AEX Index: 4%+ Drop Sends Amsterdam Market To 12-Month Low

Table of Contents

Factors Contributing to the AEX Index's Sharp Decline

Several interconnected factors contributed to the dramatic drop in the AEX Index, creating a perfect storm of negative market sentiment.

Global Economic Uncertainty

The global economic landscape is currently fraught with uncertainty, significantly impacting the AEX Index. Several key factors are at play:

- Rising inflation rates: Persistent inflation in major economies like the US and Europe is eroding purchasing power and dampening consumer spending, leading to reduced corporate profits and impacting stock valuations.

- Recession fears: Concerns about a potential global recession are weighing heavily on investor sentiment. The possibility of a prolonged economic downturn is causing investors to move to safer assets, leading to sell-offs in riskier markets like the AEX.

- Geopolitical instability: The ongoing war in Ukraine and other geopolitical tensions are adding to the overall uncertainty, further impacting investor confidence and fueling market volatility. The energy crisis stemming from the war is also a major contributing factor, impacting energy-dependent companies listed on the AEX.

Performance of Key AEX Components

The decline in the AEX Index is not solely due to global factors; the performance of individual companies listed on the index has also played a significant role. Several key AEX components experienced substantial drops:

- ASML Holding: The semiconductor giant, a major component of the AEX, experienced a considerable drop, reflecting broader concerns within the tech sector and potential slowdown in chip demand.

- Unilever: This consumer goods company saw its share price fall, potentially due to increased cost pressures and slowing consumer spending.

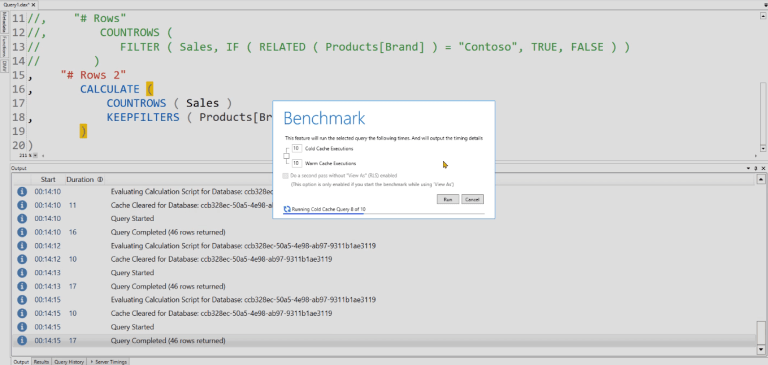

- ING Group: The financial services giant also experienced a decline, reflecting broader concerns within the banking sector related to rising interest rates and economic uncertainty. (Charts and graphs visualizing the performance of these stocks would be included here).

Impact of Interest Rate Hikes

Central banks worldwide, including the European Central Bank, are aggressively raising interest rates to combat inflation. This has had a significant knock-on effect on the AEX Index:

- Increased borrowing costs: Higher interest rates increase borrowing costs for businesses, making expansion and investment more expensive, impacting profitability and potentially slowing economic growth.

- Investor behavior: Rising interest rates often lead to investors moving money from riskier assets (like stocks) into safer, higher-yielding fixed-income investments like bonds. This shift in investor behavior contributes to sell-offs in the stock market.

- Market sentiment: The aggressive interest rate hikes signal a tighter monetary policy, which can negatively impact market sentiment and lead to increased volatility.

Implications of the AEX Index Drop

The significant drop in the AEX Index has several important implications:

Investor Sentiment and Market Volatility

The decline has undeniably shaken investor confidence. We are seeing:

- Decreased investor confidence: The sharp drop is likely to further decrease investor confidence, potentially leading to further sell-offs and increased market volatility in the short term.

- Increased market volatility: Expect increased fluctuations in the AEX Index in the coming weeks and months as investors react to economic data and corporate earnings reports.

- Long-term consequences: The long-term impact will depend on the trajectory of the global economy and the effectiveness of policy responses. A prolonged period of low investor confidence could hinder economic growth in the Netherlands.

