ABN Amro: Dutch Central Bank Investigates Bonus Payments

Table of Contents

The Nature of the Investigation

The DNB, as the Netherlands' central bank, plays a crucial role in overseeing the stability and integrity of the financial system. Its regulatory powers extend to investigating potential breaches of banking regulations, ensuring responsible risk management, and maintaining public confidence in financial institutions. The investigation into ABN Amro's bonus payments stems from concerns that the bank may have violated regulations regarding responsible risk management and potentially awarded excessive bonuses during periods of financial instability.

- Specific Regulations Potentially Violated: The investigation likely focuses on regulations concerning the appropriate linking of bonuses to long-term performance and the responsible management of risk. Specific articles of Dutch banking law and possibly EU directives related to executive compensation are likely under scrutiny.

- Public Statements: While neither the DNB nor ABN Amro has released detailed public statements concerning the specifics of the investigation, both have confirmed its existence. The DNB has emphasized its commitment to upholding robust regulatory standards within the Dutch banking sector. ABN Amro has stated its cooperation with the investigation.

- Investigation Timeframe and Potential Penalties: The timeframe of the investigation remains unclear, but it is expected to take several months. Potential penalties could include substantial fines, reputational damage, and even changes in senior management.

Potential Consequences for ABN Amro

The consequences for ABN Amro stemming from this investigation could be significant and far-reaching. Beyond the financial penalties, reputational damage poses a serious threat to the bank's long-term stability and profitability.

- Financial Penalties: Possible fines imposed by the DNB could reach millions of Euros, depending on the severity of any regulatory violations discovered.

- Reputational Damage and Investor Confidence: Negative publicity surrounding the investigation could erode investor confidence, impacting the bank's share price and its ability to attract and retain clients. This reputational damage could be long-lasting.

- Impact on Future Bonus Structures: The investigation may lead to significant changes in ABN Amro's bonus structure, potentially resulting in stricter criteria for awarding bonuses and a greater emphasis on long-term performance and risk management. The bank might also need to restructure its executive compensation packages.

- Shareholder Lawsuits: It's possible that shareholders could initiate lawsuits against ABN Amro if the investigation reveals mismanagement or negligence contributing to the alleged inappropriate bonus payments.

Wider Implications for the Dutch Banking Sector

The investigation into ABN Amro's bonus payments has wider implications for the Dutch banking sector as a whole. It signals a renewed focus on regulatory oversight and could trigger similar investigations into other Dutch banks.

- Similar Incidents and Controversies: The Dutch banking sector has experienced controversies regarding executive compensation in the past. This investigation may prompt a more thorough review of bonus practices across the sector.

- Impact on Public Trust: A lack of transparency and perceived excessive bonuses in the banking sector can erode public trust, impacting the relationship between banks and their customers. This investigation could further amplify these concerns.

- Potential Changes in Banking Regulations: The outcome of this investigation could influence future banking regulations in the Netherlands. The government may consider stricter rules on bonus payments, potentially aligning them more closely with international best practices.

Comparison with International Practices

The Dutch approach to regulating executive compensation and bonus payments in the banking sector shares similarities with, but also differs from, international standards, notably EU regulations. While the EU promotes responsible remuneration practices, the specific implementation and enforcement vary between member states. The Dutch approach, as illustrated by this investigation, generally leans towards a stricter and more proactive approach to supervisory oversight.

Conclusion

The investigation into ABN Amro bonus payments highlights the ongoing scrutiny of ethical banking practices and corporate governance within the Dutch financial system. The potential consequences for ABN Amro, including substantial fines and reputational damage, are significant. Moreover, the investigation could lead to broader regulatory changes within the Dutch banking sector and strengthen oversight of executive compensation. Stay informed about the ongoing investigation into ABN Amro bonus payments and the implications for the future of banking regulation. Follow [Your Website/News Source] for updates on the ABN Amro bonus payments case and related developments in the Dutch financial sector.

