Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

Table of Contents

Magnitude of the Losses

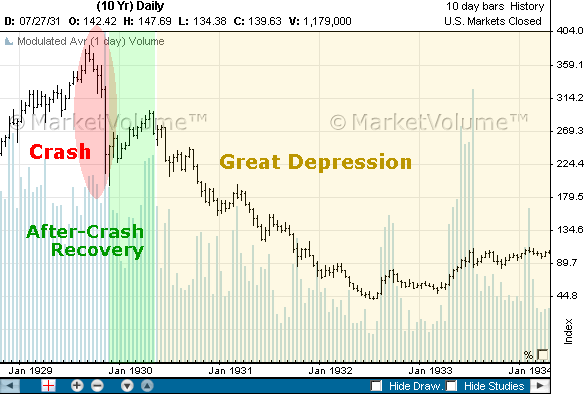

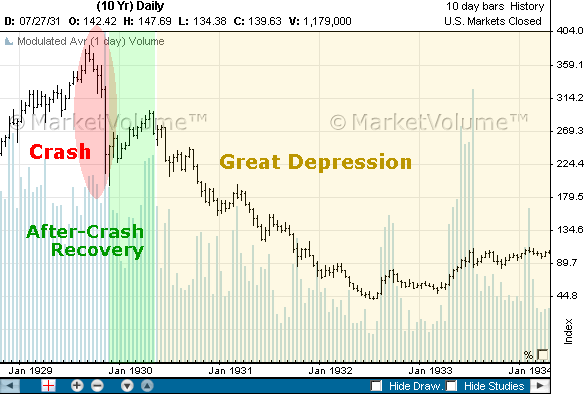

The AEX index has plummeted significantly over the past three days, marking a substantial decline in share prices across numerous sectors. The three-day drop represents a [Insert Precise Percentage] fall, a considerable decrease compared to previous market corrections. For context, the last significant market downturn in [Year] resulted in a [Percentage] drop over [Timeframe]. This current decline surpasses that event in both speed and severity.

The technology, finance, and energy sectors have been particularly hard hit, experiencing disproportionately large losses. For instance, [Company Name 1] in the technology sector saw its share price decrease by [Percentage], while [Company Name 2] in the finance sector experienced a [Percentage] drop. These are just two examples of the widespread impact across various sectors.

Trading volume has [Increased/Decreased] significantly during this period, suggesting [Investor Sentiment - e.g., panic selling, cautious waiting]. This contrasts with [Previous Period] when trading volume was [Description]. This stark difference further highlights the current market uncertainty.

- Day 1: [Percentage] drop in the AEX index.

- Day 2: [Percentage] drop in the AEX index.

- Day 3: [Percentage] drop in the AEX index.

- Examples: [Company Name 1] (-[Percentage]%); [Company Name 2] (-[Percentage]%); [Company Name 3] (-[Percentage]%);

- Trading Volume: Compared to the average daily volume in the last month, trading volume increased by [Percentage] (or decreased by [Percentage]).

Potential Causes of the Decline

Several interconnected factors contribute to this sharp decline in the Amsterdam Stock Exchange.

Global Factors: Rising global interest rates are impacting investment strategies worldwide, leading to decreased appetite for riskier assets. Geopolitical instability, particularly the ongoing [Mention Specific Geopolitical Event], adds further uncertainty to the global market. High inflation rates in many countries are also contributing to investor apprehension and cautious investment decisions.

European Economic Concerns: The ongoing energy crisis across Europe, coupled with the persistent threat of recession, significantly impacts investor sentiment in the Eurozone, including the Netherlands. Uncertainty surrounding future energy prices and supply security adds further pressure on market performance.

Internal Dutch Factors: Recent changes in government policy regarding [Specific Policy Area] might have negatively affected investor confidence. Additionally, challenges faced by specific Dutch industries, such as [Specific Industry], might be impacting market performance.

