Amsterdam Stock Market Plunges: 7% Drop Amidst Trade War Fears

Table of Contents

Trade War Uncertainty as the Primary Catalyst

The primary catalyst for today's sharp decline in the Amsterdam Stock Market is undoubtedly the escalating uncertainty surrounding the global trade war. This uncertainty is impacting investor confidence and driving a significant "risk-off" sentiment.

Impact of US-China Trade Tensions

The ongoing trade dispute between the US and China has had a direct and significant impact on Dutch businesses and investor confidence. The Netherlands, as a significant trading nation, is highly vulnerable to disruptions in global trade flows.

- Specific Examples: Companies in the Dutch technology sector, heavily reliant on exporting microchips and other components to China, have seen their share prices plummet. Similarly, agricultural exports, such as dairy products and flowers, destined for the US and China, are facing significant uncertainty.

- Statistical Impact: Dutch exports to China represent a considerable percentage of the national GDP. Any slowdown in this trade significantly impacts economic growth and overall investor sentiment. Preliminary estimates suggest a potential loss of X billion Euros in export revenue due to the trade war.

- Sectors Affected: The technology, agriculture, and manufacturing sectors are particularly hard hit. The uncertainty surrounding tariffs and trade restrictions is causing businesses to postpone investments and reduce production.

Broader Geopolitical Instability

Beyond the US-China trade war, broader geopolitical instability is contributing to the current market downturn. Other trade disputes, such as those involving the European Union and other nations, further exacerbate the uncertainty.

- Indirect Impacts: The interconnectedness of the global economy means that even seemingly unrelated trade disputes can have cascading effects on the Netherlands and its stock market. The resulting uncertainty makes investors hesitant to commit capital.

- Risk-Off Sentiment: Investors are moving away from riskier assets, such as stocks, and seeking refuge in safer havens like government bonds. This "risk-off" sentiment is characteristic of periods of heightened economic and geopolitical uncertainty.

- Expert Opinions: Leading financial analysts are predicting a prolonged period of uncertainty, cautioning against overly optimistic outlooks for the near future. Several economists warn of a potential global recession if the trade tensions persist.

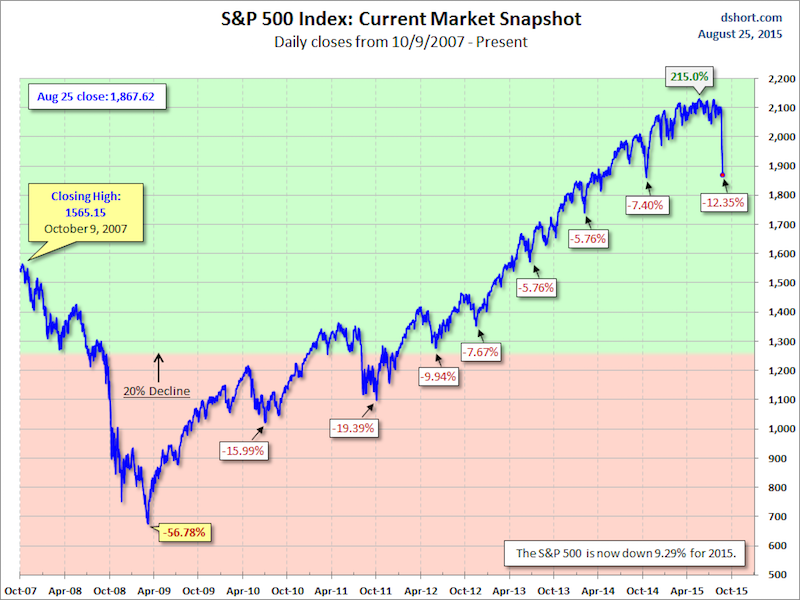

Amsterdam AEX Index Performance and Key Losers

The Amsterdam AEX Index, a benchmark for the Amsterdam Stock Exchange, reflects the severity of today's decline.

AEX Index Deep Dive

The AEX Index opened at [Opening Value], reached an intraday low of [Intraday Low], and closed at [Closing Value], representing a sharp [Percentage Change]% drop. This is one of the most significant single-day declines in the index in recent years.

- Trading Volume: The high volume of trading activity suggests significant investor anxiety and a rush to liquidate positions. The increased trading volume further highlights the market's volatility.

- Historical Comparison: This drop surpasses previous weekly/monthly declines by [Percentage Difference]%, indicating an exceptionally severe market reaction.

Sectors Most Affected

Several sectors within the Amsterdam Stock Exchange experienced particularly heavy losses.

- Hardest Hit Companies: [Company A] experienced a [Percentage Drop]% decline, followed by [Company B] with a [Percentage Drop]% fall. [Company C] also suffered a significant drop. These declines are linked to their high reliance on export markets impacted by trade tensions.

