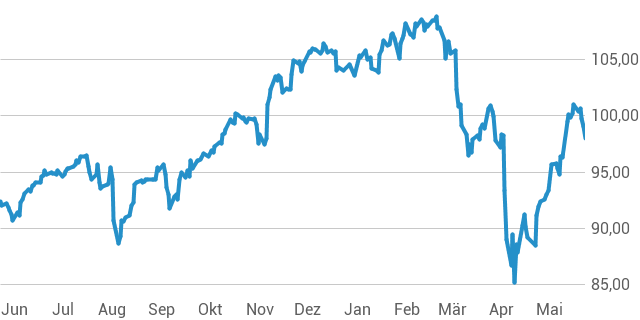

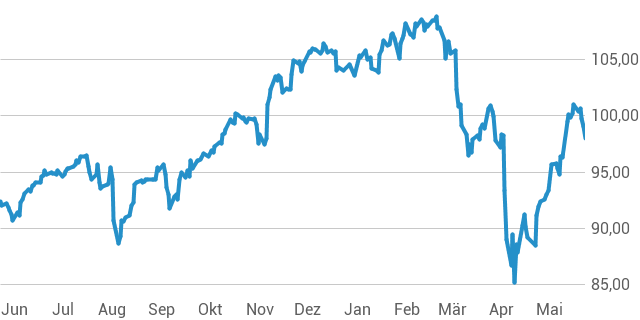

Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's calculated by subtracting the ETF's liabilities from the total market value of its holdings, then dividing by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, a global ETF tracking the MSCI All Country World Index, the NAV reflects the collective value of its diverse global holdings. Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV is vital because it provides a true reflection of the ETF's intrinsic worth, independent of market fluctuations in its share price. This is particularly important for UCITS ETFs, which are regulated under European Union law.

What Influences the Amundi MSCI All Country World UCITS ETF USD Acc NAV?

Several key factors influence the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

-

Underlying Asset Performance: The primary driver is the performance of the underlying assets within the index. Positive global market movements generally lead to an increase in the NAV, while negative movements decrease it. Currency fluctuations also play a significant role, as the ETF holds assets in various currencies. A strengthening US dollar (USD) against other currencies could negatively impact the NAV, while the opposite is also true.

-

Expense Ratio and Management Fees: The ETF's expense ratio and management fees directly impact the NAV. These fees are deducted from the ETF's assets, reducing the overall value available for distribution to shareholders. A higher expense ratio will result in a slightly lower NAV.

-

Dividend Distributions and Capital Gains: Dividend payments from the underlying companies held within the ETF reduce the NAV, as cash is distributed to shareholders. Similarly, capital gains realized from the sale of assets within the ETF are also reflected in NAV changes.

-

Impact of Market Trading and Liquidity: Market trading activity and the ETF's liquidity can also indirectly affect the NAV. High trading volume and liquidity generally ensure accurate pricing of the underlying assets, leading to a more precise NAV calculation. Conversely, low liquidity can lead to discrepancies between the NAV and market price.

How to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV?

Finding the real-time or historical NAV data for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward:

-

Official ETF Provider Website: Amundi's official website is the most reliable source for the latest NAV information. Look for a dedicated section on the ETF's details page.

-

Financial News Websites and Data Providers: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance typically provide real-time and historical NAV data for ETFs. Search using the ETF's ticker symbol.

-

Brokerage Platforms: Most brokerage platforms display the real-time NAV of your held ETFs within your account summary.

Step-by-Step Guide (Example using Amundi's website and Yahoo Finance):

-

Amundi Website: Go to Amundi's website, locate the ETF's page, and search for the "NAV" or "Net Asset Value" section. This usually updates daily.

-

Yahoo Finance: Search for the ETF's ticker symbol (e.g., the ticker symbol will vary depending on your exchange) on Yahoo Finance. The key statistics section should include the current NAV.

Interpreting the Amundi MSCI All Country World UCITS ETF USD Acc NAV: What Does It Mean for Investors?

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is a powerful tool for investors:

-

Performance Assessment: Compare the NAV to the ETF's share price. Significant discrepancies might indicate potential arbitrage opportunities (though this requires careful consideration). Tracking NAV changes over time shows the ETF's growth or decline.

-

Return on Investment (ROI) Calculation: Use the historical NAV to calculate your ROI since your investment date.

-

Understanding NAV vs. Market Price: The market price can fluctuate throughout the day due to trading activity, whereas the NAV is calculated at the end of the trading day. Differences arise because the market price reflects supply and demand for the ETF shares, while the NAV reflects the underlying assets' value.

-

Decision Making: A consistently declining NAV (after accounting for dividends) might signal underperformance, potentially prompting a reassessment of the investment.

Risks Associated with Investing in the Amundi MSCI All Country World UCITS ETF USD Acc Based on NAV

While understanding the NAV helps manage risks, it's crucial to acknowledge inherent investment risks:

-

Global Market Risk: The ETF is exposed to global market fluctuations. A downturn in major markets directly impacts the NAV.

-

Currency Risk: Fluctuations in exchange rates between the USD and other currencies can affect the NAV.

-

Investment Risk: The value of the ETF, as reflected in the NAV, can decrease, potentially leading to investment losses.

-

Portfolio Diversification: While the ETF offers diversification across the global market, it's not a guarantee against losses. Proper portfolio diversification is crucial to manage overall investment risk.

Conclusion: Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV is fundamental to successful global market investing. By tracking NAV changes, comparing it to the market price, and understanding the factors that influence it, you can make more informed decisions. Regularly monitoring the NAV allows you to effectively assess the ETF's performance and adjust your investment strategy accordingly. Start monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV today to make informed investment choices! Learn more about effective ETF investment strategies and global market investing to build a robust portfolio.

Featured Posts

-

Escape To The Country Choosing The Right Rural Property For You

May 24, 2025

Escape To The Country Choosing The Right Rural Property For You

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Czy Porsche Cayenne Gts Coupe To Suv Marzen Szczegolowy Test

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Suv Marzen Szczegolowy Test

May 24, 2025 -

Memorial Day 2025 Air Travel When To Fly And When Not To

May 24, 2025

Memorial Day 2025 Air Travel When To Fly And When Not To

May 24, 2025 -

The Unexpected Twist Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 24, 2025

The Unexpected Twist Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 24, 2025

Latest Posts

-

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025 -

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025 -

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025