- Global Inflation: The current global inflation rate of [Percentage] is squeezing consumer spending and impacting corporate profits.

- Geopolitical Instability: The war in Ukraine continues to disrupt global supply chains and increase market volatility.

- European Energy Crisis: Soaring energy prices are putting pressure on businesses and consumers across Europe.

- Dutch Government Policies: The recent tax increase on [Specific Tax] may have negatively affected certain sectors.

Impact on the Dutch Economy

The dramatic losses on the Amsterdam Stock Exchange are having a significant ripple effect on the Dutch economy.

Investor Confidence: The current market downturn is severely impacting investor confidence in the Dutch economy. [Cite a survey or data source showing decreased investor confidence]. This lack of confidence can lead to decreased investments and slower economic growth.

Pension Funds: Dutch pension funds, significant investors in the stock market, are facing significant losses, potentially impacting their ability to meet future obligations to retirees. The current market volatility necessitates a reassessment of their investment strategies.

Economic Growth: The prolonged decline in the AEX index could significantly impact Dutch economic growth. Reduced investment and consumer spending could lead to a slowdown in GDP growth.

Government Response: The Dutch government has [Summarize any government actions or statements concerning the market decline].

- Investor Confidence Index: [Specific Data Point – e.g., The Investor Confidence Index dropped by X% in the last week].

- Pension Fund Losses: Preliminary estimates suggest pension funds have lost approximately [Estimated Amount] due to the market downturn.

- GDP Growth Projections: Economists predict a decrease in GDP growth by [Percentage] if market conditions do not improve.

- Government Response: The Dutch government has announced plans to [Summarize government's plans].

Outlook and Potential Recovery

Predicting the future of the Amsterdam Stock Exchange remains challenging.

Short-Term Predictions: A short-term recovery is possible if [Mention potential positive factors, e.g., easing inflation, resolution of geopolitical tensions]. However, the decline might represent a more significant trend if [Mention potential negative factors, e.g., persistent inflation, further geopolitical instability].

Long-Term Implications: The long-term impact on the AEX index and the Dutch economy will depend on various factors, including global economic conditions, government policies, and the resilience of the Dutch businesses.

Investor Advice: Investors should exercise caution and carefully evaluate their investment portfolios. Diversification and a long-term investment strategy are crucial in navigating market volatility.

- Potential Catalysts for Recovery: A reduction in inflation and positive economic news from Europe could trigger a market rebound.

- Long-Term Risks: Prolonged uncertainty surrounding global events could lead to further declines in the AEX.

- Investor Advice: Consider seeking advice from a financial advisor before making any significant investment decisions.

Conclusion

The three consecutive days of heavy losses on the Amsterdam Stock Exchange represent a significant challenge for the Dutch economy. The magnitude of the losses, driven by a combination of global and local factors, has impacted investor confidence, pension funds, and economic growth projections. While a short-term recovery is possible, navigating the current market volatility requires careful attention and strategic decision-making.

Monitor the Amsterdam Stock Exchange closely, stay updated on the AEX index, and understand the volatility of the Amsterdam Stock Exchange to make informed decisions regarding your investments in the Amsterdam Stock Exchange. Stay informed about economic developments to make the best choices for your financial future.

