AI Quantum Computing Stock: Time To Buy The Dip?

Table of Contents

Understanding the AI Quantum Computing Market

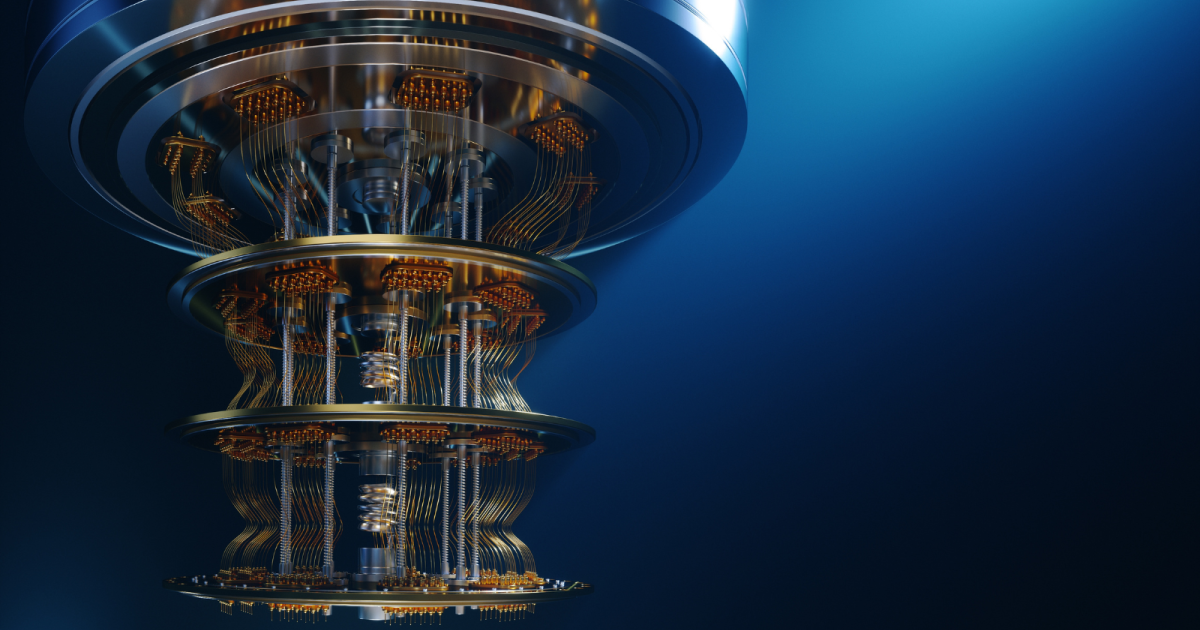

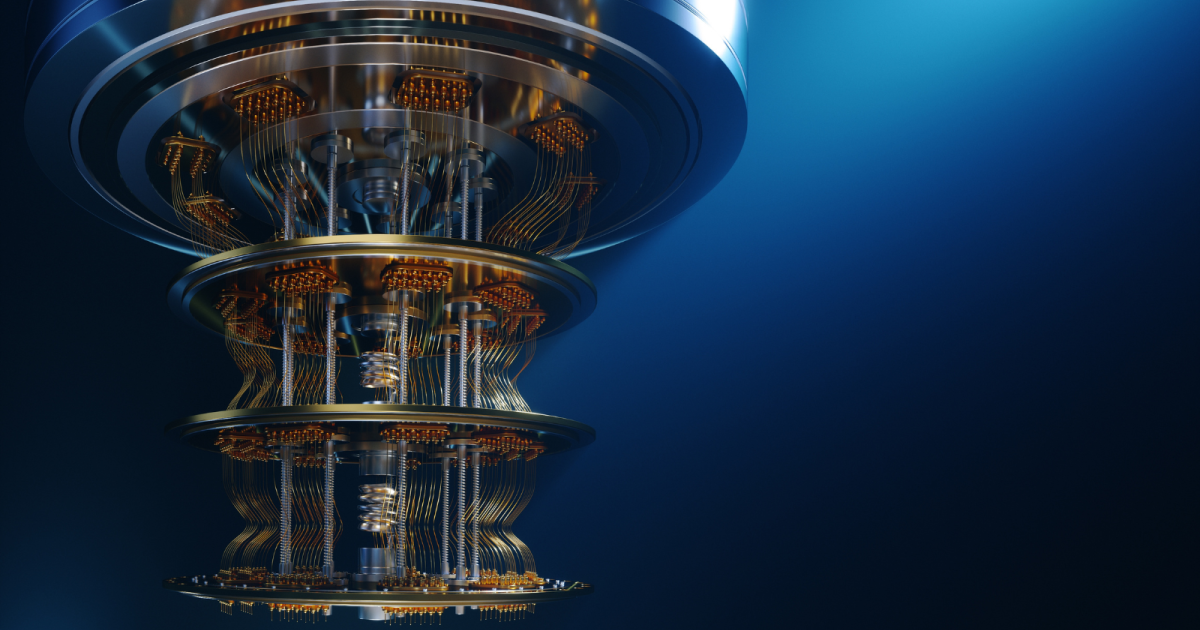

The Potential of Quantum Computing

Quantum computing harnesses the principles of quantum mechanics to perform calculations far beyond the capabilities of classical computers. This exponential computational power opens doors to solutions for currently intractable problems across numerous fields. The potential applications are vast and hold immense promise for future growth in related stocks.