Economic Outlook for the Netherlands

The AEX Index decline is a significant indicator of potential challenges for the Dutch economy:

- Impact on GDP: A weakened AEX Index can signify a potential slowdown in overall economic activity and potentially lower GDP growth.

- Employment concerns: Economic slowdown could lead to reduced job creation and potentially even job losses in some sectors.

- Government response: The Dutch government will likely need to carefully monitor the situation and may need to implement fiscal policies to support economic growth and mitigate negative impacts.

Potential Recovery Strategies and Future Outlook for the AEX Index

While the current situation presents challenges, there are potential paths towards recovery:

Analyst Predictions and Market Forecasts

Financial analysts offer varying forecasts for the AEX Index's future performance:

- Potential catalysts for recovery: Positive economic data, easing inflation, and a resolution of geopolitical tensions could potentially trigger a recovery in the AEX.

- Support and resistance levels: Technical analysts are monitoring key support and resistance levels to predict potential turning points in the market.

- Long-term growth potential: Despite the current downturn, many analysts maintain a long-term positive outlook for the AEX, citing the underlying strength of the Dutch economy and the potential for future growth.

Investor Strategies for Navigating Market Volatility

Investors can employ several strategies to mitigate risk during market downturns:

- Diversification: Diversifying investments across different asset classes and geographical regions can help reduce overall portfolio risk.

- Asset allocation: Adjusting asset allocation based on risk tolerance and market conditions is crucial.

- Seeking professional advice: Consulting a financial advisor for personalized advice tailored to individual investment goals and risk tolerance is highly recommended.

Conclusion

The significant 4%+ drop in the AEX Index has pushed the Amsterdam market to a 12-month low, raising concerns about the broader economic outlook. Several factors, including global economic uncertainty, the performance of key AEX components, and rising interest rates, contributed to this decline. The implications for the Dutch economy and investor sentiment are substantial. Understanding the dynamics of the AEX Index and its various influencing factors is crucial for informed investment decisions.

Call to Action: Stay informed about the fluctuating AEX Index and its potential impact on your investments. Monitor market trends closely and consider consulting a financial advisor for personalized guidance on navigating the current market volatility. Careful monitoring of the AEX Index is crucial for making sound investment decisions.

