Amundi Dow Jones Industrial Average UCITS ETF: A NAV Deep Dive

Table of Contents

Investing in exchange-traded funds (ETFs) can be a smart strategy for diversifying your portfolio. But understanding the intricacies of your investment is crucial. This article provides a deep dive into the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF, a popular choice for investors seeking exposure to the iconic Dow Jones Industrial Average. We'll explore how its NAV is calculated, what factors influence it, and why understanding NAV is critical for making informed investment decisions.

What is Net Asset Value (NAV) and Why is it Important?

Keywords: Net Asset Value, NAV calculation, ETF valuation, investment analysis, portfolio management

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. It essentially reflects the intrinsic value of the ETF's holdings. Unlike the market price, which can fluctuate throughout the trading day based on supply and demand, the NAV provides a more accurate picture of the underlying assets' true worth.

- NAV reflects the intrinsic value of the ETF's underlying assets. This means it considers the current market value of all the stocks comprising the Dow Jones Industrial Average within the ETF.

- Understanding NAV helps investors assess the true value of their investment. By comparing the NAV to the market price, you can identify potential discrepancies and make informed buying or selling decisions.

- Differences between NAV and market price can indicate potential buying or selling opportunities. A significant discount of the market price to the NAV might suggest an undervalued ETF, while a premium might signal an overvalued one.

- Regular NAV updates provide transparency and accountability. Reputable ETF providers regularly publish their NAV, ensuring transparency and allowing investors to track their investments effectively.

Calculating the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV calculation, index fund valuation, asset allocation, portfolio diversification

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, typically at the close of the market. The process involves several key steps:

- Daily Calculation Process: The ETF provider determines the closing market price of each of the 30 constituent stocks of the Dow Jones Industrial Average. These prices are then weighted according to each stock's representation within the index.

- Impact of Currency Fluctuations: As this is a UCITS ETF, the impact of currency fluctuations between the base currency (likely EUR) and the currencies of the underlying assets needs to be considered. Any exchange rate differences will affect the overall NAV calculation.

- Role of Management Fees and Expenses: The total expense ratio (TER) for the Amundi Dow Jones Industrial Average UCITS ETF is deducted from the total value of the underlying assets. This reflects the ongoing costs of managing the fund.

- Dividend Factor: Dividends received from the underlying stocks are reinvested, increasing the overall value of the assets and thus contributing to the NAV calculation. This reinvestment is crucial for long-term growth.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV drivers, market performance, economic indicators, risk factors, investment strategy

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is subject to various factors:

- Impact of Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth significantly influence the performance of the Dow Jones Industrial Average and, consequently, the ETF's NAV. Recessions or periods of strong economic expansion can significantly impact the value of the underlying assets.

- Influence of Individual Company Performance: The performance of individual companies within the Dow Jones Industrial Average directly impacts the ETF's NAV. Strong performance by a major component can boost the NAV, while poor performance can decrease it.

- Effect of Geopolitical Events and Market Volatility: Global events, such as political instability or unexpected crises, can trigger market volatility and significantly affect the NAV. Increased uncertainty often leads to market declines.

- Role of Investor Sentiment and Market Demand: Investor sentiment and market demand play a crucial role in the ETF's market price, which, although not directly impacting the NAV, can create discrepancies between the two. High demand can drive up the market price above the NAV.

Analyzing NAV Performance and Trends

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV analysis, historical performance, investment returns, long-term investment, risk assessment

Analyzing historical NAV data is crucial for understanding the ETF's performance and potential. This involves examining charts and graphs showcasing NAV trends over time.

- Historical NAV Charts and Graphs: Reviewing past NAV data allows investors to identify growth patterns and periods of volatility. This historical data provides valuable context for making future investment decisions.

- Comparison to Benchmark Indices: Comparing the ETF's NAV performance to that of other benchmark indices (like the S&P 500) offers insights into its relative performance and risk profile.

- Discussion of Risk Factors and Potential Volatility: The Dow Jones Industrial Average, like any market index, experiences periods of volatility. Understanding this inherent risk is important before investing.

- Insights into Long-Term Investment Potential: Investing in an index fund like the Amundi Dow Jones Industrial Average UCITS ETF is often considered a long-term strategy, benefiting from the overall growth potential of the market.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for making informed investment decisions. This article has outlined the process of NAV calculation, the key factors influencing it, and methods for analyzing its performance. Remember that while the NAV provides a valuable indicator of the ETF's underlying asset value, external factors can impact its market price. By consistently monitoring the NAV and market price, and understanding the influence of economic and geopolitical events, investors can effectively manage their risk and maximize their investment potential in this popular index fund. Deepen your understanding of the Amundi Dow Jones Industrial Average UCITS ETF's NAV and its implications for your portfolio by conducting further research and seeking professional financial advice when needed. Start your research on the Amundi Dow Jones Industrial Average UCITS ETF NAV today and make smarter investment choices.

Featured Posts

-

Dazi Trump 20 Impatto Sul Settore Moda Nike Lululemon E Le Conseguenze

May 25, 2025

Dazi Trump 20 Impatto Sul Settore Moda Nike Lululemon E Le Conseguenze

May 25, 2025 -

Tisice Prepustenych Kriza Zasiahla Najvaecsie Nemecke Firmy

May 25, 2025

Tisice Prepustenych Kriza Zasiahla Najvaecsie Nemecke Firmy

May 25, 2025 -

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 25, 2025

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 25, 2025 -

Escape To The Countryside The Costs And Benefits Of Rural Living

May 25, 2025

Escape To The Countryside The Costs And Benefits Of Rural Living

May 25, 2025 -

Aex Index Over 4 Decline Sends Market To 12 Month Low

May 25, 2025

Aex Index Over 4 Decline Sends Market To 12 Month Low

May 25, 2025

Latest Posts

-

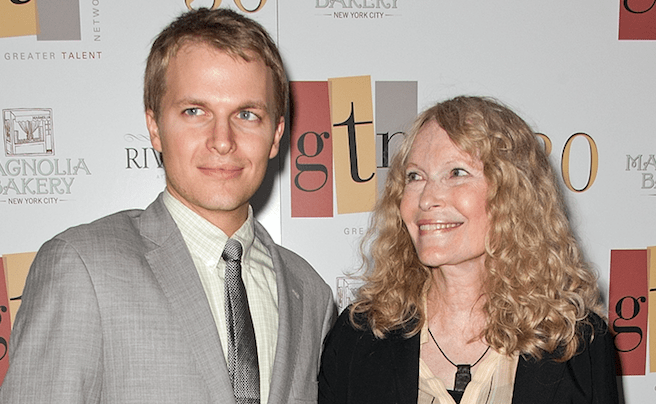

Will Ronan Farrow Orchestrate Mia Farrows Showbiz Return

May 25, 2025

Will Ronan Farrow Orchestrate Mia Farrows Showbiz Return

May 25, 2025 -

Michael Caines Shocking Mia Farrow Sex Scene Story A Bloody Hell Recounting

May 25, 2025

Michael Caines Shocking Mia Farrow Sex Scene Story A Bloody Hell Recounting

May 25, 2025 -

Analysis Mia Farrows Comments On Trump And The Future Of American Democracy

May 25, 2025

Analysis Mia Farrows Comments On Trump And The Future Of American Democracy

May 25, 2025 -

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025 -

Florida Film Festival A Star Studded Event Featuring Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival A Star Studded Event Featuring Mia Farrow And Christina Ricci

May 25, 2025