Amundi MSCI World Catholic Principles UCITS ETF Acc: NAV Tracking And Analysis

Table of Contents

NAV Tracking Performance Analysis

The Amundi MSCI World Catholic Principles UCITS ETF Acc aims to replicate the performance of the MSCI World Catholic Principles Index. Understanding its NAV tracking performance is crucial for assessing its investment efficiency.

Methodology

We assessed the ETF's NAV tracking performance by comparing its daily market price to its Net Asset Value (NAV) over a defined historical period. The tracking error, calculated as the difference between the ETF's return and the index return, was used as a key metric to evaluate tracking efficiency. A smaller tracking error indicates better performance.

Historical Performance

[Insert Chart/Graph showing historical NAV tracking performance]. The chart illustrates the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV tracking performance over [specify time period, e.g., the past five years]. While generally exhibiting tight tracking, periods of higher tracking error were observed during [specify periods and potential reasons, e.g., periods of high market volatility].

Factors Affecting Tracking Error

Several factors can influence the tracking error of the Amundi MSCI World Catholic Principles UCITS ETF Acc. These include:

-

Transaction Costs: Buying and selling securities to maintain the ETF's portfolio composition incurs costs that can impact tracking.

-

Management Fees: The ETF's annual management fee directly affects its overall return and can contribute to tracking error.

-

Index Replication Methodology: The strategy used to replicate the underlying index (e.g., full replication, sampling) impacts tracking accuracy.

-

Illustrative examples of tracking differences: [Provide specific examples of days or periods with significant deviations between ETF price and NAV, explaining potential causes].

-

Comparison to benchmark indices: [Compare tracking error against similar ETFs tracking the MSCI World Index].

-

Significant events impacting NAV: [Mention any significant market events, such as global crises or sector-specific shocks, that affected the ETF's NAV].

Understanding the Catholic Principles Integration

The Amundi MSCI World Catholic Principles UCITS ETF Acc distinguishes itself through its commitment to Catholic social principles.

Screening Criteria

The ETF employs a rigorous screening process based on ESG (Environmental, Social, and Governance) criteria aligned with Catholic social teachings. This includes:

- Exclusion of companies involved in controversial activities: This might include companies involved in weapons manufacturing, abortion services, or activities deemed unethical according to Catholic doctrine.

- Promotion of companies with strong governance practices: This includes transparency, ethical labor practices, and environmental sustainability.

- Alignment with key Catholic social teachings: Such as the preferential option for the poor, the dignity of work, and the common good.

Impact of Ethical Screening on Portfolio Composition

The ethical screening process significantly impacts the ETF's portfolio composition compared to a standard MSCI World index. It results in:

- Underrepresentation of certain sectors: Sectors like defense or certain energy companies might be underrepresented due to ethical exclusions.

- Overrepresentation of other sectors: Sectors aligned with Catholic values, such as healthcare or sustainable energy, might have higher weightings.

- Different geographic allocations: Depending on the distribution of ethically compliant companies across the globe, this will lead to a different geographical weighting compared to a standard MSCI World index.

Performance Implications of Ethical Investing

The question of whether adhering to Catholic principles impacts overall performance is complex. While some might argue that ethical screening could limit investment opportunities, others contend that strong corporate governance and sustainable practices can lead to long-term value creation. [Include data or studies comparing the ETF's performance to non-ethical benchmarks].

- Specific examples of companies included or excluded: [Give specific examples to illustrate the screening criteria in action].

- Discussion of controversies or challenges: [Discuss any controversies surrounding the selection criteria or challenges in implementing ethical screening consistently].

- Data illustrating portfolio diversification: [Provide data showing how the ethical screening affects the diversification of the portfolio].

Amundi MSCI World Catholic Principles UCITS ETF Acc: Fees and Expenses

Understanding the cost structure of the Amundi MSCI World Catholic Principles UCITS ETF Acc is crucial for assessing its overall return.

Expense Ratio

The ETF has an expense ratio of [insert expense ratio percentage]. This compares [favorably/unfavorably] to the average expense ratio of similar global equity ETFs.

Transaction Costs

Investors should be aware of potential brokerage commissions when buying or selling the ETF. These costs are not included in the expense ratio.

Tax Implications

The tax implications for investors will depend on their individual circumstances and the relevant tax laws in their jurisdiction. Consult a qualified financial advisor for specific tax advice.

- Breakdown of fees and charges: [Provide a detailed breakdown of all fees, including management fees, custodial fees, and any other applicable charges].

- Comparison to competitor ETFs' fee structures: [Compare fees with similar ethically-focused ETFs].

- Tax efficiency considerations: [Discuss any aspects of the ETF's structure that might contribute to tax efficiency].

Amundi MSCI World Catholic Principles UCITS ETF Acc: Suitability for Investors

The Amundi MSCI World Catholic Principles UCITS ETF Acc is particularly suitable for specific investor profiles.

Investor Profile

This ETF is ideal for:

- Long-term investors: The ETF is designed for investors with a long-term investment horizon.

- Socially responsible investors: Investors seeking to align their investments with their ethical values.

- Catholic investors: Investors who wish to support companies that align with Catholic social teachings.

Risk Considerations

Investors should be aware of the following risks:

- Market risk: The value of the ETF can fluctuate significantly due to market conditions.

- Currency risk: Fluctuations in exchange rates can impact returns for investors holding the ETF in a currency different from the base currency.

- Tracking error risk: The ETF may not perfectly replicate the performance of the underlying index.

Alternative Investment Options

Investors may also consider other ethical or sustainable investment options such as other ESG-focused ETFs or socially responsible mutual funds.

- Advantages and disadvantages of investing in the ETF: [Summarize the pros and cons].

