A Royal Scandal: Uncovering Corruption In Monaco's Elite

Table of Contents

The History of Allegations: A Timeline of Monaco's Corruption Scandals

Monaco, despite its image of pristine wealth, has a history punctuated by allegations of corruption. While the principality fiercely guards its privacy, several instances have emerged over the years, shedding light on the underbelly of its seemingly flawless reputation. These scandals, involving money laundering, tax evasion, and bribery, highlight the persistent challenges Monaco faces in maintaining its image as a beacon of luxury and financial integrity.

- The Société Générale Case (2008): This high-profile case involved allegations of large-scale money laundering through Société Générale's Monaco branch. While specifics remain shrouded in secrecy due to banking confidentiality, investigations revealed suspicious transactions linked to international organized crime. The case underscored Monaco's vulnerability to being used as a conduit for illicit funds.

- The "Rainbow Warrior" Affair (1985): Though not directly related to financial corruption, this incident, involving the bombing of a Greenpeace ship, exposed the potential for political maneuvering and clandestine operations within Monaco's borders, highlighting the susceptibility to corruption beyond simple financial crimes. The subsequent legal battles and international pressure revealed vulnerabilities in Monaco's regulatory framework.

- Ongoing Investigations: Several investigations into potential corruption within Monaco's real estate and construction sectors are currently underway, though details remain largely confidential pending the conclusion of legal proceedings. These investigations demonstrate that Monaco corruption remains a persistent concern.

Money Laundering and Tax Evasion: Monaco's Vulnerability

Monaco's long-standing reputation as a tax haven has made it a prime target for money laundering and tax evasion schemes. Its strict bank secrecy laws, combined with relatively lenient regulations in the past, have historically created an environment conducive to illicit financial activities.

- Bank Secrecy and Lenient Regulations: Historically, Monaco's banking system offered a high degree of confidentiality, attracting individuals and entities seeking to shield their assets from scrutiny. While reforms have been implemented, concerns remain about the level of transparency.

- Scale of the Problem: Precise statistics on money laundering in Monaco are difficult to obtain due to the secretive nature of these operations. However, international organizations like the Financial Action Task Force (FATF) have repeatedly urged Monaco to strengthen its anti-money laundering (AML) and combating the financing of terrorism (CFT) frameworks.

- International Pressure: Increased international scrutiny and pressure from organizations like the OECD and the EU have forced Monaco to implement stricter regulations and cooperate more extensively with international investigations, significantly impacting the methods employed in Monaco corruption.

The Role of Offshore Entities and Shell Companies

Offshore entities and shell companies play a significant role in facilitating money laundering and concealing the true origins of illicit funds within Monaco. These opaque structures, often registered in jurisdictions with lax regulatory environments, serve as intermediaries, masking the ultimate beneficiaries of suspicious transactions.

- Functionality of Shell Companies: These companies exist solely on paper, lacking genuine commercial activity. They are frequently used to obscure the ownership of assets and facilitate the movement of funds across borders.

- Examples in Monaco: Several alleged corruption scandals in Monaco have involved the use of offshore entities and shell companies to disguise the source of illicit wealth and evade taxes. The complexity of these structures makes investigations challenging.

- International Efforts to Combat Shell Companies: International efforts to combat the use of shell companies include initiatives to promote beneficial ownership transparency and enhance information sharing among jurisdictions. These measures aim to increase accountability and make it more difficult to use these entities for illicit purposes.

The Impact on Monaco's Reputation and Economy

The repeated allegations of Monaco corruption have had a significant impact on its reputation and economic stability. The principality's image as a haven of luxury and discretion is increasingly challenged by negative publicity surrounding these scandals.

- Damage to Tourism and Investment: Negative media coverage of corruption scandals can deter tourists and investors, impacting revenue streams crucial to Monaco's economy. The perception of a lack of transparency can undermine confidence in the jurisdiction.

- Long-Term Economic Consequences: Persistent corruption can erode institutional trust, discourage foreign investment, and stifle economic growth. The long-term consequences of these scandals could outweigh the short-term gains obtained through illicit activities.

- Government Response: The Monegasque government has responded to international pressure by implementing reforms to improve transparency and strengthen its anti-money laundering framework. However, the effectiveness of these measures remains a subject of ongoing debate.

Ongoing Investigations and Future Outlook for Transparency in Monaco

Several investigations into corruption are currently underway in Monaco, signaling a continued effort to address these issues. The future outlook for transparency hinges on the effectiveness of ongoing reforms and sustained international cooperation.

- Current Investigations: While the specifics of ongoing investigations remain largely confidential, their existence demonstrates a recognition of the need for further action to combat Monaco corruption.

- Legislative Changes: Recent legislative changes aim to enhance transparency, increase cooperation with international authorities, and strengthen anti-money laundering measures.

- Challenges and Opportunities: Strengthening anti-corruption efforts in Monaco requires sustained political will, robust enforcement mechanisms, and ongoing collaboration with international partners. The success of these efforts will determine the future trajectory of the principality's fight against corruption.

Conclusion

The issue of Monaco corruption reveals a complex interplay of historical practices, legal frameworks, and international pressures. The scandals highlighted above have significantly damaged Monaco's reputation, impacting its tourism sector and investor confidence. While the government has undertaken steps to improve transparency and address these concerns, ongoing investigations and the need for sustained international cooperation remain crucial. The fight against Monaco corruption is ongoing. Stay informed and demand greater transparency from the Monegasque authorities to ensure a fairer and more ethical future for the principality. Learn more about the ongoing efforts to combat financial crime in Monaco and support initiatives promoting transparency and accountability.

