ABN Amro Bonus System Under Investigation By Dutch Regulator

Table of Contents

Details of the DNB Investigation into ABN Amro's Bonus Scheme

The DNB's investigation into ABN Amro's bonus scheme is reportedly comprehensive, examining various aspects of the bank's compensation structure. While the exact scope remains undisclosed, it's believed to focus on several key areas. The trigger for the investigation is not publicly known, although speculation points to a combination of factors including internal audits, media reports suggesting irregularities, and potentially, whistleblower complaints. The investigation likely covers several years of bonus payouts and may scrutinize both the methodology used to calculate bonuses and the criteria used to determine eligibility.

Specific examples of potential issues under scrutiny could include:

- Excessive Bonus Payouts: Allegations may involve significantly higher bonuses awarded compared to performance metrics or industry standards.

- Lack of Transparency: The investigation might focus on whether the bonus system’s structure and criteria are sufficiently transparent to stakeholders and comply with regulations.

- Performance-Related Criteria: Concerns could centre on the adequacy and objectivity of performance-related criteria used in determining bonus awards. Did the criteria accurately reflect the bank's overall success and individual contributions?

Bullet Points:

- Timeline of the investigation: The exact start date is unclear, but the investigation is believed to be ongoing, potentially spanning several months.

- Specific regulations potentially violated: The DNB's investigation may center around potential violations of Dutch banking regulations concerning executive compensation, transparency requirements, and responsible lending practices. Specific articles or sections of relevant legislation would need to be determined through public disclosures by the DNB or ABN Amro.

- Names of individuals or departments involved: The names of individuals or departments directly involved are not publicly available at this time, due to the ongoing nature of the investigation and the need to protect privacy.

Potential Consequences for ABN Amro

The potential consequences for ABN Amro stemming from this investigation are substantial and far-reaching. The bank could face a range of penalties, including:

Bullet Points:

- Financial Fines: Significant financial penalties could be imposed by the DNB for non-compliance with regulations concerning the bonus scheme. The amount would depend on the severity and nature of the violations found.

- Reputational Harm: Negative publicity and damage to the bank's reputation are almost inevitable. This reputational harm could translate into reduced customer trust and potentially impact future business opportunities.

- Share Price Fluctuations: The investigation and its potential outcomes are likely to cause volatility in ABN Amro's share price, potentially impacting shareholder confidence and investor relations.

- Changes in Executive Compensation: The bank may be forced to restructure its entire executive compensation system, leading to significant changes in the way bonuses are calculated and awarded.

Broader Implications for the Dutch Banking Sector

The ABN Amro bonus system investigation has significant implications for the broader Dutch banking sector. It signals a heightened focus on ethical practices and transparency within the financial industry, pushing other banks to critically examine their own bonus schemes. The DNB's actions may lead to a domino effect, with increased regulatory scrutiny across the sector and potential revisions to existing regulations.

Bullet Points:

- Increased Regulatory Oversight: The DNB is likely to intensify its supervision of compensation systems in other Dutch banks, leading to more rigorous audits and stricter enforcement of existing regulations.

- Changes in Bonus Regulations Across the Sector: The outcome of this investigation could serve as a catalyst for wider regulatory changes, potentially impacting the entire banking sector's approach to bonus structures. New legislation or guidelines could be introduced to enhance transparency and align bonus systems more closely with performance and risk management.

- Impact on Public Trust in the Banking Industry: The investigation highlights public concerns about banking ethics and reinforces the need for greater accountability and transparency in the financial sector.

Comparison to Other Banking Bonus Scandals

The ABN Amro case echoes similar controversies seen in other countries. Several international banking institutions have faced investigations and penalties related to excessive or improperly awarded bonuses. While the specific details may vary, the underlying issues—lack of transparency, inadequate performance metrics, and potential conflicts of interest—are often common threads. These past cases underscore a global trend toward stricter regulation of bank bonuses, reflecting a growing emphasis on responsible banking practices.

