ABN Amro Under Scrutiny: Potential Fine For Employee Bonuses

Table of Contents

Allegations of Misconduct

The Nature of the Allegations

The allegations against ABN Amro center around improper practices in the awarding of employee bonuses. While specific details remain largely undisclosed pending the ongoing investigation, the core issue appears to be a breach of internal regulations and potentially external laws concerning fair compensation and transparency. The DNB's investigation suggests that bonuses may have been awarded inappropriately, possibly exceeding pre-defined limits or being linked to activities that did not meet the bank's ethical standards. Reports hint at a possible lack of robust oversight and internal controls within the bonus structure.

- Specific examples: Precise details of the alleged misconduct are still emerging, but sources suggest inconsistencies in bonus calculations and a potential lack of documentation supporting certain payouts.

- Regulatory body: De Nederlandsche Bank (DNB), the Dutch central bank, is leading the investigation into ABN Amro's employee bonus practices.

- Scope of violations: The potential scope of the violations is still being determined, but the investigation could uncover a pattern of misconduct spanning several years and potentially impacting a significant number of employees.

- Whistleblower involvement: While not officially confirmed, industry sources suggest the investigation may have been triggered, at least in part, by internal whistleblowers who raised concerns about the fairness and legality of the bonus system.

Potential Impact on ABN Amro

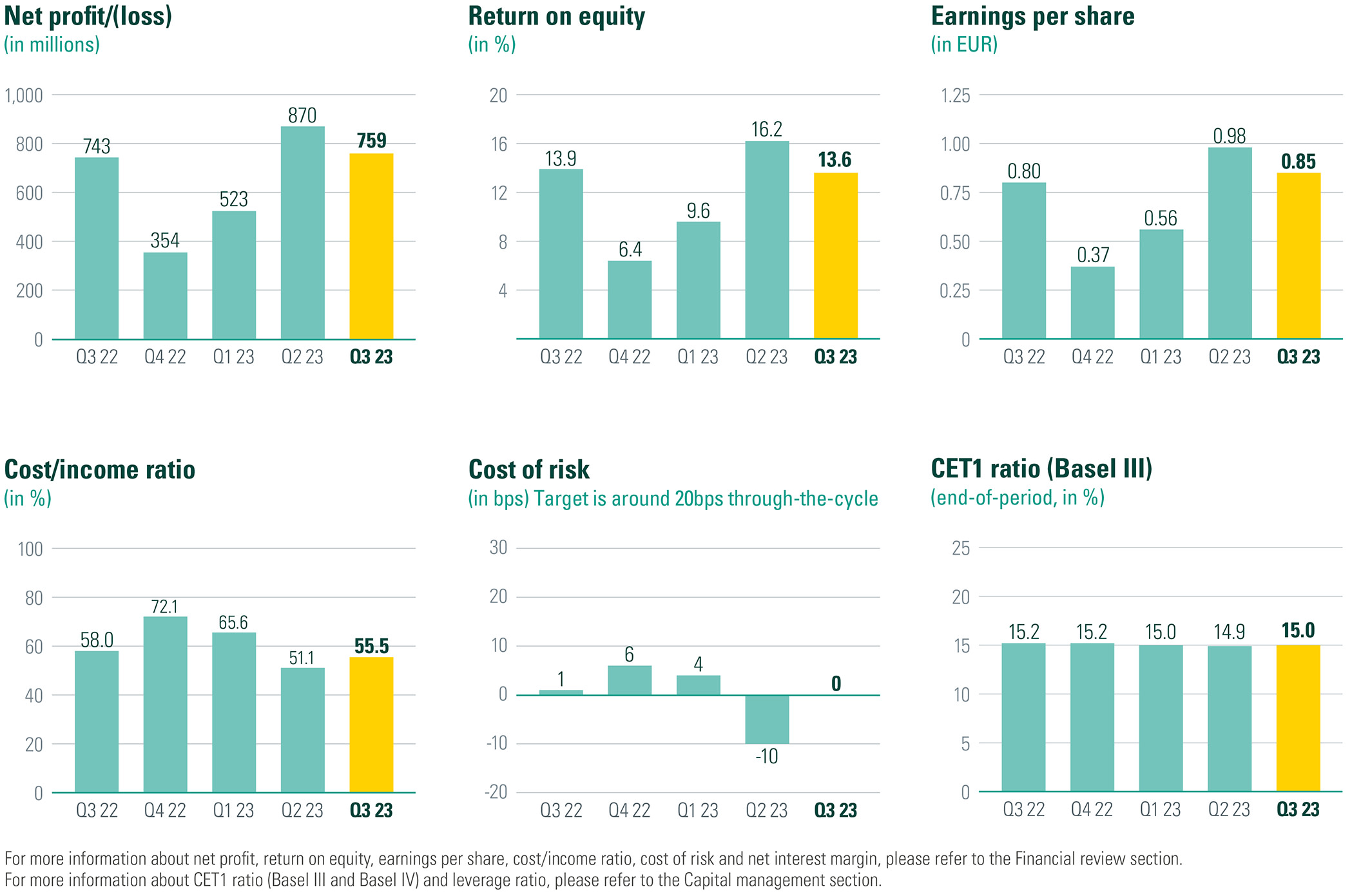

Financial Implications of a Fine

The potential financial repercussions for ABN Amro are substantial. A significant fine from the DNB could severely impact the bank's profitability and its overall financial health. The size of the potential penalty will depend on the severity and extent of the misconduct uncovered during the investigation.