Featured Posts

-

Steady Start For Frankfurt Dax Following Record Breaking Performance

May 24, 2025

Steady Start For Frankfurt Dax Following Record Breaking Performance

May 24, 2025 -

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025 -

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Purchase Guide

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Purchase Guide

May 24, 2025 -

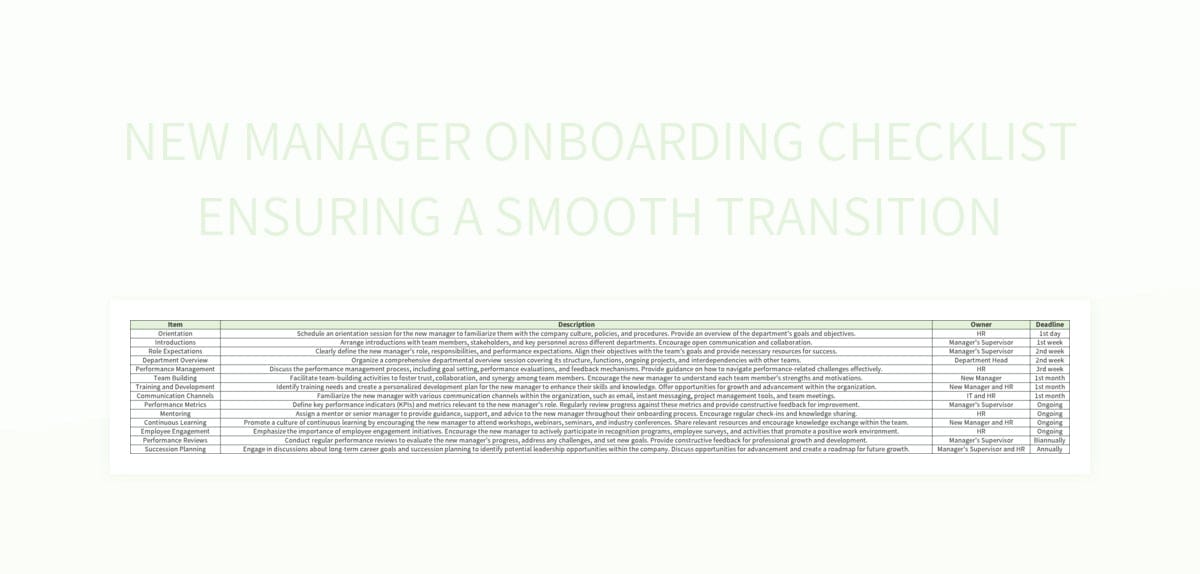

Escape To The Country The Ultimate Checklist For A Smooth Transition

May 24, 2025

Escape To The Country The Ultimate Checklist For A Smooth Transition

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

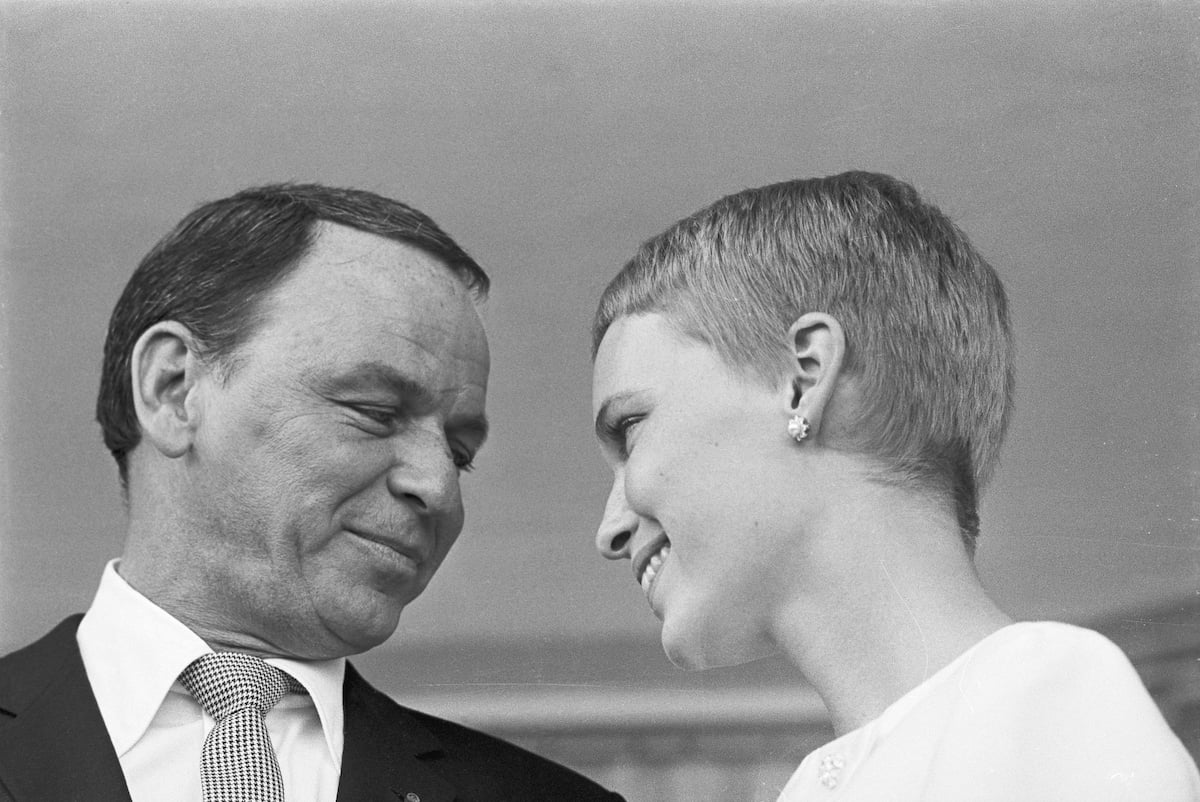

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025