A Simple Path To High Dividend Returns

Table of Contents

Understanding High Dividend Returns

What are Dividend Stocks?

Dividend stocks are shares in companies that regularly distribute a portion of their profits to shareholders. This payout, known as a dividend, offers a consistent stream of income, making dividend investing attractive for those seeking passive income generation. Understanding the difference between dividend yield and dividend payout ratio is crucial.

-

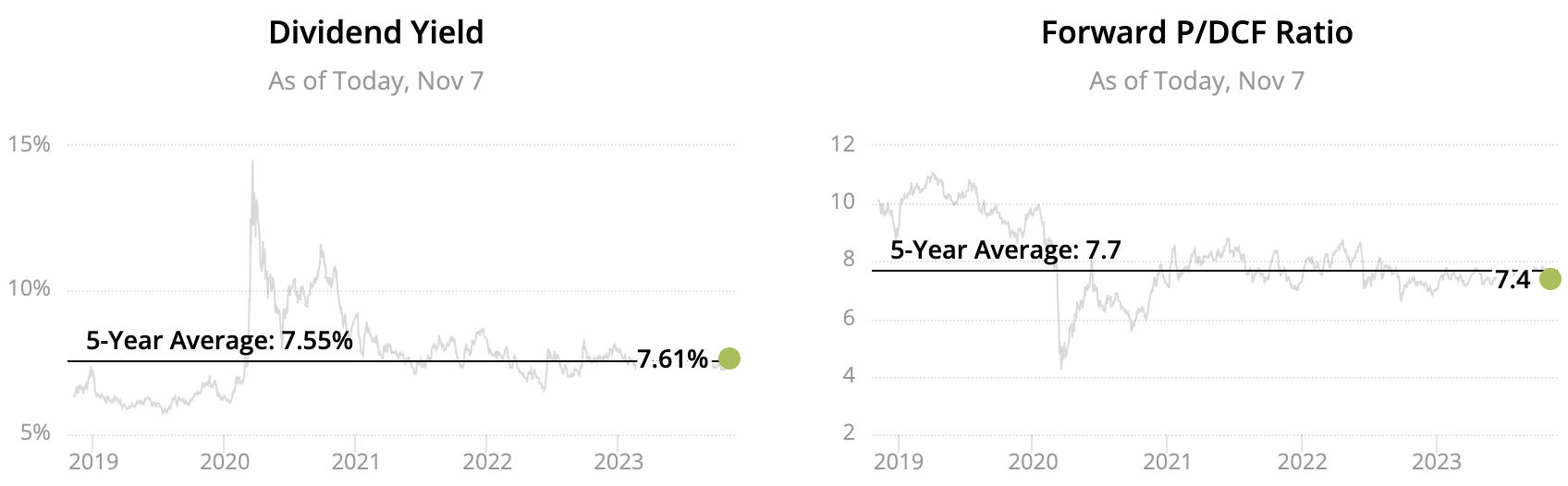

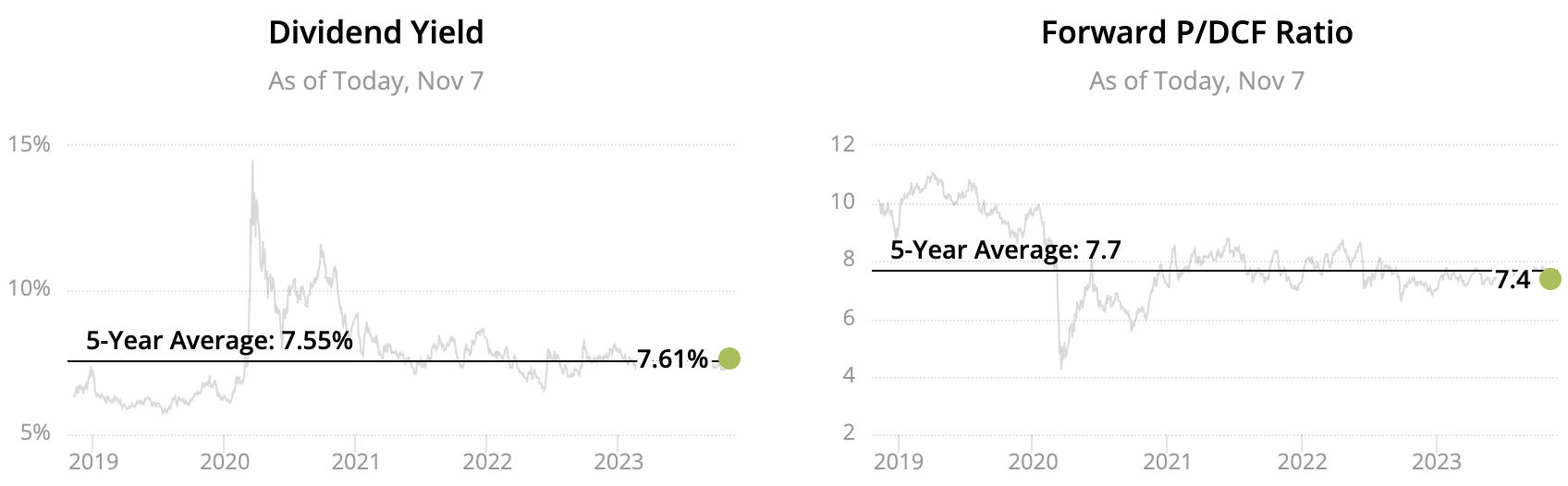

Dividend Yield: This represents the annual dividend payment relative to the stock's current market price. A higher dividend yield generally indicates a higher return on your investment, but it's important to consider the sustainability of that yield. For example, a stock with a 10% dividend yield might seem attractive, but if the company is struggling financially, that yield might not be sustainable.

