A Half-Point Rate Cut: The Bank Of England's Path Forward

Table of Contents

The Rationale Behind the Half-Point Rate Cut

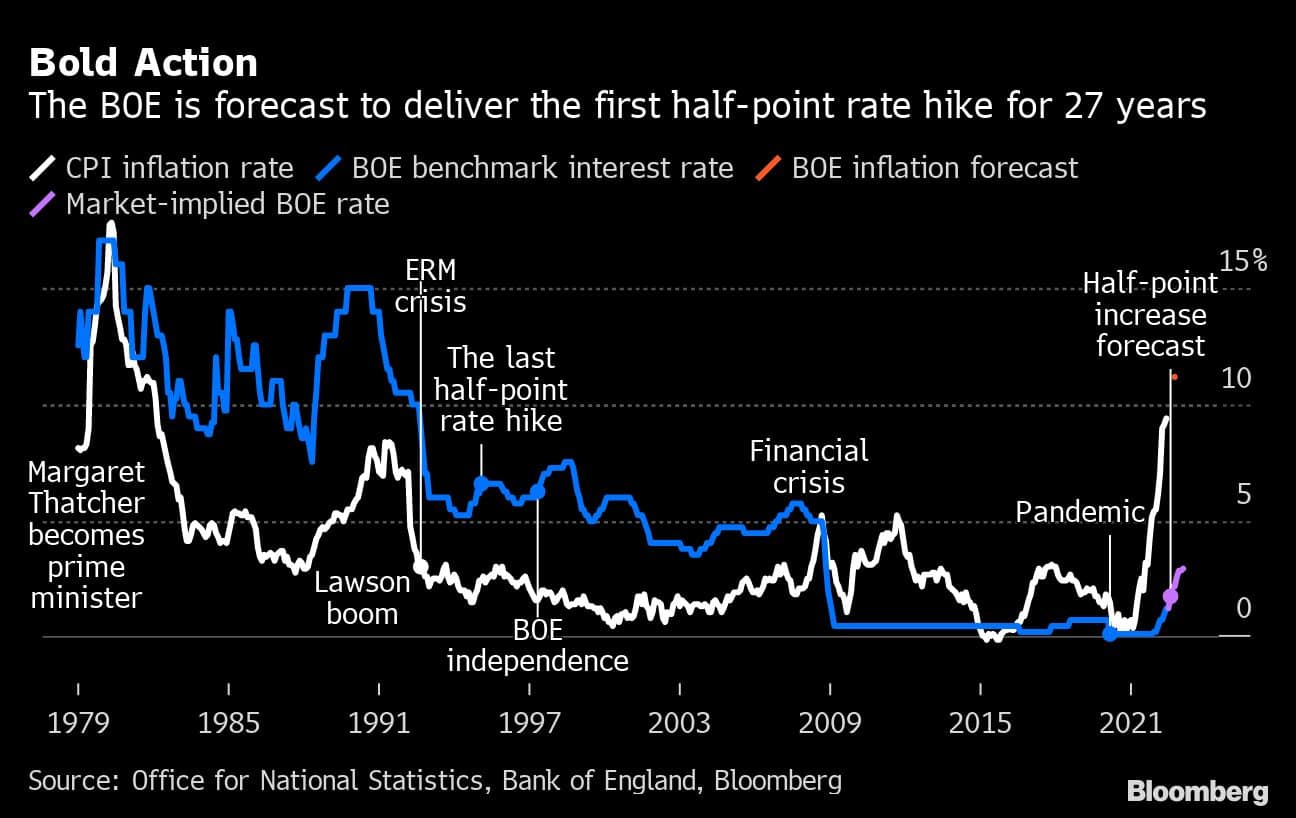

The UK economy is currently navigating a complex and challenging landscape. High inflation, slowing economic growth, and weakening consumer confidence have created a perfect storm prompting the Bank of England to take decisive action. The current interest rates, while previously aimed at curbing inflation, have inadvertently contributed to the slowdown. The Bank's decision to implement a half-point rate cut reflects a shift in priorities – attempting to stimulate economic activity in the face of a potential recession.

