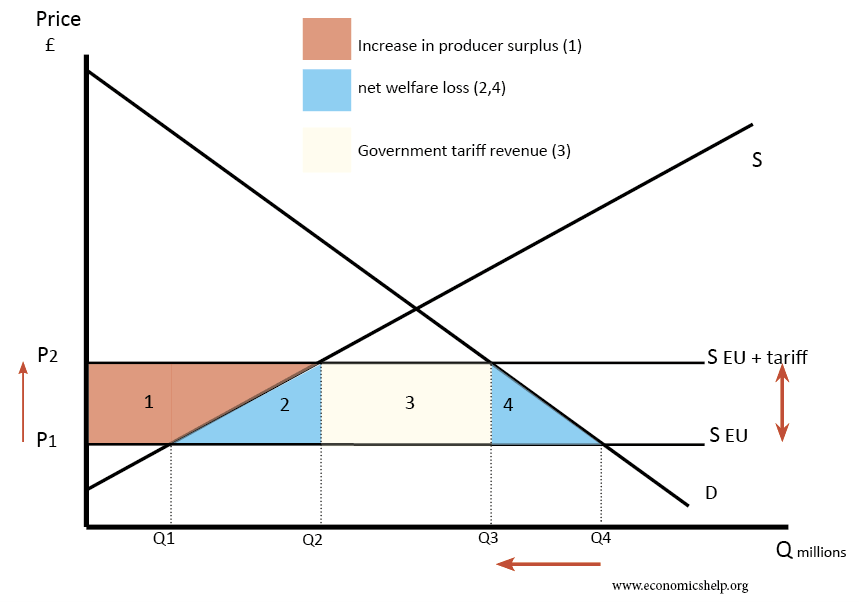

The $900 million tariff represents a significant challenge for Apple. This tariff specifically targets certain Apple products imported into [Target Country/Region], resulting in a [Percentage]% increase in import costs. This is not a new isolated incident but rather an escalation of existing trade tensions between [Country A] and [Country B], reflecting a broader global trade war impacting many multinational corporations.

- Specific product lines affected: This tariff primarily impacts iPhones, iPads, and MacBooks imported into the specified region, affecting a substantial portion of Apple's product portfolio.

- Impact on Apple's overall revenue projections: Analysts estimate the $900 million tariff could reduce Apple's annual revenue by [estimated percentage or dollar amount], depending on the company's ability to adjust pricing and production.

- Potential supply chain disruptions: The tariff may trigger supply chain disruptions, forcing Apple to reconsider its manufacturing and distribution strategies, potentially leading to delays and increased production costs.

Apple's Stock Price Reaction: Immediate and Long-Term Implications

The announcement of the $900 million tariff immediately impacted Apple's stock price. Within [Timeframe - e.g., 24 hours], Apple's stock price dropped by [Percentage]% or [Dollar amount], representing a significant loss in market capitalization. This dramatic fall reflects investor sentiment, with a notable sell-off indicating concern about the potential long-term effects of the tariff.

- Specific data points: Before the announcement, Apple's stock traded at [Price]. Immediately following the announcement, it dropped to [Price], before stabilizing at [Price] [Timeframe after the announcement].

- Analyst predictions: Several analysts downgraded their ratings on Apple stock, citing concerns about reduced profitability and potential market share erosion due to increased prices.

- Investor concerns: Investors are primarily concerned about the impact on future earnings, potential price increases that could affect consumer demand, and the overall uncertainty surrounding global trade relations.

Potential Strategies for Apple to Mitigate Tariff Impact

Faced with this significant challenge, Apple has several options to mitigate the impact of the $900 million tariff. These strategies may involve a combination of approaches, each with its own potential benefits and drawbacks.

- Specific strategies:

- Price increases: Apple could absorb some of the tariff's cost, but passing it on to consumers through higher prices could hurt demand.

- Production shifts: Diversifying manufacturing locations to countries outside of the affected region could reduce reliance on affected import routes. This however may involve significant investment and logistical challenges.

- Lobbying efforts: Actively engaging with policymakers to advocate for tariff reductions or exemptions could be a long-term strategy.

- Analysis of effectiveness: The effectiveness of each strategy depends on various factors, including consumer demand elasticity, production costs in alternative locations, and the success of lobbying efforts.

- Long-term implications: Production shifts could impact supply chain management and labor costs, while price increases could damage Apple's brand image.

Broader Economic Context: Global Trade Wars and Market Volatility

The $900 million tariff on Apple is not an isolated incident. It's part of a larger pattern of escalating trade tensions between nations, creating significant uncertainty in global markets. These trade wars contribute to market volatility, affecting not only Apple but also other technology companies and the broader economy.

- Similar tariffs: Many other tech companies have faced similar tariffs, highlighting the widespread impact of these trade policies.

- Market volatility: The uncertainty surrounding global trade relations has created significant market volatility, making it challenging for investors to predict future stock prices.

- Global economic trends: The $900 million tariff is intricately linked to broader global economic trends, such as rising inflation and supply chain disruptions.