-

Dividend Payout Ratio: This ratio shows the percentage of a company's earnings that are paid out as dividends. A sustainable payout ratio is generally between 30% and 70%, though this can vary depending on the industry. A payout ratio above 70% might signal financial instability, as the company might be paying out more than it earns.

-

Ex-Dividend Date: This is the date on or after which a buyer of a stock is no longer entitled to receive the next dividend payment. It's important to be aware of this date when planning your trades.

High dividend paying sectors often include:

- Real Estate Investment Trusts (REITs): These companies own and operate income-producing real estate, offering relatively high dividend yields.

- Utilities: Utility companies, providing essential services like electricity and gas, tend to have stable earnings and consistent dividend payments.

Assessing Dividend Sustainability

Before investing in any high-yield dividend stock, it’s vital to evaluate the company's financial health to ensure the dividend is sustainable. A high dividend yield without financial stability is a red flag.

-

Dividend History: Examine the company's track record of dividend payments. Consistency suggests a commitment to shareholders.

-

Debt Levels: High levels of debt can strain a company's ability to pay dividends. Analyze debt-to-equity ratios and other relevant financial metrics.

-

Free Cash Flow: This represents the cash a company generates after covering its operating expenses and capital expenditures. Strong free cash flow is essential for sustainable dividend payments.

-

Payout Ratio: As discussed earlier, a sustainable payout ratio is crucial for long-term dividend growth. Analyze the payout ratio over several years to identify trends.

Remember to consult the company’s financial statements (available on the company website and through financial data providers) and stay informed about relevant news and announcements that might impact dividend payments.

Building a High-Dividend Portfolio

Diversification Strategies

Diversification is key to mitigating risk in any investment portfolio, and dividend investing is no exception. Don't put all your eggs in one basket!

-

Industry Diversification: Spread your investments across different sectors to reduce the impact of any single industry downturn. For example, don't only invest in REITs; include utilities, consumer staples, and other sectors.

-

Geographical Diversification: Consider diversifying across different countries or regions to further reduce risk. This can help mitigate the impact of economic or political events in a single region.

A good starting point for beginners might be a portfolio of 10-15 different high-dividend stocks across various sectors.

Selecting High-Yield Dividend Stocks

Identifying promising dividend stocks requires careful research and analysis. Several strategies can help:

-

Screening Tools: Many online brokerage platforms offer stock screening tools that allow you to filter stocks based on criteria such as dividend yield, payout ratio, and market capitalization.

-

Fundamental Analysis: Dive deeper into a company's financial statements, assessing its profitability, debt levels, and future growth prospects.

-

Research Individual Companies: Don't rely solely on screening tools. Thoroughly research individual companies to understand their business model, competitive landscape, and management team.

Reputable sources for financial data include sites like Yahoo Finance, Google Finance, and Bloomberg.

Reinvesting Dividends for Growth

The power of compounding is a key factor in maximizing returns from dividend investing. Reinvesting your dividends allows you to buy more shares, increasing your overall income over time.

- Dividend Reinvestment Plans (DRIPs): Many companies offer DRIPs, which automatically reinvest your dividends into more shares of the company's stock. This simplifies the process and eliminates brokerage fees.

Compounding allows your initial investment to grow exponentially over time. The earlier you start reinvesting, the greater the benefit.

Managing Your High-Dividend Portfolio

Monitoring Performance and Adjusting

Regularly reviewing your portfolio’s performance is crucial for long-term success.

-

Frequency: Aim to review your portfolio at least quarterly, or even annually, depending on your investment strategy and risk tolerance.

-

Factors to Consider: When making adjustments, consider factors like market fluctuations, changes in a company's financial performance, or shifts in your personal financial goals.

Tax Implications of Dividend Income

Dividends are considered taxable income. Understanding the tax implications is essential.

-

Qualified vs. Non-Qualified Dividends: Qualified dividends (held for a specific period) generally receive a lower tax rate than non-qualified dividends.

-

Tax Advice: Consult with a qualified tax professional to understand the specific tax implications of your dividend income based on your individual circumstances.

Conclusion

Investing in high dividend returns can be a strategic path towards building a reliable passive income stream and achieving your financial goals. By understanding dividend stocks, building a diversified portfolio, and actively managing your investments, you can significantly improve your chances of success. Remember to always conduct thorough research and consider seeking professional financial advice.

Start your journey towards high dividend returns today! Begin researching high-yield dividend stocks and take the first step towards building a secure financial future. Learn more about finding reliable high dividend returns and achieving your financial aspirations.

Featured Posts

-

Suri Cruise Tom Cruises Unconventional Postnatal Response

May 11, 2025

Suri Cruise Tom Cruises Unconventional Postnatal Response

May 11, 2025 -

Increased Border Checks Result In Fewer Arrests And Higher Deportations

May 11, 2025

Increased Border Checks Result In Fewer Arrests And Higher Deportations

May 11, 2025 -

Before Freaked Exploring Alex Winters Obscure Mtv Sketches

May 11, 2025

Before Freaked Exploring Alex Winters Obscure Mtv Sketches

May 11, 2025 -

Mirniy Plan Trampa Ta Reaktsiya Borisa Dzhonsona Detalniy Oglyad

May 11, 2025

Mirniy Plan Trampa Ta Reaktsiya Borisa Dzhonsona Detalniy Oglyad

May 11, 2025 -

Meet The Winners Of The 2025 Resi Awards

May 11, 2025

Meet The Winners Of The 2025 Resi Awards

May 11, 2025