Addressing Concerns: BofA's Perspective On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall assessment of the current market leans towards cautious optimism, although their stance is far from bullish. They acknowledge the robust corporate earnings growth witnessed in recent quarters, driven partly by pent-up demand and supply chain improvements. However, they emphasize that these gains are not uniformly distributed across all sectors and that several headwinds threaten future performance. Their reasoning hinges on a careful consideration of multiple key economic indicators.

-

Key economic indicators cited by BofA: BofA analysts point to persistently high inflation, albeit showing signs of moderation, and the Federal Reserve's ongoing efforts to combat it through interest rate hikes. While GDP growth remains positive, the pace is slowing, indicating a potential economic slowdown.

-

Sector performance: BofA exhibits optimism towards sectors demonstrating resilience amidst inflationary pressures, such as energy and certain consumer staples. Conversely, they express concerns regarding the technology sector's valuation, given its sensitivity to interest rate changes and potential future earnings contractions.

-

BofA research: Their research, published in various reports accessible on their website (insert relevant links here if available), extensively details these observations and provides a more in-depth analysis of the macroeconomic factors shaping their outlook. These reports frequently utilize sophisticated econometric models and incorporate qualitative assessments from industry experts.

Identifying Potential Risks Highlighted by BofA

BofA identifies several significant risks associated with the elevated stock market valuations. These risks warrant careful consideration by investors.

-

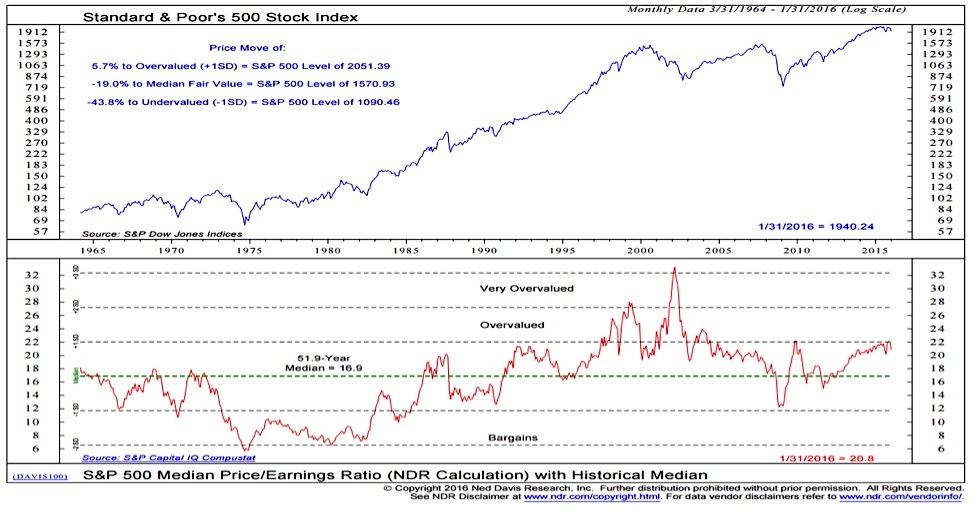

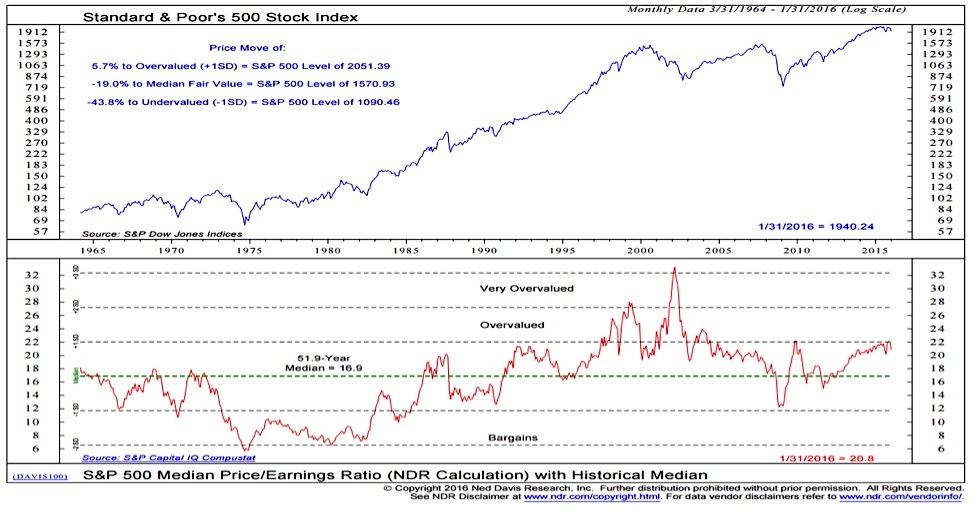

High valuations relative to historical averages: Many market indices are trading at price-to-earnings (P/E) ratios significantly above their long-term historical averages, suggesting a potential overvaluation.