- Examples of companies investing heavily in quantum computing: Google, IBM, Microsoft, IonQ, Rigetti Computing.

- Potential applications and their market size estimates:

- Drug discovery and development: Potentially revolutionizing pharmaceutical research, with market estimates reaching hundreds of billions.

- Materials science: Designing new materials with enhanced properties, impacting industries from energy to aerospace.

- Financial modeling: Developing more accurate and efficient risk management and investment strategies, a market worth trillions.

- Cryptography: Breaking current encryption methods and developing new, quantum-resistant cryptography.

AI's Role in Quantum Computing

AI and quantum computing are not mutually exclusive; they are synergistic. AI algorithms play a crucial role in optimizing quantum computer performance and enhancing their capabilities. This symbiotic relationship is accelerating innovation in both fields.

- Examples of AI applications in quantum computing:

- Error correction: Mitigating errors inherent in quantum computations.

- Algorithm optimization: Developing more efficient quantum algorithms.

- Quantum hardware control: Optimizing the control and operation of quantum hardware.

- Companies developing AI-quantum computing hybrid systems: Many of the major players mentioned above are actively pursuing this hybrid approach.

Current Market Landscape and Recent Dip

The AI quantum computing stock market is still in its nascent stages, characterized by high growth potential but also significant volatility. Recent dips can be attributed to several factors:

-

Broader market downturn: The overall tech stock dip has impacted many emerging technology sectors, including AI quantum computing.

-

Investor uncertainty: The long-term viability and return on investment in this nascent field remain uncertain for some investors.

-

Key players and their stock performance: Tracking the performance of companies like IonQ, Rigetti, and those heavily invested in quantum computing within larger corporations is crucial. Analyzing their financial reports provides valuable insights.

-

Potential short-term and long-term risks: Short-term risks include market volatility and regulatory uncertainties. Long-term risks involve technological hurdles, competition, and the potential for slower-than-anticipated market adoption.

Evaluating Investment Opportunities in AI Quantum Computing Stocks

Identifying Promising Companies

Identifying promising companies in the AI quantum computing sector requires careful due diligence. Focus on factors like:

-

Research and development: Companies with strong R&D capabilities and a pipeline of innovative technologies.

-

Partnerships and collaborations: Strategic alliances with industry leaders can significantly enhance a company's prospects.

-

Intellectual property: A strong patent portfolio provides a competitive advantage.

-

Key metrics to evaluate potential investments:

- Revenue growth: A strong indicator of market traction.

- Market share: An indication of competitive dominance.

- Competitive advantage: Unique technologies or business models that set a company apart.

-

Examples of companies that fit this profile: Research companies actively involved in developing cutting-edge quantum technologies and those with strong partnerships.

Risk Assessment and Diversification

Investing in AI quantum computing stocks involves significant risk. Diversification and careful risk assessment are crucial:

- Different investment strategies: Consider long-term investments for higher potential returns, but with increased risk tolerance. Short-term trading might be more appropriate for investors with lower risk tolerance.

- Inherent risks of investing in emerging technologies: These include technological failures, regulatory changes, and intense competition.

