Amundi Dow Jones Industrial Average UCITS ETF: How To Interpret Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the current market value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation is directly tied to the performance of the 30 companies that make up the Dow Jones Industrial Average (DJIA). This means the ETF's NAV reflects the collective value of its holdings in these 30 blue-chip companies.

-

Definition of NAV: NAV is calculated by subtracting the ETF's liabilities from the total market value of its assets, and then dividing the result by the number of outstanding shares.

-

Breakdown of Assets: The Amundi Dow Jones Industrial Average UCITS ETF's assets primarily consist of shares in the 30 companies comprising the DJIA, held in proportion to their weighting in the index. This ensures the ETF closely mirrors the index's performance.

-

Contribution to Overall NAV: Each company's share price contributes proportionally to the overall NAV. A rise in the price of a large-cap company like Apple will significantly impact the NAV, more so than a smaller-weighted company.

-

Expenses and Fees: The ETF's management fees and other operating expenses are deducted from the total asset value before the NAV is calculated. These expenses slightly reduce the NAV.

-

Frequency of NAV Calculation: The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, providing investors with a regularly updated valuation of their investment.

How to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV?

Accessing the current and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this crucial information:

-

Official Amundi Website: The official Amundi website is the primary source for ETF information, including daily NAV updates. Look for their dedicated ETF section.

-

Major Financial News Websites and Portals: Reputable financial news websites such as Google Finance, Yahoo Finance, and Bloomberg typically provide real-time and historical NAV data for major ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

-

Brokerage Account Platforms: If you hold the ETF within your brokerage account, the platform usually displays the current NAV alongside the market price of the ETF.

-

Dedicated Financial Data Providers: Companies like Refinitiv or FactSet (subscription required) offer comprehensive financial data, including detailed historical NAV information for ETFs.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV for Investment Decisions.

Understanding how to interpret the Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful investment management. Changes in the NAV directly reflect the performance of the underlying Dow Jones Industrial Average.

-

Tracking Investment Growth: By monitoring the NAV over time, investors can easily track the growth (or decline) of their investment in the ETF.

-

Comparing NAV to Benchmark Indices: Comparing the ETF's NAV to the Dow Jones Industrial Average itself allows investors to assess how effectively the ETF is tracking its benchmark.

-

Assessing Risk and Return: Fluctuations in the NAV indicate the level of risk associated with the investment. Higher volatility in the NAV suggests higher potential returns, but also higher potential losses.

-

Understanding the Relationship Between NAV and Market Price: The market price of an ETF may differ slightly from its NAV due to supply and demand. Sometimes a premium or discount exists. A significant difference warrants investigation.

-

Using Historical NAV Data: Analyzing historical NAV data helps investors identify long-term trends and patterns, providing valuable insights for making informed investment decisions.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Numerous factors influence the Amundi Dow Jones Industrial Average UCITS ETF NAV, making it essential to consider broader market conditions and economic trends:

-

Overall Market Performance: The general performance of the stock market significantly impacts the ETF's NAV, as the Dow Jones Industrial Average itself is influenced by broad market sentiment.

-

Performance of Individual Companies: The performance of individual companies within the DJIA directly affects the ETF's NAV. Strong performance by major components boosts the NAV, and vice-versa.

-

Economic News and Events: Macroeconomic events like interest rate changes, inflation reports, and geopolitical events all influence the Dow Jones Industrial Average and consequently, the ETF's NAV.

-

Geopolitical Factors: Global events and political uncertainty can create market volatility, impacting the NAV of the ETF.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is fundamental for successful investing. We've covered how the NAV is calculated, where to find it, and how to interpret its fluctuations to make informed buy/sell decisions. Remember that external factors significantly impact the NAV, so staying informed about market trends is crucial. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF investments by regularly checking the NAV and conducting thorough research. Master your Amundi Dow Jones Industrial Average UCITS ETF investments by understanding its NAV and utilizing the resources available to track its performance effectively.