- Risk tolerance levels appropriate for this investment: [Specify suitable risk tolerance levels].

- Comparison to other ethical investment vehicles: [Compare to similar products].

Conclusion: Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc

Our analysis highlights that the Amundi MSCI World Catholic Principles UCITS ETF Acc generally exhibits good NAV tracking performance, although periods of higher tracking error can occur. The ETF's commitment to Catholic social principles significantly shapes its portfolio composition, potentially leading to both financial and ethical considerations. The ETF is suitable for long-term investors prioritizing ethical investing aligned with Catholic values. By carefully considering the NAV tracking performance and ethical alignment offered by the Amundi MSCI World Catholic Principles UCITS ETF Acc, investors can make informed decisions that reflect both their financial goals and their commitment to responsible investing. Learn more about the Amundi MSCI World Catholic Principles UCITS ETF Acc and consider adding this ethical investment option to your portfolio today.

Featured Posts

-

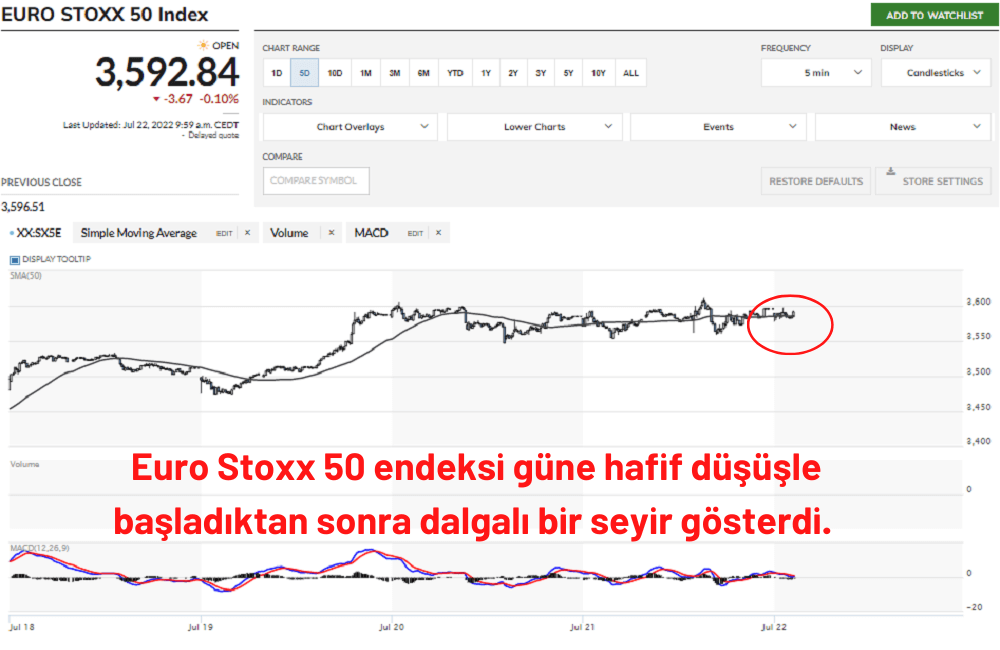

Avrupa Piyasalari Buguenkue Karisik Performans

May 24, 2025

Avrupa Piyasalari Buguenkue Karisik Performans

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025 -

Making The Transition Your Successful Escape To The Country

May 24, 2025

Making The Transition Your Successful Escape To The Country

May 24, 2025 -

Joy Crookes New Song I Know You D Kill Release Details And More

May 24, 2025

Joy Crookes New Song I Know You D Kill Release Details And More

May 24, 2025 -

Ferrari Hot Wheels Mamma Mia A Look At The New Releases

May 24, 2025

Ferrari Hot Wheels Mamma Mia A Look At The New Releases

May 24, 2025

Latest Posts

-

M6 Motorway Crash Current Traffic And Travel Disruptions

May 24, 2025

M6 Motorway Crash Current Traffic And Travel Disruptions

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025 -

M6 Crash Live Updates And Traffic Delays

May 24, 2025

M6 Crash Live Updates And Traffic Delays

May 24, 2025 -

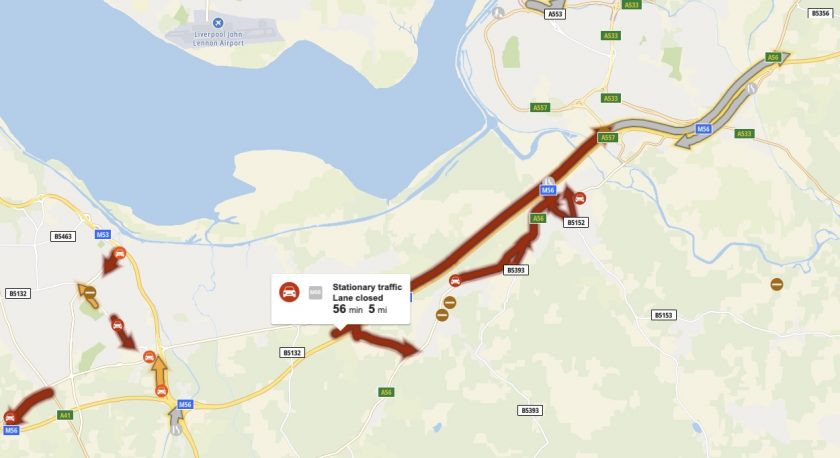

Cheshire Deeside M56 Road Closure Following Serious Accident

May 24, 2025

Cheshire Deeside M56 Road Closure Following Serious Accident

May 24, 2025 -

M56 Traffic Delays Cheshire And Deeside Affected By Accident

May 24, 2025

M56 Traffic Delays Cheshire And Deeside Affected By Accident

May 24, 2025