Conclusion

The DNB investigation into ABN Amro's bonus system underlines the increasing importance of ethical conduct and transparency in the financial industry. The potential repercussions for ABN Amro – financial penalties, reputational damage, and substantial changes to its compensation system – are considerable. Furthermore, this case has far-reaching implications for the Dutch banking sector and could trigger more stringent regulations globally. Staying informed about the developments in this ABN Amro bonus system investigation is crucial for anyone interested in understanding the future of banking ethics and compensation structures. Keep checking back for updates on this evolving situation and its impact on the financial world.

Featured Posts

-

Tory Councillors Wife Migrant Hotel Fire Rant Was Not Intended To Incite Violence

May 21, 2025

Tory Councillors Wife Migrant Hotel Fire Rant Was Not Intended To Incite Violence

May 21, 2025 -

Competitive Landscape Transformed Wtt Press Conference Announcement

May 21, 2025

Competitive Landscape Transformed Wtt Press Conference Announcement

May 21, 2025 -

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino Owners

May 21, 2025

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino Owners

May 21, 2025 -

Het Geen Stijl Abn Amro Debat Betaalbaarheid Van Huizen In Nederland

May 21, 2025

Het Geen Stijl Abn Amro Debat Betaalbaarheid Van Huizen In Nederland

May 21, 2025 -

Analyzing Tariff Fluctuations Key Takeaways From Fp Video

May 21, 2025

Analyzing Tariff Fluctuations Key Takeaways From Fp Video

May 21, 2025

Latest Posts

-

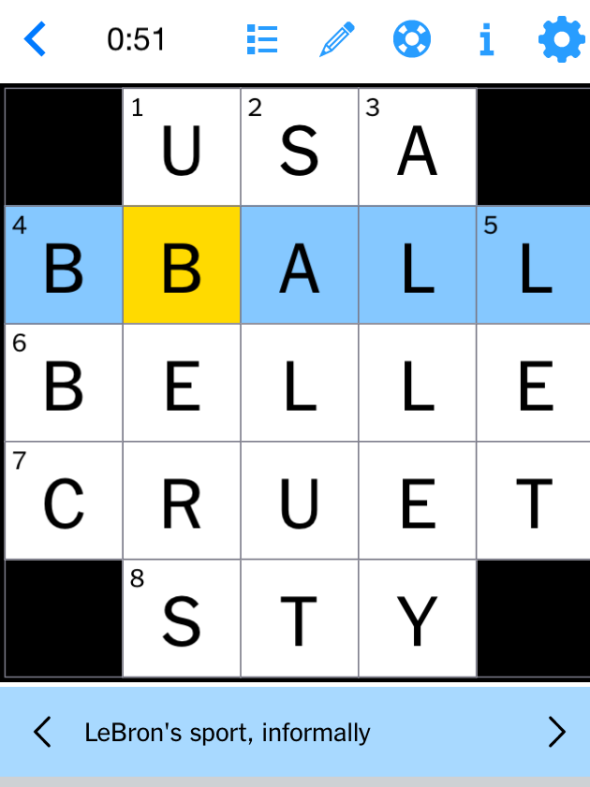

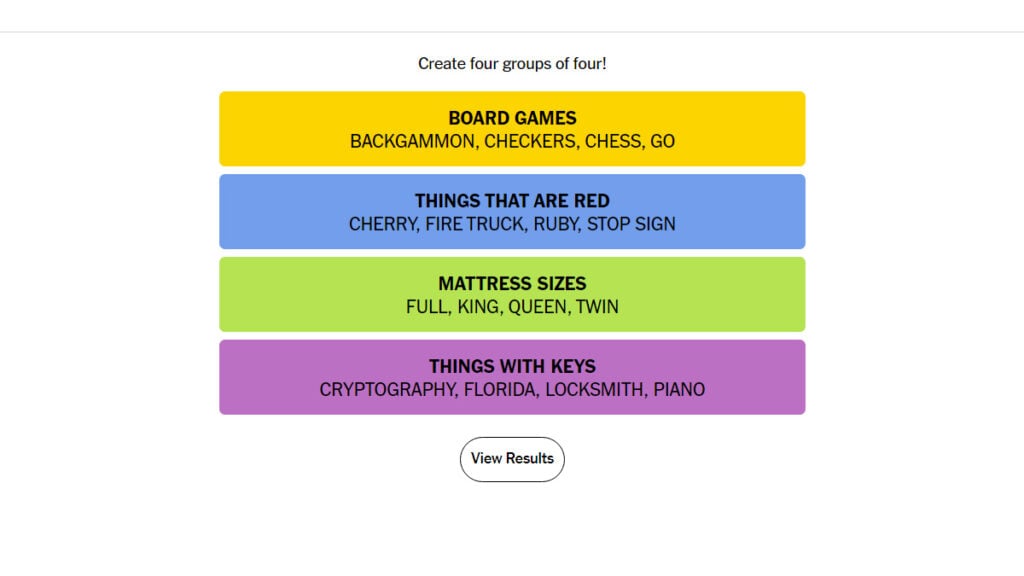

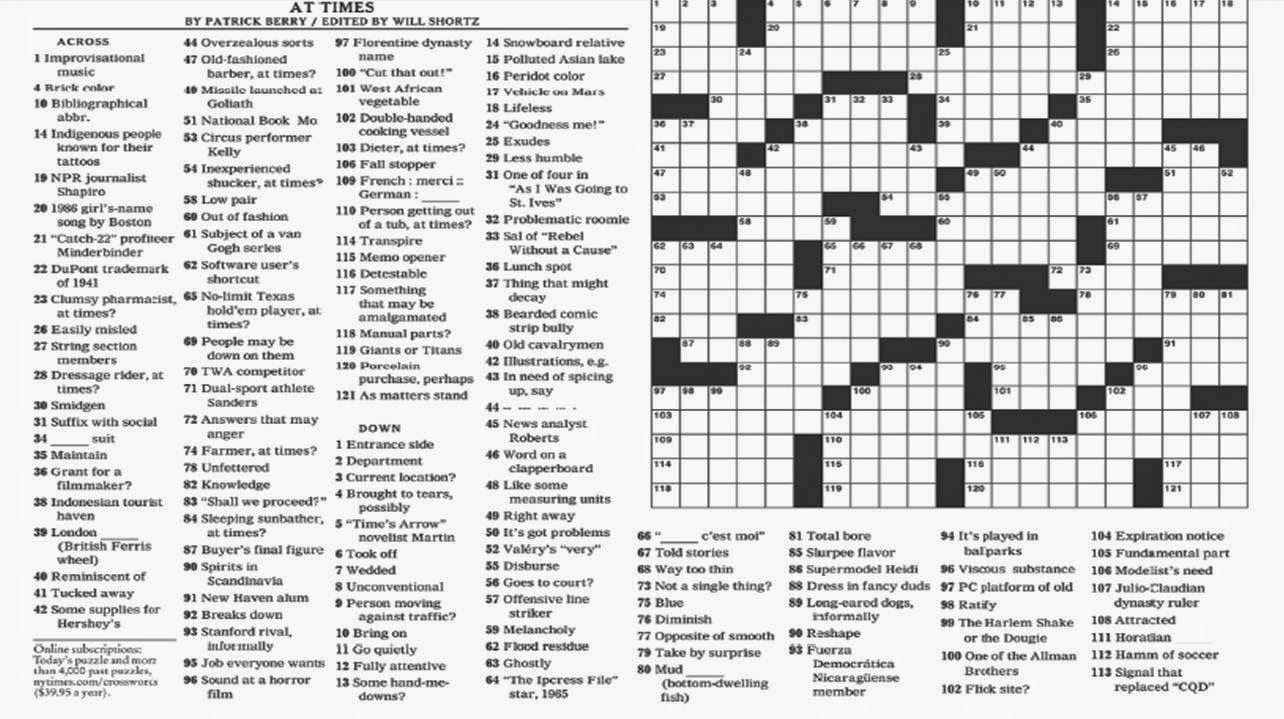

Nyt Mini Crossword Solutions March 16th 2025

May 21, 2025

Nyt Mini Crossword Solutions March 16th 2025

May 21, 2025 -

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025 -

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 21, 2025

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 21, 2025 -

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025 -

Nyt Mini Crossword Solutions March 13 2025

May 21, 2025

Nyt Mini Crossword Solutions March 13 2025

May 21, 2025