Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Key Findings on Elevated Stock Market Valuations

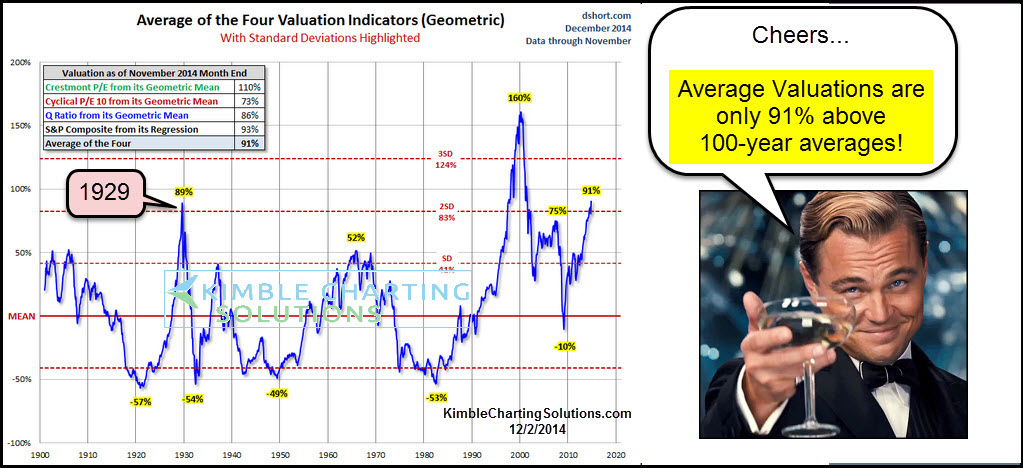

BofA's analysis concludes that current stock market valuations are indeed elevated, though the extent of overvaluation is a subject of debate. Their assessment relies on a combination of valuation metrics, considering both short-term and long-term perspectives.

- Specific valuation metrics used: BofA employed a range of metrics, including traditional Price-to-Earnings (P/E) ratios, and the cyclically adjusted price-to-earnings ratio (Shiller PE), a measure that accounts for inflation and economic cycles. They also likely considered other factors like dividend yields and growth rates.

- BofA's assessment of current market risk: While acknowledging elevated valuations, BofA likely didn't declare an immediate crash imminent. Their assessment likely included a nuanced perspective on risk, possibly highlighting specific sectors or asset classes deemed more vulnerable than others. The report likely qualified their assessment with a discussion of potential mitigating factors.

- Specific sectors identified as overvalued or undervalued: BofA's analysis likely pinpointed particular sectors showing signs of overvaluation, potentially those with high P/E ratios and slower growth prospects. Conversely, they might have identified undervalued sectors with strong fundamentals and growth potential. (Note: Specific sector details would need to be taken directly from the BofA report if available.)

For example, a hypothetical quote from the BofA report might state: "While valuations are stretched, we believe that continued earnings growth, albeit at a slower pace, could support current market levels in the near term. However, investors should remain vigilant and diversify their portfolios."

Factors Contributing to Elevated Stock Market Valuations According to BofA

BofA's analysis likely attributes the elevated valuations to a confluence of factors, including:

- Low interest rates: Extremely low interest rates, a consequence of monetary policy in recent years, have made bonds less attractive relative to stocks. This has pushed investors towards equities, driving up demand and prices.

- Quantitative easing (QE) and its effects on market liquidity: QE programs, designed to stimulate economic activity, have injected significant liquidity into the market. This increased liquidity has contributed to higher asset prices across the board, including stocks.

- Strong corporate earnings growth (or lack thereof): While corporate earnings have generally been strong in recent years, the pace of growth may have slowed, yet stock prices have continued to rise. This discrepancy contributes to concerns about valuation.

- Investor sentiment and market psychology: Optimism and positive investor sentiment can drive stock prices higher, even if underlying fundamentals don't fully justify the increase. "Fear of missing out" (FOMO) can also amplify this effect.

- Geopolitical factors influencing investment decisions: Geopolitical events, such as trade wars or political instability, can impact investor confidence and, subsequently, stock valuations. BofA's analysis likely incorporated such factors into its overall assessment.

BofA's Recommendations for Investors Amidst Elevated Valuations

Given the elevated valuations, BofA's recommendations are likely to emphasize a cautious but not necessarily bearish approach.

- Suggested portfolio adjustments: Diversification is likely a key recommendation. This would involve spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Specific sectors or investment styles BofA recommends: They might suggest focusing on sectors with strong fundamentals and sustainable growth potential, even if their valuations appear relatively higher than other sectors.

- Risk management strategies: Employing risk management strategies, such as hedging techniques or stop-loss orders, could help limit potential losses in case of a market downturn.

- Importance of long-term investment horizons: BofA likely emphasizes the importance of maintaining a long-term perspective, as short-term market fluctuations are less significant in the context of long-term goals.

BofA might add a crucial caveat: "Our recommendations are not financial advice, and investors should conduct their own thorough due diligence before making any investment decisions."

Alternative Perspectives and Criticisms of BofA's Analysis

It's important to consider alternative perspectives on BofA's analysis. Other financial institutions or analysts might disagree on the extent of overvaluation or the significance of certain factors.

- Counterarguments to BofA's valuation methods: Some might argue that BofA's chosen valuation metrics are not entirely suitable for the current market environment or that they overlook certain crucial factors.

- Differing opinions on the impact of specific factors: Different analysts might assign varying weights to the factors contributing to elevated valuations. For example, some may downplay the role of low interest rates while emphasizing the impact of technological innovation.

- Alternative predictions for future market performance: Some analysts might predict a more significant market correction than BofA anticipates, while others might foresee continued growth, despite the high valuations.

Conclusion: Addressing Investor Concerns: A Summary of BofA's Take on Elevated Stock Market Valuations

BofA's analysis indicates that current stock market valuations are elevated, although the degree of overvaluation is a subject of ongoing debate. Several factors contribute to these high valuations, including low interest rates, quantitative easing, and investor sentiment. BofA likely recommends a cautious approach with a focus on diversification, risk management, and a long-term investment horizon. However, investors should remember that alternative perspectives exist, and it's crucial to conduct independent research and seek professional financial advice. To stay informed about future market trends and BofA's evolving analysis on stock market valuations and investor concerns, regularly check their publications and reports. Stay informed about future BofA reports related to market valuations to refine your investment strategies.

Featured Posts

-

Inter Beat Barca A Classic Champions League Final Showdown

May 08, 2025

Inter Beat Barca A Classic Champions League Final Showdown

May 08, 2025 -

Inter Milan Vs Fc Barcelona Watch The Live Champions League Match

May 08, 2025

Inter Milan Vs Fc Barcelona Watch The Live Champions League Match

May 08, 2025 -

Spk Nin Kripto Para Karari Yatirimcilar Icin Nelere Dikkat Edilmeli

May 08, 2025

Spk Nin Kripto Para Karari Yatirimcilar Icin Nelere Dikkat Edilmeli

May 08, 2025 -

The Road To 3 40 Ripple Xrp Price Outlook

May 08, 2025

The Road To 3 40 Ripple Xrp Price Outlook

May 08, 2025 -

Outer Banks Voice Longtime Coast Guard Member Ryan Gentry Celebrated

May 08, 2025

Outer Banks Voice Longtime Coast Guard Member Ryan Gentry Celebrated

May 08, 2025