-

Potential for a market correction or downturn: The elevated valuations increase the susceptibility of the market to a sharp correction or even a more significant downturn if economic conditions worsen unexpectedly or investor sentiment shifts negatively. BofA highlights this possibility as a significant risk.

-

Impact of rising interest rates on stock prices: The Federal Reserve's ongoing interest rate hikes increase borrowing costs for companies, impacting profitability and potentially reducing investment. This negatively influences stock valuations, especially for growth-oriented companies reliant on future earnings.

-

Geopolitical risks and their influence on market sentiment: Geopolitical uncertainties, such as the ongoing war in Ukraine and escalating tensions in other regions, inject considerable volatility into the market, causing sudden shifts in investor sentiment and asset prices. BofA emphasizes the need for vigilance regarding such unpredictable factors.

BofA's Strategies for Navigating Elevated Valuations

BofA suggests several strategies to help investors navigate the risks associated with these elevated valuations. A balanced and diversified approach is strongly advocated.

-

Diversification strategies: BofA recommends diversifying across various asset classes (stocks, bonds, real estate, etc.) and sectors to reduce overall portfolio risk and mitigate potential losses in any single sector.

-

Defensive investment approaches: In this environment, adopting a more defensive posture, favoring value stocks over growth stocks, and focusing on companies with strong balance sheets and consistent dividend payouts might be beneficial.

-

Focus on value stocks versus growth stocks: Given the potential for higher interest rates to impact future earnings, BofA suggests a shift towards value stocks, which are often less sensitive to interest rate changes.

-

Importance of risk management: BofA consistently emphasizes the critical importance of thorough risk assessment and management as an integral part of any investment strategy. This includes defining your risk tolerance, setting clear investment objectives, and regularly reviewing your portfolio.

Comparing BofA's Perspective to Other Market Analyses

While BofA's cautious optimism is a prevalent sentiment, it's not universally shared. Other prominent financial institutions offer varying outlooks. For instance, Goldman Sachs might hold a slightly more bullish stance, emphasizing the resilience of certain sectors. Conversely, some more bearish analysts at institutions like Morgan Stanley may highlight the risks of a more significant market correction. These competing viewpoints underscore the inherent complexities and uncertainties within market forecasting.

Conclusion: Understanding and Acting on BofA's Perspective on Elevated Stock Market Valuations

BofA's analysis highlights a cautiously optimistic yet risk-aware perspective on elevated stock market valuations. The key takeaway is the need for a balanced approach, acknowledging the potential for robust earnings but also recognizing the significant risks presented by high valuations, rising interest rates, and geopolitical uncertainties. Investors should prioritize diversification, consider defensive investment strategies, and remain vigilant about market developments. Remember to consult with qualified financial advisors to create a personalized investment plan tailored to your individual risk tolerance and financial goals. By staying informed and proactively managing risk, you can navigate the complexities of the market and make informed decisions about your investments. Further research into BofA's reports on elevated stock market valuations and consultation with financial advisors are strongly recommended to make informed decisions about your investment strategy.

Featured Posts

-

Analysis Pbocs Reduced Yuan Support Below Initial Projections

May 16, 2025

Analysis Pbocs Reduced Yuan Support Below Initial Projections

May 16, 2025 -

Giants Vs Padres Game Prediction Analyzing A Close Contest

May 16, 2025

Giants Vs Padres Game Prediction Analyzing A Close Contest

May 16, 2025 -

Albanese And Duttons Election Pitches A Detailed Comparison

May 16, 2025

Albanese And Duttons Election Pitches A Detailed Comparison

May 16, 2025 -

Shohei Ohtanis Walk Off Homer Dodgers 8 0 Shutout

May 16, 2025

Shohei Ohtanis Walk Off Homer Dodgers 8 0 Shutout

May 16, 2025 -

Pley Off N Kh L Gol Ovechkina Ne Stal Klyuchom K Pobede Vashingtona

May 16, 2025

Pley Off N Kh L Gol Ovechkina Ne Stal Klyuchom K Pobede Vashingtona

May 16, 2025