Amundi MSCI All Country World UCITS ETF USD Acc: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi MSCI All Country World UCITS UCITS ETF USD Acc

ETF Overview

The Amundi MSCI All Country World UCITS ETF USD Acc offers diversified exposure to global equities. It tracks the MSCI All Country World Index, a benchmark representing large, mid, and small-cap companies across developed and emerging markets. This UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is denominated in US Dollars, making it accessible to a broad range of international investors. Its aim is to provide investors with a cost-effective way to gain broad global market exposure.

-

Index Composition: The MSCI All Country World Index is weighted by market capitalization, reflecting the relative size of companies within the index. This means larger companies have a proportionally greater influence on the index's performance. Geographic diversification is extensive, covering a wide range of countries and sectors.

-

Expense Ratio and Fees: The ETF has a competitive expense ratio (check the official fact sheet for the most up-to-date figure), representing the annual cost of managing the fund. Understanding this fee is vital for calculating your overall returns.

-

Suitability: This ETF is particularly well-suited for long-term investors seeking broad global diversification and aiming for exposure to the overall performance of the global equity market. It's a suitable core holding for a global investment portfolio.

-

Official Documents: For the most current and detailed information, refer to the official Amundi fact sheet and prospectus: [Insert Link Here]

Accessing Daily NAV Updates for the Amundi MSCI All Country World UCITS ETF USD Acc

Reliable Sources for NAV Data

Obtaining accurate and timely NAV data for the Amundi MSCI All Country World UCITS ETF USD Acc is paramount. Several reliable sources can provide this information:

-

Amundi's Website: The official Amundi website is a primary source for the daily NAV and other fund information. [Insert Link Here - if available]

-

Major Financial News Websites: Reputable financial news sources, such as Bloomberg, Yahoo Finance, and Google Finance, typically provide real-time or near real-time NAV updates for major ETFs.

-

Brokerage Platforms: If you hold the ETF through a brokerage account, your platform will typically display the current NAV alongside your portfolio holdings.

-

Dedicated ETF Data Providers: Several specialized providers focus on ETF data, offering comprehensive information, including historical NAV data and analytics.

-

Locating the NAV: The exact location of the NAV information varies across platforms. Typically, you'll find it on the fund's page or within your portfolio view. [Consider adding screenshots here as visual aids for each platform mentioned above].

-

Discrepancies: Minor discrepancies between sources might occur due to time lags in data updates. For critical decisions, always prioritize data from the official Amundi website.

-

Update Time: The NAV is typically updated at the close of the relevant market, reflecting the value of the underlying assets at that time.

-

Reliable Sources are Key: Using reliable sources is crucial to avoid inaccurate or misleading information that could impact your investment decisions.

Analyzing Daily NAV Changes and Market Trends

Interpreting NAV Fluctuations

Daily NAV changes for the Amundi MSCI All Country World ETF reflect the combined performance of all the underlying assets within the index. Several factors contribute to these fluctuations:

-

Market Movements: Broad market trends (bull or bear markets) have a significant impact on the ETF's NAV. A rising market generally leads to a higher NAV, while a falling market leads to a lower NAV.

-

Currency Fluctuations: Since the ETF is denominated in USD, fluctuations in exchange rates against other currencies can affect the NAV, particularly for holdings in non-USD denominated markets.

-

Sector Performance: The performance of specific sectors within the index also influences the NAV. Strong performance in certain sectors will positively impact the NAV, while underperformance in others will have the opposite effect.

-

Interpreting Movements: A positive NAV change signifies an increase in the value of the underlying assets, while a negative change indicates a decrease.

-

Historical NAV Data: Analyzing historical NAV data helps identify trends and patterns, providing valuable insights for long-term investment strategies.

-

Economic Indicators: Monitoring key economic indicators (e.g., inflation, interest rates, GDP growth) can help anticipate potential impacts on the ETF's NAV.

-

Event-Driven Impacts: Significant global events (political instability, economic crises, etc.) can cause substantial short-term fluctuations in the ETF’s NAV. For example, a major geopolitical event might trigger a market selloff, causing a temporary decline in the NAV.

Amundi MSCI All Country World UCITS ETF USD Acc: Investment Strategies and Considerations

Using NAV Data for Investment Decisions

Daily NAV data provides valuable insights, but shouldn't be the sole driver of investment decisions. Consider these points:

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the NAV. This strategy mitigates the risk of investing a large sum at a market peak.

-

Long-Term Horizon: The Amundi MSCI All Country World UCITS ETF USD Acc is best suited for long-term investors. Short-term fluctuations in the NAV should be viewed within a broader long-term context.

-

Risk Management: Diversification is crucial. Don't concentrate your entire portfolio in this single ETF. Consider diversifying across different asset classes and geographies to mitigate risk.

-

Global Events: Be aware of potential impacts from global economic and political events, and adjust your investment strategy accordingly if necessary.

Conclusion

Regularly tracking the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for informed investment decision-making. This article has highlighted reliable sources for NAV data, explained how to interpret NAV fluctuations, and offered strategies for utilizing this information. Remember to consider your risk tolerance, investment goals, and the broader market context when using NAV data to make investment choices. For personalized investment advice tailored to your specific financial situation, consult a qualified financial advisor. Start actively tracking the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc today and make well-informed choices for your global investment portfolio.

Featured Posts

-

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025 -

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 24, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025 -

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Latest Posts

-

Emergency Services Respond To Major Crash Person Taken To Hospital

May 24, 2025

Emergency Services Respond To Major Crash Person Taken To Hospital

May 24, 2025 -

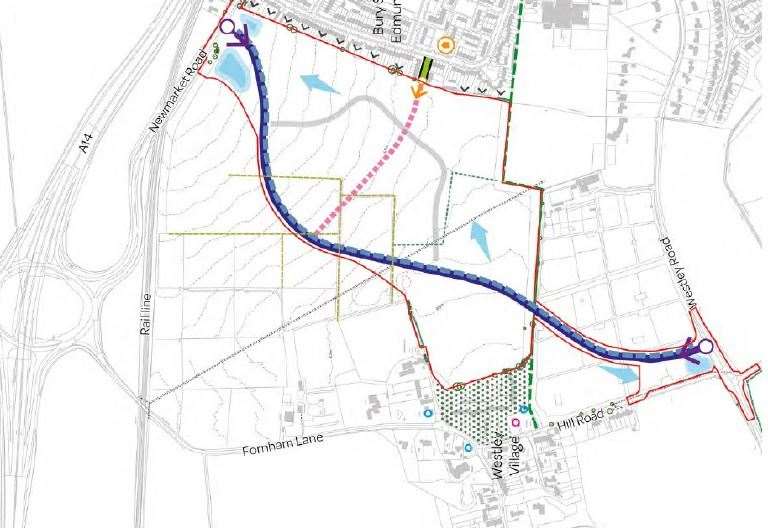

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025 -

Serious M56 Motorway Incident Car Overturn And Casualty Treatment

May 24, 2025

Serious M56 Motorway Incident Car Overturn And Casualty Treatment

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025