ABN Amro Facing Potential Fine For Bonus Scheme

Table of Contents

The Alleged Violations of the ABN Amro Bonus Scheme

The ABN Amro bonus scheme is under scrutiny for several alleged violations of financial regulations and internal guidelines. These alleged breaches are serious and could have far-reaching consequences. Specifically, the investigation focuses on:

- Breach of EU banking regulations on risk management: Allegations suggest the bonus scheme incentivized excessive risk-taking, potentially violating EU directives designed to ensure the stability of the financial system. This might involve awarding bonuses based on short-term gains without sufficient consideration of long-term risks.

- Failure to comply with internal control guidelines: The investigation examines whether ABN Amro's internal controls adequately monitored and prevented inappropriate bonus payouts. This includes assessing whether sufficient oversight mechanisms were in place to ensure compliance with both internal policies and external regulations.

- Insufficient oversight of bonus payouts: Concerns have been raised regarding a lack of transparency and oversight in the allocation and calculation of bonuses. This could involve inadequate documentation, insufficient independent review processes, or a lack of clear criteria for awarding bonuses.

These alleged violations threaten not only the bank's financial stability but also severely damage its reputation and stakeholder trust. The lack of regulatory compliance could lead to significant erosion of public confidence in the institution. Improving regulatory compliance and risk management is paramount for ABN Amro to restore public trust.

The Regulatory Investigation into ABN Amro's Practices

De Nederlandsche Bank (DNB), the Dutch central bank, is leading the regulatory investigation into ABN Amro's bonus scheme. The investigation process involves a thorough review of the bank's internal documents, interviews with employees, and an assessment of the bank's risk management practices. The timeline of the investigation is not yet publicly known, but the potential outcomes range from a formal warning to significant financial penalties.

While both ABN Amro and the DNB have yet to release comprehensive statements regarding the specifics of the allegations, the ongoing investigation signifies the seriousness of the situation and the potential for substantial regulatory action. The scrutiny highlights the importance of robust internal controls and strict adherence to financial regulations within the banking sector.

Potential Financial Penalties and Their Impact on ABN Amro

The potential financial penalties ABN Amro faces could range from millions to tens of millions of euros. The exact amount will depend on the severity of the violations and the findings of the DNB investigation. Such a significant financial penalty could severely impact the bank's financial performance, potentially reducing profitability and affecting shareholder value.

Furthermore, the reputational damage resulting from this investigation could be substantial. Loss of investor confidence, difficulty attracting and retaining top talent, and decreased business opportunities are all potential consequences. The impact on the bank’s long-term growth and stability is a major concern. The reputational risk associated with non-compliance is a serious consideration for all financial institutions.

ABN Amro's Response and Future Implications for Bonus Schemes

ABN Amro has stated its commitment to cooperating fully with the DNB investigation and to improving its internal controls. While specific details of their response remain limited, the bank is likely to implement significant changes to its bonus scheme to mitigate future risks and prevent further violations. This could involve:

- Strengthening risk management frameworks: Implementing more robust systems to assess and manage risks associated with bonus payouts.

- Enhancing internal controls: Improving oversight, transparency, and accountability within the bonus scheme.

- Reviewing bonus criteria: Revising the criteria for awarding bonuses to ensure alignment with long-term strategic goals and regulatory requirements.

This situation underscores the need for a comprehensive review of bonus schemes across the financial industry. The incident highlights the importance of aligning compensation structures with sound risk management practices and ensuring strict adherence to regulatory compliance. The future may see a shift toward more transparent and responsible bonus structures.

Conclusion: ABN Amro Bonus Scheme Under Scrutiny – What's Next?

The investigation into the ABN Amro bonus scheme highlights the critical importance of regulatory compliance and effective risk management within the financial sector. The alleged violations, the ongoing regulatory investigation, and the potential for substantial financial penalties underscore the significant risks associated with poorly designed or inadequately overseen bonus schemes. ABN Amro’s response and any subsequent changes to their compensation structure will set a precedent for other financial institutions.

Stay updated on the ongoing investigation into the ABN Amro bonus scheme and its implications for corporate governance and regulatory compliance in the financial sector. Follow our updates for the latest news on this evolving situation, and understand how this affects the future of ABN Amro bonus scheme design and implementation.

Featured Posts

-

Adios Enfermedades Cronicas Este Superalimento Revoluciona La Salud Y La Longevidad

May 22, 2025

Adios Enfermedades Cronicas Este Superalimento Revoluciona La Salud Y La Longevidad

May 22, 2025 -

The World Trading Tournament Wtt And Aimscap Successes And Challenges

May 22, 2025

The World Trading Tournament Wtt And Aimscap Successes And Challenges

May 22, 2025 -

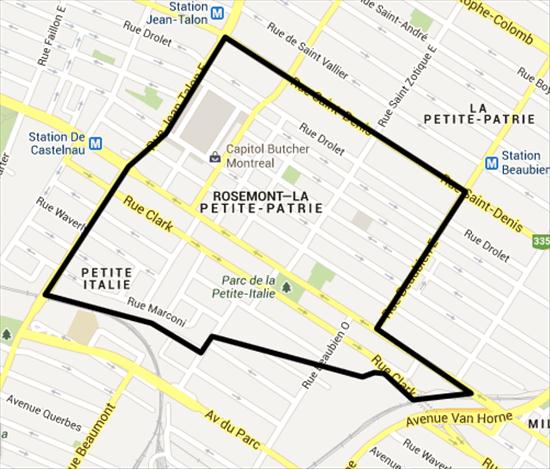

Decouvrir La Petite Italie De L Ouest Une Architecture Toscane Remarquable

May 22, 2025

Decouvrir La Petite Italie De L Ouest Une Architecture Toscane Remarquable

May 22, 2025 -

Arne Slot Vs Liverpool A Tactical Comparison And Alissons World Class Goalkeeping

May 22, 2025

Arne Slot Vs Liverpool A Tactical Comparison And Alissons World Class Goalkeeping

May 22, 2025 -

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025

Latest Posts

-

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025 -

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025 -

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025