- Potential fine range: While an exact figure remains unknown, estimates from financial analysts suggest the potential fine could range from tens of millions to hundreds of millions of Euros.

- Shareholder value: A large fine would undoubtedly negatively affect shareholder value, leading to a drop in the bank's share price and eroding investor confidence.

- Credit rating: The outcome of the investigation could also impact ABN Amro's credit rating, potentially increasing its borrowing costs and making it more difficult to raise capital.

- Future bonus structures: This scandal will likely lead to a complete overhaul of ABN Amro’s bonus schemes and compensation plans, with a renewed focus on transparency, accountability, and compliance with regulatory requirements.

Regulatory Response and Implications for the Banking Sector

The Regulatory Response

The DNB's response to the allegations reflects a growing emphasis on regulatory oversight of employee compensation within the banking sector. The investigation is thorough and indicates a firm stance against misconduct within financial institutions.

- Ongoing investigation: The DNB's investigation is ongoing, with a team of experts reviewing documents, interviewing employees, and analyzing the bank's internal controls.

- ABN Amro's actions: ABN Amro has publicly stated its commitment to cooperating fully with the DNB's investigation and has launched its own internal review to identify weaknesses in its processes.

- Broader implications: This case highlights the increased regulatory scrutiny on bank compensation practices across Europe and globally, pushing for stricter rules and more transparent bonus structures.

- Potential regulatory changes: The outcome of this investigation could lead to more stringent regulations on employee bonuses within the Dutch banking sector and potentially inspire similar reforms across the EU.

ABN Amro's Response and Future Actions

Public Statements and Internal Investigations

ABN Amro has issued public statements acknowledging the investigation and expressing its commitment to cooperating fully with the DNB. The bank has also initiated an internal investigation to determine the extent of the alleged misconduct and identify any systemic failures.

- Public statements: ABN Amro has emphasized its commitment to ethical conduct and its dedication to improving its compliance and risk management procedures.

- Internal investigations: The bank's internal investigation is focused on identifying individuals responsible for any wrongdoing and implementing measures to prevent similar incidents from occurring in the future.

- Preventive measures: ABN Amro is likely to implement new controls and stricter oversight of bonus calculations and payouts to ensure compliance with all relevant regulations and internal policies.

- Commitment to compliance: The bank's response underscores its commitment to strengthening its compliance procedures and enhancing its risk management framework to prevent future regulatory breaches.

Conclusion

The ABN Amro employee bonus scandal highlights the significant risks associated with inadequate oversight of employee compensation within the financial industry. The potential for a substantial fine underscores the importance of robust risk management, ethical conduct, and stringent compliance with regulatory requirements. The ongoing regulatory scrutiny and the bank's own internal investigation point towards a significant restructuring of its bonus practices and a broader reassessment of its compliance framework. The severity of these allegations and their potential consequences for ABN Amro will undoubtedly shape future practices within the banking sector. Stay informed about the ongoing developments in this case. Further investigation into the ABN Amro employee bonus scandal is essential to ensure accountability and prevent similar occurrences in the future. Follow reputable financial news sources for updates on the potential ABN Amro fine and its impact.

Featured Posts

-

Lucy Connolly Loses Appeal In Racist Social Media Post Case

May 22, 2025

Lucy Connolly Loses Appeal In Racist Social Media Post Case

May 22, 2025 -

Impact Van Invoertarieven Abn Amro Rapporteert Over Daling Voedselexport Naar Vs

May 22, 2025

Impact Van Invoertarieven Abn Amro Rapporteert Over Daling Voedselexport Naar Vs

May 22, 2025 -

Espace Julien Presentation Des Novelistes Avant Le Hellfest

May 22, 2025

Espace Julien Presentation Des Novelistes Avant Le Hellfest

May 22, 2025 -

Dialogue On Tariffs A Switzerland China Proposal

May 22, 2025

Dialogue On Tariffs A Switzerland China Proposal

May 22, 2025 -

Bolidul De Milioane De Euro Al Fratilor Tate Baie De Multime In Centrul Bucurestiului

May 22, 2025

Bolidul De Milioane De Euro Al Fratilor Tate Baie De Multime In Centrul Bucurestiului

May 22, 2025

Latest Posts

-

Googles Ai Ambitions Convincing Investors Of Its Mastery

May 22, 2025

Googles Ai Ambitions Convincing Investors Of Its Mastery

May 22, 2025 -

Navigating The Chinese Market The Bmw And Porsche Case Study And Lessons Learned

May 22, 2025

Navigating The Chinese Market The Bmw And Porsche Case Study And Lessons Learned

May 22, 2025 -

Hollywood Production Ground To A Halt Writers And Actors On Strike

May 22, 2025

Hollywood Production Ground To A Halt Writers And Actors On Strike

May 22, 2025 -

Increased Rent In La After Fires Exploitation Or Market Forces

May 22, 2025

Increased Rent In La After Fires Exploitation Or Market Forces

May 22, 2025 -

The Pilbaras Future A Debate Between Rio Tinto And Andrew Forrest On Environmental Impact

May 22, 2025

The Pilbaras Future A Debate Between Rio Tinto And Andrew Forrest On Environmental Impact

May 22, 2025