Conclusion: Navigating the $900 Million Tariff and its Impact on Apple Stock

The $900 million tariff presents a significant challenge to Apple, impacting its stock price and raising concerns about future profitability. The company may need to employ a combination of strategies, including price adjustments, production shifts, and lobbying efforts, to mitigate the tariff's effects. The broader context of global trade wars further complicates the situation, leading to increased market uncertainty. Stay updated on the latest news regarding the $900 million tariff and its impact on Apple stock, and monitor Apple stock performance closely given the ongoing impact of this significant tariff. Understanding these developments is crucial for investors seeking to navigate this complex economic climate.

Featured Posts

-

Escape To The Country The Ultimate Checklist For A Smooth Transition

May 24, 2025

Escape To The Country The Ultimate Checklist For A Smooth Transition

May 24, 2025 -

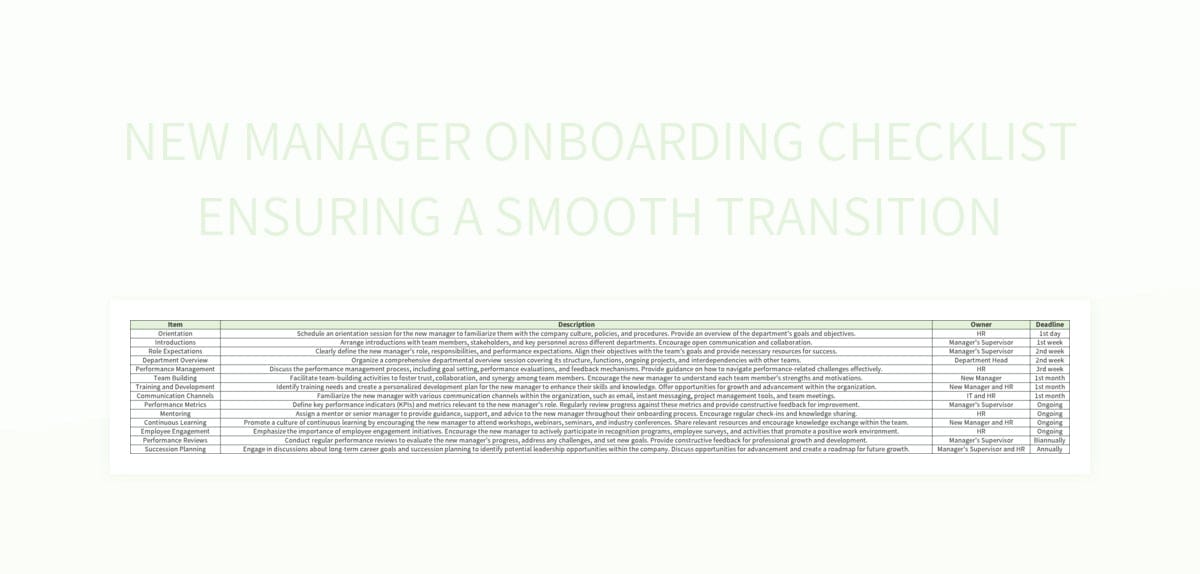

Tva Group Job Cuts Impact Of Streaming Services And Regulatory Changes

May 24, 2025

Tva Group Job Cuts Impact Of Streaming Services And Regulatory Changes

May 24, 2025 -

Maryland Softball Defeats Delaware 5 4 In Thrilling Contest

May 24, 2025

Maryland Softball Defeats Delaware 5 4 In Thrilling Contest

May 24, 2025 -

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025 -

Avrupa Borsalari Ve Ecb Faiz Politikasinin Etkisi Detayli Inceleme

May 24, 2025

Avrupa Borsalari Ve Ecb Faiz Politikasinin Etkisi Detayli Inceleme

May 24, 2025

Latest Posts

-

Potential Canada Post Strike New Contract Offers Revealed

May 24, 2025

Potential Canada Post Strike New Contract Offers Revealed

May 24, 2025 -

Nouvelles Reglementations Quotas De Contenu Francophone Sur Les Plateformes De Streaming Au Quebec

May 24, 2025

Nouvelles Reglementations Quotas De Contenu Francophone Sur Les Plateformes De Streaming Au Quebec

May 24, 2025 -

Le Quebec Reglemente Le Contenu Francophone Sur Les Plateformes De Streaming

May 24, 2025

Le Quebec Reglemente Le Contenu Francophone Sur Les Plateformes De Streaming

May 24, 2025 -

Quotas De Contenu Francophone Le Gouvernement Du Quebec Regit Les Plateformes De Diffusion

May 24, 2025

Quotas De Contenu Francophone Le Gouvernement Du Quebec Regit Les Plateformes De Diffusion

May 24, 2025 -

Quebec Impose Des Quotas Pour Le Contenu Francophone En Diffusion Continue

May 24, 2025

Quebec Impose Des Quotas Pour Le Contenu Francophone En Diffusion Continue

May 24, 2025