- High inflation rates exceeding the Bank of England's target: Inflation has consistently remained above the Bank's 2% target, eroding purchasing power and impacting consumer spending.

- Slowing economic growth and potential recession: Several key economic indicators point towards a significant slowdown in growth, with some forecasting a potential recession.

- Weakening consumer confidence and spending: Uncertainty about the future has led to decreased consumer spending, further dampening economic activity.

- Global economic uncertainty impacting the UK: The global economic climate, marked by geopolitical tensions and supply chain disruptions, has also played a role in influencing the Bank's decision.

These intertwined factors have led the Bank of England to believe that a significant rate cut is necessary to mitigate the risks of a deeper economic downturn. The hope is that lower interest rates will stimulate borrowing, investment, and ultimately, economic growth.

Impact of the Half-Point Rate Cut on the UK Economy

The half-point rate cut is expected to have a multifaceted impact on the UK economy, both in the short-term and the long-term. The immediate effect will likely be a reduction in borrowing costs for businesses and consumers, potentially leading to increased investment and consumer spending.

- Lower borrowing costs for businesses and consumers: Reduced interest rates make it cheaper to borrow money, encouraging businesses to invest and consumers to spend.

- Potential boost to consumer spending and investment: This increased borrowing capacity could lead to a surge in consumer spending and business investment, providing a much-needed boost to the economy.

- Increased affordability of mortgages: Lower interest rates will translate to lower mortgage rates, making homeownership more affordable and potentially stimulating the housing market.

- Risk of fueling inflation if the cut proves too stimulative: However, a significant risk is that the rate cut could inadvertently fuel inflation if it leads to excessive demand in the economy. The Bank will need to carefully monitor the impact of the cut on inflation.

The impact will vary across different sectors. The housing market is likely to experience a short-term boost due to lower mortgage rates. However, the manufacturing sector may experience a slower recovery depending on global demand and supply chain issues.

The Bank of England's Forward Guidance and Future Monetary Policy

The Bank of England's forward guidance will be crucial in understanding its future monetary policy path. While the half-point rate cut represents a significant shift, the Bank's statements regarding future interest rate adjustments remain unclear. This uncertainty reflects the complex and evolving nature of the UK's economic situation.

- Analysis of the Bank's future interest rate projections: The Bank will closely monitor key economic indicators such as inflation, employment, and GDP growth to inform its future decisions.

- Potential for further rate cuts or increases depending on economic data: Depending on the economic data, further rate cuts or even rate increases remain possibilities.

- Discussion of other potential monetary policy tools the Bank might utilize: The Bank might utilize other tools, such as quantitative easing, if the economic situation deteriorates further.

The uncertainty surrounding the future economic outlook – particularly concerning inflation and the potential for a deeper recession – makes the Bank of England's decision-making process exceptionally challenging.

Alternative Monetary Policy Strategies

The Bank of England could have considered alternative monetary policy strategies. Quantitative easing (QE), a policy where the central bank creates new money to purchase assets, could have been an option to increase liquidity in the market. However, QE carries its own risks and potential side effects, including inflation. Other unconventional tools, such as negative interest rates, could also have been considered, but their effectiveness and potential drawbacks are still being debated.

Conclusion

The half-point rate cut represents a significant shift in the Bank of England's monetary policy, reflecting the urgent need to address the challenges facing the UK economy. The rationale behind this bold move stems from high inflation, slowing economic growth, and concerns about a potential recession. The impact of this half-point rate cut will be felt across various sectors, with potential benefits including lower borrowing costs and increased affordability but also risks including the potential to fuel inflation. The Bank of England's future path will depend heavily on economic data and its ongoing assessment of the situation. Understanding the complexities of this half-point rate cut and its implications is critical for businesses and individuals alike. Stay informed about the evolving economic situation and the Bank of England's response. Follow our blog for further analysis on the impact of this half-point rate cut and future monetary policy decisions. Learn more about the implications of this half-point rate cut and how it might affect your finances.