Featured Posts

-

This Seasons Must Have Looks Style Inspiration From F1 Drivers

May 26, 2025

This Seasons Must Have Looks Style Inspiration From F1 Drivers

May 26, 2025 -

Transparency And Accountability Examining Presidential Spending Practices Related To Official Seals Luxury Items And Events

May 26, 2025

Transparency And Accountability Examining Presidential Spending Practices Related To Official Seals Luxury Items And Events

May 26, 2025 -

Streaming Moto Gp Inggris 2025 Sprint Race Akses Link Live Pukul 20 00 Wib

May 26, 2025

Streaming Moto Gp Inggris 2025 Sprint Race Akses Link Live Pukul 20 00 Wib

May 26, 2025 -

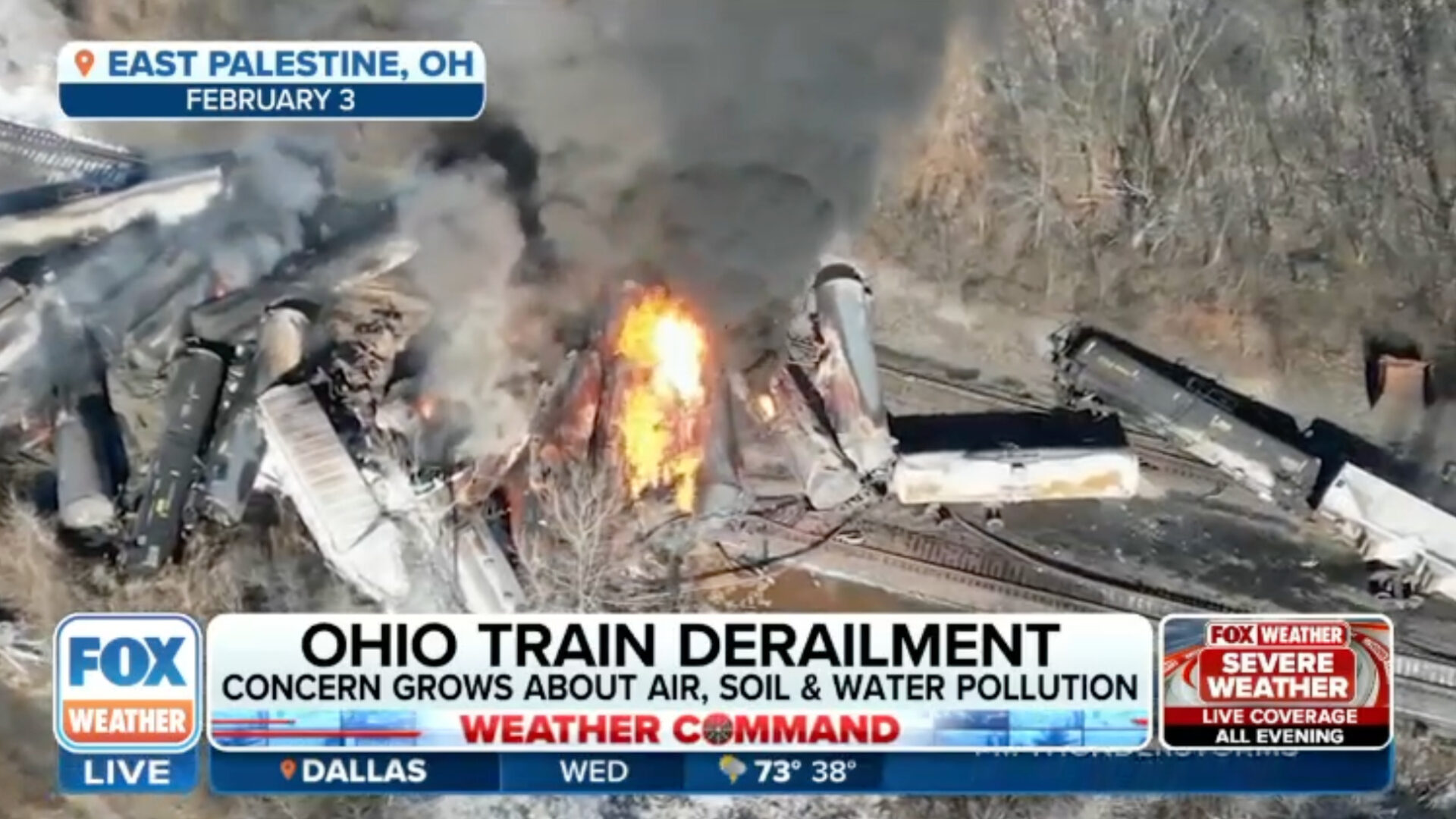

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 26, 2025

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 26, 2025 -

The Power Of Memory Analyzing Kazuo Ishiguros Narrative Techniques

May 26, 2025

The Power Of Memory Analyzing Kazuo Ishiguros Narrative Techniques

May 26, 2025

Latest Posts

-

Smartphone Samsung Galaxy S25 512 Go Avis Et Meilleur Prix

May 28, 2025

Smartphone Samsung Galaxy S25 512 Go Avis Et Meilleur Prix

May 28, 2025 -

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025 -

Avis Clients Samsung Galaxy S25 256 Go Modele 256 Go A 775 E

May 28, 2025

Avis Clients Samsung Galaxy S25 256 Go Modele 256 Go A 775 E

May 28, 2025 -

Comparatif Samsung Galaxy S25 256 Go Vs Concurrents 775 E

May 28, 2025

Comparatif Samsung Galaxy S25 256 Go Vs Concurrents 775 E

May 28, 2025 -

Bon Plan Samsung Galaxy S25 128 Go 5 Etoiles A 814 22 E

May 28, 2025

Bon Plan Samsung Galaxy S25 128 Go 5 Etoiles A 814 22 E

May 28, 2025