Featured Posts

-

Uncover The Perfect Hot Weather Quencher

May 22, 2025

Uncover The Perfect Hot Weather Quencher

May 22, 2025 -

Councillors Wifes Jail Sentence For Threatening Tweet Appeal Awaits

May 22, 2025

Councillors Wifes Jail Sentence For Threatening Tweet Appeal Awaits

May 22, 2025 -

Premier League 2024 25 Champions Photo Highlights

May 22, 2025

Premier League 2024 25 Champions Photo Highlights

May 22, 2025 -

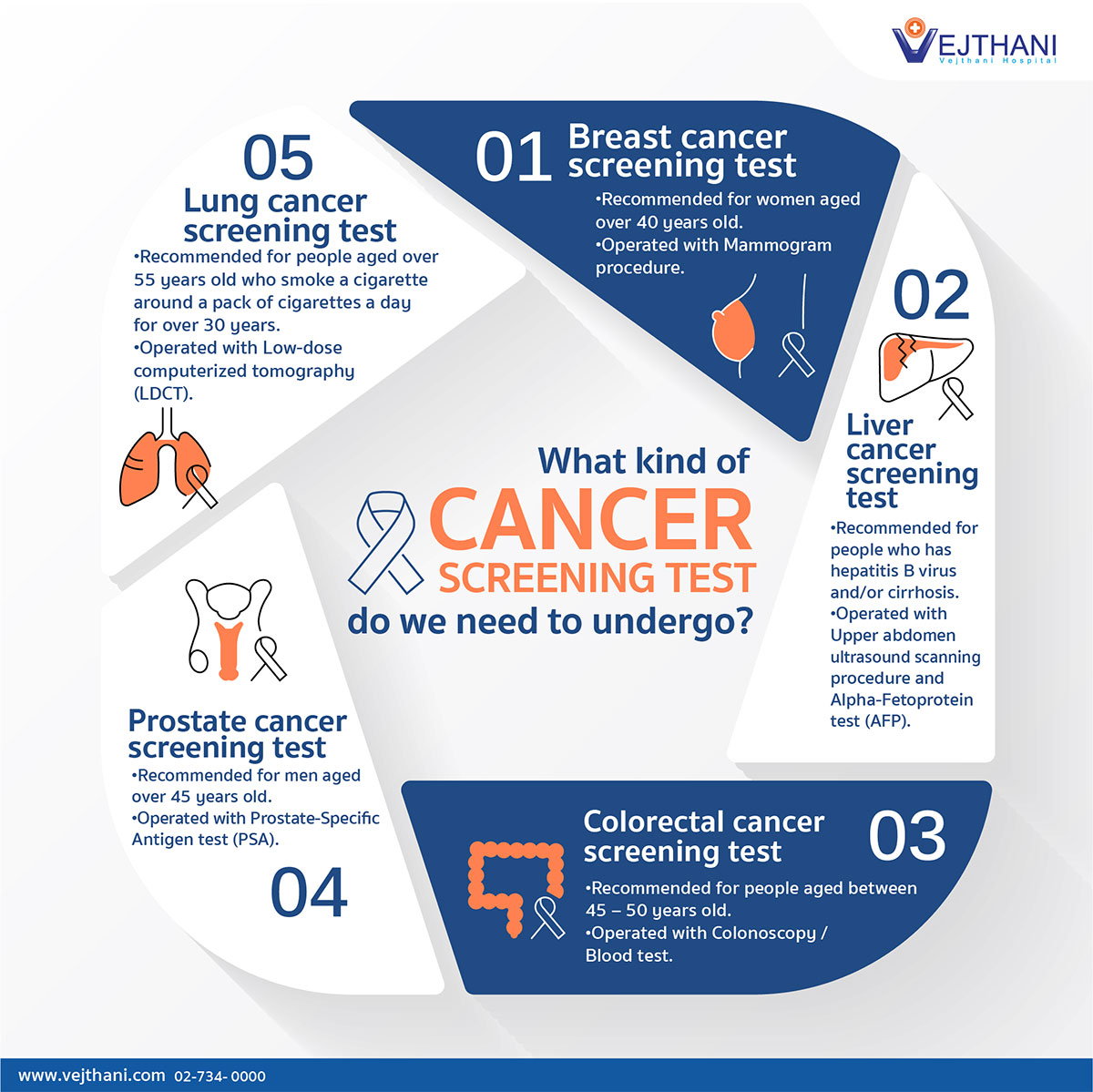

Bidens 2014 Prostate Cancer Screening What We Know

May 22, 2025

Bidens 2014 Prostate Cancer Screening What We Know

May 22, 2025 -

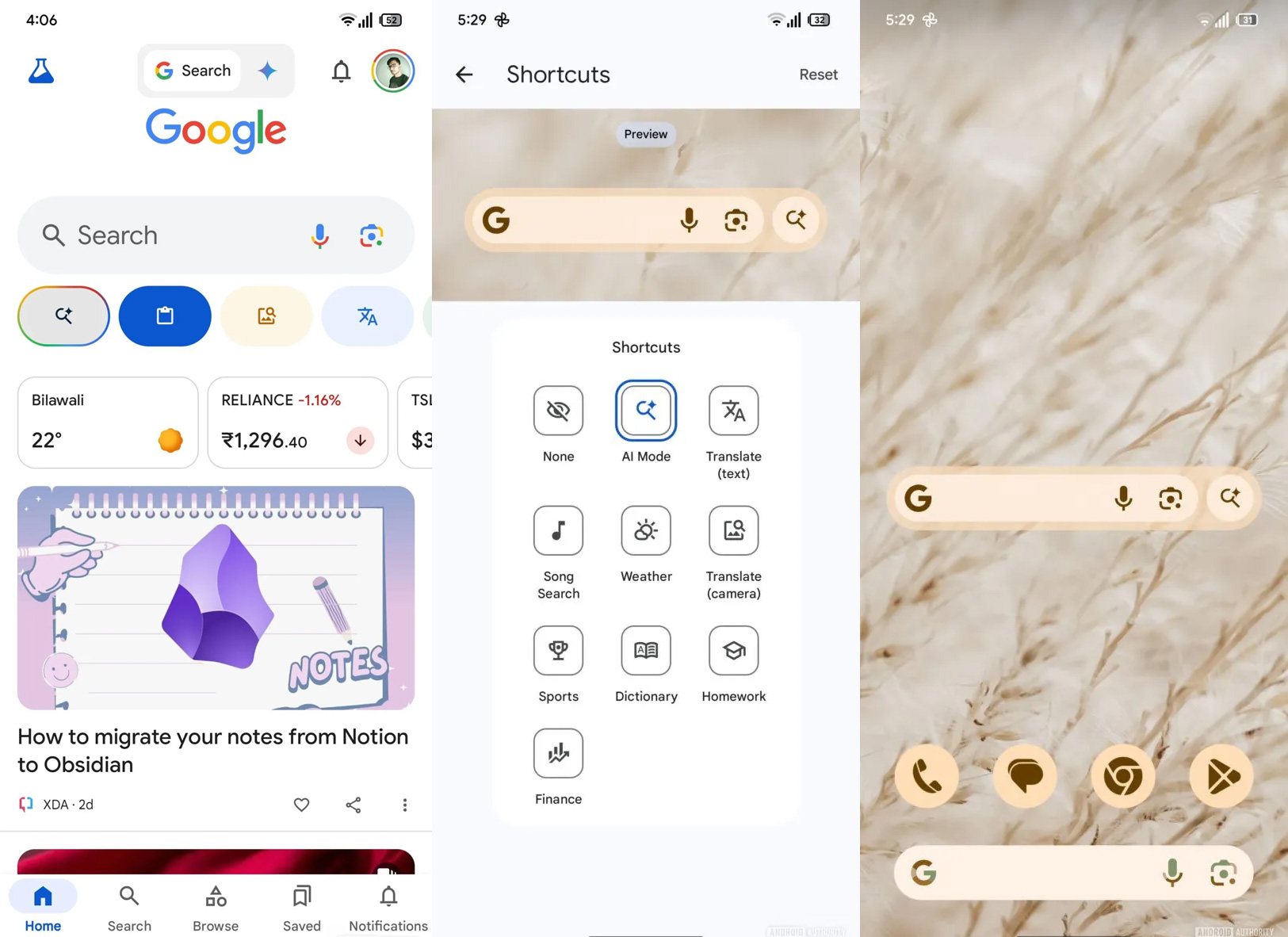

Google Searchs Ai Mode Evolution Or Revolution

May 22, 2025

Google Searchs Ai Mode Evolution Or Revolution

May 22, 2025

Latest Posts

-

Experience Report Googles Ai Smart Glasses Prototype

May 22, 2025

Experience Report Googles Ai Smart Glasses Prototype

May 22, 2025 -

Google Searchs Ai Mode Evolution Or Revolution

May 22, 2025

Google Searchs Ai Mode Evolution Or Revolution

May 22, 2025 -

Is Ai Mode The Future Of Google Search A Deep Dive

May 22, 2025

Is Ai Mode The Future Of Google Search A Deep Dive

May 22, 2025 -

Ai Mode The Future Of Google Search

May 22, 2025

Ai Mode The Future Of Google Search

May 22, 2025 -

Our Impressions Of Googles Ai Smart Glasses Prototype

May 22, 2025

Our Impressions Of Googles Ai Smart Glasses Prototype

May 22, 2025