Amundi MSCI World Catholic Principles UCITS ETF Acc: NAV Analysis And Tracking

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc (AMUNDI ETF)

The AMUNDI ETF seeks to track the performance of the MSCI World Index while adhering to a set of investment criteria rooted in Catholic social teachings. This means the ETF invests in companies that align with Catholic values, contributing to a more ethical and responsible investment approach.

- Investment Objective: To provide investors with exposure to a diversified portfolio of global equities that meet specific Catholic ethical criteria.

- Underlying Index: The MSCI World Index serves as the benchmark, representing a broad range of large and mid-cap companies across developed markets. Its significance lies in its comprehensive coverage of global equities.

- Screening Process: The AMUNDI ETF employs a rigorous screening process to exclude companies involved in activities considered incompatible with Catholic principles. This typically includes companies involved in:

- Controversial Weapons: Production or distribution of weapons considered unethical under Catholic doctrine.

- Adult Entertainment: Businesses involved in the pornography industry.

- Gambling and Alcohol: Companies heavily involved in gambling or alcohol production.

- Stem Cell Research (Specific Types): Depending on the specifics of the research, some stem cell research companies may be excluded.

- Expense Ratio: The AMUNDI ETF has an expense ratio (check the fund provider's website for the current ratio). This represents the annual cost of managing the fund and directly impacts the overall returns. A lower expense ratio generally translates to higher potential returns.

- Keywords: MSCI World Index, Catholic values, ESG investing, socially responsible investing, SRI, ethical index fund

NAV Analysis: Deciphering the Net Asset Value

The Net Asset Value (NAV) represents the value of the ETF's underlying assets per share. It's calculated daily by taking the total value of the ETF's holdings (stocks, bonds, etc.), subtracting any liabilities, and dividing by the total number of outstanding shares.

- NAV Calculation: The AMUNDI ETF's NAV is calculated daily by Amundi, reflecting the closing prices of the constituent securities.

- Influencing Factors: Several factors influence the NAV, including:

- Market Fluctuations: Changes in the market value of the underlying securities directly impact the NAV.

- Currency Exchange Rates: If the ETF holds assets in multiple currencies, fluctuations in exchange rates affect the NAV.

- Dividends Received: Dividend payments from underlying companies increase the total value of assets and thus the NAV.

- Finding NAV Data: You can typically find the daily NAV of the AMUNDI ETF on Amundi's website, financial news portals, or through your brokerage account.

- Keywords: Net Asset Value, NAV calculation, ETF valuation, market fluctuations, currency risk, daily NAV

Tracking Performance: How Closely Does the AMUNDI ETF Track its Benchmark?

Tracking error measures the difference between the AMUNDI ETF's return and the return of its benchmark, the MSCI World Index. A lower tracking error indicates a closer alignment with the benchmark.

- Measuring Tracking Performance: Tracking performance is assessed by comparing the ETF's returns to the MSCI World Index's returns over a specific period.

- Reasons for Tracking Differences: Several factors can lead to tracking differences:

- Transaction Costs: Buying and selling securities to maintain the portfolio incurs costs that impact performance.

- Management Fees (Expense Ratio): The expense ratio directly reduces the ETF's returns relative to the benchmark.

- Index Reconstitution: Changes in the MSCI World Index composition necessitate buying and selling securities, creating temporary tracking differences.

- Historical Tracking Data: While past performance is not indicative of future results, reviewing historical tracking data can give insights into the ETF's performance consistency. This information is often available from Amundi or financial data providers.

- Keywords: Tracking error, benchmark performance, index tracking, ETF performance, expense ratio, MSCI World performance

Investing in the AMUNDI ETF: Considerations and Strategies

The AMUNDI ETF's suitability depends on individual investor profiles and investment goals.

- Investor Profiles: The AMUNDI ETF might be a good fit for investors who:

- Seek global market exposure.

- Align their investments with Catholic values.

- Have a medium to long-term investment horizon.

- Portfolio Integration: The AMUNDI ETF can be a valuable component of a diversified portfolio, providing exposure to a wide range of global companies while maintaining alignment with ethical investment principles.

- Advantages:

- Diversified global exposure.

- Alignment with Catholic values.

- Relatively low expense ratio (compared to actively managed funds).

- Disadvantages:

- Potential for lower returns compared to a non-screened global market index.

- Limited geographic diversification (primarily developed markets).

- Keywords: Investment strategy, portfolio diversification, risk management, ethical investment portfolio, socially responsible investing

Conclusion

Analyzing the NAV and tracking performance of the AMUNDI ETF provides valuable insights for potential investors. While it closely tracks its benchmark, understanding the factors influencing NAV and tracking differences is crucial for making informed investment decisions. This ETF plays a significant role in the growing ethical investment market, offering a way to combine financial goals with adherence to Catholic values. Learn more about the AMUNDI ETF and consider its inclusion in your investment strategy, based on your individual financial goals and risk tolerance. Start your ethical investing journey with the AMUNDI ETF today. Remember to conduct your own thorough research before making any investment decisions.

Featured Posts

-

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Analizi

May 24, 2025

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Analizi

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Photos Reveal Key Details

May 24, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal Key Details

May 24, 2025 -

M56 Traffic Delays Cheshire And Deeside Affected By Accident

May 24, 2025

M56 Traffic Delays Cheshire And Deeside Affected By Accident

May 24, 2025 -

Country Home Buyers Rejoice Dream Homes Found Under 1m Budget

May 24, 2025

Country Home Buyers Rejoice Dream Homes Found Under 1m Budget

May 24, 2025 -

Escape To The Country Tips For A Smooth Relocation

May 24, 2025

Escape To The Country Tips For A Smooth Relocation

May 24, 2025

Latest Posts

-

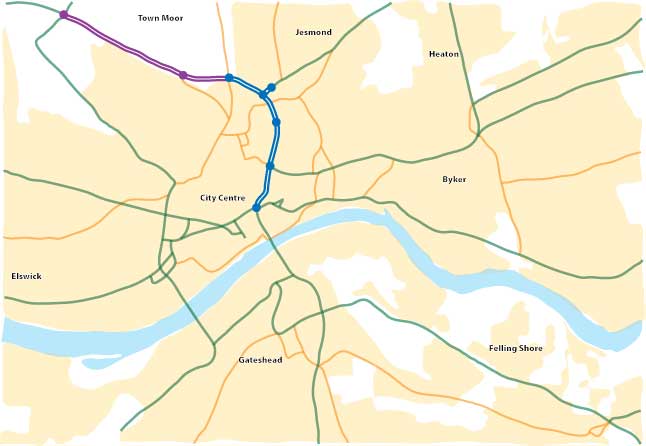

The M62 Relief Road Burys Bypassed Opportunity

May 24, 2025

The M62 Relief Road Burys Bypassed Opportunity

May 24, 2025 -

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025 -

Pair Text And Refuel At 90mph During Police Chase

May 24, 2025

Pair Text And Refuel At 90mph During Police Chase

May 24, 2025 -

Road Closure Following Serious Collision Patient Transported To Hospital

May 24, 2025

Road Closure Following Serious Collision Patient Transported To Hospital

May 24, 2025 -

Burys Unbuilt M62 Relief Road Examining The Lost Project

May 24, 2025

Burys Unbuilt M62 Relief Road Examining The Lost Project

May 24, 2025