Amundi Dow Jones Industrial Average UCITS ETF: NAV Calculation And Implications

Table of Contents

Amundi Dow Jones Industrial Average UCITS ETF: A Deep Dive into NAV Calculation

The Net Asset Value (NAV) of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF represents the net value of its assets per share. It's calculated by taking the total market value of the ETF's holdings, subtracting liabilities (primarily expenses), and dividing the result by the number of outstanding shares. Let's break down the process for this specific ETF:

-

Identifying the Constituents: The Amundi DJIA UCITS ETF tracks the Dow Jones Industrial Average, meaning its holdings consist of the 30 large, publicly-owned companies that make up this well-known index.

-

Obtaining Market Prices: The market value of each of these 30 stocks is obtained either in real-time or at the end of the trading day, depending on the ETF's calculation methodology.

-

Calculating Weighted Average Market Value: Each stock's market value is weighted according to its representation within the Dow Jones Industrial Average. This weighted average gives a total value of the underlying assets.

-

Subtracting Expenses: The ETF's expenses, including management fees and other operational costs, are deducted from the total weighted average market value.

-

Determining NAV per Share: The final NAV per share is calculated by dividing the net asset value (after expenses) by the total number of outstanding shares of the Amundi Dow Jones Industrial Average UCITS ETF.

The NAV is typically calculated daily, providing investors with a regular update on the value of their investment. Understanding this calculation process is key to interpreting the NAV data accurately. Keywords: NAV calculation, Amundi DJIA UCITS ETF, Dow Jones Industrial Average, market value, ETF holdings, expenses, management fees.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

The Amundi Dow Jones Industrial Average UCITS ETF's NAV fluctuates daily, mirroring the dynamic nature of the financial markets. Several factors contribute to these fluctuations:

-

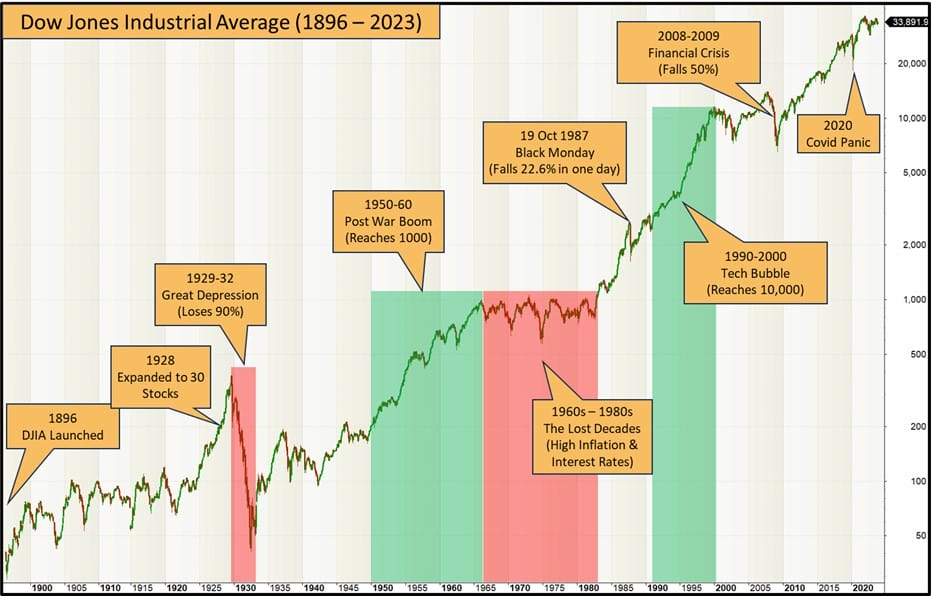

Market Performance of the Dow Jones Industrial Average: The most significant influence on the ETF's NAV is the overall performance of the Dow Jones Industrial Average. A positive market trend generally leads to a higher NAV, while a negative trend results in a lower NAV.

-

Individual Stock Price Movements: While the ETF tracks the index as a whole, individual stock price movements within the Dow Jones Industrial Average can also affect the NAV. Strong performance from a heavily weighted stock can positively impact the NAV, while poor performance from such a stock can have the opposite effect.

-

Currency Exchange Rate Changes: Since the Dow Jones Industrial Average includes companies operating globally, currency exchange rate fluctuations can impact the NAV, particularly for investors holding shares in a currency different from the base currency of the ETF.

-

Dividend Payments: Dividend payments from the underlying stocks affect the NAV. When a company pays a dividend, the NAV will generally decrease by the amount of the dividend distributed, reflecting the reduction in the ETF's assets. However, reinvestment policies may mitigate this effect.

Keywords: NAV fluctuations, market movements, Dow Jones Industrial Average, currency risk, dividends, ETF price, investment risk.

Implications of NAV for Amundi Dow Jones Industrial Average UCITS ETF Investors

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF has several critical implications for investors:

-

Performance Evaluation: The NAV is a key indicator of the ETF's performance. By tracking NAV changes over time, investors can assess their returns and the overall effectiveness of their investment.

-

Buy and Sell Decisions: Comparing the NAV to the ETF's market price helps investors identify potential buying or selling opportunities. A significant difference between the two might suggest arbitrage opportunities or indicate market inefficiencies.

-

Tracking Error: Investors should be aware of the ETF's tracking error – the difference between the ETF's return and the return of the underlying index. A high tracking error indicates the ETF isn't precisely mirroring the index’s performance. The NAV helps in monitoring this.

-

Risk Management and Portfolio Diversification: Monitoring the NAV, in conjunction with other market indicators, allows investors to effectively manage risk and optimize their portfolio diversification strategy.

Keywords: Investment decisions, portfolio performance, return on investment, buy/sell signals, tracking error, risk management, portfolio diversification.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV is paramount for making well-informed investment decisions. This article has outlined the process of NAV calculation, the key factors influencing its fluctuations, and its implications for investors. Regularly monitoring the NAV and staying abreast of market trends are crucial steps in maximizing returns and mitigating risks. Stay informed about the Amundi Dow Jones Industrial Average UCITS ETF's NAV and make smarter investment decisions. Learn more about ETF NAV calculations today!

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value

May 24, 2025 -

The Ultimate Escape To The Country Choosing The Right Property

May 24, 2025

The Ultimate Escape To The Country Choosing The Right Property

May 24, 2025 -

Analyzing Jordan Bardellas Chances In The French Election

May 24, 2025

Analyzing Jordan Bardellas Chances In The French Election

May 24, 2025 -

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025 -

Previsioni Borsa Europa Cauta Impatto Decisioni Fed Su Piazza Affari

May 24, 2025

Previsioni Borsa Europa Cauta Impatto Decisioni Fed Su Piazza Affari

May 24, 2025

Latest Posts

-

Philips Agm 2025 Agenda And Important Information For Shareholders

May 24, 2025

Philips Agm 2025 Agenda And Important Information For Shareholders

May 24, 2025 -

Philips Shareholders Meeting 2024 A Summary Of Decisions

May 24, 2025

Philips Shareholders Meeting 2024 A Summary Of Decisions

May 24, 2025 -

Boosting Local Economies And Global Connections The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Boosting Local Economies And Global Connections The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025 -

Europese En Amerikaanse Aandelen Analyse Van Recente Marktbewegingen En Mogelijke Trends

May 24, 2025

Europese En Amerikaanse Aandelen Analyse Van Recente Marktbewegingen En Mogelijke Trends

May 24, 2025