Featured Posts

-

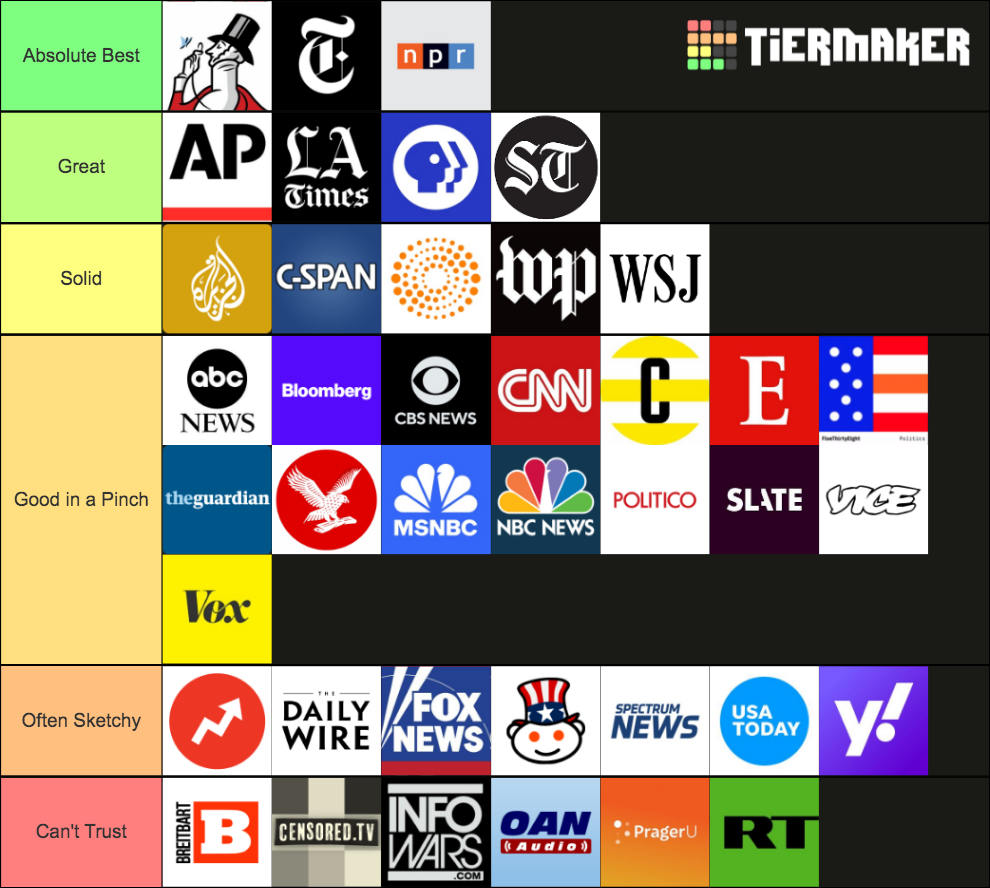

Building Trust In Crypto Why Reliable News Sources Are Essential

May 08, 2025

Building Trust In Crypto Why Reliable News Sources Are Essential

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Gewinnzahlen Lotto 6aus49 19 April 2025

May 08, 2025

Gewinnzahlen Lotto 6aus49 19 April 2025

May 08, 2025 -

Greenlands Strategic Importance Evaluating Trumps China Concerns

May 08, 2025

Greenlands Strategic Importance Evaluating Trumps China Concerns

May 08, 2025 -

The Long Walk Trailer A Chilling Glimpse At Stephen Kings New Horror Film

May 08, 2025

The Long Walk Trailer A Chilling Glimpse At Stephen Kings New Horror Film

May 08, 2025