Addressing High Stock Market Valuations: Expert Insights From BofA

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA Global Research employs various valuation metrics to assess the stock market's health. Key among these are the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio). These ratios compare a company's stock price to its earnings per share, providing insights into whether a stock or the overall market is overvalued or undervalued.

BofA's recent analysis reveals that while specific sectors might show varying levels of valuation, the overall market shows signs of being stretched. While not necessarily signaling an immediate crash, these high valuations increase the risk of future market corrections.

- Key valuation ratios and their current levels: BofA's reports detail current P/E and Shiller PE ratios, showing levels significantly above historical averages in some market segments. Specific numerical data would be included here from BofA's published research.

- Comparison to historical averages: BofA's analysis compares current valuation ratios to long-term historical averages, highlighting the deviation from historical norms.

- BofA's rationale for their assessment: BofA's assessment considers factors beyond simple ratios, incorporating macroeconomic indicators, interest rate environments, and geopolitical events that influence market sentiment and valuation.

Identifying Potential Risks Associated with High Valuations

Investing in a potentially overvalued market presents significant risks. High valuations often precede market corrections or even crashes, leading to substantial losses for investors.

- Risk of market correction or crash: High valuations inherently increase the probability of a market correction, potentially leading to sharp declines in stock prices.

- Impact on portfolio returns: Investing in an overvalued market can significantly reduce portfolio returns, potentially negating the benefits of long-term investment strategies.

- Increased risk of capital loss: The potential for substantial capital loss is amplified in a highly valued market, demanding careful risk management and diversification.

BofA's Recommended Strategies for Navigating High Valuations

Given the current market conditions, BofA recommends a cautious and strategic approach to investing. Their recommendations emphasize diversification and risk management.

- Diversification across asset classes: BofA suggests diversifying portfolios across various asset classes, including stocks, bonds, real estate, and alternative investments, to mitigate risk and improve resilience in a volatile market.

- Focus on value stocks versus growth stocks: In a highly valued market, BofA may recommend focusing on value stocks (companies trading below their intrinsic value) which often display stronger resilience during market corrections.

- Potential sectors for investment: BofA might identify specific sectors less sensitive to market fluctuations, providing sector-specific recommendations for investors seeking stability. This would involve citing specific sectors and their rationale from their published research.

- Importance of risk management: Effective risk management is crucial, necessitating a thorough understanding of one's risk tolerance and the implementation of appropriate risk mitigation strategies.

Long-Term Outlook and Implications for Investors

BofA's long-term outlook acknowledges the uncertainties inherent in predicting market behavior. While specific numerical forecasts would be sourced from their reports, they generally advise a long-term perspective, emphasizing the importance of a well-defined investment plan.

- BofA's long-term market forecast: This section would incorporate details from BofA's long-term market projections, factoring in economic growth, inflation, and other macroeconomic factors.

- Recommendations for long-term investment strategies: BofA's recommendations for long-term investment strategies may involve regular rebalancing, disciplined investing, and focusing on fundamental analysis.

- Importance of a well-defined investment plan: Having a clear investment plan aligned with financial goals and risk tolerance is crucial for navigating market volatility and achieving long-term financial success.

Conclusion: Addressing High Stock Market Valuations: A Call to Action

BofA's analysis highlights the elevated risks associated with high stock market valuations. Understanding and addressing these valuations before making investment decisions is paramount. The potential for market corrections and the impact on portfolio returns necessitate a cautious and strategic approach. Consult with your financial advisor to discuss a personalized investment strategy that aligns with your risk tolerance and financial objectives, incorporating BofA's insights into market valuation analysis and developing effective stock market valuation strategies. Understanding and effectively addressing high stock valuations is crucial for achieving your financial goals. Contact your financial advisor today to discuss a personalized investment strategy based on BofA's insights and your individual risk tolerance.

