$900 Million Tariff Impact: Apple Stock Takes A Hit

Table of Contents

The $900 Million Tariff: A Breakdown

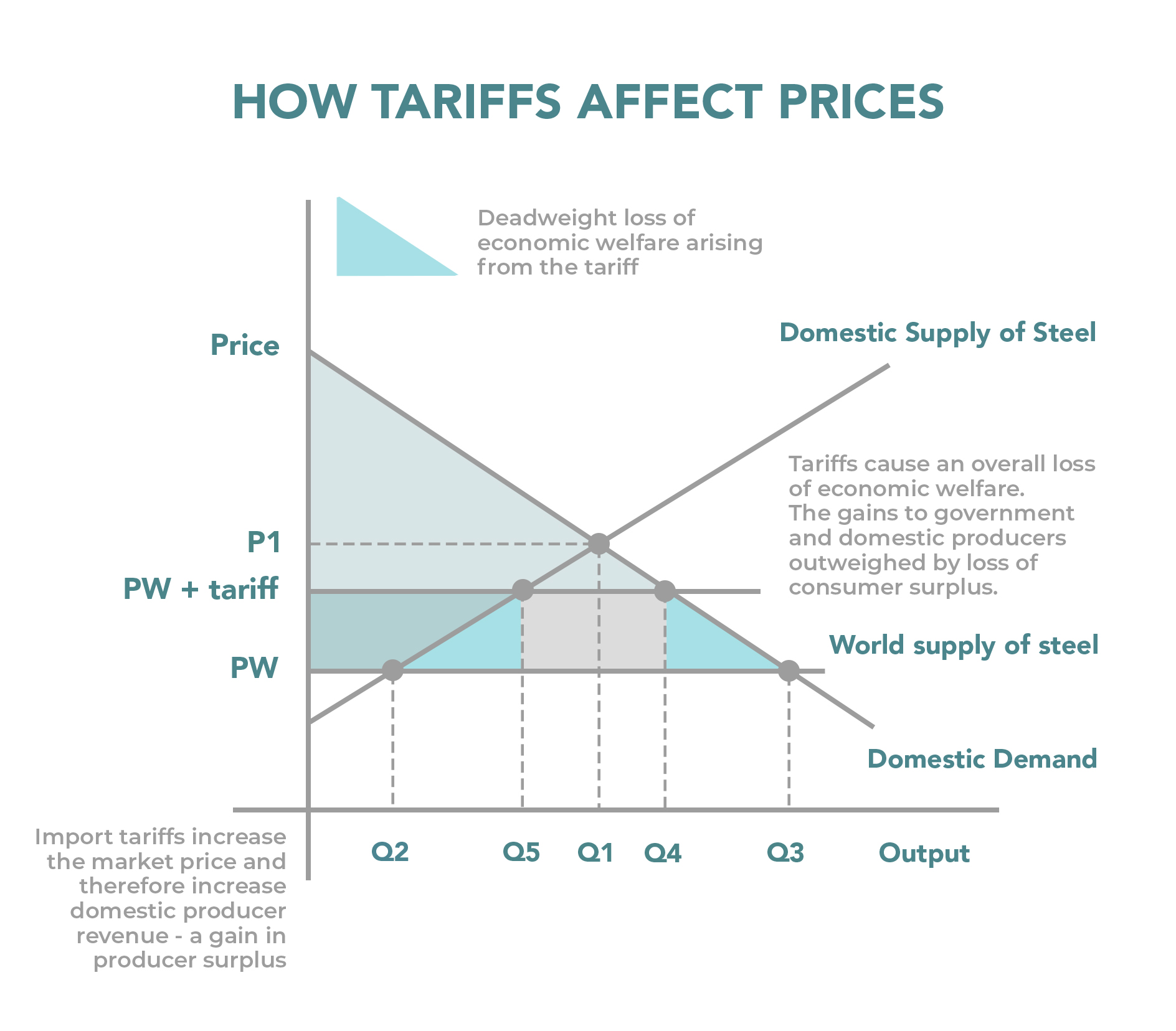

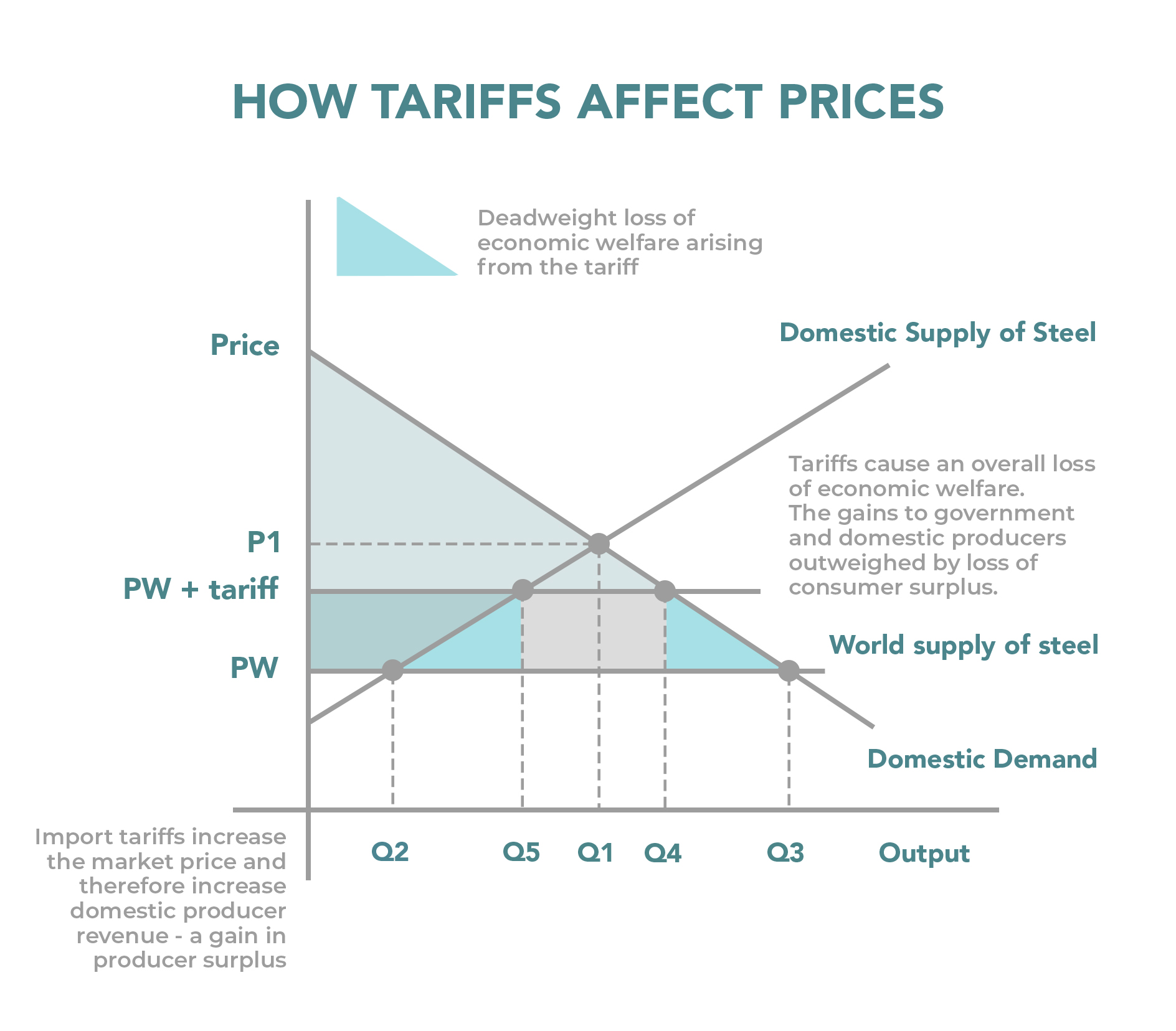

The imposition of new tariffs on various Apple products has resulted in a significant $900 million cost increase. These tariffs, primarily stemming from ongoing trade disputes, specifically target imported components and finished goods crucial to Apple's manufacturing process.

- Tariff Percentage Increase: The specific percentage increase varies depending on the product category and component, ranging from a few percentage points to significantly higher rates. Precise figures are difficult to pinpoint due to the complexity of global supply chains.

- Affected Product Categories: The tariffs impact a wide range of Apple products, including:

- iPhones

- iPads

- MacBooks

- Apple Watches

- AirPods

- Source of Information: Information regarding the tariffs comes from official government announcements and reputable financial news outlets such as the Wall Street Journal, Bloomberg, and Reuters.

- Geographical Impact: The increased import costs most significantly affect regions heavily reliant on importing Apple products, impacting consumers and retailers worldwide. However, the impact varies depending on import duties and local economic conditions.

Immediate Impact on Apple Stock Price

The news of the $900 million tariff hit sent Apple stock into a noticeable decline. The immediate market reaction reflected investor concern over the potential impact on Apple's profitability and future growth.

- Percentage Drop: Apple's stock price experienced a notable percentage drop in the days following the tariff announcement. The exact percentage varied based on the specific trading timeframe and overall market conditions.

- Trading Volume Increase: The trading volume significantly increased, indicating heightened investor activity and a flurry of buy and sell orders based on the new information.

- Investor Sentiment and Analyst Reactions: Investor sentiment turned negative, reflected in sell-off trends. Analysts expressed varying degrees of concern, with some forecasting a more significant long-term impact than others.