- Reasons for Susceptibility: Companies with significant exposure to US and Chinese markets were particularly vulnerable to the uncertainty surrounding trade policies. Those reliant on global supply chains are also particularly vulnerable to disruptions.

Investor Sentiment and Market Reactions

The current market conditions are characterized by significant uncertainty and a shift in investor sentiment.

Flight to Safety

In times of uncertainty, investors typically seek "safe haven" assets, moving their capital away from riskier investments towards more stable options.

- Increased Demand for Safe Havens: Government bonds, particularly those issued by countries perceived as politically and economically stable, are experiencing increased demand.

- Impact on Bond Yields: The increased demand for government bonds has led to a decrease in bond yields, as investors are willing to accept lower returns for the perceived safety.

Analyst Predictions and Future Outlook

Financial analysts offer diverse perspectives on the future outlook for the Amsterdam Stock Market.

- Analyst Views: Some analysts predict a potential for further declines in the short term, citing the persistent uncertainty surrounding trade relations. Others remain more optimistic, suggesting that the market might recover once clarity emerges regarding trade policies.

- Short-Term and Long-Term Scenarios: The short-term outlook is highly dependent on developments in the US-China trade talks. The long-term impact will depend on the overall resolution of trade tensions and the broader global economic climate. Further declines are possible if tensions escalate.

Conclusion

The 7% plunge in the Amsterdam Stock Market highlights the significant impact of global trade war anxieties on investor confidence and market stability. The uncertainty surrounding international trade policies, coupled with the interconnectedness of global markets, created a perfect storm leading to this sharp decline. Specific sectors and companies were heavily impacted, reflecting the Netherlands' reliance on global trade. The "flight to safety" further illustrates the market's reaction to heightened risk aversion.

Call to Action: Stay informed about developments in the Amsterdam Stock Market and global trade relations. Monitor the AEX index and relevant news for updates on the impact of trade war fears on the Amsterdam Stock Market’s performance. Consider diversifying your investment portfolio to mitigate risks associated with market volatility and the broader impacts of the global trade war on the Amsterdam Stock Exchange and beyond.