Featured Posts

-

Dakota Johnson Channels Spring Style With Mother Melanie Griffith

May 10, 2025

Dakota Johnson Channels Spring Style With Mother Melanie Griffith

May 10, 2025 -

Should You Buy Or Sell Palantir Stock Before The May 5th Report

May 10, 2025

Should You Buy Or Sell Palantir Stock Before The May 5th Report

May 10, 2025 -

Elizabeth Hurley Baring It All Her Most Unforgettable Cleavage Moments

May 10, 2025

Elizabeth Hurley Baring It All Her Most Unforgettable Cleavage Moments

May 10, 2025 -

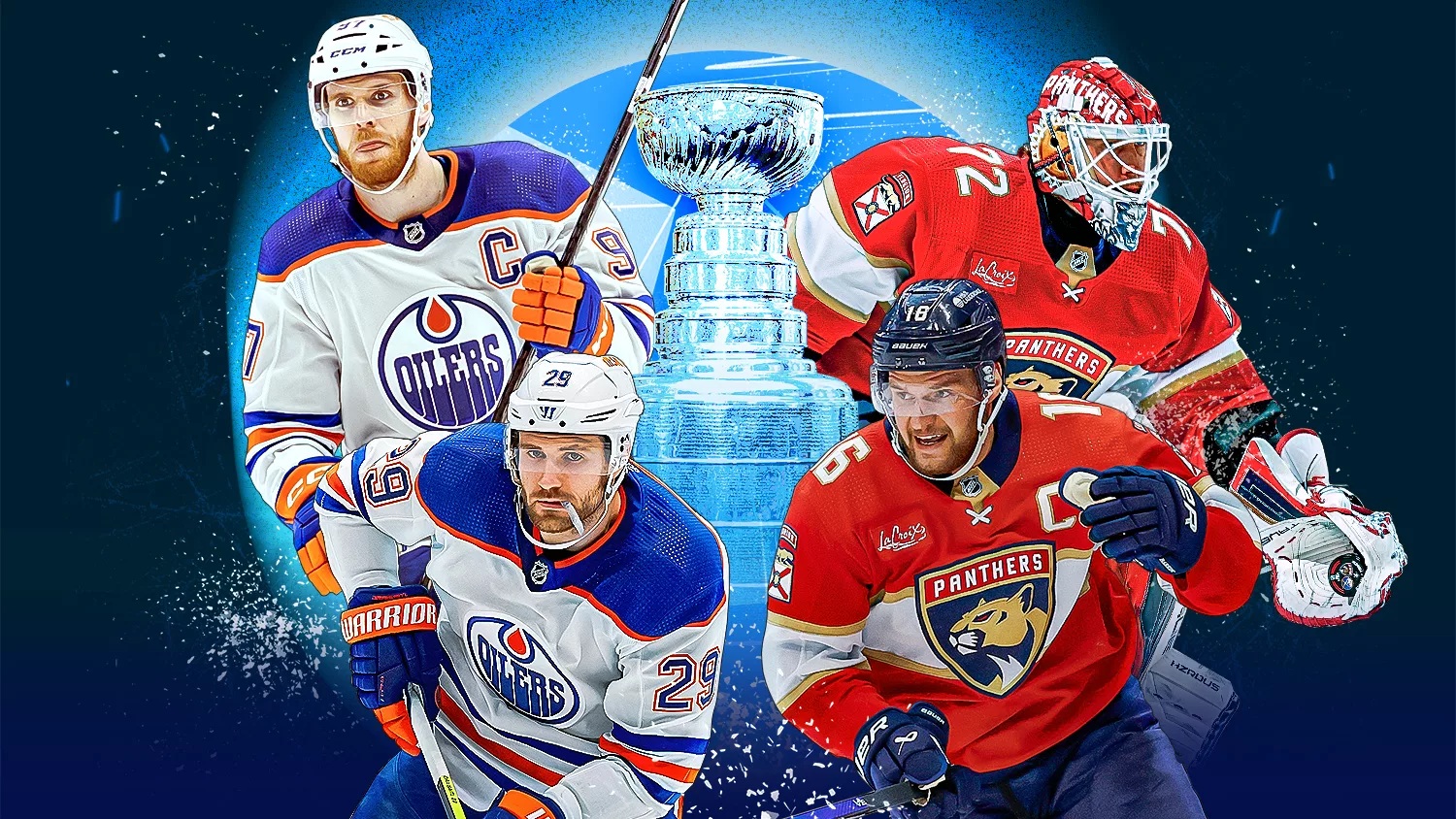

Draisaitls Return Edmonton Oilers Playoff Hopes Hinge On Star Centers Recovery

May 10, 2025

Draisaitls Return Edmonton Oilers Playoff Hopes Hinge On Star Centers Recovery

May 10, 2025 -

2025 Presidential Politics A Focus On The Trump Administrations Day 109

May 10, 2025

2025 Presidential Politics A Focus On The Trump Administrations Day 109

May 10, 2025