- Other Influencing Factors: Beyond tariffs, several other factors influenced the Apple stock price drop. These included the overall market conditions and other news affecting Apple, such as concerns about slowing iPhone sales and competition in the tech industry. Understanding these interconnected factors is crucial for a comprehensive analysis.

Long-Term Implications for Apple and Investors

The long-term implications of the $900 million tariff on Apple are multifaceted and uncertain. The company will likely implement several strategies to mitigate the negative impact.

- Mitigation Strategies: Apple may adjust prices, explore alternative manufacturing locations, lobby for tariff reductions, or implement cost-cutting measures throughout its supply chain. The effectiveness of these strategies is uncertain.

- Impact on Profitability and Market Share: The tariffs threaten Apple's profitability and could potentially impact its market share if competitors can offer more affordable alternatives.

- Implications for Consumers: Consumers might face higher prices for Apple products if the company passes on the increased costs. This could affect consumer demand, especially in price-sensitive markets.

- Potential Scenarios: Several scenarios are possible:

- Successful Mitigation: Apple successfully mitigates the tariff impact through price adjustments or production shifts.

- Sustained Negative Impact: The tariffs negatively affect Apple's profitability and market share in the long term.

- Limited Impact: The impact of the tariffs on Apple is limited, and the market adapts relatively quickly.

- Supply Chain and Manufacturing: The tariffs have highlighted the vulnerability of Apple's global supply chain and emphasized the need for diversification and resilience in its manufacturing strategy.

Comparing Apple's Response to Other Tech Companies

Apple's response to the tariffs can be compared to that of other tech giants facing similar challenges. Examining these responses provides valuable insights and context.

- Comparative Analysis: A comparison of Apple's response with that of companies like Samsung, Huawei, and Google reveals different approaches to mitigating tariff impacts. This could include variations in pricing strategies, diversification of manufacturing locations, or lobbying efforts.

- Diversification Strategies: Some tech companies have already adopted diversification strategies, including regional production hubs and varied supplier networks to minimize reliance on any single country or region. This is a key learning point for all major tech players.

- Examples of Other Companies' Responses: Specific examples of how other companies responded to previous tariffs or trade wars can be studied to identify successful and unsuccessful strategies.

- Comparing Strategies and Outcomes: A side-by-side comparison of different companies’ strategies and their consequent outcomes helps highlight what works and what doesn't in navigating challenging trade environments.

Conclusion

The $900 million tariff impact on Apple products represents a significant challenge for the company. The immediate market reaction underscores investor concern, but the long-term implications remain uncertain. Apple's response, including its potential mitigation strategies, will play a critical role in shaping its future performance. Monitoring Apple stock and its reactions to trade challenges is essential for informed investment decisions.

Call to Action: Stay informed about the evolving situation affecting Apple stock and the broader tech sector. Follow our blog for updates on the impact of tariffs on Apple stock and other relevant market analyses. Continue to monitor Apple stock and its response to these significant trade challenges. Understanding the dynamics of Apple stock and its susceptibility to tariff impacts is crucial for informed investment decisions.

Featured Posts

-

Plan Your Memorial Day Trip 2025 Flight Booking Guide

May 25, 2025

Plan Your Memorial Day Trip 2025 Flight Booking Guide

May 25, 2025 -

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 25, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 25, 2025 -

Analysis Former French Prime Ministers Views On Macron

May 25, 2025

Analysis Former French Prime Ministers Views On Macron

May 25, 2025 -

Yevrobachennya 2025 Chi Spravdyatsya Prognozi Konchiti Vurst

May 25, 2025

Yevrobachennya 2025 Chi Spravdyatsya Prognozi Konchiti Vurst

May 25, 2025 -

Positieve Aex Prestaties Tegenover Onrustige Amerikaanse Beurs

May 25, 2025

Positieve Aex Prestaties Tegenover Onrustige Amerikaanse Beurs

May 25, 2025

Latest Posts

-

Louisiana Inmates Ingenious Escape Plan Hair Trimmers And A New Orleans Jail

May 25, 2025

Louisiana Inmates Ingenious Escape Plan Hair Trimmers And A New Orleans Jail

May 25, 2025 -

Trump Suffers Another Legal Defeat In Battle Against Elite Firms

May 25, 2025

Trump Suffers Another Legal Defeat In Battle Against Elite Firms

May 25, 2025 -

Us Japan Trade Trumps Impact On The Nippon Steel Deal

May 25, 2025

Us Japan Trade Trumps Impact On The Nippon Steel Deal

May 25, 2025 -

Europe And Trumps Trade Policies Causes And Consequences Of The Conflict

May 25, 2025

Europe And Trumps Trade Policies Causes And Consequences Of The Conflict

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Urban Politics

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Urban Politics

May 25, 2025