AEX Index Falls Over 4%, Hits Lowest Point In 12 Months

Table of Contents

Reasons Behind the AEX Index's Sharp Decline

Several interconnected factors contributed to the AEX Index's precipitous fall. Understanding these underlying causes is crucial for assessing the current market situation and anticipating future trends.

-

Global Economic Slowdown: The global economy is facing significant headwinds. Rising inflation, fueled by persistent supply chain disruptions and the ongoing war in Ukraine, is dampening consumer spending and business investment. Fears of a looming recession are weighing heavily on investor sentiment, leading to a risk-off environment where investors move away from equities and towards safer assets. Keywords: global economic uncertainty, inflationary pressures, recession risk.

-

Specific Sector Underperformance: The decline wasn't uniform across all sectors. The technology sector, particularly sensitive to interest rate hikes and economic uncertainty, experienced particularly sharp declines. Similarly, energy companies, already grappling with volatile oil prices, also saw significant losses. Keywords: sector-specific weakness, underperforming stocks.

-

Impact of Interest Rate Hikes: The European Central Bank (ECB) has been aggressively raising interest rates to combat inflation. While necessary to curb rising prices, these hikes increase borrowing costs for businesses and reduce the attractiveness of equities relative to bonds, contributing to the sell-off in the AEX. Keywords: interest rate hikes, monetary policy, ECB policy.

-

Investor Sentiment and Market Volatility: Negative news headlines, coupled with the aforementioned factors, have fueled a climate of fear and uncertainty among investors. This risk aversion is manifesting in increased market volatility, with sharp price swings becoming increasingly common. Keywords: investor confidence, market volatility, risk aversion.

Impact on Key AEX Companies and their Stock Prices

The AEX Index's decline significantly impacted many major Dutch companies. For example, ASML Holding, a key player in the semiconductor industry, saw its stock price fall by [insert percentage]%, while Unilever experienced a [insert percentage]% drop. ING Group, a major financial institution, also suffered a notable decline. These are just a few examples of the widespread impact on AEX-listed companies. [Insert links to relevant financial news articles detailing stock price changes for specific companies]. Keywords: AEX company performance, stock price fluctuations, ASML Holding stock price, Unilever stock price, ING Group stock price.

Analyst Predictions and Future Outlook for the AEX Index

Financial analysts offer varied perspectives on the AEX Index's future trajectory. Some believe the current downturn represents a temporary correction, with the potential for a rebound in the coming months. Others express more cautious views, citing ongoing global uncertainty and the persistent risk of a recession. "[Insert quote from a financial analyst expressing a short-term outlook]," stated [Analyst Name] at [Financial Institution]. The long-term outlook remains uncertain, with much depending on the effectiveness of central bank policies and the overall global economic recovery. Keywords: market forecast, AEX index prediction, economic outlook, analyst predictions.

Strategies for Investors During Market Downturns

Navigating market downturns requires a measured and strategic approach. Investors should prioritize risk management and portfolio diversification.

-

Risk Management: Assess your risk tolerance and adjust your investment strategy accordingly. Avoid panic selling and making rash decisions based on short-term market fluctuations.

-

Portfolio Diversification: A well-diversified portfolio can help mitigate losses during market downturns. Consider spreading your investments across different asset classes, sectors, and geographies.

-

Long-Term Investment Planning: Maintaining a long-term investment horizon is crucial. Market fluctuations are normal, and focusing on long-term growth can help weather short-term volatility. Keywords: risk management, portfolio diversification, investment strategy, long-term investing.

Conclusion: Navigating the AEX Index's Fall – What's Next?

The over 4% fall in the AEX Index represents a significant event, driven by a confluence of global economic concerns, sector-specific weaknesses, and rising interest rates. The impact on individual companies has been substantial, and the outlook remains uncertain, with varying predictions from analysts. For investors, navigating this challenging period necessitates a focus on risk management, diversification, and a long-term investment strategy. Stay updated on the latest developments affecting the AEX Index to make well-informed investment decisions. [Insert link to a reputable financial news source or stock market tracker].

Featured Posts

-

Pengalaman Seni And Otomotif Porsche Classic Art Week Indonesia 2025

May 25, 2025

Pengalaman Seni And Otomotif Porsche Classic Art Week Indonesia 2025

May 25, 2025 -

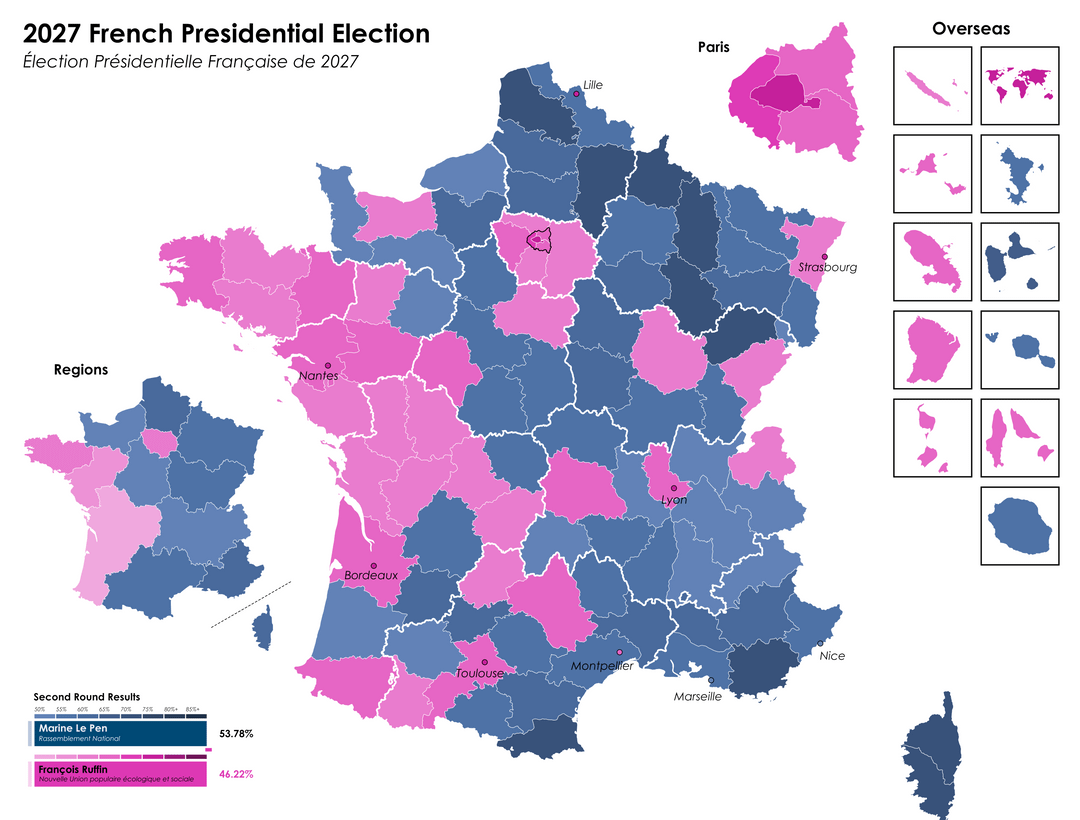

Bardellas Bid For Power A Look At The 2027 French Elections

May 25, 2025

Bardellas Bid For Power A Look At The 2027 French Elections

May 25, 2025 -

Porsche Now

May 25, 2025

Porsche Now

May 25, 2025 -

Test Na Znanie Filmov S Olegom Basilashvili

May 25, 2025

Test Na Znanie Filmov S Olegom Basilashvili

May 25, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025

Latest Posts

-

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Gang Member Deportations

May 25, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 25, 2025