Featured Posts

-

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025 -

Avrupa Borsalarinda Son Durum Ecb Faiz Kararinin Etkisi

May 25, 2025

Avrupa Borsalarinda Son Durum Ecb Faiz Kararinin Etkisi

May 25, 2025 -

Beurzen Klimmen Na Trump Uitstel Aex Analyse En Winnaars

May 25, 2025

Beurzen Klimmen Na Trump Uitstel Aex Analyse En Winnaars

May 25, 2025 -

West Hams Pursuit Of Kyle Walker Peters A Transfer Offer Breakdown

May 25, 2025

West Hams Pursuit Of Kyle Walker Peters A Transfer Offer Breakdown

May 25, 2025 -

Air Travel Around Memorial Day 2025 A Guide To Avoiding Delays

May 25, 2025

Air Travel Around Memorial Day 2025 A Guide To Avoiding Delays

May 25, 2025

Latest Posts

-

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025 -

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025 -

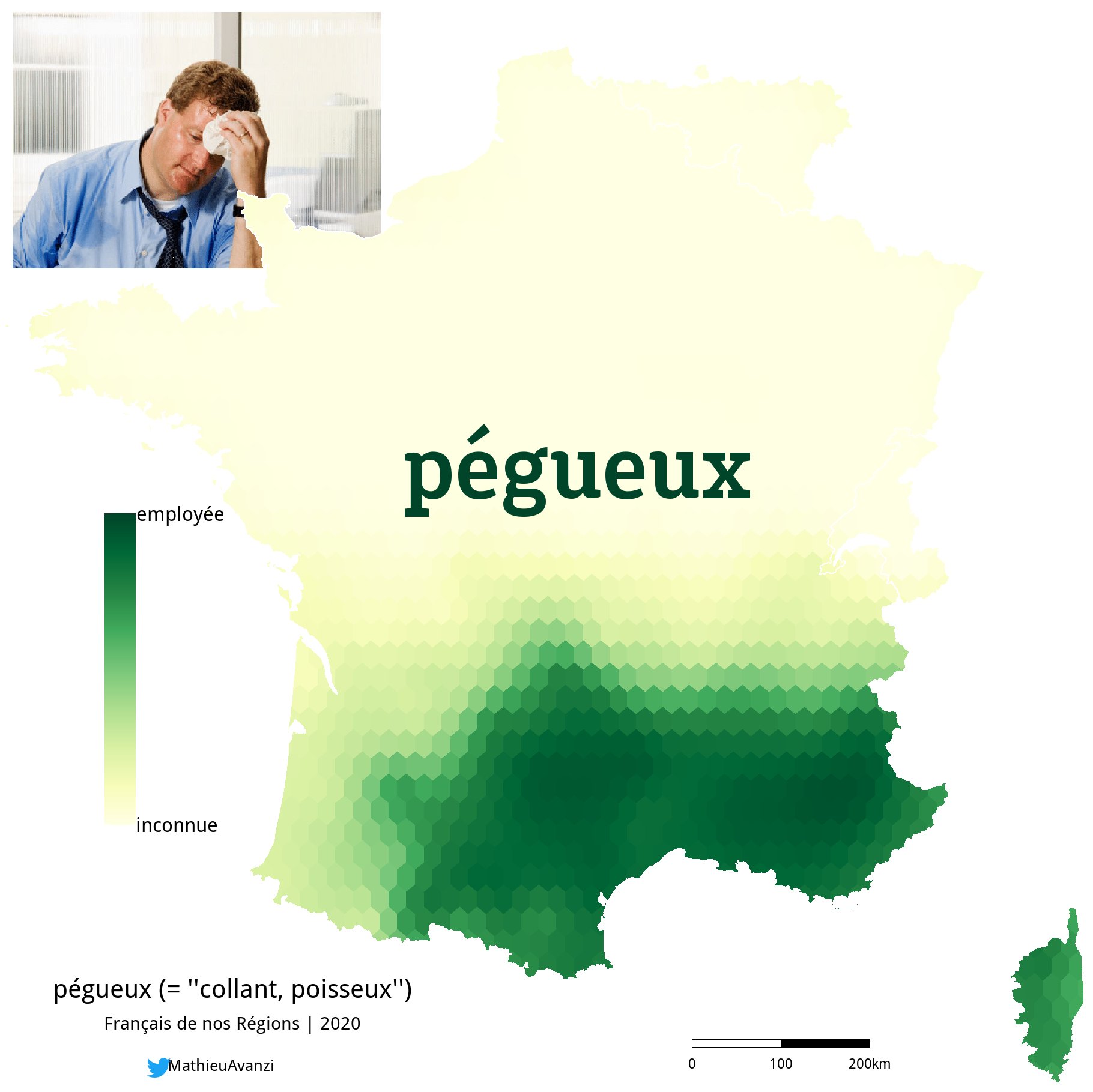

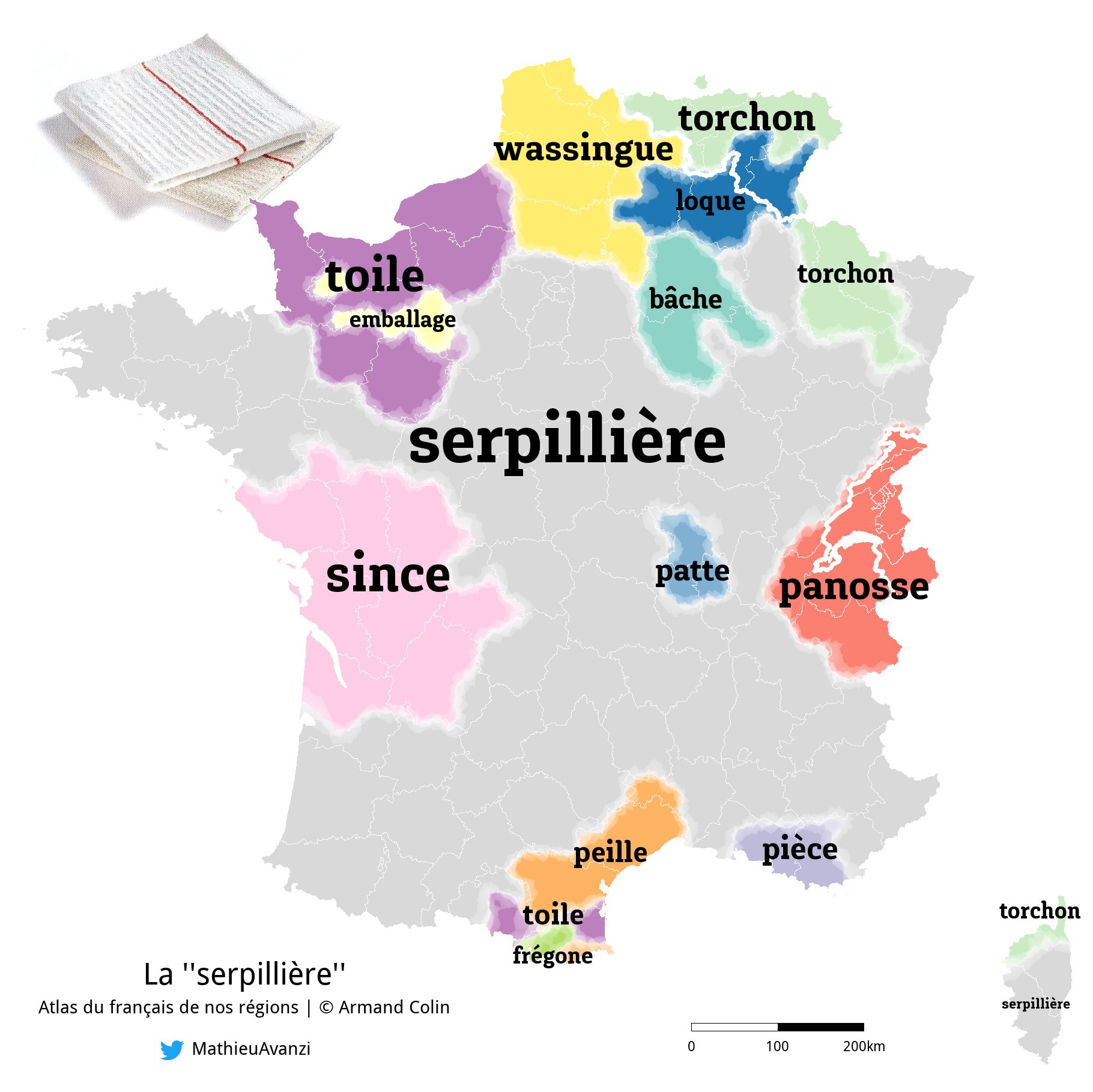

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025