Featured Posts

-

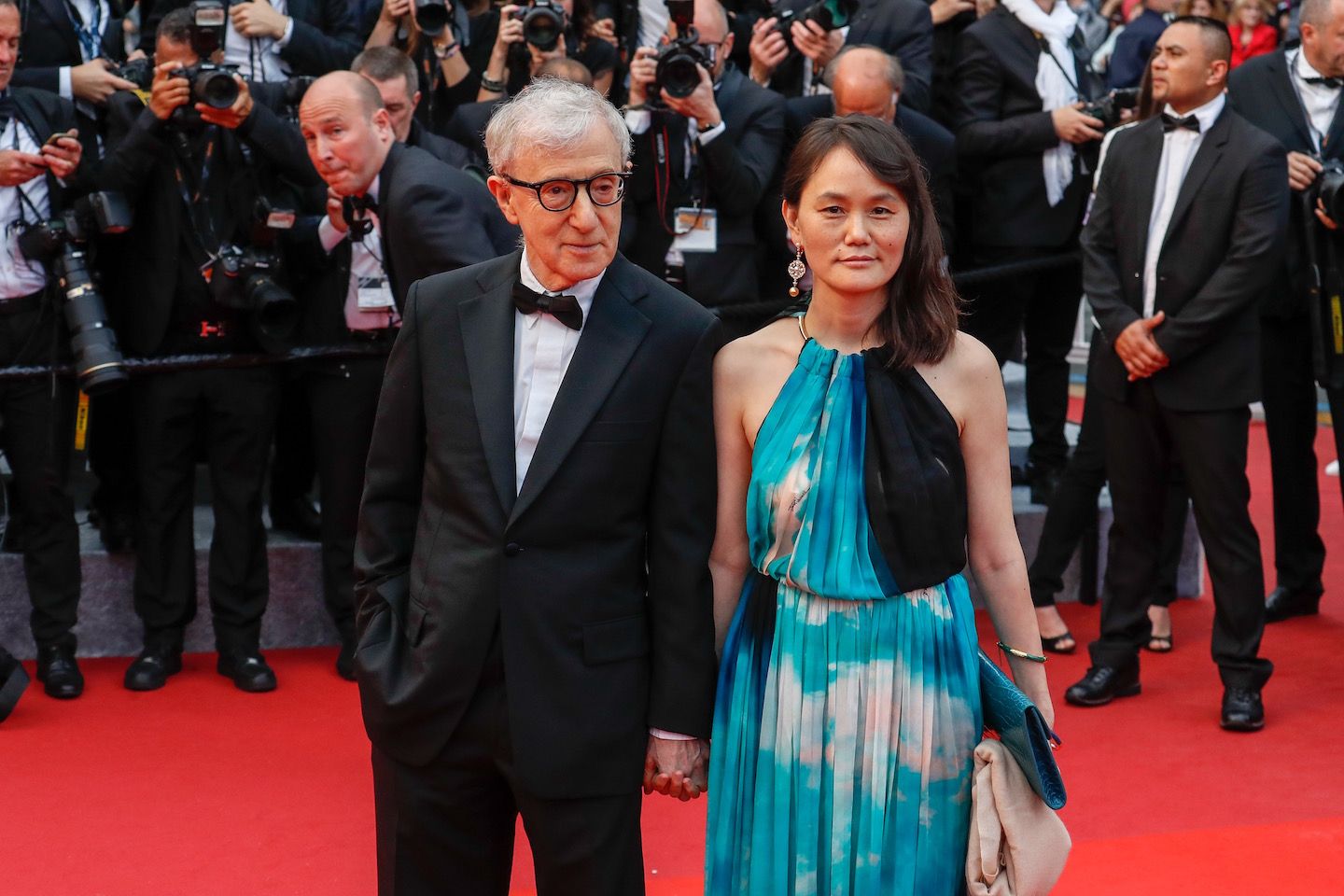

Woody Allen Abuse Allegations Sean Penn Expresses Uncertainty

May 24, 2025

Woody Allen Abuse Allegations Sean Penn Expresses Uncertainty

May 24, 2025 -

Explaining The Recent Events Surrounding Kyle Walker Annie Kilner And Mystery Women

May 24, 2025

Explaining The Recent Events Surrounding Kyle Walker Annie Kilner And Mystery Women

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025 -

Cac 40 Weekly Close Down Despite Stability March 7 2025

May 24, 2025

Cac 40 Weekly Close Down Despite Stability March 7 2025

May 24, 2025 -

The High Cost Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The High Cost Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025