Featured Posts

-

The Phone Rings A Story Of Waiting

May 25, 2025

The Phone Rings A Story Of Waiting

May 25, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Ac Milan Transfer

May 25, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Ac Milan Transfer

May 25, 2025 -

Hollywood Production Halts As Sag Aftra Joins Wga On Strike

May 25, 2025

Hollywood Production Halts As Sag Aftra Joins Wga On Strike

May 25, 2025 -

Uk Inflation Data Drives Pound Higher Boe Rate Cut Expectations Fall

May 25, 2025

Uk Inflation Data Drives Pound Higher Boe Rate Cut Expectations Fall

May 25, 2025 -

Trumps Hardball Tactics The Fight For A Republican Deal

May 25, 2025

Trumps Hardball Tactics The Fight For A Republican Deal

May 25, 2025

Latest Posts

-

Nvidias Rtx 5060 Debacle Exposes Issues In Gpu Reviews

May 25, 2025

Nvidias Rtx 5060 Debacle Exposes Issues In Gpu Reviews

May 25, 2025 -

Nvidia Rtx 5060 Review A Wake Up Call For Gamers

May 25, 2025

Nvidia Rtx 5060 Review A Wake Up Call For Gamers

May 25, 2025 -

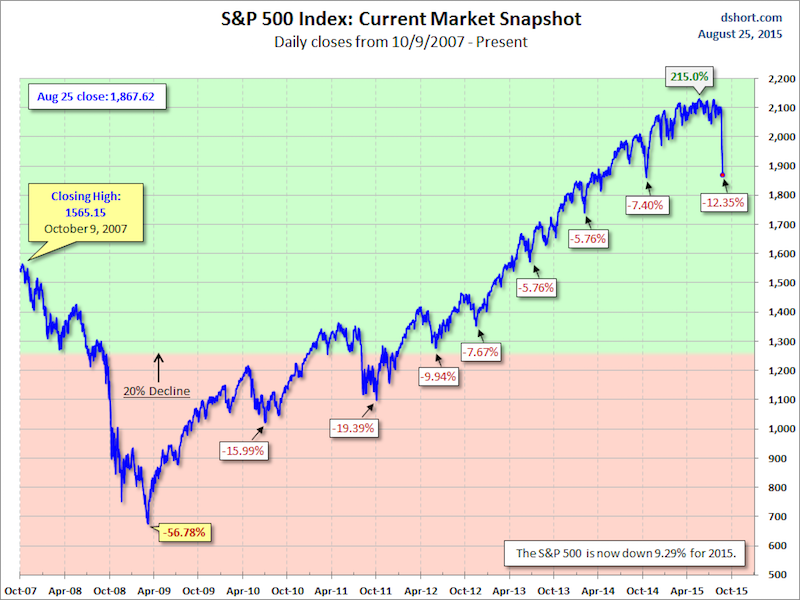

The Battle For Ai Supremacy Analyzing Googles I O And Open Ais Io Strategies

May 25, 2025

The Battle For Ai Supremacy Analyzing Googles I O And Open Ais Io Strategies

May 25, 2025 -

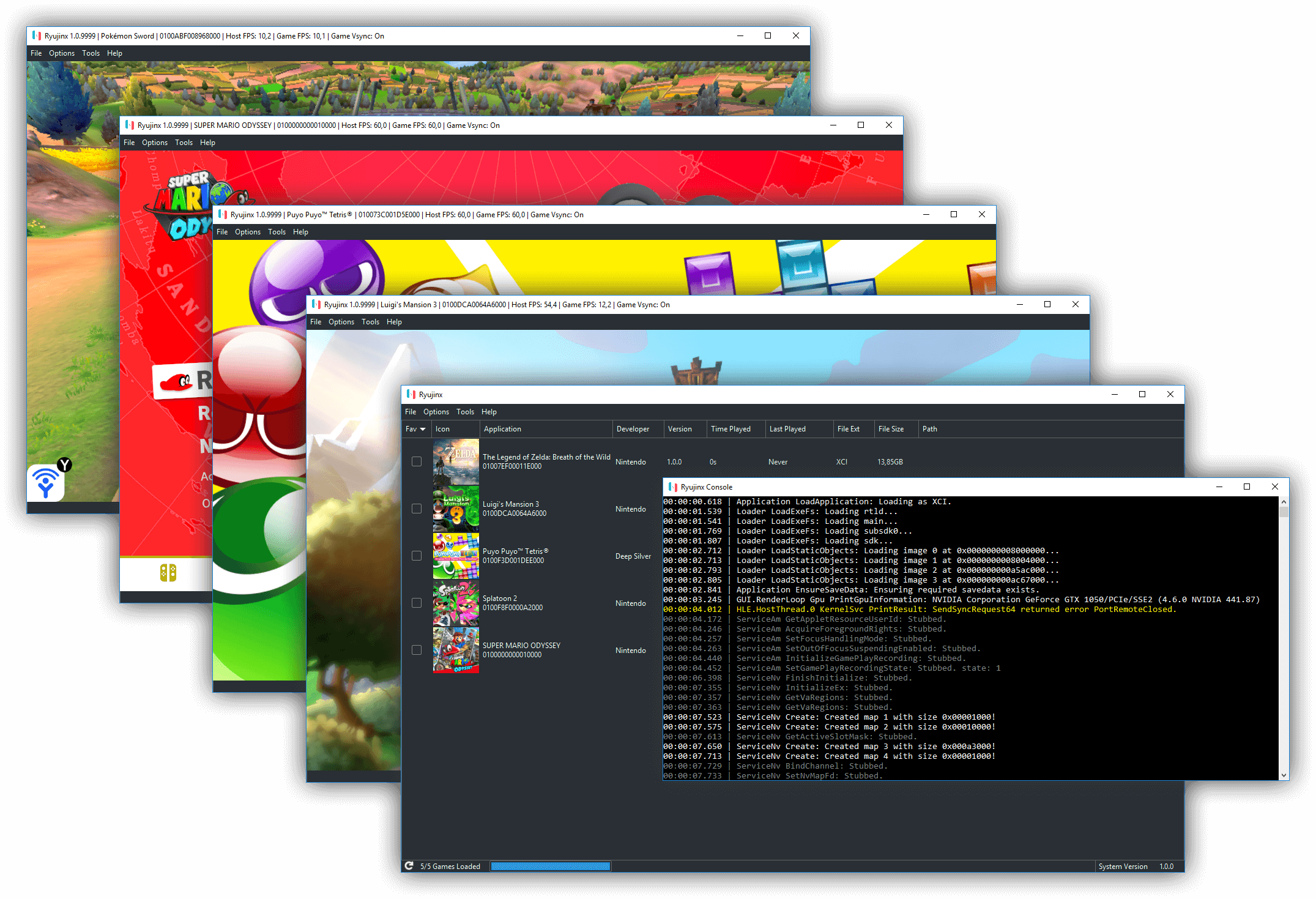

Ryujinx Switch Emulator Ceases Development After Nintendo Intervention

May 25, 2025

Ryujinx Switch Emulator Ceases Development After Nintendo Intervention

May 25, 2025 -

I O And Io How Google And Open Ais Approaches Shape The Future Of Ai

May 25, 2025

I O And Io How Google And Open Ais Approaches Shape The Future Of Ai

May 25, 2025