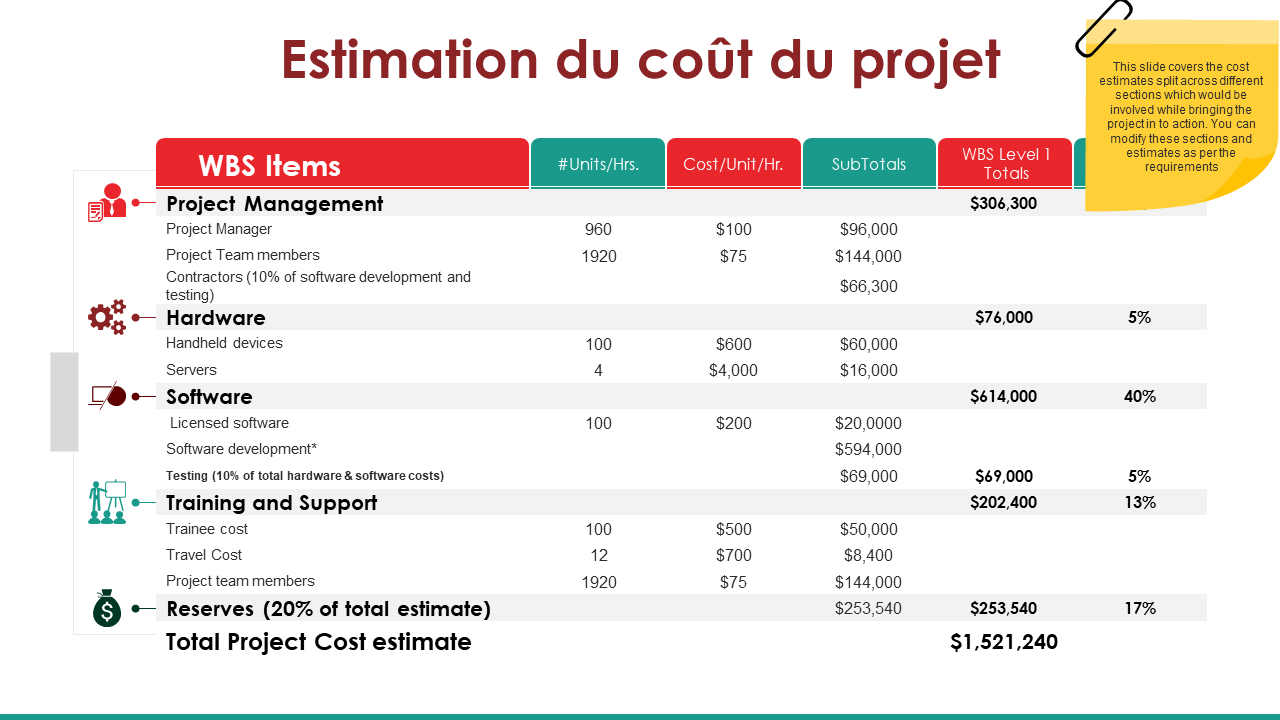

Analyzing Financial Statements and Future Projections

Thoroughly analyze financial statements and future projections before investing:

- Crucial financial metrics for analysis: Revenue, expenses, profitability, debt levels, cash flow.

- Resources for obtaining financial data: SEC filings (for US-listed companies), company websites, and financial news sources.

Conclusion

The potential rewards of investing in AI quantum computing stock are significant, driven by the transformative power of this technology. However, the sector is characterized by inherent risks associated with emerging technologies and market volatility. The long-term potential is undeniable, fueled by the exponential growth expected in quantum computing applications across diverse industries. Thorough due diligence, a well-informed investment strategy, and careful risk management are paramount for success in this rapidly evolving field. Start your research today and capitalize on the opportunities in this revolutionary sector of AI quantum computing stock. Understanding the interplay between AI and quantum computing is key to identifying potentially lucrative quantum computing investment opportunities in the years to come. Remember to carefully assess your risk tolerance and diversify your portfolio appropriately before investing in this exciting yet volatile market.

Featured Posts

-

4eme Pont D Abidjan Analyse Du Cout Des Delais Et Du Financement Du Projet En Cote D Ivoire

May 20, 2025

4eme Pont D Abidjan Analyse Du Cout Des Delais Et Du Financement Du Projet En Cote D Ivoire

May 20, 2025 -

Nyt Mini Crossword March 22 Answer Key

May 20, 2025

Nyt Mini Crossword March 22 Answer Key

May 20, 2025 -

Kaellman Ja Hoskonen Puola Ura Paeaettynyt

May 20, 2025

Kaellman Ja Hoskonen Puola Ura Paeaettynyt

May 20, 2025 -

Tadi Shmit E Tri Godine Podstitsao Sukobe A Sada Pere Ruke

May 20, 2025

Tadi Shmit E Tri Godine Podstitsao Sukobe A Sada Pere Ruke

May 20, 2025 -

Analyzing The Us Typhon Missile Systems Role In Philippine China Relations

May 20, 2025

Analyzing The Us Typhon Missile Systems Role In Philippine China Relations

May 20, 2025

Latest Posts

-

Baggelis Giakoymakis To Bullying Oi Vasanismoi Kai To Tragiko Telos

May 20, 2025

Baggelis Giakoymakis To Bullying Oi Vasanismoi Kai To Tragiko Telos

May 20, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls Analyontas Tis Pithanotites

May 20, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls Analyontas Tis Pithanotites

May 20, 2025 -

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025 -

I Epistrofi Toy Giakoymaki Sto Mls Elpides Kai Provlepseis

May 20, 2025

I Epistrofi Toy Giakoymaki Sto Mls Elpides Kai Provlepseis

May 20, 2025 -

Efimeries Iatron Patras Odigos Gia To Savvatokyriako

May 20, 2025

Efimeries Iatron Patras Odigos Gia To Savvatokyriako

May 20, 2025