Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF offers investors a convenient way to participate in the performance of the Dow Jones Industrial Average. But what exactly is a UCITS ETF? UCITS stands for Undertakings for Collective Investment in Transferable Securities, a European Union regulatory framework ensuring high standards of investor protection. This regulatory oversight provides peace of mind for investors.

The ETF's primary investment objective is to replicate the performance of the Dow Jones Industrial Average, tracking its index movements closely. This means your investment gains (or losses) will closely mirror the overall performance of this well-known index. Investing in this specific ETF offers several key benefits:

- Diversification: Gain instant diversification across 30 of the largest and most influential companies in the US economy.

- Low Cost: Index-tracking ETFs generally have lower expense ratios compared to actively managed funds.

- Liquidity: UCITS ETFs are typically highly liquid, making it easier to buy and sell shares.

- Transparency: The underlying holdings of the ETF are publicly disclosed, providing transparency to investors.

Compared to other Dow Jones ETFs, the Amundi ETF often stands out due to its competitive expense ratio and robust tracking record.

Daily NAV Updates and Their Significance

Monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is vital for understanding its performance. The NAV represents the net asset value of the ETF per share, calculated by subtracting liabilities from the total market value of the ETF's assets and dividing by the number of outstanding shares.

Fluctuations in the daily NAV directly reflect changes in the market value of the underlying Dow Jones Industrial Average components. Understanding these fluctuations is key to:

- Calculating Returns: By tracking the daily NAV, you can precisely calculate your investment returns over any given period.

- Assessing Performance: Comparing the NAV over time reveals the ETF's performance against its benchmark.

- Informing Investment Decisions: While not advocating for day trading, monitoring daily NAV changes can help inform longer-term investment strategies and potential rebalancing.

Remember that the NAV is distinct from the ETF's market price. While usually closely correlated, differences can sometimes arise, particularly during periods of high market volatility.

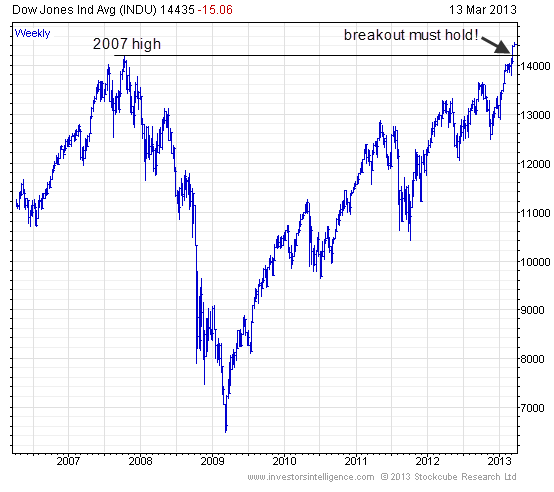

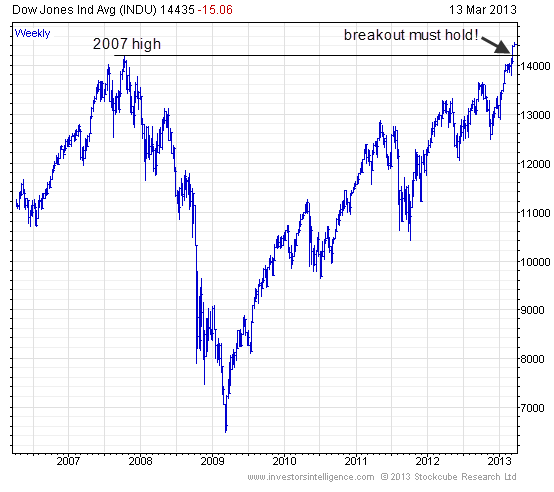

Analyzing Amundi Dow Jones Industrial Average UCITS ETF Performance

Analyzing the historical performance of the Amundi Dow Jones Industrial Average UCITS ETF involves examining its daily NAV data. Accessing this data is relatively straightforward:

- ETF Provider's Website: Amundi typically provides historical NAV data on their website.

- Financial Data Providers: Reputable financial data providers (e.g., Bloomberg, Refinitiv) offer comprehensive historical NAV data.

- Brokerage Accounts: Most brokerage accounts display historical performance data, including the NAV, for ETFs held within the account.

Key performance indicators used in this analysis include:

- Annualized Return: The average annual growth rate of the investment.

- Standard Deviation: A measure of the volatility or risk associated with the investment.

- Sharpe Ratio: Measures risk-adjusted return, showing how much extra return you receive for each unit of additional risk.

It's crucial to compare the ETF's performance to the Dow Jones Industrial Average itself, assessing how effectively the ETF tracks the index. Potential risks associated with investing in this ETF include:

- Market Risk: The overall risk inherent in investing in the stock market.

- Currency Risk: If investing in a currency other than your base currency, exchange rate fluctuations could impact returns.

Where to Find Daily NAV Updates for the Amundi Dow Jones Industrial Average UCITS ETF

Reliable sources for daily NAV updates are crucial. Here are some trustworthy avenues:

- Amundi's Official Website: Check the official Amundi website for the most up-to-date NAV information.

- Major Financial News Websites: Reputable financial news sources (e.g., Yahoo Finance, Google Finance) often display real-time or near real-time NAV data.

- Brokerage Platforms: Your brokerage account will display the current NAV of any ETFs you own.

Always verify the accuracy of the data by cross-referencing multiple sources.

Conclusion

Regularly monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for informed investment decisions. Understanding the ETF's characteristics, analyzing its performance using key metrics, and accessing daily NAV updates from reputable sources will allow you to make strategic investment choices. Stay informed about the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF and make smart investment choices based on regular analysis. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and start tracking its daily NAV today!

Featured Posts

-

Satira V Sssr Istoriya Filma Garazh I Protivostoyanie S Plenumom

May 24, 2025

Satira V Sssr Istoriya Filma Garazh I Protivostoyanie S Plenumom

May 24, 2025 -

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025 -

Dax Surge Will A Wall Street Rebound Derail The Rally

May 24, 2025

Dax Surge Will A Wall Street Rebound Derail The Rally

May 24, 2025 -

Former French Prime Minister Critiques Macrons Policies

May 24, 2025

Former French Prime Minister Critiques Macrons Policies

May 24, 2025 -

2025 Memorial Day Flights The Least And Most Crowded Days

May 24, 2025

2025 Memorial Day Flights The Least And Most Crowded Days

May 24, 2025

Latest Posts

-

Everything For Expats Housing Finance Fun And Kids At The Iam Expat Fair

May 24, 2025

Everything For Expats Housing Finance Fun And Kids At The Iam Expat Fair

May 24, 2025 -

Housing Finance Family Fun Everything You Need At The Iam Expat Fair

May 24, 2025

Housing Finance Family Fun Everything You Need At The Iam Expat Fair

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025 -

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025 -

Shareholder Information Philips Annual General Meeting 2025 Agenda

May 24, 2025

Shareholder Information Philips Annual General Meeting 2025 Agenda

May 24, 2025